Summary:

- Apple Inc.’s OpenAI deal has opened up the potential for Apple to innovate in AI applications, and hardware, and further develop its operating systems to boost product demand.

- Despite the potential in AI, management has not indicated enough critical innovation strategy to make results certain. Market saturation concerns and a lack of product innovation could reduce long-term growth.

- Apple is overvalued, considering my operations analysis. I expect its P/E ratio to contract, with a base-case price CAGR target of roughly 12% over the next decade.

hapabapa

I last covered Apple (NASDAQ:AAPL) in December 2023; I put out a Hold rating at the time, and since then, the stock has gained roughly 12% in price. Since the initial thesis, I have done multiple rounds of in-depth research into Apple, and I consider the sentiment I presented in my first written analysis on Seeking Alpha of the company to be true. Yet, in the near term, it is worth investors considering that the company still has more room to expand, albeit at lower annual growth rates than previously, particularly for its revenue.

In this analysis, I also look carefully at Apple’s role in AI, as I believe this to be the most accretive sector of the technology industry at the time of this writing. Despite my overall lower growth concerns here, this segment of its operations, including its partnership with OpenAI, could be significantly accretive to Apple over the long term. However, at this time the excitement of this deal has definitely overvalued the stock for now, in my opinion.

OpenAI Deal & Apple AI

Apple is not paying OpenAI as part of their partnership, which is positive for its short-term financial position. The deal is intended to integrate ChatGPT into Apple’s products, including Siri and into the writing capabilities on iPhone, iPad, and Mac. This is likely to drive future revenue for both Apple and OpenAI, particularly due to higher demand from the excitement and desirability of Apple’s new AI capabilities as a result of the partnership. Crucial to the deal is that if users subscribe to OpenAI’s services through Apple devices, the transactions would be processed through the Apple platform, which has the potential to provide Apple with a percentage of OpenAI’s revenue.

To further support its position in AI, Apple is expanding its data center operations to support new online AI services—this is likely to incur significant capital expenditures in the short-to-medium term. However, in my opinion, this is absolutely vital for management to prioritize and execute well because any failure for the firm to keep up with data center capabilities would likely leave Apple devices devoid of the capabilities they need to retain strong demand in the global market. The reason I believe this to be true is that I see it as highly likely that artificial intelligence is going to become more valuable than the hardware it runs on, and much of this capability is significantly rooted in the power and information stored in data centers.

Apple’s historical efforts in AI should not be underestimated. It has been actively acquiring AI companies since 2015. To date, it has acquired over two dozen AI companies, with 32 AI startups acquired in 2023 alone. It is crucial to understand that Apple is much more reserved than other AI companies, in that it has used most of its AI to date in the background of its devices rather than at the forefront of user engagement. This is likely to change with the newly settled OpenAI partnership.

However, in my opinion, we still need to ground our understanding of Apple’s position in AI in reality. Unlike Microsoft (MSFT) and Alphabet (GOOGL, GOOG), Apple is unlikely to be one of the leaders in generating artificial general intelligence any time soon because models like ChatGPT and Gemini already have a significant lead.

But what investors need to understand is that Apple could develop a very significant niche in AI by being the company that develops the best usability of third-party AI systems. Many users agree that AI systems are currently lacking in precision, concision, and user-friendliness to varying degrees. Therefore, by using its hardware and operating systems to act as filters for these large language models, Apple could regenerate a significant new demand for its offerings. I think the market might not fully recognize this in full yet.

Broader Financial & Growth Concerns

Despite the potential for continued strength in innovation from Apple as it relates to its approach to artificial intelligence, I think that the company’s saturation in its core market, the iPhone, deserves to be further stressed here. In addition, understanding that the company might benefit from a broader capital allocation strategy similar to Microsoft, which includes taking many more minority interests in companies as well as acquiring them, might be beneficial for shareholders to consider in assessing if management is taking the right steps to preserve the company’s long-term capital growth.

The iPhone is Apple’s primary revenue driver, and it is showing signs of market saturation—this is likely to lead to longer upgrade cycles because users are already happy with their relatively new devices, and also may put pressure on Apple’s pricing to boost demand, which will potentially reduce its profit margins. However, I think it needs to be recognized how profitable Apple’s pricing strategy currently already is; in 2017, it sold 19% of smartphones globally but captured 87% of the profits. Therefore, the company is likely to retain a lot of its earning power through this moat despite a potential looming further contraction in demand—that’s unless its AI implementations become exclusive to newer hardware models, which, I think, is one area where management could begin to drive a new wave of demand at higher prices.

The core concern here many investors have is that, at this time of market saturation and dependence on third parties for market-leading AI models, the company is also potentially lagging in innovation at the level that the iPhone was when it was initially introduced. In my opinion, the Apple Vision Pro was highly innovative, but its target market was much smaller than the iPhone, and at this time when many investors are reducing or selling their positions in AAPL stock due to future growth concerns, I think the company would be wise to either more aggressively innovate or to adopt a shrewder capital allocation strategy.

