Summary:

- Apple reported solid growth for FQ4, but the company guided to disappointing FQ1 sales growth.

- The company only recently released Apple Intelligence with a lot of features not released until 2025, likely limiting AI iPhone demand.

- Berkshire Hathaway continues unloading shares with the position down to only 300 million shares now.

- AAPL stock trades at 30x forward sales, which remains far too expensive for a tech stock only expecting minimal growth.

1001slide/E+ via Getty Images

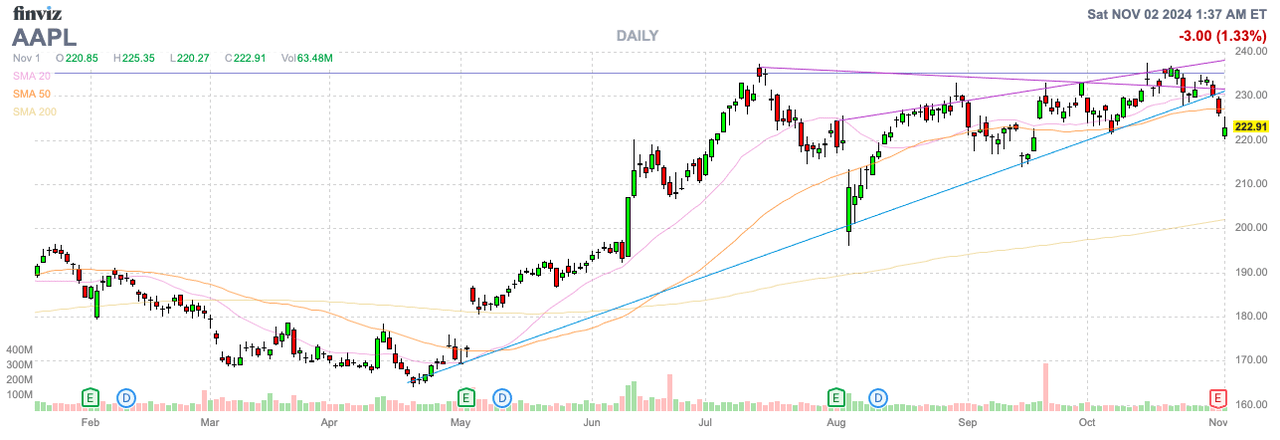

Apple Inc. (NASDAQ:AAPL) just warned that the key holiday quarter wouldn’t meet estimates, but the stock mostly blew off the miss. The tech giant recently launched a once promising new smartphone with AI, yet the quarterly results weren’t actually impressive for the stock valuation. My investment thesis remains very Bearish on Apple, with the stock trading near all-time highs, while the results don’t match the valuation.

Another Flop

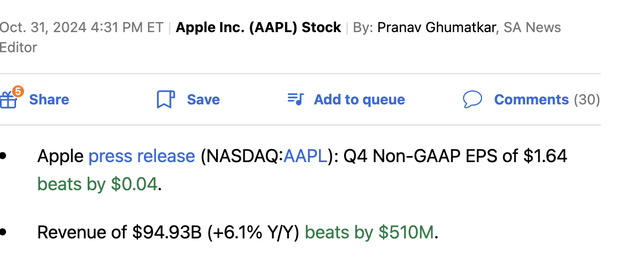

Apple reported FQ4’24 results on Halloween where the company at least returned to growth following the launch of the iPhone 16 as follows:

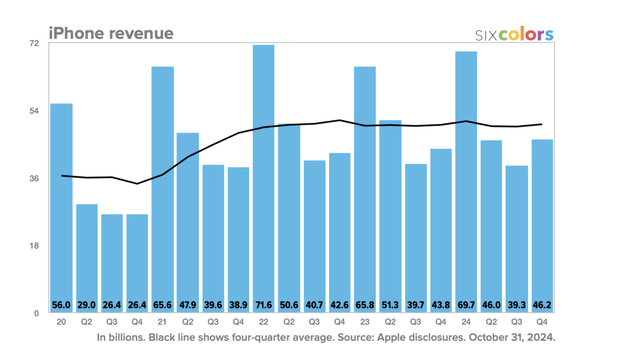

The tech giant had gone a couple of years without reporting any meaningful growth, yet the stock traded near all-time highs. The stock market really needed Apple to report blowout numbers for the iPhone business, especially considering the easy comps from the iPhone 15 Pro production issue last year.

The good news for investors is that Apple did report FQ4 revenues of $46 billion that surpassed consensus’s estimates by $510 million, up 6% YoY. The bad news is that the September quarter isn’t a meaningful quarter for sales due to the launch of new iPhones late in the quarter.

The iPhone chart definitely doesn’t highlight a business that should be trading at all-time highs based on an expensive valuation multiple. Apple hasn’t reported a quarter where iPhone sales growth hit 10% since FQ4’22, which was the only quarter since FQ4’21 when the Covid boost ended.

The worst part of the story is that Apple cut the numbers for FQ1’25. The market was forecasting another quarter of 6% growth, but the company guided to growth slowing from the FQ4 pace.

