Summary:

- Ahead of Apple’s Q4 earnings, long-term investors should be cautious about expanding positions at current valuations.

- Initial sales for iPhone 16/16 Plus are below expectations. However, pending Apple Intelligence deployment indicates potential for future growth.

- While Apple’s market cap may exceed $4T soon, this growth might not last. Long-term investors should hold their positions instead of buying more.

- Long-term investors should watch for potential growth declines due to innovation challenges and a diversifying hardware market affecting Apple’s performance.

nelic/iStock via Getty Images

After covering Apple (NASDAQ:AAPL) in August and putting out a Buy rating related to short-term momentum factors from the upgrade supercycle, the stock gained 9% in price. I am returning to a long-term-oriented approach for this analysis, touching on my expectations of the company’s Q4 and full-year 2024 results; these are expected on 10/31/24 during market hours. Apple’s relatively weak position in the AI industry, as well as concerns with market saturation and innovation risks, could mean the stock is positioned poorly in a potentially weakening macroeconomic environment. Furthermore, it is one of the most highly valued companies in the Magnificent Seven, and there is no indication that it deserves this based on its future expected growth rates.

Important Factors Leading Into Q4 and FY24 Earnings

The iPhone is still the major driver of Apple’s growth, but the expansion in sales from AI-driven sentiment from the iPhone 16 and iPhone 16 Plus has not manifested quite as expected. These models sold 37 million in their first weekend, which is lower than the previous iPhone 15 launch and shows a 12.7% drop in demand. This isn’t a great sign, but it’s primarily because the new AI features are not active yet, which is why, arguably, the upgrade supercycle has not fully begun. That being said, it is a slow start, and I believe it touches on a broader innovation weakness at Apple right now. I do not believe this is what Steve Jobs would have been pleased to see, and I think we are seeing much more ingenious innovation from Meta (META) right now, which had a blockbuster Meta Connect 2024, showcasing incredible levels of technological breadth and innovation, particularly with smart and AR glasses, including Orion.

Furthermore, Apple has recently been struggling in the Chinese market. The company is competing against domestic brands like Huawei, vivo, and OPPO. Huawei, in particular, has made a strong comeback with high-end devices, and I believe this threat could intensify. Apple could be weakened in the coming years, especially as the globalization narrative, which was so accretive to Western big tech, becomes further disrupted by geopolitical tensions. In a multipolar world, do not be surprised if companies like Huawei start to become more internationally formidable alongside Apple. Similar to Tesla (TSLA) with its EVs, Apple has been offering discounts to maintain its market position in China, aiming to counteract aggressive pricing and feature-rich offerings of local competitors.

Furthermore, many consumers in China prioritize features such as camera quality and battery life over AI capabilities, which has influenced purchasing decisions. The delayed introduction of AI features in Apple’s devices means that this status quo is still maintained, despite potential accretive shifts to Apple later. It’s also a valid concern that Apple will face stringent regulatory hurdles in China related to Apple Intelligence, an area that could be weaponized by the Chinese government in an escalating geopolitical climate.

Another important segment to monitor in Q4 is the company’s services segment, which continues to perform well and be at new all-time highs in revenue. This is expected to maintain its growth trajectory, driven by subscription services such as Apple Music and Fitness+.

Overall, the consensus is that Apple will achieve a YoY normalized EPS growth of 9.4% for Q4, up from 4.9% in Q3. However, my independent view is that this will be underperformed, primarily related to weaker initial sales of the iPhone 16 and 16 Plus. That being said, there is near-term growth here to support momentum, but I expect most of this to occur in 2025, when Apple Intelligence will likely begin to create much more demand in the market for Apple’s latest devices. That being addressed, I believe the greatest near-term risk is overvaluation from the AI upgrade supercycle, which could be followed by the beginning of a long-term Western recession and an intensifying geopolitical environment. At a potentially speculative valuation in a couple of years, I believe there could be significant downside volatility.

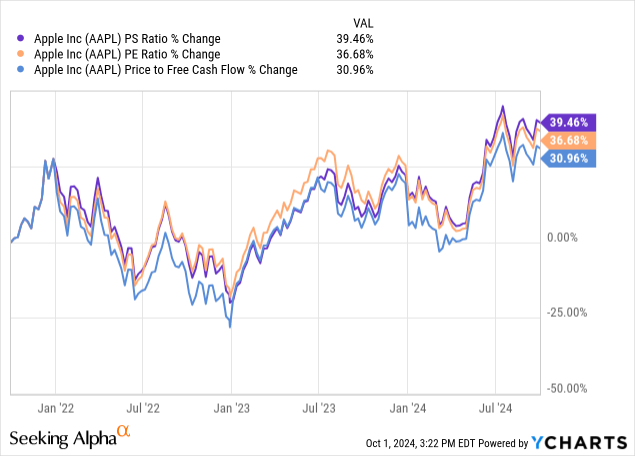

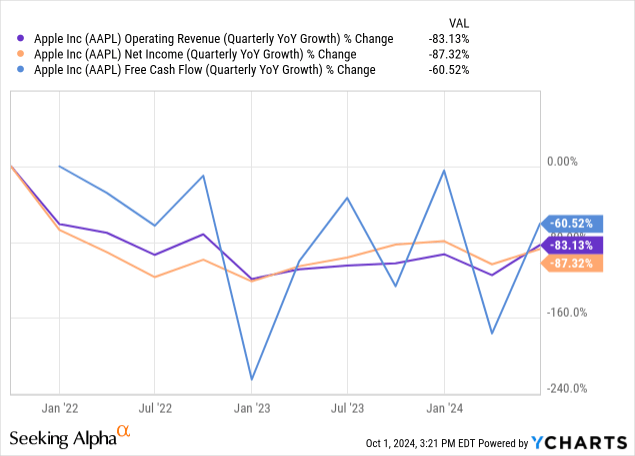

Valuation Analysis: Near-Term Momentum Likely Followed by a Medium-Term Correction

The following graphs show the core weakness in the long-term Apple investment thesis at this time. The company’s three core valuation ratios (P/S, P/E, and P/FCF) have all risen significantly over the past three years. However, its operating revenue, net income, and free cash flow quarterly YoY growth have been declining. While we can expect future increases related to the AI upgrade supercycle, this is largely already priced into the stock, which can be seen evidently in the first of the two charts below.

