Summary:

- Apple’s seamless ecosystem and strong iPhone growth contribute to its ability to maintain sales growth despite declines in other product categories.

- Services sales are a bright spot, with significant growth potential in digital advertising and payment services.

- The success of Huawei in China poses a risk to Apple’s financial performance, and the high price of Apple’s Vision Pro mixed-reality headset may hinder widespread adoption.

yalcinsonat1/iStock Editorial via Getty Images

Thesis

Apple Inc.’s (NASDAQ:AAPL) ability to maintain sales growth, despite two of its product segments having faced substantial declines, underscores the strength of the company’s ecosystem. Despite now being in a mature smartphone market, iPhone has continued to show growth. Moreover, the recently announced Mac models featuring faster versions of Apple’s in-house processors are likely to stimulate demand in the near term.

However, the prospect of weak iPhone sales in China poses a major risk to Apple’s financial performance in 2024. The company’s stock is trading at a high multiple valuation, and I believe there is a limited risk/reward from here, leading to my hold rating on Apple stock.

Q4 Review and Outlook

Apple’s sales continued to decline in every quarter during FY2023. The slowdown in growth was due to a combination of several factors, including high growth in the previous years due to major product upgrades and higher-than-normal demand during the pandemic years. The company’s sales of $89.5 billion in the fiscal fourth quarter were down 0.7% YoY. The gross profit, operating, and net income all were up in the quarter, though marginally down for the full year. The services segment’s growth accelerated significantly to 16% in the quarter, compared to mid-single-digit growth in previous quarters.

Going forward, Apple’s long-term prospects remain solid. The company has been able to consistently gain market share in developed quarters, and in recent quarters, the market share in India has continued to grow. Although it does not contribute meaningfully to financials as of yet, it provides a good opportunity for growth going forward. Moreover, the continued growth in the number of users of Apple devices, driven by the company’s chip innovations, opens up opportunities to sell more services. While Services revenues have traditionally come from app developers’ commissions on the App Store, there is now a growing contribution from digital advertising and payment services, supported by the increasing use of Apple Pay in physical stores.

Huawei’s Phone Generating Excitement

Consensus revenue estimates for Apple in 2024 have continued to go down after the company’s fourth-quarter result as analyst revised their forecast for wearables and iPhone sales. The reduction in estimates is also due to Huawei’s recent success in China, which is a critical growth market for Apple in the medium term. Huawei’s new smartphones have emerged as the top choice among consumers, with many in China preferring Huawei over Apple’s iPhone. The key driver of this enthusiasm for Huawei appears to be the phone’s 5G capabilities. The threat from Huawei is a problem for Apple’s long-term outlook in the region. The company’s smartphone install-base market share in China is only around 18%, compared with a much more mature market like the U.S., where it accounts for roughly 42% of total smartphone units.

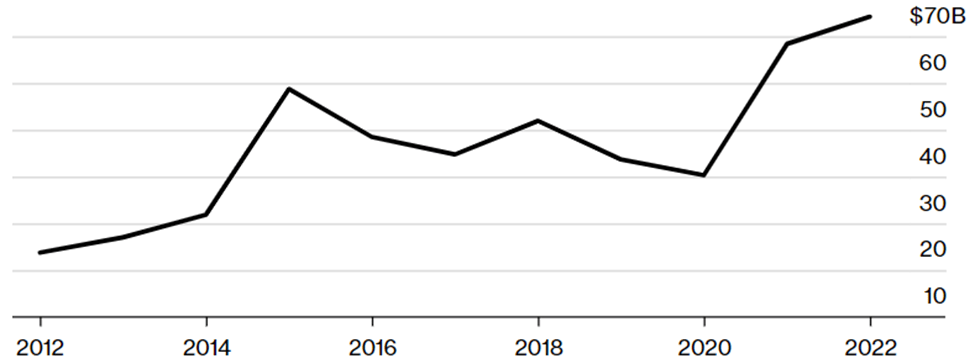

Apple’s fiscal year revenue from China (Bloomberg)

Services Sector Remains a Bright Spot

The services segment has been a bright spot for the company, and I expect Apple to sustain a low-double-digit growth in the services segment in 2024. I believe the growth from services will help offset the slowdown in sales of new products. Within services, digital advertising is becoming increasingly important as a driver of growth, alongside iCloud, AppleCare, the App Store, and payment services. AppleCare sales are directly linked to the average selling prices of Apple products, and I anticipate an increase in ASP, especially with the introduction of higher-priced models like the iPhone Pro Max. Moreover, I expect iCloud to grow as well, given steady increases in the content quality generated on Apple’s large install base of devices.

