Summary:

- Foxconn’s Zhengzhou facility may have ended its closed-loop arrangement due to COVID lockdowns. However, China is now facing a surge in COVID cases.

- Hence, Apple’s COVID nightmare in China has likely not ended. Further disruption could impact its iPhone Pro series production significantly.

- Apple’s third-party app store compliance with the EU’s Digital Markets Act is not a significant concern. We have confidence that it could overcome the regulatory concessions.

- But, investors need to be worried about its iPhone growth slowdown and disruptions. Also, the Apple Car production ramp looks a mile away, even if we assume it could succeed.

- Investors are not encouraged to add at the current levels.

ViewApart

Apple: China’s COVID Headwinds Not Over Yet

Apple Inc. (NASDAQ:AAPL) stock has significantly underperformed the S&P 500 (SPX) (SP500) since we urged investors to continue cutting exposure, as its China headwinds could cause further disruptions to its supply chain.

However, there have been significant developments in China since our previous update, as China has eased its COVID restrictions markedly. In addition, Foxconn also updated that it has ended its closed-loop production at its Zhengzhou facility, bringing relief to Apple’s most crucial holiday quarter.

However, many questions remain, including what’s the production ramp cadence that Foxconn has managed to restart? Also, China’s COVID reopening has led to a significant surge in cases where workers have fallen sick, with residents now having fears about contracting the COVID virus. After nearly three years of getting locked down by COVID zero restrictions, China’s COVID easing is facing significant hurdles.

Therefore, Apple’s supply chain in Zhengzhou is likely still under tremendous strain. IDC articulated:

Foxconn will now need to address the potential increase in sickened staff and a possible shortage of workers. Many workers may be afraid to leave their homes ahead of family gatherings during the Chinese New Year next month. More initiatives will need to be taken to appease staff, other than financial compensation. – Bloomberg

DIGITIMES forecasts that Apple’s iPhone production in India could account for 45% to 50% of its total production as the Cupertino company looks to diversify its production risks. However, before anyone gets too excited, a reminder that the estimated timeframe stretches toward 2027.

Hence, in the near- to medium-term, Apple continues to be beset by China’s COVID reopening headwinds as authorities, and its residents, deal with a surge they have not managed previously.

We believe that further disruption to Apple’s Zhengzhou facility cannot be ruled out, with more risks to the downside on Apple’s FQ1 (ending December 2022). In addition, we also see downside risks to Apple’s FQ2 (ending March quarter) if the Chinese authorities continue to face significant challenges in managing the surge in caseloads across China.

Apple: Third-Party App Store Not A Major Concern

Bloomberg reported recently that Apple could allow third-party app stores in its iOS ecosystem, a pivotal development. Apple’s conviction about privacy and security has been tested, as it has likely been forced to comply with the European Union’s Digital Markets Act (DMA) by 2024.

However, analysts’ estimates suggest that the hit to Apple’s topline is likely insignificant and thus could be “more bark than bite.” As a result, we aren’t overly concerned with Apple’s requirement to comply with the DMA here. Moreover, we believe that Apple’s credibility and trust built up with its consumers over time should help mitigate the impact of losing business to third-party app stores.

The Information also highlighted how Apple’s past regulatory concessions had not crimped its ability to maintain its gatekeeper role effectively. It highlighted:

These past concessions don’t appear to have crimped App Store sales by much. And as part of the EU change, Apple may choose to enact rules that make it difficult for would-be rival app stores to gain traction on Apple devices. – The Information

It went on further to remind developers not to expect to take much business away from Apple’s official App Store, as “Apple knows how to nudge consumers to do what it wants them to do. It is the master of setting up rules that prioritize its services,” relating its App Tracking Transparency (ATT) implementation, that likely “benefited” Tim Cook and Co. The Information added:

Non-Apple companies that want their mobile users to opt in to targeting have to ask users to allow the app to “track [their] activity.” For its own tracking, Apple prompts users to “enable personalized ads,” which feels far less nefarious. There is every reason to believe Apple will take a similar approach to pushing people toward the App Store and making any other route appear suboptimal. – The Information

Therefore, while we aren’t fans of AAPL at its current valuation, we also don’t think the DMA implementation would cause significant earnings compression as it stands.

AAPL: But Current Valuation Remains Questionable

The critical question facing investors isn’t about Apple’s execution prowess. Apple has demonstrated significant prowess in China, even as its smartphone rivals faltered in 2022, as it reportedly “[enjoyed] robust sales during the shopping holidays while Chinese vendors suffered sales declines compared to a year earlier.”

Also, it has demonstrated its ability to “circumvent” regulatory restrictions with concessions that mitigated the impact on its services business.

Hence, the question has always been about its valuation and why, despite robust execution, Apple would likely continue to face headwinds unless it could ramp up its big bets moving forward.

Therefore, the pushout of its watered-down Apple Car with no autonomous driving is likely not welcomed by its investors. As Loup Ventures highlighted, Apple Car’s production could likely ramp up by 2030, with an estimated 2% global market share, representing 25% of its overall revenue base.

However, it’s another long-term timeframe, like its production diversification to India. Will investors really consider AAPL’s expensive valuation at the current levels to partake in a market that’s still an optionality at this point? We wouldn’t bet against Apple making Project Titan a success eventually, as it could well afford the $1B in R&D spending annually.

But, with global smartphone shipments continuing to grow at a tepid pace through 2027, Apple Car’s delay is highly unconstructive. Moreover, we believe Apple has faced significant difficulties in commercializing the project, which was well-documented. Notably, Apple had “set out to build a vehicle in the early 2010s.”

As such, we believe Apple’s commitment to making Project Titan a success is deep-seated, but even its technological prowess couldn’t overcome its ambitions of making autonomous driving work. The technology just wasn’t ready, and Apple’s insistence has likely caused it to lose precious time developing a massive market to mitigate the saturation in iPhone’s growth. Bloomberg highlighted:

But a few years into [Apple Car] development, Apple executives decided that a car would need a clear differentiator to make it worth launching. Enter autonomy: Apple quickly became fixated on launching a car with full self-driving capabilities and no pedals or steering wheel. That ambition — pursuing something that has bedeviled the entire automotive industry — quickly began to hurt Apple, leading to management turnover, layoffs and project resets. – Bloomberg

Despite the recent selloff, AAPL still traded at an NTM EBITDA of 16.3x, right smack in the one standard deviation zone above its 10Y average of 11x. However, that zone has also seen valuation support from buyers since 2021. As such, we believe consolidation could occur at the current levels after the recent decline.

Takeaway

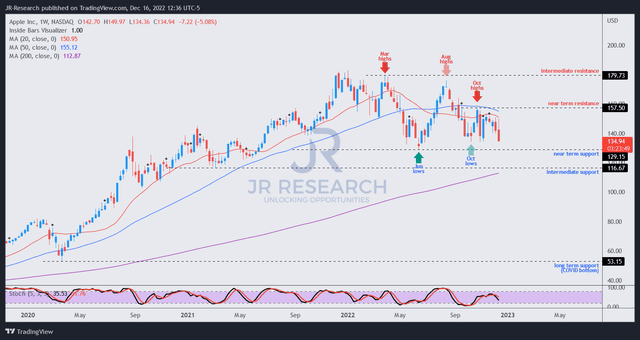

AAPL price chart (weekly) (TradingView)

Our price action analysis suggests that AAPL is getting closer to potentially re-testing its June/October lows, which could attract AAPL buyers to return to the fold and stanch further near-term downside.

Hence, we move to the sidelines from here as we expect AAPL to consolidate, with its near-term reward/risk more well-balanced.

Revising from Sell to Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!