Summary:

- Apple’s recent product event, including the iPhone 16, failed to generate significant excitement due to incomplete AI features.

- Analysts remain mixed about Apple’s ability to achieve 10% EPS growth due to competitive pressures, especially from China.

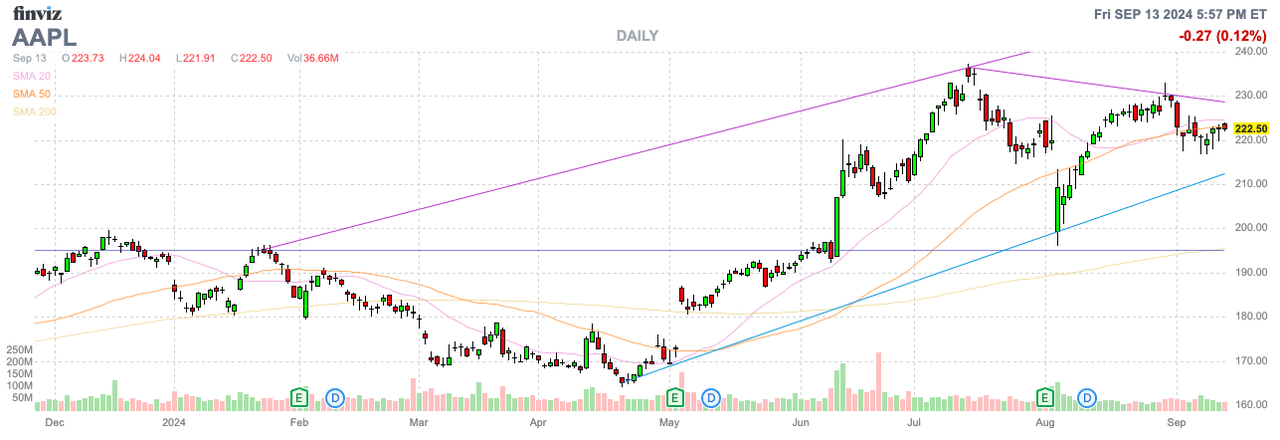

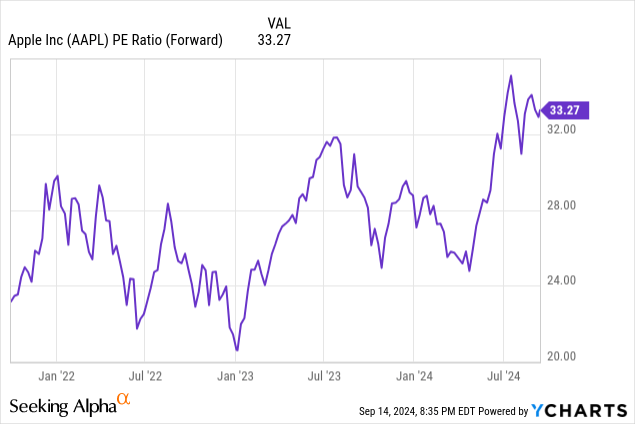

- The stock is overvalued at a 33x forward P/E multiple, with limited growth prospects and potential sales disappointments for the iPhone 16.

Yuuji

Apple, Inc. (NASDAQ:AAPL) (NEOE:AAPL:CA) held their annual product release event last week and the market mostly yawned. The company launched the much-anticipated iPhone 16 with Apple Intelligence, yet the device will be mostly devoid of AI to start. My investment thesis remains Bearish on the stock, as the event failed to drive huge consumer excitement.

No Glow Up

As typical of the annual event, Apple announced new products, including the iPhone 16, Apple Watch Series 10 and AirPods 4. All of the products have new features, but the big question is whether AI can drive higher iPhone 16 sales.

As usual, the newest iPhone versions have new chips, improved camera and more memory bandwidth while using the latest 3-nanometer tech from TSMC (TSM). The issue here is that Apple Intelligence only enters beta testing next month with a plan for full release in the following months, though other languages like Chinese and Spanish won’t launch until next year.

Considering the prime feature isn’t even ready with the product sales starting on September 20, analysts are mixed on the sales impact. Influential Apple analyst Ming-Chi Kuo doesn’t see iPhone 16 delivery dates matching the demand for prior hot Apple products in the iPhone 15 Pro Max and the Vision Pro.

Ming-Chi Kuo had already predicted iPhone 16 sales to dip after an initial bump in comparisons to the iPhone 15 Pro Max production issues last year. The forecast is for iPhone units shipped in 2024 to dip slightly to 88-89 million units from the 91 million for iPhone 15. The major weakness is predicted for the December quarter with a 5% to 7% dip from last year.

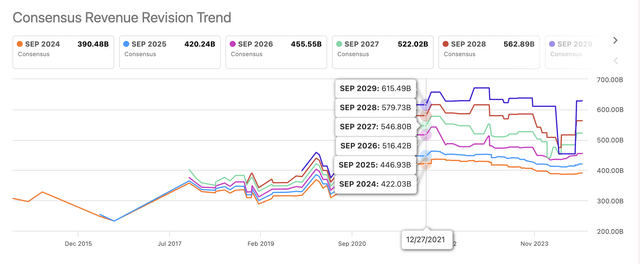

The amazing part on the stock is that consensus analyst estimates over time have only slipped since the peaks around the start of 2022. Once the Covid-19 boost ended, Apple has struggled to meet reduced targets with revenue estimates for FY25 dipping from $447 billion to only $420 billion now.

Analysts had started boosting targets going forward due to excitement on AI, but the iPhone 16 Glowtime event doesn’t provide any reason for this excitement. The majority of the iPhone AI features aren’t presently available and will take up to at least 6 months to fully rollout.

