Summary:

- Apple’s recent earnings were overall resilient but showed low growth heading into a potential recession.

- Amid declining consumer sentiment in the U.S. and a low rebound in China, I believe Apple’s near-term prospects are lackluster.

- Apple’s recent high executive turnover and Google’s launch of the Pixel Fold add pressure to Apple.

- In a late cycle economy, particularly in the U.S., I believe Apple is overvalued at current levels.

AleksandarNakic

Thesis

Apple Inc. (NASDAQ:AAPL), is famously known as being Berkshire Hathaway’s largest holding and recently it eclipsed the entire Russell 2000 Index’s market capitalization. In its most recent earnings, Apple also beat on EPS, revenue, and gross margin. Everything seems to being going well for Apple even though the macro-environment has been tough. However, a closer look at earnings reveals stagnant growth and even declines in revenues in many product categories and geographic regions. Furthermore, U.S. Consumer Confidence is declining and being a mainly consumer discretionary stock, Apple could be facing an increasingly tough macro-environment. In addition, while China has begun its reopening, Apple’s Greater China business is still showing net sales declines YOY. Apple’s recent executive departures and the recent Google Pixel Fold launch raises questions over Apple’s corporate structuring and growth prospects. Nonetheless, Apple still trades at a premium valuation after a large rally to start this year. I believe Apple is overvalued given the macro-environment and its lack of growth prospects.

Earnings

Overview

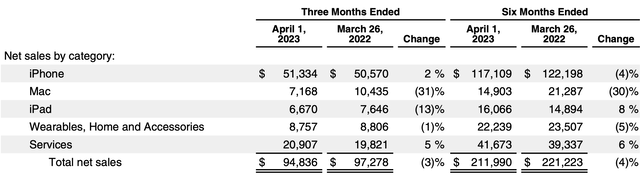

As stated above, Apple beat earnings, revenues, and gross margin consensus estimates from Refinitiv in their most recent earnings report and the stock surged as a result. Reported EPS came in at $1.52 vs $1.43 expected while revenue was $94.84 billion vs expected $92.96 billion. Gross margins were also slightly better than expected at 44.3% vs 44.1%. In terms of segment revenues, the iPhone crushed expectations by bringing in $51.33 billion vs a StreetAccount consensus estimate of $48.84 billion. However, Mac, iPad, and services revenues fell short of exceptions with the Mac showing only $7.17 billion of revenue vs an estimate of $7.80 billion, the iPad showing $6.67 billion of revenue vs an estimate of $6.69 billion, and services showing $20.91 billion vs $20.97 billion expected. Other products managed to beat the estimate of $8.43 billion by showing $8.76 billion in revenue. In addition, Apple did not provide any formal guidance for analysts and CFO Luca Maestri expects current quarter revenue to continue to decline by 3%.

In comparison to the prior year, Apple’s results were only satisfactory. For the quarter, their product sales dropped from $77.457 billion to $73.929 billion YOY and for the 6-month period, product sales dropped from $181.886 billion to $170.317 billion YOY. Their services sales were able to partially offset these declines as in the quarter they showed an increase from $19.821 billion to $20.907 billion YOY and for the 6-month period showed an increase from $39.337 billion to $41.673 billion YOY. I believe it should be highlighted that Apple conducted healthy R&D spending as quarterly R&D expenses were up to $7.457 billion from the prior year’s $6.387 billion and 6-month period expenses up to $15.166 billion from $12.693 billion. Overall net income dropped for both quarterly and the 6-month period YOY. In my view, another potentially concerning figure would be the significant increase in inventory. On April 1st, 2023, the company held $7.482 billion of inventory, versus only $4.946 billion on Sept 24th, 2022. This could signal low inventory turnover, a potential red flag.

Overall, I believe that Apple demonstrated a resilient quarter but it should also be noted that estimates reflected quite low expectations to begin with. Compared to the prior year, results were questionable even though the environment was tough, especially for consumer discretionary companies. In addition, formal guidance was not given and that does not help clear up the murky growth prospects. From my analysis, Apple’s earnings were a mixed bag as a whole and the rally post-earnings was likely unwarranted as the resilience was likely already priced-in given the premium valuation of Apple’s stock.

Performance Breakdown

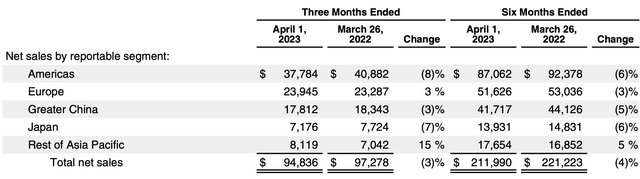

By Region

For the Americas, net sales were down 8% YOY for the quarter and down 6% YOY for the 6-month period. This was a result of lower iPhone and Mac sales with higher service sales partially offsetting the declines. U.S. Consumer Confidence also declined from 104.0 in March to 101.3 in April, reflecting increased cautiousness. In addition, the Expectations Index also declined from 74.0 to 68.1, with levels below 80 being associated with recessions within the coming year. Therefore, with already weak results in the Americas regions, I believe things may get worse for Apple in the coming quarters.

