Summary:

- Apple Inc. spent most of 2022 valued as if a couple of moonshot projects would move the needle for their $400 billion business.

- The key AR/VR devices launch plans continue to be pushed back, with the scale of sales targets not large enough to impress the market.

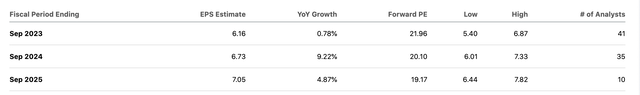

- Apple stock remains expensive at 20x FY24 EPS targets, despite the limited growth forecast over the 2-year period from supply and demand issues.

Greg Ballan/iStock via Getty Images

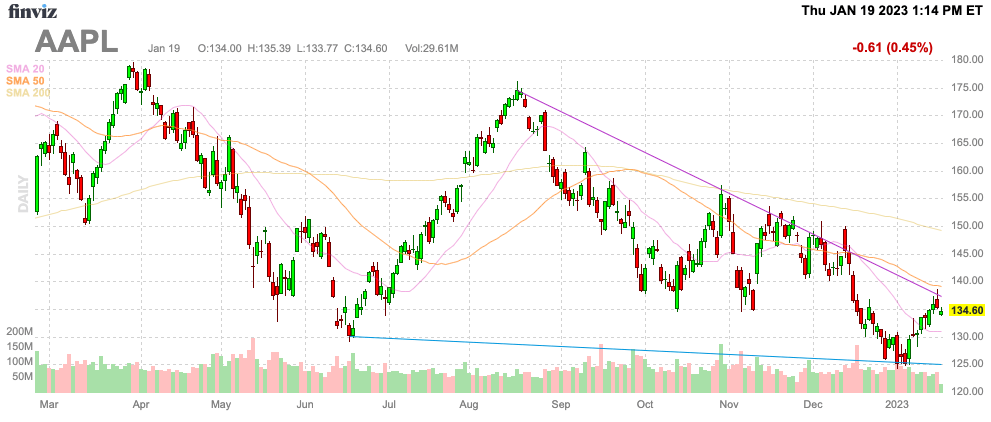

As Apple Inc. (NASDAQ:AAPL) returns back to a more normal valuation multiple, investors need to be aware the equation still isn’t in favor of outsized gains over the long term. The tech giant has recently run into demand issues, finally popping up following a couple of years of strong covid boosts and key moonshot projects continuing to struggle. My investment thesis remains Bearish on Apple Inc. stock, with the dead money thesis playing out in full force now.

Source: FinViz

More Moonshot Delays

A big part of the dead money call on Apple Inc. was the reliance on new hyped products to drive the stock higher. The Apple Car and the AR/VR headsets were the big drivers of pushing the stock up to $160+, and these products weren’t set to provide much revenue for the tech giant over the next few years.

The news surrounding the AR/VR devices have helped the dead money call to a huge degree. The long-speculated mixed-reality device costing upwards of $3,000 has yet to be released, while the Apple Car continues to scale back and push out any delivery data.

The latest news from Bloomberg has the whole schedule for AR/VR devices delayed further, with the AR glasses delayed indefinitely due to a technical issues. The low-end MR device may not reach market until 2025, leaving a huge vacuum from the release of the high-end MR device this year until a second model reaches market up to 2 years later.

The problem facing Apple is that the initial cost of the MR device, possibly named “Reality Pro,” expected to be released this year will likely price most people out of the market. In fact, the tech giant doesn’t appear to have a product competitive with the Meta Platforms (META) Pro device until possibly 2025.

Apple currently has 10 cameras, sensors, and multiple chips needed to build the MR device. The company is pushing to use cheaper iPhone related products and chips in the low-end device to lower prices, but this product may not reach market for a couple of years, after which Meta has released newer versions and established a strong roadmap in the VR sector.

The revenue potential for the AR/VR device category over the next 2 to 3 years appears very limited. The Apple Car is already forecast as a 2026 product, with limited details providing confidence the tech giant will have a product in this area anytime soon.

The AR glasses are the most promising device where Apple could replace the bulky iPhone with a device providing a display to replace most of the functions of a smartphone. The problem is that this device appears to have no specific plans anymore, with a limited employee group even working on the device. The VR device is far behind Meta’s Oculus products that have been on the market since 2016 with the original Oculus Rift.

