Summary:

- Apple’s stock is in a tricky spot. There are multiple avenues for management to re-ignite growth after a long period of stagnation, but the valuation reflects this fact.

- iPhone pricing, services pricing, and the potential to collect AI ‘toll booth’ fees should drive financials up and to the right over the medium term.

- The valuation, at 9x sales, is at record highs, and buying here appears very risky.

- Thus, our ‘Hold’ rating. If you’d like to buy or get involved, waiting for a dip seems like the move.

ozgurdonmaz

Over the last year or so, we’ve put out 3 separate articles about Apple (NASDAQ:AAPL):

- It’s Time To Trim Apple On Saturation Concerns

- Apple: A Big Bearish Rejection (Technical Analysis)

- Apple: Relatively Immune From AI Disruption

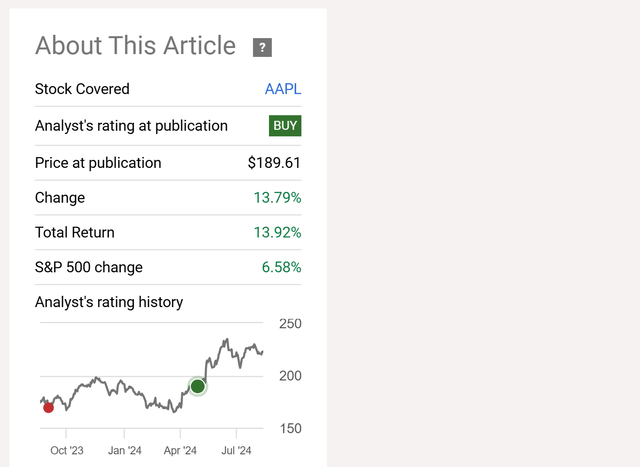

In the first two articles, we rated AAPL a Sell based on a number of fundamental and technical factors, and from the time of our first rating, the stock basically traded sideways, underperforming the S&P 500.

However, in our most recent article from May, we upgraded AAPL to a ‘Buy‘, arguing that the stock was relatively immune (and could possibly even benefit) from the AI boom. When combined with continued growth on the services front, it was enough for us to flip to a bullish stance, despite the heightened valuation.

Since then, AAPL has done well, outperforming the market by more than double:

Fast forward to today, and we find ourselves in a tricky spot with AAPL.

While the company continues to pump out $25 billion a quarter in profit, sales growth has been anemic as the company’s sales velocity has slowed as of late.

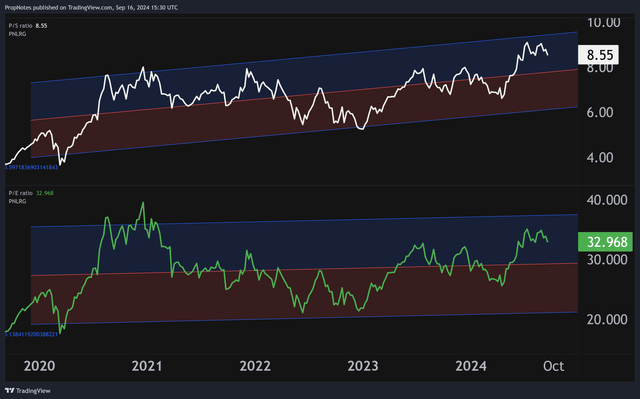

At the same time, the stock is more richly valued than almost ever before, trading at nearly 9x sales and 33x net income, which is basically at the top end of the range.

Despite this valuation, though, we think AAPL has a number of levers they can pull to re-invigorate growth, which could lead to continued gains in the coming year or two.

Taken together, we don’t think anyone should sell AAPL simply due to the valuation, given the multiple routes AAPL has for growth. That said, for those looking to add to a position, now may not be the best time to do so.

As a result, we’re downgrading AAPL from a ‘Buy’ to a ‘Hold’ for the time being.

Let’s dive in and explore this thesis in more detail.

AAPL’s Big Picture

If you zoom ‘all the way’ out, AAPL has had an interesting couple of years.

