Summary:

- Apple’s stock valuation is highly dependent on the trajectory of Services business.

- It is highly likely that the company will post a negative growth rate in Services segment in the upcoming quarter or the next.

- A declining Services business will hurt the short-term sentiment toward the stock.

- Both Apple Music and TV+ services are facing significant fundamental headwinds, which will limit their growth and hurt the overall growth trend of Services segment.

- Apple’s PE valuation is quite high compared to its historical average and any decline in Services segment can create a bearish sentiment.

Nikada/iStock Unreleased via Getty Images

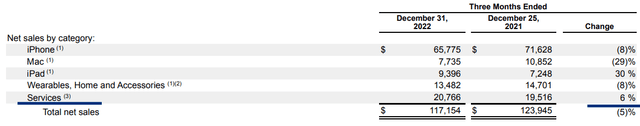

The bullish thesis for Apple (NASDAQ:AAPL) stock in the last few years has been dependent on the Services growth shown by the company. It is expected that the company is moving away from seasonal hardware sales to a recurring Services business with higher growth potential. However, in the previous quarter, the Services segment reported YoY growth of 6%. In a previous article, Apple faces a perfect storm, written in March 2022 it was mentioned that Services segment growth rate will decline rapidly. This started happening as we can see in the last two quarters. Since the last article, Apple’s Services business has seen an increase in headwinds due to regulatory and competitive challenges. This will cause the YoY growth rate of Services segment to drop further.

It is highly likely that Services segment could show a negative growth rate in this earnings report and in the near term. This will limit any bullish sentiment toward the stock.

Some of the negative trends in Services segment are due to the challenging macro environment. However, the company is also facing saturation from lucrative revenue streams like the licensing agreement with Google (GOOG) and the App Store. Apple’s performance in consumer-facing services like Apple Music and TV+ has been very modest which will limit the ability of the company to improve the growth rate in Services segment.

Newer initiatives in financial services and a bigger push to improve its business in India will take a longer time to show results. During this time, slower or negative growth in Services business will be the biggest headwind for Apple stock. Investors should closely follow the Services growth rate reported by the company in the next quarter to gauge the short-term potential of Apple stock.

Negative Services growth rate

For the better part of the last decade, Apple’s management has mentioned the strong Services growth rate as the key reason behind long-term potential of Apple stock. The Services segment has opened newer growth options for the company and has also provided a stable, recurring revenue base with higher margins compared to Products business.

A big chunk of the Services segment revenue comes from high margin businesses like the licensing rights to Google which made it the default search engine on all devices. It is estimated that Apple receives close to $20 billion per year from Google which is 20% of the net profits of Apple. This revenue stream could be reaching a saturation point as regulators closely review the arrangement between the two giants.

Apple’s App Store revenue growth is also coming under scrutiny due to higher commissions and limitations placed by the company on using third-party payment services. Together, these two revenue streams have shown rapid growth with very high margins which has improved the overall growth rate of Services segment. A slowdown in these two businesses will make it difficult for Apple to show good growth and margin trajectory in Services business in the near term.

Figure 1: Low single-digit growth in Services segment in the previous quarter. Source: Company Filings

Apple TV+ and Music underperform

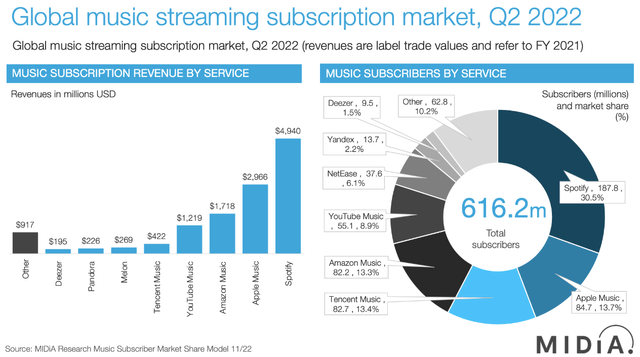

Good growth in App Store and licensing revenue has masked the underperformance in other services provided by Apple. We could see a greater focus on subscriber numbers of Apple TV+ and Music business in the next few quarters. It has been close to four years since Apple last updated its Apple Music subscriber count which was 60 million at the time. Apple’s management usually gives updates when reaching important milestones for products and services. A lack of updates for Apple Music could be a sign that the growth rate in this service has been below expectations.

Third-party sources like MIDiA Research have shown a steady increase in market share of Amazon (AMZN) and YouTube Music. YouTube has already updated that it has hit 80 million subscriber count, including free trials, by September 2022. It is certainly possible that both Amazon and YouTube Music would overtake Apple Music by end of this year.