For Europe, relative currency weakness vs the USD had an unfavourable impact. Nonetheless, net sales were up 3% for the quarter YOY but showed declines of 3% for the 6-month period YOY. For the quarter, they had higher iPhone sales but lower Mac sales and for the 6-month period, they had lower Mac sales but higher iPhone sales.

For the Greater China region, the quarterly sales were down by 3% YOY and for the 6-month period down 5% YOY. They had lower sales in the both iPhone and Mac for both the quarter and 6-month period. The Renminbi was also relatively weak against the USD causing unfavourable currency conditions. It should be noted that during the reopening in China, Consumer Confidence hit 94.90 in March vs a 94.70 figure in February. Last fall, it was sitting at only 85.5 in November. In my view, it is concerning that Apple’s sales remain quite weak even though consumers are regaining momentum in China’s reopening.

For Japan, net sales were down 7% YOY for the quarter and down 6% YOY for the 6-month period. In the quarter, they experienced lower iPad, services, and iPhone sales while in the 6-month period they had lower services, wearables, home and accessories, and Mac sales. The Yen was also weak vs the USD and therefore created an unfavourable environment.

Lastly, the Rest of Asia Pacific region showed the most positive results. Quarterly sales were up 15% YOY and for the 6-month period was up 5% YOY. Again, the currencies were weak compared to the dollar. They had higher iPhones sales offset by lower Mac sales.

Overall, I believe the weakness in their largest market in the Americas is concerning especially as U.S. Consumer Confidence continues to drop. Also, the slow rebound in their China sales despite the rising consumer confidence amid China’s reopening is also worth mentioning. Their Asia Pacific region showed growth but the region still lacked magnitude. In my view Apple’s results were weak in many of its key regions.

By Product

For the iPhone, net sales were up 2% for the quarter YOY but down 4% for the 6-month period YOY. The 6-month period decline was attributed to lower sales in iPhones launched in Q4 2022. For the Mac, sales were down significantly for both the quarter and 6-month period and is attributable to lower net sales of the MacBook Pro. For the quarter sales were down 31% YOY and for the 6-month period, sales were down 30% YOY. In term of the iPad, sales were down 13% YOY for the quarter but was up 8% for the 6-month period YOY. For the quarter, Apple reported lower sales of the iPad Pro and iPad Air while in the 6-month period they reported strong iPad sales offset partially by lower iPad mini sales. For their Wearables, Home and Accessories, their quarterly sales were down 1% YOY and for the 6-month period was down 5% YOY. The decrease in the 6-month period sales was attributed to lower AirPod sales. Lastly, for services, they had growth of 5% for the quarter YOY and had growth of 6% YOY for the 6-month period as they reported higher sales in cloud services, music, and advertising. In my view, these result were also a mixed bag as the iPhone saw some rebound and services saw overall growth but that is significantly offset by the large decrease in Mac sales. From my analysis, there is no clear engine of sustained growth for Apple and that is a concern especially when the valuation is rich.

Current Events

Executive Departures

On March 12th, there was a report detailing an unprecedented amount of executive turnover at Apple over the past months. It was reported that since the second half of 2022, Apple has been hit with abnormal departures of executives, particularly Vice Presidents. These executives were important figures with large responsibilities for day-to-day operations. The departures also spanned many departments including industrial design, info systems, hardware and software engineering, and subscription services. For some of the positions, Apple could not find a suitable replacement and had to redistribute responsibilities. For example, Apple could not find a replacement for the head of industrial design, Evans Hankey. In addition they also could not find a replacement Chief Privacy Officer. Bloomberg reported that many departures were veterans of the company and more VPs could be retiring in the coming years. The reported reasons for the departures include growing responsibilities for VPs, company becoming more bureaucratic, and having a difficult time making an individual difference at a large company. Apple’s structure is also reportedly causing stress as it is organized functionally. For instance, hardware engineering VPs would have to oversee all major products like the iPhone, Apple Watch, iPad, Mac and AirPods. This structure has led to delays and more complexity. Overall, I believe that such high executive turnover is a red flag, especially at Apple. Their structure seems to be weighing on executives and that is forcing many of them to reconsider their positions. In my view, this can potentially cause operation disruptions or inefficiencies at Apple especially in departments where replacements have not been hired.

Foldable Phone Market

On May 10th, Bloomberg reported that Apple is the only remaining major phone brand that does not offer a foldable phone. In 2022, foldable phone sales hit 15M units and it is predicted that this market can hit tens of billions of dollars in the coming years. This report comes as Google just launched their Google Pixel Fold. Bloomberg reports that Apple could soon be years behind competitors if it does not act quickly amid this trend. Currently, the foldable phone market is still quite small but is expected to be a growth driver in the smartphone space. In my view, this is a significant risk for Apple. Of course Apple has many times been late with its product offerings but still created the superior selling product over the long run but there is a risk that Apple is falling behind in this area too far. In my view, with hardware growth in a relatively stagnant state, Apple would be wise to invest in this area to reignite growth in their product sales. Nonetheless, as of this moment they have not offered any clues as to whether a foldable phone is on the horizon while the competitors are threatening to leave Apple behind.

