Summary:

- Apple’s new Vision Pro AR/VR headset is expected to contribute around $63 billion in revenues by 2032, with a dominant market share in the spatial computing industry.

- The total addressable market for AR/VR headsets is projected to be valued at around $210 billion by 2032, with Apple’s total revenues forecasted to reach $630 billion.

- Despite the potential success of the Vision Pro, I believe Apple’s stock is currently overvalued by 26.9%, making it a less attractive investment opportunity at present prices.

Nikada/iStock Unreleased via Getty Images

Investment Thesis

The freshly introduced Apple Vision Pro catapulted Apple (NASDAQ:AAPL) into the Metaverse race. Not only did the company present an AR/VR headset years ahead of any of its competitors, but it also felt the right to rename the market from Metaverse, a vague term, to spatial computing, a precise term to fully explain Apple Vision Pro’s capabilities paving the way for its adoption.

Aside from the initial critics about the whopping $3499 price tag, an Apple product has rarely been a flop. Public opinion was harsh against the AirPods when they were first launched, but fast-forward to the present day you can see people wearing them everywhere.

Now, I don’t think the streets will be crowded by people walking with their Apple Vision Pro on, at least not in the near term, but I still tried to project the total addressable market (TAM) of the new Vision Pro and the potential impact it will have on Apple’s bottom line.

Total Addressable Market

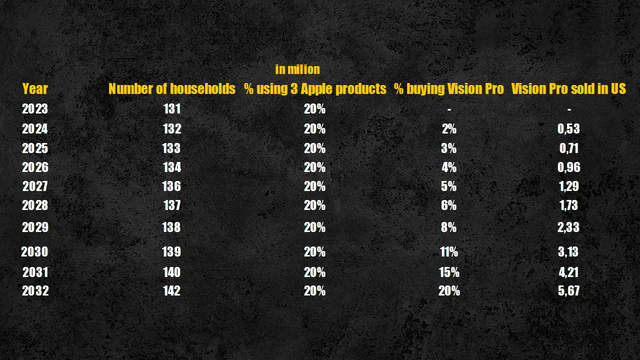

The early adopters of the Vision Pro will likely be people already heavily invested in Apple’s ecosystem. Parks Associates, a market research firm, conducted a market survey at the beginning of 2023 revealing that 20% of US households, roughly 26 million, have 3 or more Apple devices in their homes. However, given the $3499 price tag, I expect the very first buyers to be a combination of very loyal and wealthy customers.

More precisely I assumed that the percentage of US households having 3 or more Apple products purchasing the Vision Pro will increase from 2% in 2024 to 20% by 2032, equal to nearly 6 million visors sold only in the US.

US Vision Pro sales volume (Personal Data)

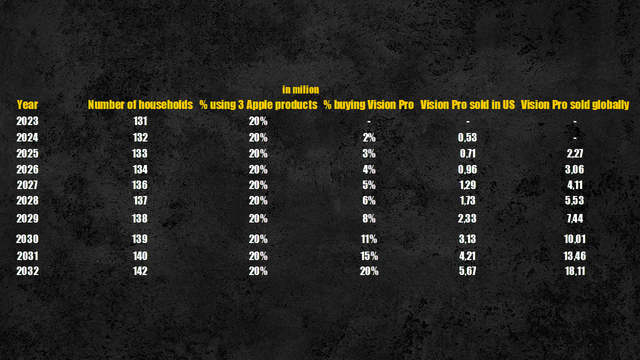

As regards international markets, I assumed the Vision Pro’s sales volumes to mimic iPhone’s ones, accounting for 31% of sales in the US and 69% in foreign markets. With these assumptions, I expect the Apple Vision Pro to sell around 18 million units globally by 2032.

Global Vision Pro sales volume (Personal Data)

Compared to 2022 figures, selling 18 million units would place the Vision Pro behind the Mac and MacBook in terms of sales volumes, which sold 26 million units in 2022. With Apple referring to the new market as spatial computing, and not as Metaverse, the company made clear its intent to market the new product as a business and productivity tool rather than a mere gaming console as all other AR/VR visors presented so far. Therefore, is plausible to see sales volumes closer to Mac’s ones as the two products will probably be used together.

Apple will likely have a dominant market share in the newborn spatial computing industry. The iPhone has a 20% market share in the smartphone industry, and I do expect Apple to achieve an even greater market share, around 30%, in the headset industry.

Apple products are already widely used for business purposes thanks to the powerful ecosystem the company was able to create. Leveraging on the already existing ecosystem, the Vision Pro will probably undertake a smoother adoption than rivals’ headsets, which will have to integrate with external ecosystems, granting Apple a dominant market share.