I believe that Microsoft’s multi-billion dollar investment in OpenAI, which reportedly has given it non-controlling equity ownership of 49%, is telling against Apple’s failure to acquire or own a portion of a leading model thus far. While there are certainly many AI companies developing strong large language models, there are very few which are exceptional. In my opinion, ChatGPT, Gemini, and the full development stack offered by AWS are the three core leaders in the field, with players like Elon Musk now potentially gearing up to take a more active role through xAI. There are, however, many other small companies that are working through these dominant models—in my opinion, Apple would be wise to begin allocating capital at an early stage to highly innovative technologies as well as simply trying to develop this in-house. Such an approach might expose the company’s capital to the high growth it now needs to sustain market-beating returns over the next decade or more.

However, to give Apple credit, it certainly has the capital to make these investments. So, its decision is most likely deliberate and to retain the “closed ecosystem” approach that Steve Jobs was famous for instilling in the company. Yet, it has to be recognized that its partnership and revenue-sharing strategy is likely less accretive than the equity growth it could achieve if it took more aggressive minority interests in third-party technology innovators.

Apple currently has over $67 billion in cash and short-term investments, and part of this is an investment portfolio of roughly half that amount. Yet, this is likely to keep its returns competitive for idle cash rather than to seek high-growth opportunities that would be present in a more active venture capital ethos at Apple.

Value Analysis

While Apple has more reasonable valuation metrics than some other leading tech companies like Microsoft and Tesla (TSLA), it is still richly valued, and investors would be wise to consider that the company might experience a contraction in P/E and P/S ratios if its growth rates begin to contract over the next decade. This is likely to reduce the overall annual price returns achieved by Apple shareholders.

| AAPL | GOOGL | MSFT | TSLA | |

| FWD P/E GAAP Ratio | 31.83 | 23.33 | 37.74 | 83 |

| Historical FWD P/E GAAP Ratio 5Y Avg | 26.63 | 25.9 | 31.03 | NM |

| FWD P/S Ratio | 8.31 | 6.29 | 13.52 | 5.84 |

| Historical FWD P/S Ratio 5Y Avg | 6.27 | 5.68 | 10.36 | 9.21 |

The above table shows that the market is currently anticipating Apple’s future growth to be stronger than it has been over the past five years, which is made evident by the 5.2-point increase in its FWD P/E GAAP ratio against its five-year average on the metric. In addition, its FWD P/S ratio is a 2.04-point increase from its five-year average on the metric. This is cause for concern, in my opinion, because, as I have outlined in my operations analysis above, a large proportion of Apple’s markets, particularly in its core market, the iPhone, are well saturated. These operational considerations are evidence that Apple’s growth over the next 10 years does not support a forward P/E GAAP ratio of around 32 when comparing this to its historical P/E ratios, which includes a median P/E ratio over 10 years of around 18.

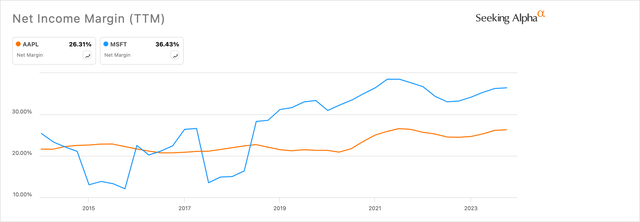

In contrast, Alphabet’s forward P/E ratio is a reduction from its five-year average, and in my opinion, while Microsoft’s P/E is a significant expansion compared to historically, this is largely more warranted than Apple’s P/E expansion because Microsoft has a more diversified and venture-capital growth strategy, which is likely to facilitate its growth over time with more stability, in my opinion. Microsoft also has higher margins than Apple—a 36.43% net margin for MSFT and a 26.31% net margin for AAPL. Both of these margins have been expanding significantly, but Microsoft’s at a much faster rate than Apple’s:

It is important to also consider that as Microsoft is more invested in AI development in-house, it is likely to benefit from the efficiencies this provides with slightly more rigor. I think that Microsoft’s 49% stake in OpenAI is quite likely to allow it to develop internal automation at a faster rate than Apple due to the partnership being much tighter in the financial agreement.

In my opinion, we might imagine that Apple’s P/E ratio will reduce to 25 over the next 10 years. In addition, basic EPS annual growth of around 15% may be presumed reasonable over the time period. Considering a starting TTM basic EPS of $6.45, the stock may be worth $652.35 in 2034. That implies a CAGR of 11.94% from the current stock price of $211.08.

Conclusion

The significant risks I have outlined in this thesis related to Apple’s long-term future growth should not be underestimated. While my price target above is a base case that could be easily beaten with more rigorous innovation and a more aggressive AI and venture capital strategy, the company is currently positioned to continue to meet growth inhibitions, primarily from market saturation.

I think it is reasonable to presume that Apple will continue to deliver stock price growth over the next few decades, but whether it is becoming likely that this will be competitive against broader market indexes like the S&P 500 is uncertain. Despite the OpenAI deal, which is promising in the short-term, Apple needs to more aggressively innovate, potentially utilizing its AI partnerships to develop user-friendly AI applications and hardware, to maintain its historically impressive expansion results.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.