Summary:

- Apple is expected to release the long awaited AR/VR device at the WWDC on June 5.

- The tech giant could release a flop setting back product development under CEO Tim Cook.

- The stock trades at 30x FY23 EPS targets, likely due to an investor base overly bullish on the new product release.

Niall/iStock via Getty Images

Apple (NASDAQ:AAPL) is heading to towards a huge moment of truth event with the expected release of an AR/VR device at the WWDC. Meta Platforms (META) just announced another headset while Apple investors are waiting on the official entry into the category in the sign of how much the tech giant is struggling with new product development. My investment thesis remains ultra Bearish on Apple with the stock trading at all-time highs while all signs point towards a major flop here.

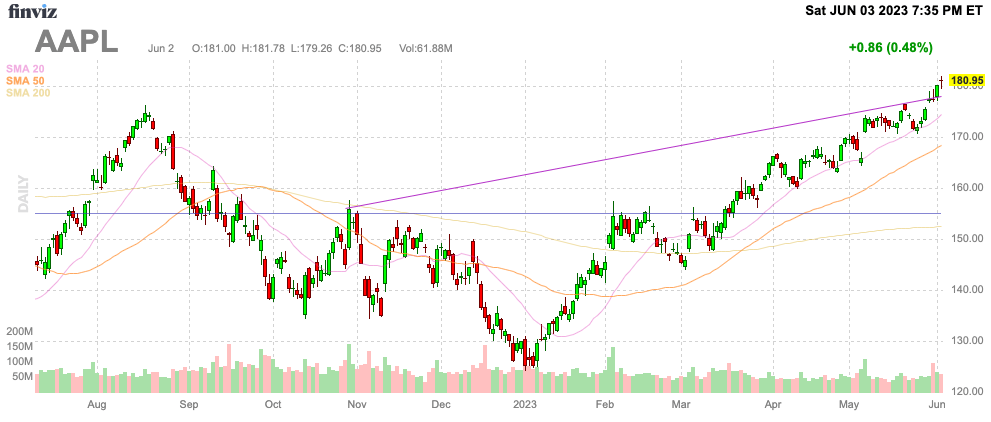

Source: Finviz

Headset Wars

Meta just announced a third generation product in the Meta Quest 3. The VR/MR headset is set to be released in the fall with a $500 price tag and more details at the Meta Connect event on September 27.

The headset offers a 40% slimmer form factor and up to 200% higher resolution with the new Snapdragon chipset from Qualcomm (QCOM). Meta already has over 500 apps that will work with the Quest 3.

The problem facing Apple is that the company doesn’t have a product, much less an ecosystem, to utilize any AR/VR device with a $3,000 price point. Apple is expected to release the device at the Worldwide Developers Conference (“WWDC”) on June 5. The good news is that Meta still hasn’t created the holy grail of smart glasses that allows for a truly immersive experience without lugging around a device strapped to one’s head.

Regardless, Meta continues to constantly release new products with enhancements to prior generations. Users can have comfort that Meta is investing in product upgrades and growing the app platform.

Note, Apple won’t have a consumer device to compete with Meta in the next year and possibly years into the future. Apple is expected to release a $3K device for developers with a wire attached for the battery. Nothing about the Apple device speaks of breakthrough technology.

As CNBC highlights, the Apple headset is the first major device since the Apple Watch in 2014. The Watch took 8 years to start delivering 50 million units with revenues reaching up to $18 billion now.

The combination with AirPods and other Home devices only generated a combined $41 billion in sales for FY22. The majority of sales were from the Watch and AirPods, yet all of the products in the Wearable/Home/Accessories category hardly generates 10% of sales.

Considering the AR/VR device is the most meaningful new product in nearly a decade, a failure will have a profound impact on Apple. The company doesn’t have another product on the radar to boost sales.

Tim Cook took over as CEO in 2011 and the executive probably gets too much credit for product development during this period. The vast majority of sales growth has occurred due to the iPhone success in growing quarterly revenues from the $10 to $20 billion range to now $40 to $70 billion levels.

As CEO, Cook has been impeccable at growing sales via improvements to existing products and expanding into services. Due to Covid pull forwards, Apple no longer has a product tailwind and in fact faces more of a headwind leading to the multiple quarters of sales declines.

During this period, iPad revenue has stalled and Mac revenue is now showing signs of returning to base revenue levels similar to pre-Covid numbers. In a lot of ways, Cook has boosted iPhone sales and grown services for iPhone users with little to no improvements in any other category during this period.

In essence, investors should have no reason to expect a major success of the AR/VR device category. Users have shown no interest in paying up for a $3K Pro device and Meta is selling the consumer AR/VR device at a price point similar to the Apple Watch and doesn’t expect annual sales to even top the 10 million level.

Apple hasn’t done anything to make the device appear headed for success and influential analyst Ming-Chi Kuo doesn’t even forecast 1 million units sold in the first year. The revenue target is only in the $3 billion range and Kuo actually appears bullish on the device suggesting some people expect Apple to fail to reach this target.

Too Much Confidence

Despite all of the logic pointing to Apple under Tim Cook failing to launch any material new product, investors are still willing to pay all-time high prices for the stock. The major risk here is that a product failure reinforces the ineffectiveness of Cook since Steve Jobs passed away.

Any AR/VR headset failure will immediately reduce any premium valuation in the stock for a future Apple Car product. The difference now is that the smartphone market wasn’t near fully saturated back in 2011 allowing Cook to utilize operational excellence to drive growth while Apple now needs a huge product hit to drive growth with annual sales reaching $400 billion.

As highlighted in prior research and ignored by the market, analysts forecast limited growth in the years ahead. These numbers should actually factor in revenues for the AR/VR device considering the expectations for a launch this year, yet Apple appears set to disappoint.

After sales dip in FY23, the consensus estimates have Apple growing sales sub-7% for the next couple of years. An AR/VR device failure couple trip several billion off those sales targets and further reduce the growth rates.

The only justification for the stock trading above 30x FY23 EPS targets is a huge hit on the AR/VR device being released at the WWDC on Monday.

Takeaway

The key investor takeaway is that Apple is priced for huge new product hits to drive growth for years into the future and this doesn’t appear grounded in reality. The tech giant is expected to disappoint the market with a new AR/VR headset and the stock should sell off next week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.