Summary:

- Apple’s growth performance has been disappointing recently, with revenues barely growing and operating income stagnating for two years.

- iPhone sales volume has been struggling in important markets like China and the U.S. In China, iPhone sales are facing competition from local manufacturers.

- Apple has been fined €1.8 billion by the EU for market abuse related to the distribution of music-streaming apps, signaling increased regulatory scrutiny.

- Apple’s current valuation at a 27x FWD P/E appears optimistic against the challenging commercial backdrop, suggesting a revaluation may be warranted.

- I see Apple fairly valued at $139/ share.

Shubhashish5

I have previously voiced negative sentiment on Apple (NASDAQ:AAPL) stock (here, here, here), as I have been concerned about sluggish commercial momentum and lack of any upside catalysts. Today, reflecting on latest data points, I double down on my bearish assessment. Apple is increasingly looking like the weakling in the Magnificent 7 collection, together with Tesla. In fact, zooming in on the Magnificent 7 stocks, it is noteworthy to point out that in Q4 2023 the group achieved a market-weighted average of 60% YoY operating profit expansion, while Apple contributed an under-performing 11%:

- Tesla Q4: -47% YoY

- Apple Q4: +11% YoY

- Google Q4: +27% YoY

- Microsoft Q4: +33% YoY

- Meta Platforms Q4: +41% YoY

- Amazon Q4: +388% YoY

- Nvidia Q4: +980% YoY

Unfortunately for investors, Apple has been delivering a disappointing growth performance for quite some time now: Apples top-line CAGR since December 2021 TTM through December 2023 TTM has been below 1%, while most recent data from China suggests that Apple is aggressively bleeding commercial momentum and market share. Adding to this, the recent heavy $2 billion fine imposed by the EU underscores the broader risk associated with Apple stock. All that said, I argue that Apple does not deserve its 27x FWD P/E multiple, which suggests a 3.7% earnings yield vs. a 4.3% implied yield on the 10 year, risk-free, Treasury. According to my estimates, which anchor on analyst consensus estimates through 2028 and a 8.5% cost of equity, Apple stock should be worth $139/ share.

For context, Apple stock has under-performed the broad equities market in 2023 and early 2024. For the trailing twelve months, AAPL shares are up about 14%, compared to a gain of approximately 27% for the S&P 500 (SP500).

Apple’s Growth Has Been Disappointing Lately

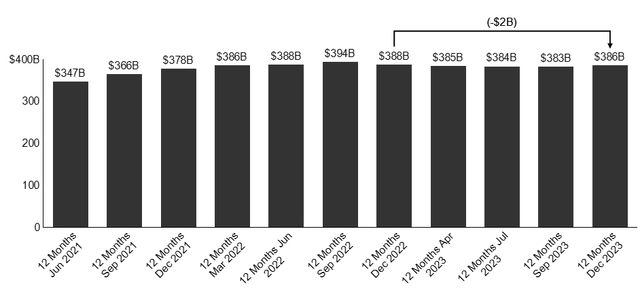

At FWD 27x P/E, Apple stock clearly implies a growth premium compared to both the broader U.S. stock and Treasury market. However, this premium has not been justified by the iPhone makers performance. Referencing Apple’s growth topline performance of over the past 2 years, it is noteworthy to point out that revenues have barely grown. Since TTM December 2021 vs. 2023, compounded annual sales growth was below 1%. And comparing Apple’s TTM revenues for December 2023 with the respective reference in 2022, I highlight that sales have actually contracted by approximately $2 billion.

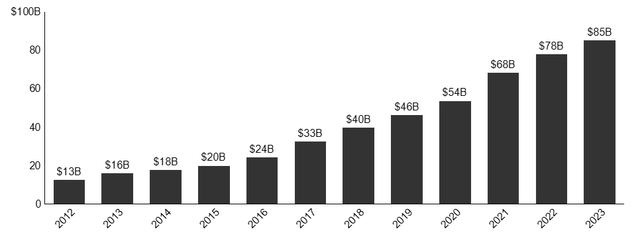

Apple Financials; Author’s Graph

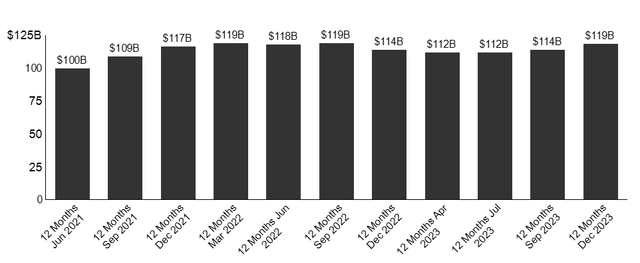

A similarly negative growth narrative is reflected in Apple’s profit growth: Apples operating income has been stagnating for about two years now.