Revenue Projections

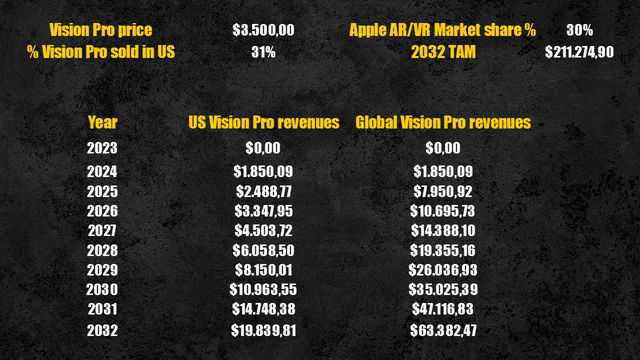

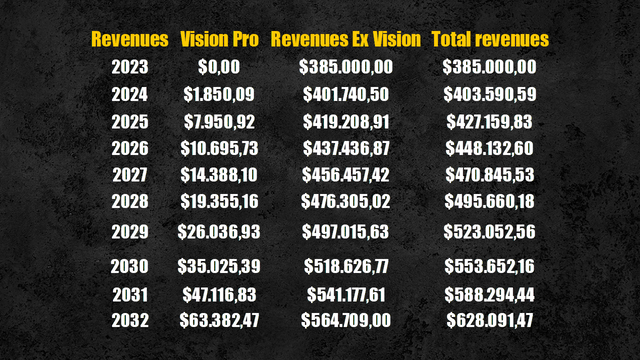

With 18 million units sold and a price of nearly $3500, I believe the new Apple Vision Pro can be expected to contribute roughly $63 billion in revenues by 2032.

Assuming the $63 billion revenues generated by the Vision Pro represent 30% of the TAM, it is implied that the TAM for AR/VR headsets will be valued at around $210 billion by 2032.

Vision Pro revenues & TAM (Personal Data)

If compared to Apple’s 2022 revenues of $394 billion, the Vision Pro would represent 16% of total revenues, however, I don’t expect the recently introduced headset to cannibalize Apple’s existing products line. The best use of the Vision Pro is in combination with the other Apple products to efficiently benefit from Apple’s ecosystem.

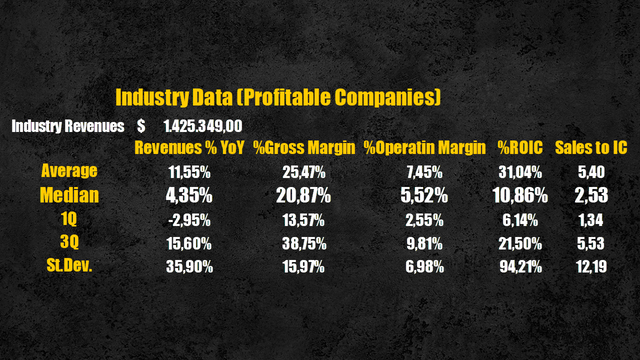

Assuming the company’s core revenues to grow at a CAGR of 4.35%, equal to the median revenue growth rate for the technology hardware industry, Apple’s revenues ex-Vision Pro are expected to reach $564 billion by 2032.

Technology hardware industry data (Personal Data)

Adding the $63 billion derived from the sales of the new visor, Apple’s total revenues are forecasted to be around $630 billion by 2032, growing at a CAGR of 4.77% in 10 years. Vision Pro, therefore, will account for 10% of total revenues.

Apple future revenues (Personal Data)

Efficiency & Profitability

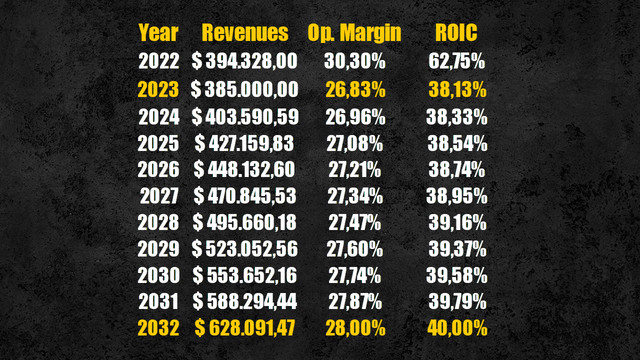

As regards Apple’s future efficiency and profitability, given the high initial price of the Vision Pro and the strong brand of the company, I don’t expect to see significant changes in the historical values registered by the company.

