Summary:

- Apple Inc. is underperforming the Index, posing a problem for portfolio managers who want to beat the Index.

- The stock is overvalued and priced to perfection, relying on a “buy and hold” philosophy and stock buybacks to maintain its high price level.

- The proprietary SID signal and Seeking Alpha’s analysts and Quant ratings suggest that Apple will continue to underperform and be sold by portfolio managers.

Justin Sullivan

Apple Inc. (NASDAQ:AAPL) is a great company, held in almost every portfolio, including Warren Buffett’s, but it is underperforming the S&P 500 Index (SP500), and that is a problem for portfolio managers who want to beat the Index. AAPL is overvalued and priced to perfection because it is still considered a growth company favorite, deserving a high valuation. It maintains its lofty price level because of a “buy and hold” philosophy that has always worked for its investors. Stock buybacks also help.

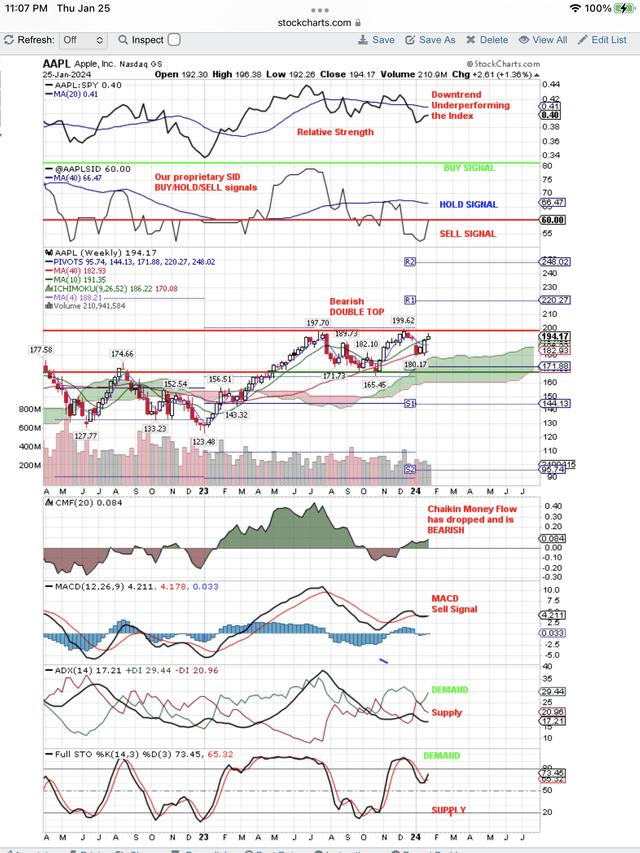

However, portfolio managers who want to beat the Index, will sell stocks that are underperforming the Index on a trend basis. You can see that downward trend happening to AAPL on the weekly chart below. Meanwhile, a weak stock like International Business Machines Corporation (IBM) is coming back to life. Maybe the pairs trade for hedge funds will be to short AAPL and go long IBM.

Our proprietary SID signal uses both fundamentals and technicals to rate a stock. It is shown at the top of the chart below. You can see the SID Sell signal below the red line, is struggling to get back to a weak Hold signal. We like to do our due diligence on AAPL using Seeking Alpha’s analysts and Quant ratings, so let’s dig into them.

SA shows that it’s analysts have a consensus Hold rating, but the two most recent articles have Sell ratings. Meanwhile, back on Wall St. the sell-side analysts still have a consensus Buy rating, but with a target of only $200. That would imply that Wall St. expects AAPL to underperform in 2024, unless that target moves higher. With AAPL’s challenges short term, that does not seem likely.

SA’s Quant ratings are not good. Profitability is great, but Growth and Valuation get poor ratings. This is a deadly combination because you always want to see high growth to offset the valuation problem. In addition, SA ratings are weak for Momentum and Revisions. These two indicate to us that the bearish double top shown on the chart below will stop price and we expect it to drop from here. It is possible that its “magnificent seven” status will take it higher, but then we expect short term, bad news to take it lower. Eventually portfolio selling will overcome the buybacks.

Here is our weekly chart for AAPL. You can see our SID Sell Signal at the top of the chart. Also Relative Strength, AAPL:SPY, shows the downtrend indicating AAPL is underperforming on a trend basis, despite the recent move up to the downtrend line.

Here is our weekly chart with our proprietary SID Sell Signal at the top. You can also see Relative Strength signal at the top of the chart is trending down and underperforming the Index, as represented by SPDR® S&P 500 ETF Trust (SPY):

Our AAPL Sell Signal and it is underperforming the Index. (StockCharts.com)

Conclusion

You can see our Demand signals improving as Apple Inc. makes an attempt to overcome all the negatives. Our proprietary Sell signal along with the downtrend in performance are formidable obstacles. Our due diligence with SA analysts and ratings seems to support our conclusion that AAPL will continue to underperform the Index and portfolio managers will use it as a source of funds to increase holdings in outperforming stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in AAPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To completely understand our fundamental and technical approach to stock selections, we suggest you read "Successful Stock Signals" by Thomas K. Lloyd, available wherever books are sold.