Apple Financials; Author’s Graph

iPhone Sales Are Topping Out, If Not Contracting Already

A key reason often cited for the stagnation in Apple’s fundamentals is the perceived lack of innovation within its established product lines, including the iPhone, iPad, and Mac. This argument suggests that these products, which have historically been core to Apple’s success, are reaching a maturity phase, where significant growth becomes more challenging due to a saturated market and reduced opportunities for groundbreaking advancements. Specifically relating to the iPhone business, which accounts for almost 60% of Apple’s revenue, it is important to note that sales growth is topping out.

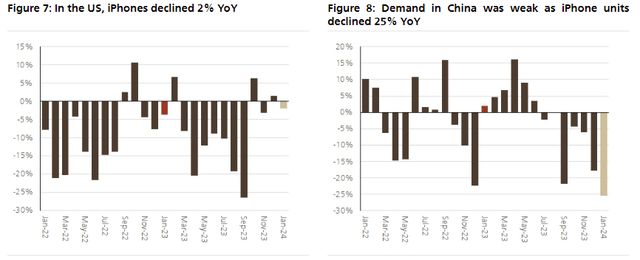

According to research conducted by Counterpoint Global, and data mapped by UBS, it is evident that iPhone sales volume has been struggling in the company’s most important markets, China and the U.S., for quite some time now (Source: UBS Research & Evidence Lab, note on Apple dated 28 February 2024). Specifically relating to China, it is noteworthy to point out an aggressive 24% YoY drop in iPhone sales since the start of 2024, despite reports of significant price reductions on iPhone 15 models by resellers.

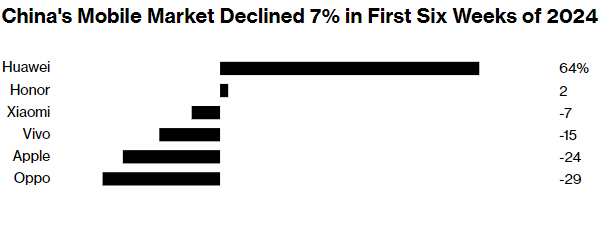

Admittedly, the downturn in China reflects broader issues such as reduced consumer demand on the backdrop of a struggling macro economy. However, investors should also acknowledge that in China Apple is facing intensified competition from local manufacturers like Vivo, Huawei, and Honor. The competitive situation is compounded by Huawei’s resurgence in popularity, attributed to nationalist purchasing behaviors and improved technology. This is reflected in market share trends, with Apple losing 24% share of volume, compared to a 64% gain for Huawei over the first six weeks of 2024. For context, China accounts for 19% of Apple’s revenue, most of which is based on iPhone sales (although the exact number has not been disclosed).

Counterpoint Global; Chart by Bloomberg

It Is Too Early To Classify The Vision Pro As A Key Growth Driver

I am well aware that Apple recently released the Vision Pro, the company’s major new tech device since the Apple watch in 2012. However, as of today, I argue that betting on the Vision Pro as a key growth driver for Apple should be considered too speculative. In my view, it is important to consider that the Vision Pro represents a significant departure from Apple’s established products like the iPhone, iPad, and Mac, which are known for their mass-market appeal and established consumer bases. The high price and niche appeal could limit its immediate market penetration. Moreover, while the first-generation Vision Pro may showcase Apple’s ability to innovate, its success is crucial but not guaranteed.

The EU Fine Is The Beginning Of A Broader Anti-Trust Battle, Not The End

With momentum in the device business slowing, Apple’s growth narrative is increasingly reliant on the company’s Services business. On that note, it is encouraging to see that Apple’s revenue from Services has grown at a 20-25% compounded annual growth rate over the past decade, while likely maintaining 25-35% operating margins.

