Summary:

- Apple has been growing phenomenally for well over a decade now.

- The company has been increasing its dividend for ten straight years.

- In early May the dividend is likely to be increased yet again – probably by 4%.

- Even so, the risks are just getting too large and numerous – look elsewhere when deploying your money.

Nikada/iStock Unreleased via Getty Images

There are few companies as successful as Apple (NASDAQ:AAPL). Personally, I deeply admire the company and what it has been able to accomplish over such a long period of time. Even though the company itself does everything as well as it possibly could do, a rich valuation and adverse outside forces make AAPL stock a sell right now.

The historical ability of this company to make people wealthy is unquestioned, growing from near-bankruptcy into a $2.7 trillion company. Even in the pretty difficult year of 2022 the company managed to post an EPS increase of 8.9% and a net income just shy of the $100 billion mark, at $99.8 billion. It is downright impressive that such a behemoth is able to grow so fast.

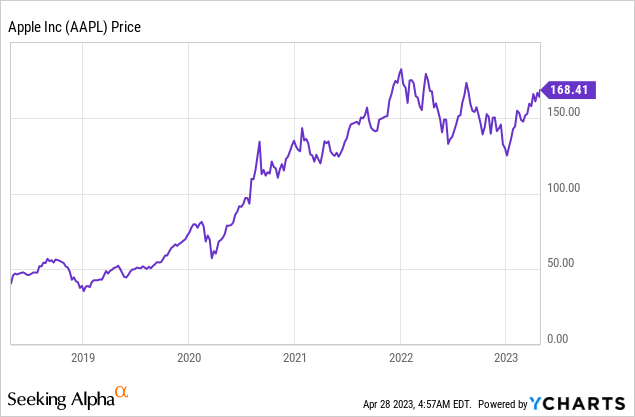

This growth has benefited shareholders quite handsomely over the last five years with the stock up 315% from $40.6 to $168.4. Throw in a couple of percentages for dividends on top and you have a happy shareholder base. All told, over the last five years, average annual return before dividends have been 32.9%.

That said, since late 2021 returns have been meager as the stock is lower now than it was back then. This could be a bump in the road but it could also be a sign of a more long term shift. In the past, the company has always been able to emerge stronger after difficult times, but there are no guarantees that it will be able to do so again. I think investors are right to be a little bit skeptical here, just considering the enormous absolute dollar-numbers this machine needs to crank out just to generate a couple of percent growth. For many years, the dividend has been almost invisible due to the low dividend yield. But if it were to grow at a fast clip going forward, that will change. So let’s have a deeper look into this company’s dividend.

Apple’s Dividend History

Although we think of Apple as modern and new, the company was actually founded 47 years ago. Its dividend history is therefore also quite long, with its first dividend being paid back in 1987. It was suspended after the December 1995 payment and wasn’t introduced until many years later in 2012 since Steve Jobs famously refused to pay a dividend.

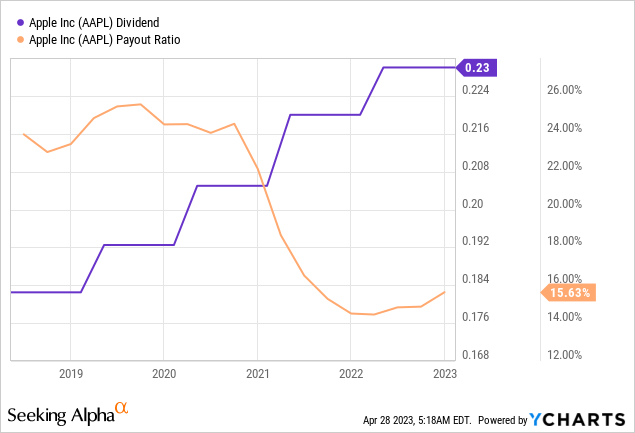

Five years ago, in the spring of 2018, the split-adjusted dividend was $15.75 whereas the last payment was of $0.23. That translates into an average annual growth rate of 7.9%. Way more than inflation over the period, and even more than the current rate of inflation, but perhaps not up there in the impressive department. Yes, buybacks have been enormous, but I still think many investors would have liked the growth rate to be just a little bit higher, closer to the double-digit mark.