Furthermore, it is worth comparing Apple with other companies in the Magnificent Seven to gauge its relative valuation.

| Apple | Meta | Tesla | ||

| Forward non-GAAP P/E ratio | 34.8 | 26.9 | 21.7 | 112.1 |

| Forward diluted EPS growth | 6.62% | 41.65% | 24.1% | -7.44% |

| Forward PEG non-GAAP | 4 | 1.5 | 1.3 | 9.3 |

| Forward P/S ratio | 9.1 | 9 | 5.9 | 8.4 |

| Forward revenue growth | 2.11% | 16.43% | 10.98% | 12.64% |

| Forward P/S to revenue growth | 4.3 | 0.55 | 0.54 | 0.66 |

Based on these metrics, it is absolutely evident that Apple is overvalued, and I believe it to be extremely risky to invest in the company given the company’s future growth narrative does not look as strong as Tesla’s, which is the other stock in the cohort that looks overvalued to me. Both Google (GOOGL) (GOOG) and Meta look cheap on all measures, and I believe both of these to be of much better value. It is one thing to invest in a company based on historical sentiment for the stock alone, but it also needs to be compared with peers, as any changes to the macroeconomic market are likely to cause more significant downside volatility in companies’ share prices with high valuation ratios unsupported by appropriate growth rates.

I mentioned in my last analysis of Apple that the company could reach a $4 trillion market cap in 2025 based on its AI upgrade supercycle. However, it is worth considering as a long-term investor that many of these gains are likely to be speculative. In essence, as the company approaches that valuation on short-term sentiment factors, expect significant downside volatility to follow, especially if a long-term recession manifests due to high inflation, United States Federal Government debt, and geopolitical intensities. In my opinion, Apple is much better positioned as a near-term investment based on AI momentum than as a long-term investment, given its high valuation, which I think is unsustainable.

Apple’s P/E non-GAAP ratio’s five-year average is 28.8. Its three-to-five-year forward EPS GAAP long-term growth CAGR consensus estimate is 8.63%, versus 11.35% as its five-year average. As a result, I think we should expect a medium-term contraction in the company’s P/E non-GAAP ratio, down from 35.5 to around 25. I expect this is likely as sentiment factors abate from the AI upgrade supercycle. So, we might be looking at this lower P/E ratio in three to five years. For this analysis, consider that if the company delivers normalized EPS of $9.40 in September 2027 (based on my 12% three-year CAGR estimate from the September 2024 EPS consensus of $6.69) and is trading at a P/E non-GAAP ratio of 25 (due to slower growth expected for the years following after tapering of AI demand), the stock price will be $235. As this analysis is written on October 3rd, 2024, and the stock price is $225, this indicates a CAGR of 1.5%. Therefore, Apple can certainly be considered no more than a medium-term to long-term Hold.

Risk Analysis: Long-Term Contraction

Even though my analysis gives a Hold rating, I think there are valuable reasons to consider that the company could face a more protracted decline in growth rates over the coming decades. This primarily includes Apple’s weak positioning in AI and a lack of innovation in critical models like AR glasses, with insignificant adoption of its Apple Vision Pro VR headset. We are at an inflection point in technological innovation, but this does not mean historical industry leaders will continue to dominate. Instead, it opens up a radical new moment of potential disruption, where novel technologies developed by competitors could take market share.

The two areas where I think Apple is currently difficult to compete with are the smartphone and PC markets. This design and hardware strength is reinforced by a robust operating system that has many users, myself included, locked into its ecosystem. That being said, I think this network effect is less strong than initially assumed. With the current trends in cloud migration, it is much easier for many workflows to be transferred from one operating system to another via the Internet. Therefore, I think we are going to see a democratization and diversification in hardware and design in the phone and laptop markets. As a result, I think Apple is becoming weak in this regard. To counter this, management could adopt deeper customization of its product set, but this goes against the culture that Apple was founded on, which is closed-source and focused on standardization. In other words, I do think management is playing it too safe here, and while this might work for some time to carry Steve Jobs’s legacy forward and create safety in the business model, it is also likely to begin to bring in elements of redundancy and customer fatigue surrounding its offerings. Business contraction happens incrementally, often compounding negatively, similar to the compounding during a company’s rise. Therefore, I think we could be at a pinnacle here with the AI upgrade cycle, which, once over, could mean the market notices the company’s valuation is too high if we also start to see a long-term contraction in the company’s fundamental growth rates.

Conclusion

Apple is one of the most important technology companies in the world, and I do not see this changing. However, I do believe that the business is vulnerable to contraction in the medium-term to long-term future. Q4 is likely to be relatively strong, with real growth coming in FY25 with Apple Intelligence, but following this, I expect valuation multiple contractions, and I estimate a CAGR of only 1.5% over the next three years. Therefore, my long-term value rating is a Hold, even though in my last near-term oriented momentum analysis, my rating was a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.