Summary:

- Apple Inc. finally announced the much-delayed AR/VR headset at WWDC 2023.

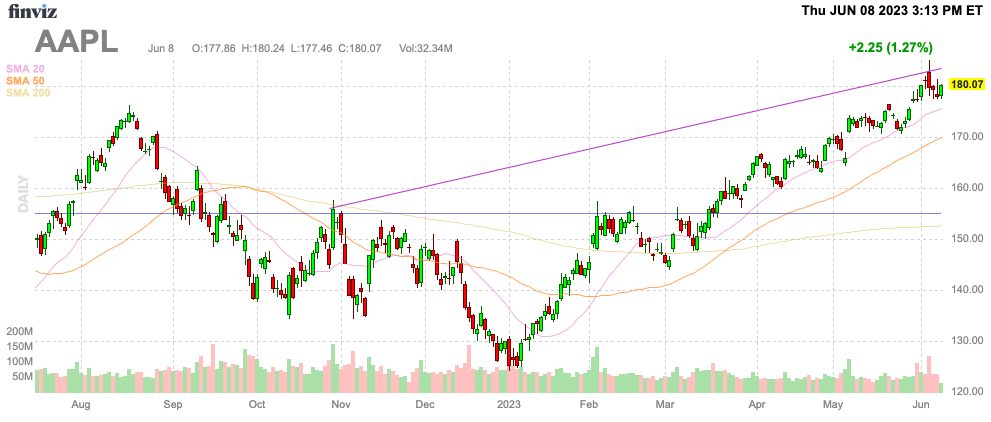

- The stock traded at all-time highs prior to the announcement in an irrational rally.

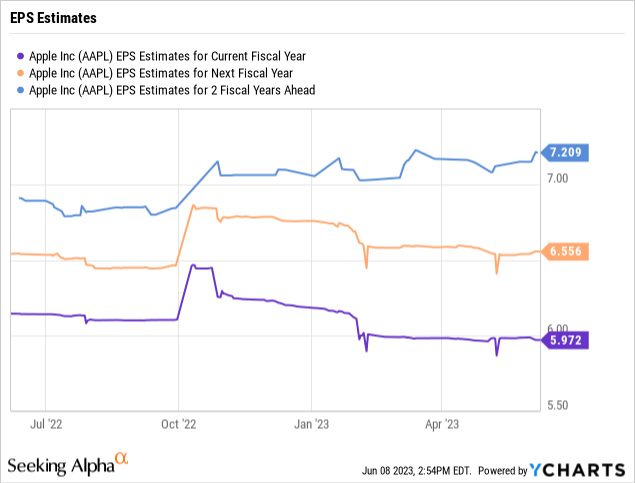

- Apple trades at 30x FY23 EPS estimates while consensus estimates for 10% EPS growth appear too aggressive.

Ildar Abulkhanov/iStock via Getty Images

By all accounts, Apple Inc. (NASDAQ:AAPL) announced a magical MR headset this week, but the device comes with several huge catches. Over the last few years, Apple has become adept at magically convincing investors that the next new killer product is on the way without actually ever releasing a new product. My investment thesis continues to remain Bearish on AAPL stock after Apple ticks a new all-time high with a very aggressive valuation multiple.

Source: Finviz

MR Headset Launch

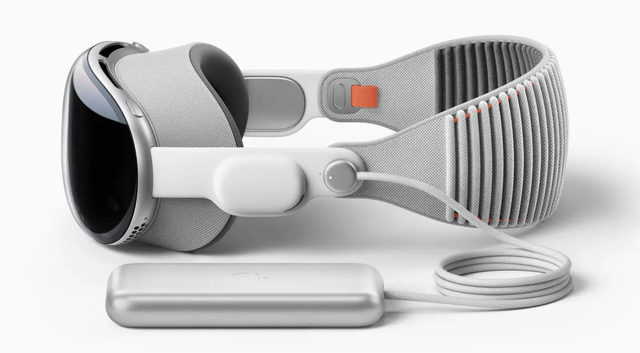

The long-anticipated mixed-reality headset was finally announced by Apple at the WWDC 2023 this week. The tech giant announced the Vision Pro headset with a couple of big catches: a $3,500 price tag and an early 2024 release date.