But it gets worse. Over the last two years the growth rate is just 5.9% and last year it was a downright disappointing 4.5% even though EPS growth clocked in at 8.9% for the year. It is safe to say that the Board is conservative in setting the dividend.

When looking at the graph above, it should be quite obvious just how conservative the Board is. A payout ratio that hasn’t been higher than 26% at any time the last five years and with the latest figure coming in at 15.6%. You might wonder why they bother to pay a dividend at all. Perhaps to satisfy dividend-focused ETFs that can only hold dividend-paying companies. On a positive note, even with flat EPS growth, the graph above makes it abundantly clear that Apple can hike its dividend for many years to come without coming into any kind of danger.

Luckily for investors, there are other ways to get capital returned from the company — the more stealthy way of buybacks. In the last quarter the company bought back stock for $19 billion whereas dividend payments were $3.8 billion. So in simple terms: With a dividend yield of 0.55% and if the company continues spending five times as much on buybacks, total return will be 3.3% per year via capital returns. That’s right up there with the more classical dividend stocks.

Apple’s Fundamentals and Upcoming Dividend Hike

In order to assess what the potential dividend hike could be and what the potential long term return could be, we should have a look at the company’s fundamental prospects.

The company is already huge so the question is: Where can longer-term growth come from? The last couple of weeks the answer has seemed to be India. It definitely makes sense to try and gain a stronger foothold in the world’s most populous country. And if the country’s middle class can grow together with Apple, there is a real chance of it being a potential long-term growth story. Thing is, let’s assume that India will grow into being as large as Rest of Asia Pacific is today, in five years’ time. Then Apple will have added $9.5 of quarterly revenue out of $117 billion — or 8.1%. That’s a contribution of about 1.5% revenue growth per year. India is necessary, but not enough.

Then we have the almighty iPhone, which constituted 56% of revenue in the last quarter, down 8% from the year before. I expect Apple to be able to crank out renewed models and be able to grow both volume and price somewhat over time, but we are not talking 10% growth here as the smartphone market is very saturated.

Services should have potential as a larger installed base with an increasing amount of data over time, will make people pay more for storage in addition to other services such as Apple TV+. However, in the last quarter, even services only grew 6.6%. It looks like legacy products and services will continue to constitute the base of revenues, and will continue to be large cash flow generators, but the company is so huge now that the company struggles to generate any meaningful growth.

For investors to believe in blockbuster growth, they will have to believe in a game-changing new product. There’s been talk of an Apple Car for about a decade. Some say it will still come, but who really knows. And if it does come, it is no easy task to grab a meaningful market share in this competitive space. The simple fact remains that if Apple is going to generate 10% top-line growth it would have to boost annual revenue by $39 billion. That is a meaningful number to say the least. This also assumes there is no material adverse events. Like for instance a further decoupling of U.S.-China relations. Several U.S. companies cannot do business in China. Were that to happen to Apple, a large proportion of revenues and profits would be wiped away. Over the long run I therefore struggle to see much more than mid-single digit revenue growth with 2-3% volume growth and 2-3% price growth. With its admittedly enormous cash flow, it could continue buying back stock, thereby boosting EPS by a further 2-3%. 6-9% long-term EPS growth is therefore conceivable. Lower than the long-term return of the market, but you do get a very large, robust and safe stock. Risk-reward wise it is not too bad, but people can’t expect history to repeat itself in terms of total returns.

