Summary:

- Expectations are high for a sales rebound later this year.

- iPhone lineup may not be as impressive this fall.

- Consumers may not be willing to pay premium prices.

guvendemir

When technology giant Apple (NASDAQ:AAPL) reported its December 2022 quarterly results, the company badly missed street revenue estimates. The primary reason was that iPhone sales declined by about $6 billion over the prior year period, mostly due to Chinese production shutdowns caused by the coronavirus. As a result, expectations are calling for a good deal of growth later this year when the new iPhone line comes out, but Apple may need to rework its smartphone offerings for shares to hit new highs.

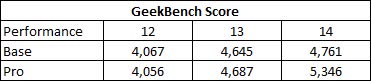

Last year, Apple’s annual iPhone launch was a bit different than we normally see. Only the Pro versions of the 14 line got the yearly upgrade to their chipsets, which was the A16 Bionic. The two entry-level versions stayed with the previous year’s chipset, the A15 Bionic. Some argue that this was due to semiconductor production constraints, while others say that Apple wanted to further differentiate the Pro lineup. As the table below shows, the Pro models certainly got their usual bump in performance scores, while the base versions only got a marginal upgrade.

iPhone Performance Scores (GeekBench via GSMArena)

We are only about five months away now from Apple releasing its next set of smartphones, expected to be the 15 line. Current expectations call for the two base models to get an upgrade to the A16 chip that was in last year’s Pro versions, but this year’s Pro models will get the A17 if the current naming convention continues. Techies are also looking to see if Apple will put a new Sony LIDAR scanner into all of the iPhone 15 lineup, or if that will just go to the Pro versions, further separating the high-end line.

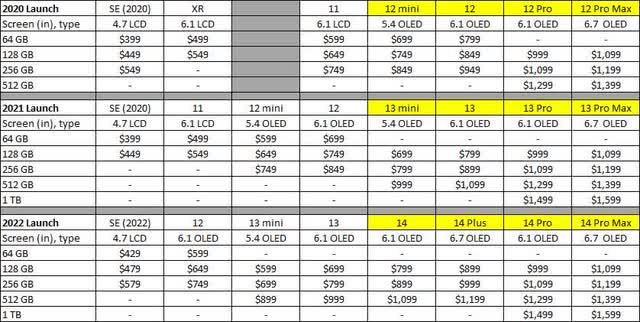

Over the past couple of years, Apple has increased the price points of its iPhone lineup. Whether it be due to component cost inflation or going to larger screens, consumers are paying more for certain phones than they did a few years ago. In the graphic below, I’ve detailed the main smartphones available in the fall of each respective year, with those in yellow indicating the four new phones launched that fall.

iPhone Lineup 2020-2022 (Apple Website)

I will be very curious to see what Apple sets its lineup as this year. There was no mini version of the 14, so will the company only keep the 13 and 14 around, or perhaps bring the 14 Plus or Pro into the mix? Additionally, the SE will have been around for a year and a half, and it’s not a very impressive phone, to begin with. Thus, with last year’s models not getting a chipset upgrade, and this year’s base two versions only having last year’s chip, this has the potential to be the weakest overall iPhone lineup we’ve seen in years.

Normally, I wouldn’t be that worried if Apple was set to launch a perhaps weaker-than-normal smartphone lineup. Some years are obviously going to be better than others. However, when you consider that the US might see a recession later this year, it could be a bigger issue, especially with increased pricing in recent years. We’ve already seen some weakness in retail sales recently, so consumers may hold off on buying a new phone, especially if it has outdated specs.

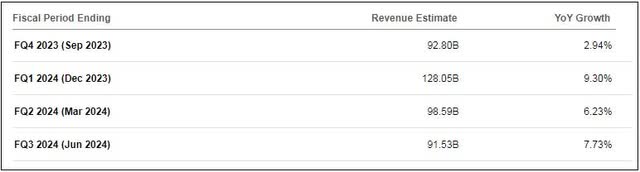

A couple of million iPhone sales here and there doesn’t seem like much, but it adds up quickly. That could mean billions in lost revenue, especially when including the potential for add-on sales or services that aren’t purchased in tandem. As the graphic below shows, analyst estimates call for accelerating revenue growth after the September fiscal period, so street expectations seem a little high right now.

Apple Revenue Estimates (Seeking Alpha)

Now, I know some readers might point out that last year’s disappointing holiday quarter means the year-ago comparison is easier to beat. While that is true to a point, that was also a 14-week quarter due to the way the calendar fell. Thus, Apple had an extra sales day in the period, which partially offsets some of those lost sales due to supply chain issues. I’d be more positive today if the revenue average for the key holiday period in 2023 was in the mid-single-digit as opposed to being just a stone’s throw away from double digits.

As for Apple shares, they’ve done quite well so far this year. However, as I pointed out in my most recent article, the stock had gotten ahead of itself on a short-term basis, being well above its 50-day moving average. Thus, shares have been down slightly over the past 2 weeks, while the S&P 500 edged out a small gain. Apple finished last week less than $5 away from the current average price target on the street, implying that shares are pretty fairly valued at the moment. Of course, those valuations depend on the above estimates, which if they come down, means we will likely see price target cuts too.

As we start to think about this year’s upcoming iPhone line launch, Apple finds itself in a rather curious position. Due to the separation of the Pro versions last year, this year’s overall sales lineup may be the weakest we have seen in some time. Currently, that means there could be some room for disappointment if the US does enter a recession, especially with analysts expecting overall revenues to rebound. While I still like Apple as a long-term hold, I would not be buying shares at the moment with risks for later this year slanted towards the downside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.