Valuation

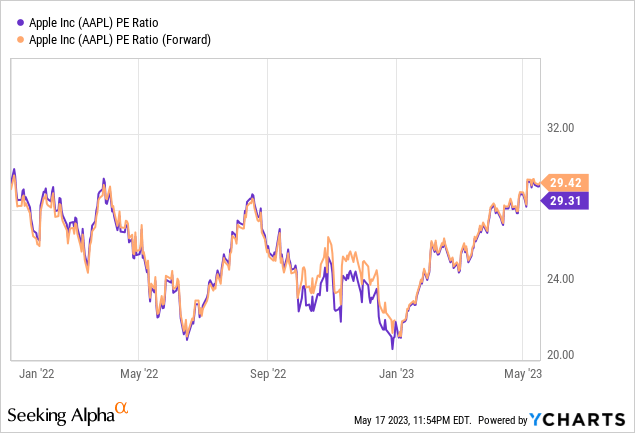

Apple’s P/E ratio sits currently at 29.31x and its forward P/E sits at a similar 29.42. The P/E ratio is sitting at 52 week highs and is much higher than the 52 week lows of approximately 21x set only a few months ago in late December. It is a very similar story for the forward P/E ratio. I believe the current P/E ratio level is unjustified as the minor improvement in Apple’s outlook over the past months cannot justify a nearly 50% increase in its P/E ratio. Even though Apple has demonstrated resilience this quarter, not enough has changed to support such a large multiple expansion. I believe Apple would be fairly valued at a P/E ratio of approximately 24x given the slight improvement in outlook for Apple compared to late last year.

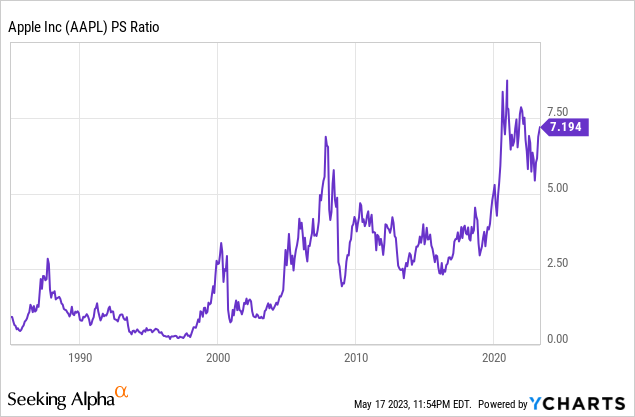

For the P/S ratio, Apple sits relatively near all-time highs. It is currently around 7.2x while the all-time high was around 8.75x. Evidently, the current P/S is much higher than historic averages and the current level is similar to that achieved during 2008. I believe Apple’s P/S is unjustified at current levels due to our current position in the economic cycle and Apple’s lack of growth drivers. Therefore, in my view, Apple would be fairly valued at a P/S of around 5.5x.

Considering the PE and PS ratios, I believe there is significant downside risk for Apple stock. Assuming earnings and revenues stay relatively unchanged, Apple stock has downside risk of approximately 20%. Therefore I initiate Apple at SELL with a $140 price target.

Risks

The most significant risk to my bear thesis would be rapid expansion and growth in emerging markets and India in particular. On May 5th, Reuters reported that Apple was betting its future growth on emerging markets starting with India. With the recent recovery in iPhone sales, Tim Cook credited emerging markets including India with people switching from Android to iPhone. It is reported that these countries have youthful populations and relatively few iPhones which could fuel growth in years to come. In fact Apple reportedly set sales records in countries in South Asia, Latin America, and the Middle East. Recently Apple also opened their first 2 stores in India in Mumbai and Delhi. Although specific numbers were not provided, it was said that Apple set a quarterly revenue record and had double digit growth YOY for revenue in India. I believe this could be an opportunity for Apple to reaccelerate hardware product sales and the stock could benefit as a result. However, this risk is only moderate currently as the size of these markets remain very small compared to the established markets. Therefore, I continue to hold my SELL rating but will monitor emerging market growth and adjust my estimates accordingly.

Conclusion

Apple is a great company that is generating cash flow like no other. However, its most recent earnings just shows resilience but low growth which is not enough to justify the current valuation given we are in a late cycle economy. Apple’s sales are questionable in key markets such as the U.S., where consumer confidence continues to drop and in China, where the reopening has led to a minimal rebound in Apple’s sales. Current events also show potential cracks in Apple’s empire with executive turnover at unprecedented levels. Its lack of movement into the fast growing foldable market is also potentially concerning with its hardware business stagnating. Meanwhile the valuation is still sitting at high levels regarding its P/E and P/S ratios. Even after accounting for Apple’s potential growth in emerging markets, I believe Apple is richly valued. Therefore, I initiate Apple at a SELL rating with a price target of $140.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.