On the FQ4 earnings call, CFO Luca Maestri provided the following weak guidance:

We expect our December quarter total company revenue to grow low- to mid-single digits year-over-year. We expect Services revenue to grow double-digits at a rate similar to what we reported in the fiscal year 2024. We expect gross margin to be between 46% and 47%. We expect OpEx to be between $15.3 billion and $15.5 billion.

Apple left a wide gap for investors to interpret the targeted growth rate for the December quarter. A target in the low-to-mid single digits is probably anywhere from 2% to 6%.

The market was focused on booming iPhone demand due to AI on the iPhone 16. Unfortunately, Apple Intelligence just started being rolled out on October 28 while the full features won’t occur until sometime in 2025.

According to noted analyst Gene Munster for Deepwater Asset Management, Apple Intelligence won’t be fully functional until March when integration to ChatGPT is expected. As well, the service is only available in the U.S. now with just 45% of the active install base having access to AI at the end of the year, while China will still be a problem though out most of 2025.

At 3% to 4% growth, Apple would likely just report growth from the Services segment. This segment reported 12% growth in FQ4 and a similar growth rate in the holiday quarter would contribute the majority of growth for the company at ~$3 billion in additional sales.

The current consensus estimates have revenues growing 4.4% to reach $125 billion for ~$5 billion in additional sales. The iPhone business is only left with ~$2 billion in sales for the key holiday quarter, assuming Apple even reaches the 4.4% growth target.

The AI iPhone would provide a limited boost to revenues in a sign Apple isn’t seeing the big upside potential predicted from Apple Intelligence due in part to the late delay.

Odd Comparisons

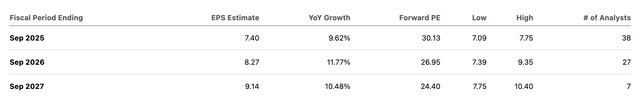

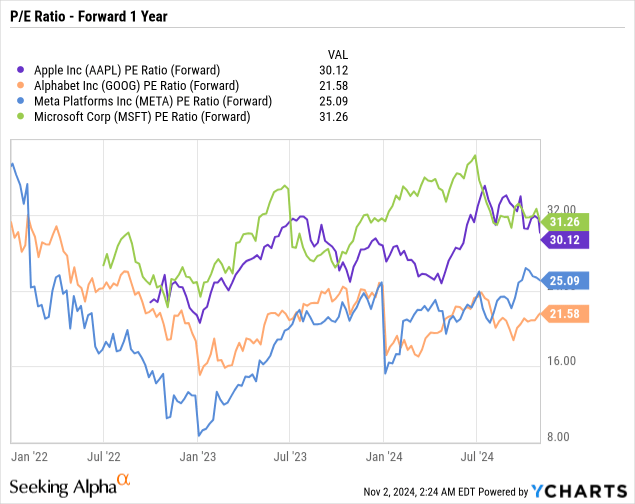

The big question with Apple is why investors are willing to continue paying over 30x forward EPS targets with the company reporting limited growth. Even with the AI iPhone, Apple is only growing sales around 4% now.

Alphabet (GOOG) (GOOGL) just reported a quarter where revenues grew over 15%, yet the stock trades at only 22x EPS targets, while the stock is far cheaper using adjusted earnings. Even Meta Platforms (META) trades at only 25x EPS targets after reporting a quarter where revenues grew at a 19% clip.

Ironically, Apple trades similar to the AI leader in Microsoft (MSFT) despite the company investing in OpenAI and growing revenues at a 16% rate. All the data can’t really explain why all of these tech giants with actual AI expertise and investments trade at similar or lower forward P/E multiples to Apple, with plans to integrate ChatGPT from OpenAI and possibly Gemini from Google.

Either way, the logic just doesn’t add up to how Apple becomes a leader in AI by utilizing the technology of other companies and implementing the technology already available from other routes online. While Apple remains a solid company, the business doesn’t have any real AI technology. Alphabet and Microsoft have cloud services offering AI to customers and are actively involved in developing leading LLMs.

Apple continues to post limited growth, yet the market is assigning a very rich valuation on the basis the iPhone will turn into the conduit for AI usage and somehow the tech giant will ultimately benefit. The actual numbers just don’t support this thesis.

Based on the actual growth rates, Apple should trade no more than 15x EPS targets. The current analyst estimates only have the tech giant producing a FY25 EPS of $7.40, which would amount to a price target of only $111.

Again, Apple is back to reporting solid growth for a company with $400 billion in sales. The growth just doesn’t warrant anything close to a 30x P/E multiple, especially after the tech giant is late to AI, failed with Vision Pro and cancelled the Apple Car.

Even Berkshire Hathaway (BRK.A)(BRK.B) continues dumping shares. The investment firm apparently sold another 100 million shares in Q3 to reduce the position to only 300 million shares after having a 900 million share position to start the year. Note, Buffett now has a record cash hoard of $325 billion, in an indication the investing legend would rather have his money in cash than Apple’s stock.

Takeaway

The key investor takeaway is that Apple remains too loved. At the best, the company plans to implement AI technology from other providers, which means Apple isn’t a leader in AI. The stock shouldn’t be valued based on either technology leadership or AI growth, with neither existing in a major way.

Investors should continue to use the irrational prices of Apple to exist any remaining shares, similar to Berkshire Hathaway.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start November, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to start finding the best stocks with potential to double and triple in the next few years.