Summary:

- Apple continues to delay and push out the launch of AR/VR devices.

- The tech giant might never launch the AR Glasses after the product release is pushed out another 1 to 2 years.

- AAPL stock doesn’t have the growth to warrant the current valuation of 28x FY23 EPS estimates without the catalyst of a hot new product.

PeopleImages/iStock via Getty Images

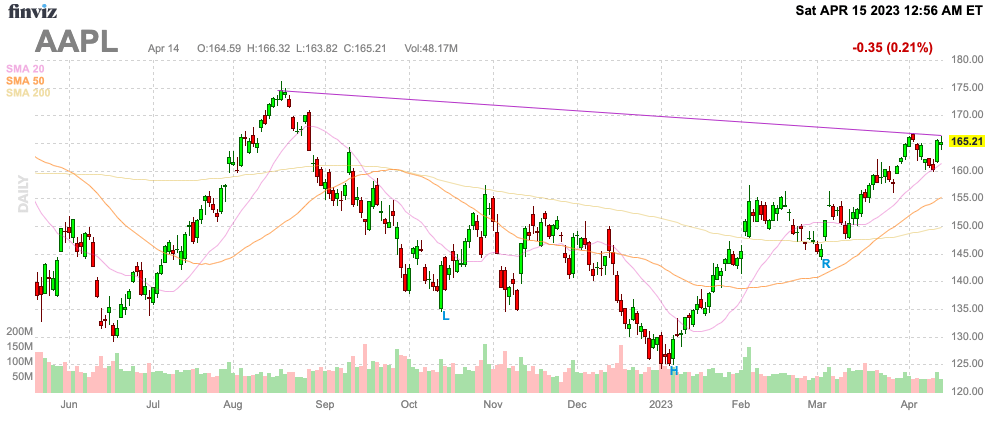

The big case for Apple (NASDAQ:AAPL) struggling over the next couple of years is the constant delay of new product releases. The iPhone has been around for well over a decade now and the tech giant needs to launch new products to re-invigorate growth. My investment thesis remains ultra Bearish on the stock priced for fast growth back at $165 while Apple struggles to launch the new AR/MR device.

Source: Finviz

AR/MR Device Delays

In the last couple of weeks alone, new Apple product plans have taken major steps backward. First, the new AR/MR headset launch has again been delayed by another 1 to 2 months. Second, Apple Glasses are now being delayed another couple of years, if not indefinitely.

A few weeks back, influential Apple analyst Ming-Chi Kuo suggested the tech giant wanted to delay the new AR/MR device for a more favorable economic environment. The analyst suggests up to a 2-month delay, moving the announcement back to late Q3’23, pushing the sales into FY24.

The headset has a long history of delays and the weak Meta (META) Quest Pro device hasn’t inspired confidence for the new Apple device. The Reality Pro device is predicted to cost between $2,000 and $3,000, not an ideal amount during a potential upcoming recession.

The same analyst is now predicting Apple Glasses won’t surface until 2026 or 2027. Ming-Chi Kuo suggests Apple is looking to adopt new metalens technology in other devices ultimately leading to the heads up display used for Apple Glasses.

The concerning aspect here is that Apple plans to use metalens covers in mass production for the Face ID system for the iPad Pro in 2024. The tech giant must successfully implement the technology in both the iPad and the iPhone products before moving on to the Apple Glasses, suggesting potential delays with the AR Glasses being 3rd inline for the new technology.

While AR Glasses are the holy grail of future products with the potential to replace smartphones, 9to5Mac predicts the device is too much of a moonshot project to expect a production date by 2026:

Apple Glasses are currently a moonshot project. Making them do all the things expected of them, in a device that has all-day battery life, which has a form factor similar to prescription eye-glasses, and is affordable enough to be a consumer product (even an Apple one), is a massively ambitious project. One that was always going to take many years: It was never likely to follow on in quick succession to the Apple Headset, gen 1 or gen 2.

At this point, Apple doesn’t appear to have much of a headset lineup with the AR/MR device primarily aimed at developers and other professional users. The company has no apparent clear path to an affordable consumer headset device anytime soon.

All of these delays come as Meta continues to roll out new products and appears to have a far more developed roadmap. The company has apparently already sold 20 million Quest devices and offers a strong roadmap unlike Apple as follows:

- 2023: Quest 3 – 2x thinner, twice as powerful

- 2023: Smart glasses – 2nd generation device

- 2024: Quest 4 – photorealistic, codec avatars

- 2025: Smart glasses – 3rd generation with a display and a neural interface

- 2027: AR glasses

The problem facing Apple is that Meta is unlike past competitors. The company has a market cap topping $570 billion, leaving prior competitors in the smartphone market like BlackBerry Limited (BB) as no comparison.

While Apple has a history of perfecting new products before release and quickly dominating the sector, Meta is a far more formidable competitor. The social media giant isn’t likely to give up a larger lead already being established as Apple flounders to even release a product.

Weak Visibility

Our view has long held that Apple needed to generate much stronger growth to warrant the current valuation. The tech giant needs successful new product launches to generate the growth warranting a stock trading at 28x FY23 EPS targets.

These AR device delays and the lack of a product roadmap similar to Meta reinforce the stock overvaluation. Analysts forecast Apple to watch EPS dip this year prior to a potential snapback in FY24.

Mac sales are already cratering, questioning the ability of Apple to even achieve the weak sales forecasts for a nearly 5% dip in the March quarter and 1% for FY23. According to IDC, Mac sales plunged 40.5% in the March quarter to only 4.1 million units while the tech giant actually underperformed the sector’s 29.0% dip.

Back in FQ2’22, Apple reported Mac sales of $10.4 billion. The tech giant could be looking at a $4 billion sales hit during the March quarter for the Mac alone.

The stock still trades at 23x FY25 EPS targets barely topping $7 while Apple currently trades at $165. The tech giant will generally struggle to reach 10% annual growth rates and the company has no new product releases to provide a big boost to an annual revenue stream set to top $415 billion next fiscal year.

Takeaway

The key investor takeaway is that Apple continues to lose visibility on the AR/VR devices expected to be the next new growth category. The stock is far too expensive here on the rally back to $165. Investors should use the recent strength to unload Apple at a premium valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.