Looking at the near term and the possible bump to the dividend in conjunction with the earnings announcement on May 4, things are not looking too exciting. Revenue and earnings were down in the last quarter and as most people are aware, the outlook for the world economy is uncertain, to say the least. Inflation is eating away at people’s purchasing power almost everywhere. Most likely earnings will be slightly down and with buybacks, and a bit of luck, EPS will be flat this year. However, with a payout ratio of just 15.6%, there is still room to increase the dividend. Last year, when things were after all going quite well, the dividend was raised by 4.5% or $0.01. I think we can pretty much rule out a higher increase this year. At the other extreme, it is unlikely that the Board will stop the stellar dividend hike history this year. After all, there is not exactly a crisis going on here. We are thus left with the middle option, which is the same dollar-wise hike as last year — $0.01 for a new quarterly dividend of $0.24. The 4.3% hike is slightly below the lates U.S. inflation figures so people relying on the dividend as income will only almost be compensated.

Risk Factors

One of the major risk factors for the company presently is the decoupling between China and the Western world. In the quarter ending December 31 2022, China constituted $23.9 billion or 20.4% of revenues. In a worst case scenario where that were to completely disappear, the company would lose a substantial part of its revenues, equivalent to more than all of its Services revenue. Another risk, which has been a real risk for many years now, is currencies. The U.S. dollar has continued to strengthen year after year, depressing foreign earnings when reported in U.S. dollars. It has partly been able to offset this with local price increases, but with many economies on the brink of recession, that will not be so easy going forward. Finally, the sheer size makes it difficult to find new markets and invent new products big enough to move the needle. When you have annual revenues of almost $400 billion it is next to impossible to grow at double digit rates over the long run.

Current Valuation

Valuation is of course paramount before deciding to either buy or sell a stock. I like to look at valuation both on its own and compared to peers. As peers I’ve chosen Samsung (OTCPK:SSNLF) for its smartphones and Microsoft (MSFT) for its software.

| Apple | Samsung | Microsoft | |

| Price/Sales | 6.9x | 1.6x | 10.7x |

| Price/Earnings | 28.2x | 7.5x | 31.6x |

| Yield | 0.6% | 2.2% | 0.9% |

Source: Seeking Alpha

Clearly, Samsung stands out as the cheapest option here. It is cheaper than the rest of the group on all three metrics. Still, Samsung is a foreign family-controlled company which operates within a lot of business segments so most investors will demand a valuation discount to invest in such a company.

Apple is cheaper than Microsoft on Price/Sales and Price/Earnings. Some might be due to Microsoft being a more pure-play software and more of a recurring-revenue type of business, but mainly it’s probably because of the higher expected growth rate going forward. As for the dividend, Apple is the most expensive of the three.

Analysts expect the company to grow EPS at 10.3% over the next five years. Assuming no change to the multiple and adding in the 0.6% dividend, we arrive at an expected total annual shareholder return of 10.9%. That is slightly higher than the long term return of the broader market. However, with only a slight multiple contraction, that return will fall substantially. Furthermore, as I have analyzed above, I do not expect the company to be able to grow as rapidly as Wall Street analysts think. My assumption is for a 6-9% EPS growth rate, which even with the dividend added, will take us below the 10% threshold. If the relatively high earnings multiple of 28.2x were to contract only a little, returns will be lackluster.

I would say that given the pretty obvious risk factors for Apple currently, the valuation is just too high and the name should not be bought. The dividend yield is low and the dividend growth is low, and as such it is not really an enticing company for dividend growth investors. For pure growth investors, the prospect for sub double-digit growth rates over the long-term is not really interesting. It might be prudent as a small position in a conservative portfolio as the company is undoubtedly of high quality. For most investors, however, this company should not be bought at these valuation levels.

Conclusion

Apple is without a doubt a wonderful company that has a history of proving naysayers wrong. The company has been growing like a weed — and the dividend has grown with it. In early May, the dividend will be raised again, probably by a meager 4%. The coming year will likely be difficult and longer-term risks are considerable, not least a potential further decoupling of China-U.S. relations. Growth is likely to be muted for many years to come. Given an already high valuation, the prospect for enticing returns is low. Look elsewhere when deploying your money in the market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.