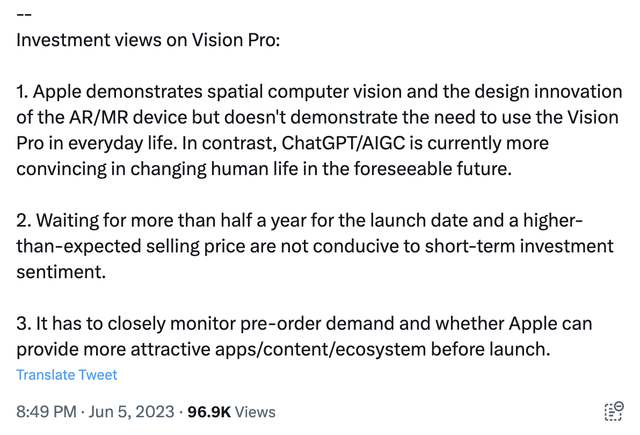

Influential analyst Ming-Chi Kuo highlighted on Twitter the main concern now facing Apple investors following the announcement of the Vision Pro and no actual release date yet:

Media focused on the actual device proclaimed the Vision Pro as magical, but lacking a purpose. The spatial computer is loaded with new features such as EyeSight delaying external visible images and numerous other features, including impressive high-resolution VR display.

Another big problem, though, is that attendees at WWDC didn’t get to test a lot of the features after the announcement. Demos apparently didn’t include the ability to take 3-D videos and photos along with the EyeSight function.

The Verge’s Nilay Patel called the device the “best headset demo ever,” likely causing some misplaced excitement for the Vision Pro device for a couple of reasons. The primary reason to dial back excitement is that the device is both the most expensive and newest release in the AR/VR category. Naturally, the device should have the best demo considering the timing and price point. More importantly, though, the Vision Pro won’t go on market until early 2024, which is at least 7 months from now.

Apple will clearly miss the key holiday window, and the release date is still uncertain. The market likes to make a lot of comparisons to the Meta Quest Pro, and logically so, but investors need to keep in mind that the Quest Pro was released last October at an initial price point of $1,499. By the time the Vision Pro is released in March (just a guess), the Quest Pro will have been on the market for 18 months.

The very interesting aspect of the note from Ming-Chi Kuo is the question about the product announcement so early before the release. Meta Platforms (META) is forecast to have the Quest 4 on market by the 2024 holidays with another smart glasses update, potentially topping the Apple device due to insights gathered from the Vision Pro announcement and eventual release.

Apple has yet to announce any product roadmap and the latest news has the AR smart glasses pushed out for up to 5 years and potentially the device is no longer in development. Before pushing the stock to all-time highs, investors need to absorb why the tech giant can’t get this device out for the crucial holidays this year and whether the delay has further risks.

Remember, the Verge editor-in-chief was clear the Vision Pro straps messed up his hair and the tethered battery is a huge problem with this headset seeing heavy demand. Apple really needs to release annual updates with major improvements here at a lower price in order for consumer sales to take off.

Slow Growth Ahead

Apple just released their first truly new product in nearly a decade, yet analysts still appear to forecast aggressive growth in the years ahead. Analysts have EPS growing at a nearly 10% clip in both FY25 and FY26 to reach a $7.21 EPS target.

The further delay of the MR headset should push out any material revenue estimates for the category till FY25. At 200K units in the next FY, Apple would only produce $700 million worth of revenues in FY24.

The struggle remains the market valuation with another product delay and even 10% EPS growth appearing aggressive here. The stock trades at 30x FY23 EPS targets and a dip to only 27x for FY24.

The new device won’t actually impact holiday sales until FY25, though a high end Pro device might not get a holiday push. Either way, this new product release isn’t material to the business and definitely won’t boost profits in the next couple of years.

A stock with 10% EPS growth would normally be lucky to trade at 20x forward EPS estimates, or ~$132 based on a FY24 EPS target of $6.56.

Takeaway

The key investor takeaway is that Apple Inc. stock is priced for a magical new product that Apple can’t actually release this year. Investor sentiment remains far too bullish for a new product with a lot of catches.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.