Apple Financials; Author’s Graph

However, while the commercial momentum in the Services business is encouraging, the regulatory risk is concerning, giving increasing scrutiny for potential monopolistic behavior. The core issue lies in Apple’s exclusive control over app distribution for iOS devices, forcing developers to comply with its terms and fee structures (15-30% of app revenue). Moreover stringent app review processes and restrictive policies have recently raised concerns about stifling competition and innovation.

On Monday 4th March, Apple has been imposed with a substantial €1.8 billion fine by the European Union, following allegations of market abuse related to the distribution of music-streaming apps via its App Store. In a nutshell, the penalty stems from accusations by Spotify that Apple leveraged its App Store to unfairly restrict competition and elevate prices. And while similar fines have historically had limited impact on the share prices and operations of big tech companies, the recent €1.8 billion EU antitrust fine against Apple may be different, as the fine suggests the beginning of anti-trust scrutiny, rather than the end.

The EU’s charge against Apple not only targets specific business practices deemed anti-competitive but also aligns with broader regulatory trends aiming to dismantle the monopolistic hold certain companies have within the tech industry. This is highlighted by ongoing investigations and the implementation of new regulations like the Digital Markets Act (DMA), which demands more open tech ecosystems and could significantly alter how companies operate within the EU. Furthermore, this fine arrives amid other antitrust charges against Apple in the EU, including issues surrounding mobile payments technology. This stacks up a scenario where Apple is not just facing a one-off penalty but rather entering a period of heightened regulatory oversight.

While the App Store business is still growing; in my opinion, the overall risk-reward relating to this business may have shifted to the downside.

Valuation: Set TP At $139/Share

In line with my thesis that Apple is a “mature” business, I like to value the company’s intrinsic worth through a residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

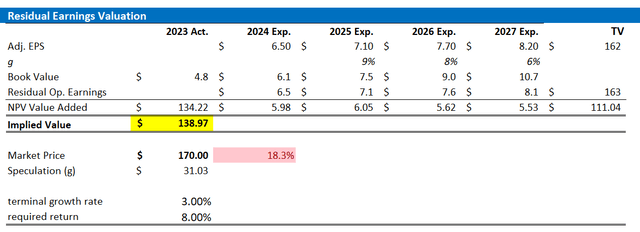

With regard to my Apple stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal till 2028. I believe taking the consensus is appropriate, as Apple stock is widely followed by analysts (thus, lots of data and estimates available) and taking the consensus smooths out any biases (mine included)

- To estimate the capital charge, I anchor on Apple’s cost of equity at 8.5%, which is approximately in line with the CAPM framework.

- For the terminal growth rate after 2025, I apply 3%, which is about 75-100 basis points above the estimated nominal global GDP growth. The growth premium should reflect the elevated potential for technology businesses in general.

Given these assumptions, I calculate a base-case target price for Apple stock of about $139/share.

Refinitiv; Company Financials; Author’s Calculations

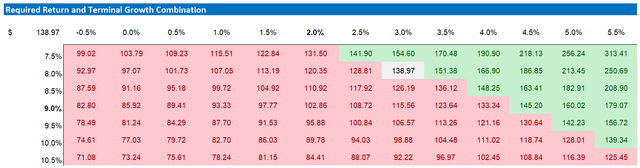

As I argued that my estimates for growth and equity charges may be conservative, I acknowledge that investors may hold varying assumptions regarding these rates. Therefore, I’ve included a sensitivity table to test different scenarios and assumptions. See below.

Refinitiv; Company Financials; Author’s Calculations

Investor Takeaway

Apple, once a leader among the “Magnificent 7” tech giants, is currently facing growth challenges, reflected in its comparatively lower Q4 YoY operating profit expansion and stagnant top-line growth. Particularly concerning are its struggles in the crucial Chinese market, where it’s losing both momentum and market share, notably impacted by local competitors and broader economic pressures. The introduction of the high-priced Vision Pro headset as a potential new growth avenue remains speculative. Adding to the complexity and risk profile, Apple is navigating a tightening regulatory landscape, particularly highlighted by the recent €1.8 billion EU antitrust fine, signaling potentially the start of increased scrutiny rather than an isolated incident. All this said, Apple’s current valuation at a 27x FWD P/E appears optimistic against this backdrop, suggesting a revaluation may be warranted given the current earnings yield juxtaposition with risk-free Treasury rates. According to my estimates, which anchor on analyst consensus estimates through 2028 and a 8.5% cost of equity, Apple stock should be worth $139/ share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.