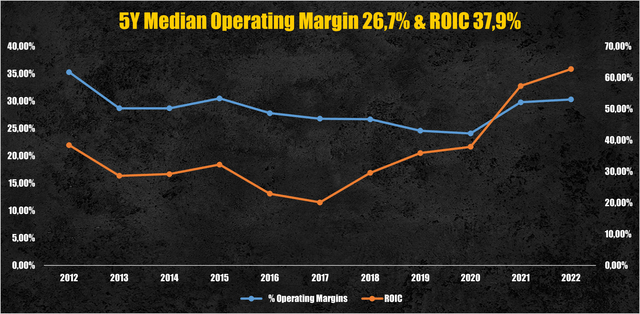

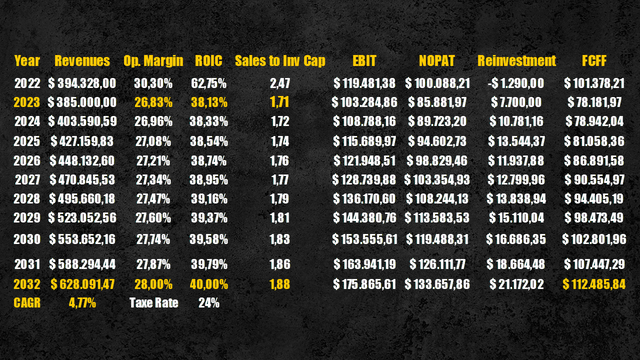

The 5-year median operating margin is 26.7% while the median return on invested capital (ROIC) is 37.9%.

Apple operating margin & ROIC (Apple)

It might be possible to witness an increase in R&D expenses as Apple invests to support the new spatial computing branch, however, as underlined by Mrwhosetheboss, a famous YouTuber whose reviews tech products

Apple has been secretly preparing for this headset for years now, they introduced the lidar scanner into the iPhone 12 Pro…. and a couple of years ago they announced spatial audio for AirPods… useless for an iPhone but meant for a headset.

For these reasons, I feel confident assuming Apple won’t require extraordinary capital investments to support the new business line, continuing to reinvest at the same rate it has done in the past.

Therefore, by 2032 I assumed both the operating margin and the ROIC to slightly improve to 28% and 40% respectively, as Apple established itself as a main player in the recently born spatial computing industry.

Apple future operating margin & ROIC (Personal Data)

Cash Flows Projections

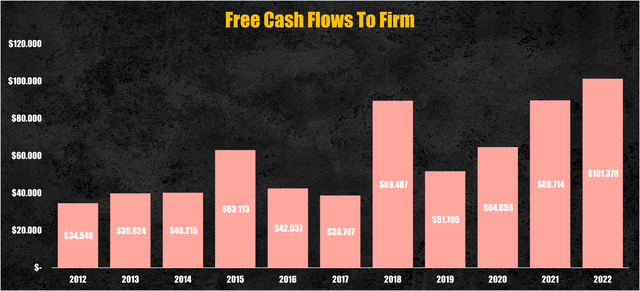

In the past Apple has generated solid cash flows for its shareholders, exceeding $100 billion in 2022.

Assuming the company will maintain a reinvestment margin of around 3%, similar to its median reinvestment margin of 3.89% registered in the last 10 years, Apple is likely to keep delivering solid free cash flows to the firm (FCFF), expected to sit around $112 billion by 2032.

Apple future FCFF (Personal Data)

Valuation

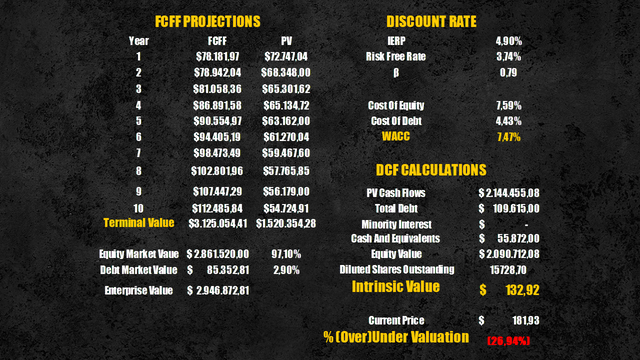

Applying a discount rate of 7.47%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $2 trillion or $132 per share.

Compared to the current prices, Apple’s stocks result overvalued by 26.9%.

Apple intrinsic value (Personal Data)

Conclusion

Apple has never been the first player, but when it enters a new market, it usually ends up as its leader. Despite the many criticisms received after the introduction of the Apple Vision Pro, seems clear that the direction we are going is more and more the one of the Metaverse, or spatial computing, whatever you want to call it.

The Vision Pro will probably be another success for Apple, contributing to generating big and consistent cash flows for its shareholders, however, given the assumption made, at today’s prices, I think Apple is too expensive to represent a good investment opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.