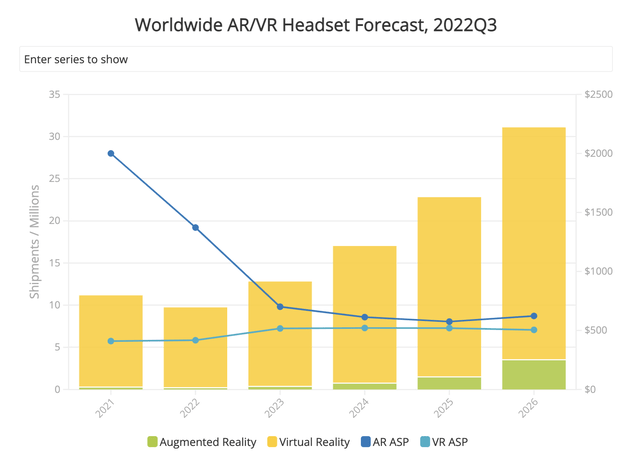

According to data from IDC, the AR/VR market struggled in 2022, with sales down due to Meta only releasing a $1,500 Pro model this year. The numbers don’t support a lot of demand for a product from Apple at double the price of the Quest Pro, with unit shipments down an estimated 12.8% last year to 9.7 million units.

The definition of moonshot has changed over time, with Merriam-Webster now defining the original “long shot” as follows:

a project or venture that is intended to have deep-reaching or outstanding results after one heavy, consistent, and usually quick push.

The AR/VR devices and the Apple Car definitely fall under the category of the potential of a moonshot. Apple expects to generate deep-reaching results by entering new categories.

Unfortunately, products for both categories continue to be pushed out. Even the Evercore ISI analyst forecasts a scale AR/VR offering delivering just $18 billion in sales and a near-meaningless EPS of $0.19.

The AR glasses have the potential to replace the iPhone over time, providing the ability for the product to move the needle for Apple. The tech giant is on the path to $400 billion in annual sales, so any product amounting to less than 5% of sales won’t even qualify as a moonshot.

Back To Trend

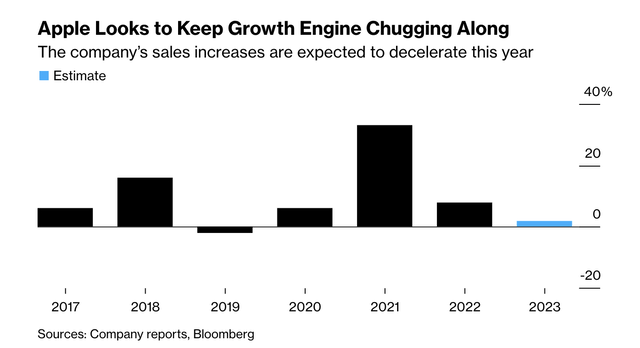

The below chart highlights the problems with Apple trading over 30x forward earnings estimates in early 2022. The tech giant doesn’t have a history of the growth warranting a high multiple.

Outside of the big FY21 boost to sales from covid, Apple has at least 5 out of the last 7 years with meager growth. The current consensus estimate forecast is for only 2.5% revenue growth in FY23.

At the start of January, Apple reportedly cut orders for the MacBook, Apple Watch and AirPod in a sign of the flip side of the big covid boosts in FY21. The un-named Apple supplier suggests the issue is partly due to less-than-expected demand.

The tech giant faced a tough end to 2022 with a lack of iPhone 14 supply due to Foxconn facing covid shutdowns in China. Apple has continued to both production away from China, but the company faces anger from the communist government that good undercut sales in the country.

Apple Inc. stock has rallied back to $135, placing the valuation in a stretched position again considering all of the production and demand issues along with both major moonshots fizzling. While analysts currently have earnings rebounding next year, Apple Inc. stock still trades at 20x FY24 EPS targets, with limited growth projected over the 2-year period.

Takeaway

The key investor takeaway is that Apple Inc. needs the big moonshot projects to pay off or investors are left with more years of limited growth. The constant delays in the AR/VR category provide no confidence the products will successfully boost revenues material enough to warrant a higher stock price.

Apple Inc. remains a sell until the valuation equation is altered by a lower stock price, or the company successfully hits on a moonshot project.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.