Vision Pro’s High Price, an Impediment to Widespread Adoption

Apple introduced its Vision Pro mixed-reality headset on June 5, marking its first major product launch since 2015. The device boasts an impressive display with 23 million pixels for each eye, far surpassing the quality of a 4K TV. I believe the Vision Pro’s high product quality in addition to Apple’s elevated standard for privacy, could draw early enterprise use cases, similar to Microsoft’s HoloLens rather than the consumer adoption seen by Meta’s Quest. These could include building 3-D immersive experiences, engineering, architecture, medical procedures, flight simulation, and other occupational training areas that are ripe for rapid adoption. On the consumer side, I anticipate that the Vision Pro could eventually carve out a new path for the Apple ecosystem, instead of expanding the iPhone’s accessories like the AirPods or Apple Watch that need to be tethered to the phone for the best experience.

Valuation

Apple’s consistent business model coupled with its share buyback strategy has been a key driver of growth in the company’s EPS over the past few years. The buybacks are increasingly important going forward, given AAPL’s revenue growth is now expected to slow in the coming year. I believe Apple doesn’t necessarily need to introduce new product categories to maintain a steady stream of free cash flow. The company’s dependable revenue stream, although facing potential challenges from longer upgrade cycles, could be further supported by increasing Services revenue.

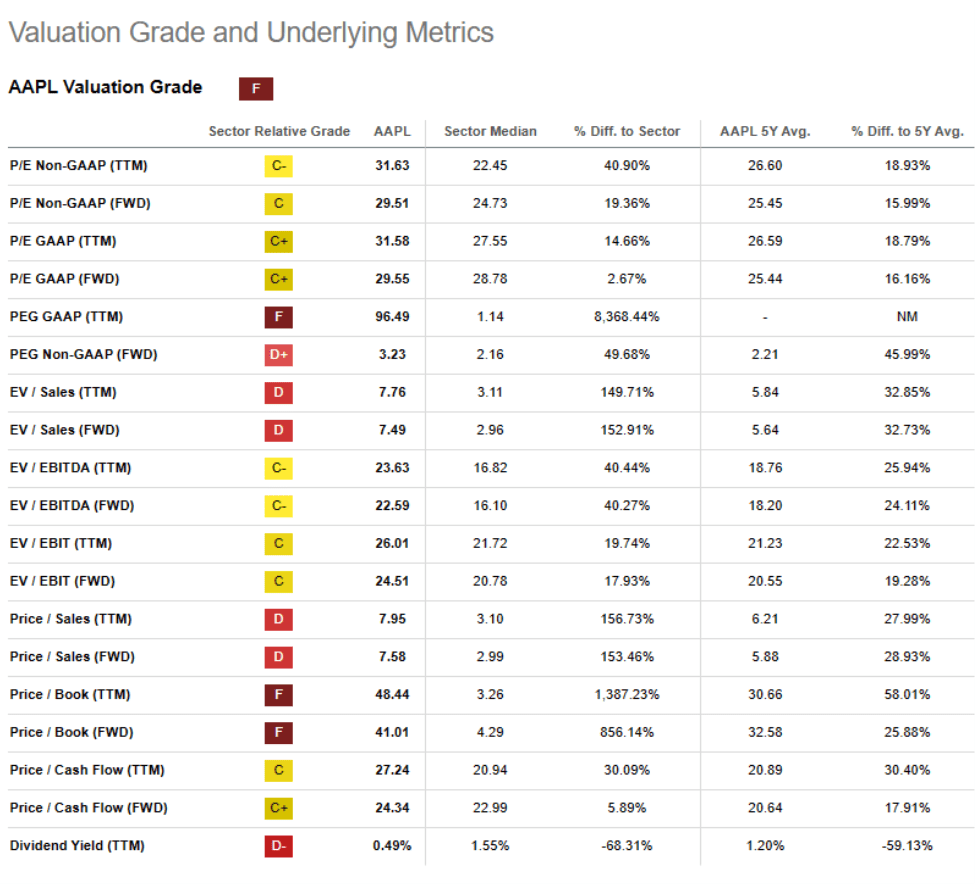

However, Apple stock is currently trading at a forward P/E of 29.5x, higher than the company’s three-year median of approximately 26x. Apple is currently facing the prospect of a slowdown of growth in China owing to increasing competition from Huawei, and if the company is not able to post a rebound in sales after a dim 2023, the stock will remain under pressure in my view. Hence, I remain cautious for now and assign a hold rating to the stock.

Seeking Alpha

Conclusion

Apple faced a decline in growth in 2023 as the demand environment slowed down after years of robust growth after the pandemic. The company’s consensus revenue estimates have come down after the fourth quarter results, partly due to the success of Huawei in China, which is a crucial growth market for Apple in the medium term. Lower-than-expected sales in China pose a significant risk to Apple in the medium term. With the stock currently trading at 29.5x forward PE, I currently stay cautious and assign a hold rating to Apple Inc. stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.