The consensus estimates have revenues growing in the 8% range for FY25 and FY26 now, but these estimates require Apple to produce some meaningful boost in sales from the iPhone and AI related products.

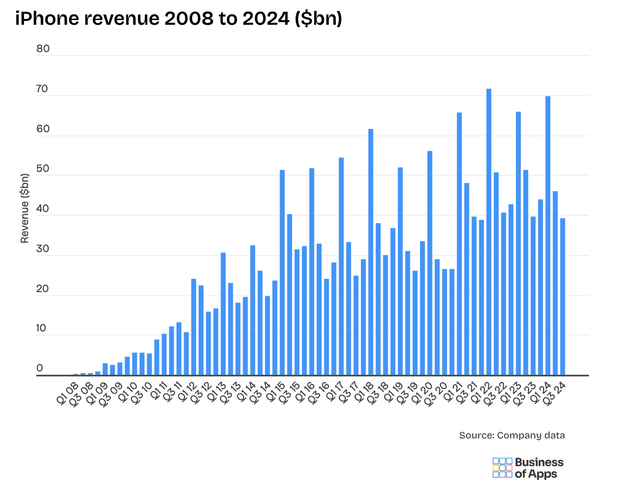

The bull case requires significant upside in iPhone sales. Gene Munster from Deepwater Asset Management has sales actually growing 8 to 10% in FY25 requiring somewhere around 250 million units sold next fiscal year.

iPhone sales in just ending FY24 are forecast to roughly approximate the 230 million units of the last couple of years. With iPhone 16 ASPs similar, Apple needs to hit at least 5% additional units sold from the roughly 230 million units sold the last couple of years.

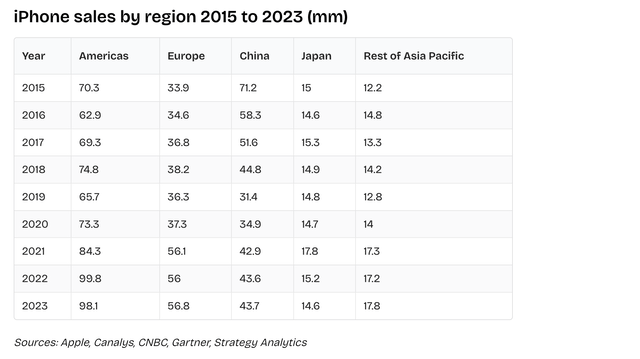

In FY21, Apple sold an estimated 242 million units from both the pull forward of demand due to Covid and the launch of the 5G iPhone. The iPhone 12 was launched in September 2020 and provided a huge boost to FY21 unit sales, which the tech giant has yet to top.

China Problem

A big part of the issue is the Asian market. In China, Huawei has quickly regained market share in the last couple of years and appears to be out innovating Apple with the release of a trifold smartphone only hours after the iPhone 16 release.

The Chinese company now has 18.1% of the market, with 50% growth in Q2’24. Apple saw sales fall to 6th place, with other companies like Vivo and Xiaomi growing sales YoY.

Apple saw June quarter sales in China dip over $1 billion to just below $15 billion. The tech giant barely grew total sales through FQ3 of this year due in large part to losing over $5 billion in sales from China.

Apple has sold an estimated 43 million units in China the last 3 fiscal years. China accounts for nearly 20% of units sold and the competitive environment in the country has shifted in the last year to the point where sales likely dip during this holiday period.

After all, Apple hasn’t really announced how the company will offer generative AI on the iPhones sold in China. The rumor mill has the tech giant likely working with Baidu (BIDU) considering the CCP requires the data stay in the country.

The issue with the stock for a long time is the valuation disconnect. Apple is valued at over 30x forward EPS targets, yet lots of questions exist on whether the tech giant can reach the targeted 10% EPS growth rates that don’t even warrant the current stock price.

Apple not only needs for iPhone sales to grow at a 5%+ clip in FY25 without any lingering impacts from China, but the tech giant needs sales to continue growing in future years. As the quarterly iPhone sales chart highlights, sales peaked back in 2021 and have failed to top prior year levels.

Apple saw no follow through sales after the big 5G/Covid boost. And one really has to wonder how much of the boost was related to 5G and not pulled forward demand for Covid work-from-home policies.

The tech giant hasn’t shown any ability to grow at even 10% clips, yet the stock is currently valued at 3x growth rates. Despite all the excitement, Apple is only forecast to produce a $7.41 EPS in FY25, which would value the stock at only $111 based on a 15x P/E multiple.

The actual risk is that Ming-Chi Kuo is right and actual iPhone 16 sales during the holidays disappoint. The stock would definitely rerate to a lower P/E multiple, if the iPhone 16 fails to drive sales growth after a couple of years with limited growth.

If an analyst like Gene Munster is correct, Apple should produce 10%+ EPS growth in FY25. The question is what the company can do to continue growing beyond the initial bump in iPhone sales, with lots of questions on AI and how the tech giant can turn Siri into a money generating software tool while users already have several generative AI tools, such as ChatGPT from OpenAI.

Our view is that Apple could grow sales in the 5% range, with EPS growth closer to 7% to 8% due to a small EPS boost from share buybacks. As mentioned above, this growth rate warrants a 15x P/E multiple. The lack of innovation and massive size with annual sales in the $400 billion range just doesn’t add up to the growth rates warranting the growth stock valuation.

Takeaway

The key investor takeaway is that Apple failed to deliver much excitement from the Apple Intelligence event launching the iPhone 16, primarily due to the fact that AI tools aren’t ready yet. The stock is already priced for perfection, but the company isn’t ready to deliver the growth warranting a forward P/E multiple of 33x.

Investors should use the premium price to sell like Warren Buffett and not risk a scenario where sales fail to deliver growth and the stock is finally rerated much lower to a limited growth scenario.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.