Figure 2: Amazon Music and YouTube Music could soon overtake Apple Music in terms of subscriber count. Source: MIDiA Research

Taking an average cost of $110 per year for every Apple Music subscriber, the company earned close to $9 billion from its 80 million subscribers. This is more than 10% of the $78 billion revenue earned by Apple in its Services segment in FY22. A slowdown or decline in market share of Apple Music will hurt the growth rate of Services business and also reduce the ability of Apple to build a stronger ecosystem of services.

According to Techcrunch, Apple TV+ has 25 million paid subscribers and is now looking at other providers like Canal+ in France to reach a broader audience. At the current price of TV+, this subscriber base would contribute $2 billion to Apple’s revenue base. Despite spending billions of dollars on its video streaming platform, Apple is still facing a high churn rate and low subscriber growth. This service can become a money pit for the company as other competitors like Amazon, Disney (DIS), and Netflix (NFLX) continue to invest tens of billions of dollars in their streaming business annually.

Future trajectory of Services business

The headwinds faced by Services segment need to be priced in when estimating the future growth potential of Apple stock. We could be seeing the peak revenue base for Services segment. Both the licensing payments and App Store revenue are facing significant regulatory scrutiny and have reached close to the saturation limit within their business domain. Apple TV+ and Music have not shown strong growth potential in recent quarters. Both these services are also facing strong competition, unlike the other services like licensing and App Store which derive revenue due to the platform.

Newer financial services announced by Apple will take a longer time to prove themselves and move the needle for the Services segment. In the near term, we could see a slowdown or negative growth in the Services segment of Apple. It would be very difficult for Apple stock to achieve a bullish momentum while the Services segment is in decline. Even a low single-digit decline in Services can spook Wall Street and cause a correction in the stock.

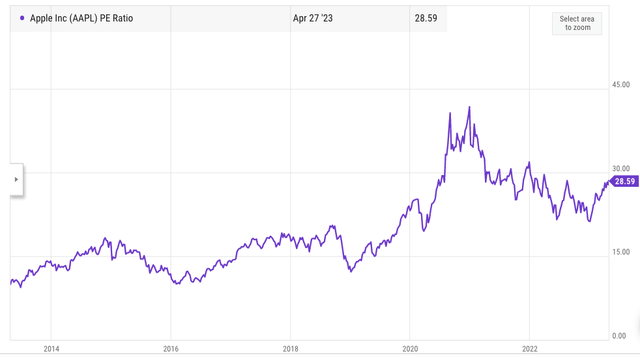

Higher valuation multiple of Apple stock

Apple stock is trading at 28.5 times its PE ratio. This is significantly above the average PE multiple the stock traded prior to the pandemic. A decline in margins or further slowdown in revenue growth will limit a bullish sentiment toward the stock. If we see a negative YoY Services growth rate in this earnings season, it will likely lead to a correction in the stock.

Figure 3: Apple is trading at close to twice the average PE multiple it had prior to the pandemic. Source: YCharts

The Services segment has been the main reason behind the expansion of the valuation multiple for Apple stock. The near-term outlook for Services segment seems negative. Despite new services, Apple would find it difficult to reignite growth in the Services segment for the next few quarters. Negative or low single-digit growth in Services segment could cause Apple stock to correct and trade with a PE multiple of 15 to 20, similar to its pre-pandemic PE multiple range. At the upper range of this estimate, Apple stock could correct to $120 in the next few quarters.

Apple’s management is trying to launch new initiatives like financial services, AR, healthcare, push in new regions, and more. However, all these positive trends might be ignored by Wall Street if the Services segment shows negative YoY growth for a quarter or two. Investors should closely watch the possibility of a decline in Services revenue and the impact it will have on Apple’s valuation multiple and long term returns.

Investor Takeaway

Apple reported 6% YoY growth in Services revenue in the last quarter. It is highly likely that the company could show low single-digit or negative YoY growth in Services segment in this earnings seasons. This metric alone can cause a significant bearish sentiment towards the stock. The slowdown in Services growth is unlikely to change in the near term and it will eliminate one of the biggest bullish thesis for Apple stock in the last decade.

The combined revenue contribution of Apple TV+ and Music to Services segment is close to 15%. However, the subscriber growth in these services is below expectation and the margins are also very low for these revenue streams. On the other hand, Apple faces headwinds for its lucrative licensing and App Store business. Even if the macroeconomic picture improves, the above reasons might limit the growth potential of Services segment. Apple stock is already trading at a premium compared to its historical average. Any negative shock in the Services segment can cause a correction in the stock in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.