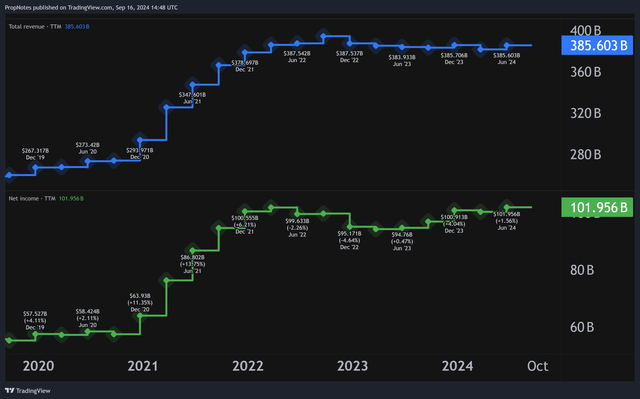

From the top down, AAPL’s revenues and net income have grown considerably from 2020 through today, which is a result of several new iPhone launches, new chips, and growth in AAPL services:

However, as you can see, TTM top and bottom-line results have been mostly flat since mid/late 2021, which shows the effect that Covid had on pulling demand forward, thus robbing subsequent years of an organic growth driver.

While all of this was happening, the content and character of AAPL’s earnings has been changing significantly.

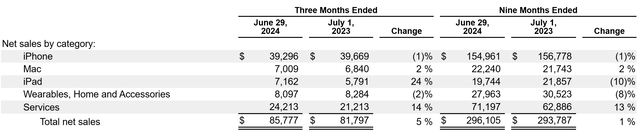

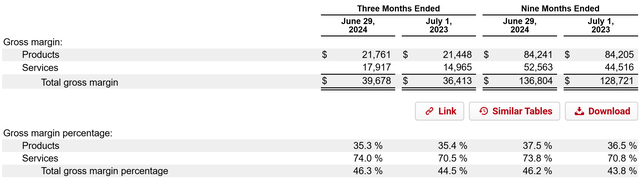

While products still make up a majority of the company’s sales, AAPL’s services segment is higher margin, and growing at a much faster rate:

Last quarter, AAPL’s services segment sported margins of 74% vs. 35% for hardware products, which is a significant gap. This margin also increased YoY by more than 400 basis points, which is considerable. Product margins stayed flat.

In terms of growth, hardware revenues have largely been flat, aside from a positive blip in iPad that is largely cyclical in nature due to the new release. However, services grew durably 14% from $21 billion to $24 billion YoY, growing from 25% of the revenue mix to 28% of the revenue mix over only 12 months. These numbers are an extension of the growth in services seen since 2020.

This dynamic has boosted net margins, even while revenue growth has remained flat.

Thus, AAPL’s financial performance has been somewhat lackluster, but under the hood it has transformed into a higher margin, recurring services business powered by excellent hardware products / platforms and a premium brand.

That has come with a more premium multiple:

We aren’t quite near the highest recorded P/E in the AAPL’s history, but we are at record highs in terms of the stock’s sales multiple – at nearly 9x (if you round up).

Plus, on the graphs above, it’s easy to see how the valuation has crept up towards the top end of the range when looking at shares historically over the last 5 years.

Thus, for all of the fundamental improvements to the company, it’s hard to argue that the multiple has left much room for upside in the stock in the short and (potentially) medium term.

Thus, it’s hard to rate AAPL shares as a ‘Buy’.

AAPL Growth Drivers

That said, selling out or shorting the stock due to the valuation doesn’t appear to be a solid course of action either because AAPL has a number of levers to pull that could potentially grow results and negate some risk in the coming year or two.

We’ve identified three key levers to follow moving forward, starting with:

1.) iPhone Pricing

Apple has always been a premium brand, but we’ve found it interesting how the company’s flagship product, the iPhone, has become a relative value over the last few years.

In 2017, the company’s iPhone X launched with a price of $1,000 USD. The XR, the less premium phone – that had less features – released for $750 USD.

A few weeks ago, AAPL announced the iPhone 16 and the iPhone 16 Pro. The less premium 16’s launch price is $799 USD, and the more premium 16 Pro’s launch price is $1,000 USD.

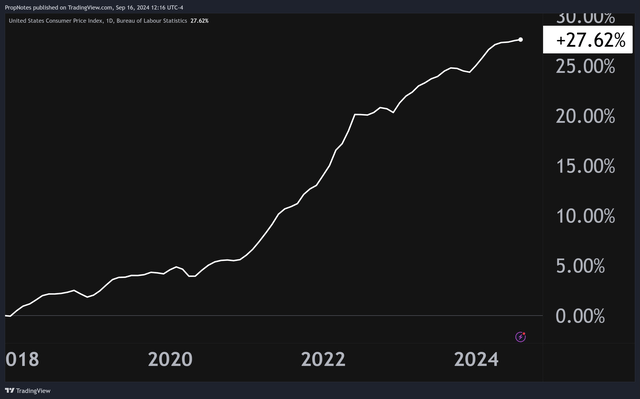

What is going on here? Since November of 2017, the CPI has increased considerably, by nearly 28%:

In that time, AAPL hasn’t seen fit to increase the price of its flagship product by even a fraction of that. By keeping the price steady, the iPhone has become a value, which is somewhat surprising given how much inflation we’ve seen elsewhere in the economy as of late.

As a result, AAPL has a huge lever to re-boost growth and margins: iPhone pricing. If they hike a bit to keep up with inflation in the coming year or two, we think the impact on business would be small, and the benefits would be significant.

This is doubly true, given the increased utility of iPhone with Apple Intelligence which runs best on newer hardware.

2.) iCloud / Services Pricing

Another area we see for pricing growth is in iCloud / Services. While services like Arcade, News+ and Music are probably saturated for the time being, in our view, iCloud – storage in particular – has a ton of room to monetize higher.

Similar to iPhone, AAPL has kept a similar pricing scheme around this core feature for a long time, which means that there’s serious potential to boost margins and sales growth with likely very little churn. AAPL doesn’t break out subscriber numbers for any of these services, but we’d estimate that at least 5% of iPhone users have some sort of storage plan with AAPL, and doubling the price of the $0.99 offering, while increasing the price of the other tiers, could add $1-3 billion in revenue per year with very little incremental cost.

Finally, TV+ and Fitness+ are both priced below comparable offerings elsewhere, which means that we think they could generate significant additional cash while improving margins with simple price adjustments that more fully reflect the value they provide.

For example, Netflix and Disney+ are priced at $15.49/mo and $13.99/mo, while Apple TV+ is still priced sub-$10/mo.

As AAPL attempts to boost revenues and profitability, we management using pricing updates across services & hardware as a likely point of leverage to improve results.

3.) AI Toll Booth

Finally, for the longest time, Google has been paying AAPL a substantial sum to be the default search engine on Safari, which is primarily due to AAPL’s strong distribution advantage with users:

Right now, this stack advantage can most clearly be seen in that GOOG pays AAPL a massive $20 billion+ every year to be the default search engine in the Safari browser. Going forward, we expect AAPL to push this leverage further.

At 2024’s WWDC, AAPL announced that they would be launching Apple Intelligence with support with ChatGPT:

However, at the end of this presentation, Craig also mentioned:

We [] intend to add support for other AI models in the future.

To us, this could end up as another ‘toll booth’ situation, where AI companies need to pony up to AAPL to become favored models for certain tasks when users query Apple Intelligence for help.

Given the size of Google’s payments to AAPL over the years, this could add up to be a substantial number on the bottom line.

Summary

Thus, as we said at the beginning, we’re in a tricky spot with AAPL at the moment.

There are a number of levers that the company could pull in order to boost financial results and re-start top and bottom-line growth after a long period of stagnation. This would no doubt be a positive for the company.

However, the extremely expensive multiple also fully reflects this reality, and thus while we don’t want to downgrade the stock to a ‘Sell’ given the positives, we feel the need to drop it down to a ‘Hold’ to more fully reflect the risk in purchasing shares up here at this price.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.