Summary:

- Apple Inc. has pushed past a $2.5 trillion valuation, a massive valuation even with the company’s profitable business.

- The company no longer has an immense cash pile or the cash flow to continue generating substantial returns.

- Apple is a great company that’s simply too overvalued, and as a result, we recommend against investing in the company.

Nikada/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ: NASDAQ:AAPL) has seen its share price recover, pushing its market capitalization back towards $2.6 trillion and its dividend back towards 0.5%. Despite an incredibly strong business, Apple’s current valuation indicates that it’s an overvalued company that will struggle to generate suitable future returns.

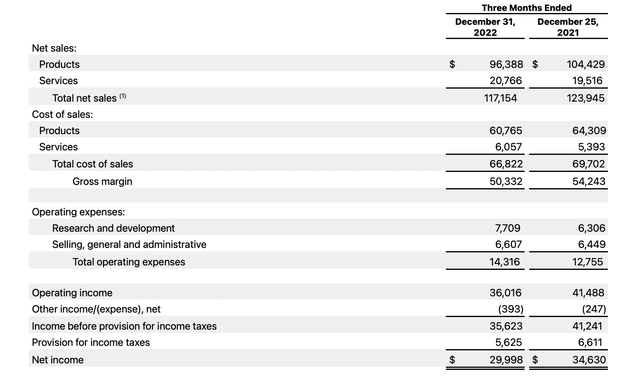

Apple Earnings

Apple has one of the most profitable businesses in the world, but it needs to be with its valuation.

Apple, in its largest quarter of the year (fiscal Q1), earned $117 billion in sales, supported by servers, and down ~5% YoY. The company’s cost of sales dropped some to help it with revenues, however, the company’s R&D expenses increased dramatically YoY. As a result, the company’s operating income dropped more than 10% YoY along with the net income which dropped double digits.

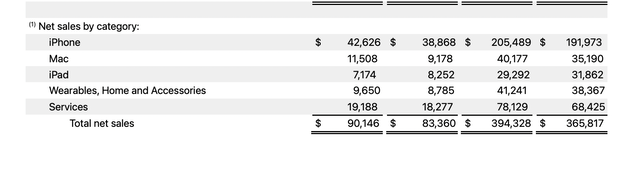

Given that effectively all businesses are expecting a slowdown from the COVID-19 technology peaks, we don’t see this downturn trend as ending right away. The company’s iPad and services businesses have remained strong, while the Mac and iPhone businesses have taken a big hit.

Apple Business Growth

Apple’s businesses have continued to remain strong, but growth has clearly slowed down.

Looking at YoY results, without accounting for the impact of the most recent downturn, the company’s revenue has shrunk to less than 10%, while net income growth was just a hair over 5%. The company’s Mac and Services revenue remain strong, while the company’s iPad and iPhone revenue has slowed down dramatically.

Given that Mac revenue, which was strong before, is expected to be heavily affected with the coming downturn, that could hurt its ability to drive future returns.

Apple Search Engine Risk

Another major risk to Apple is concern over search engines. Google pays Apple a reported $20 billion / year, to be the default search engine across its devices. However, there’s two massive risks here. The first is that Google (GOOG) and Apple are facing a class action lawsuit arguing that this payment is an illegal monopolistic practice.

Whether or not it pans out remains to be seen, but if it does, and Apple is forced to develop their own search engine, it can present a massive impact to Apple’s profits. The Department of Justice has also made complaints against the agreement, so it’s not solely a fringe lawsuit. Given that the agreement is ~20% of Apple’s profits this is a massive risk.

Additionally, Microsoft + Chat GPT are potentially launching a new search engine that could be massively competitive to Google. Chat GPT was rumored to have caused a massive “Code Red” at Google. Should Microsoft Corporation’s (MSFT) Bing engine beat Google, Apple might be forced on the back leg, with fewer options and a threat to this source of revenue.

Given this massive amount of pure profit for Apple and Apple’s valuation, this search engine deal accounts for roughly $500 billion of Apple’s valuation.

Apple’s Lack Of Shareholder Returns

Apple, in our view, will continue to struggle to generate long-term shareholder returns.

Apple has directed the majority of its shareholder returns through share repurchases. The company’s outstanding share count has declined by 3.4% YoY. Counting the company’s dividend, it has provided total shareholder returns of roughly 4%. The company is returning cash to shareholders, effectively all of its free cash flow (“FCF”).

However, it’s only earning 4% in annualized shareholder returns. We expect a short-to-medium term downturn that could hurt earnings pushing that level down further. We expect Apple to continue being a massively profitable corporation, but we don’t see it as generating shareholder returns to justify its valuation.

Our opinion is that fair value on the company would put Apple’s valuation closer to $1-1.5 trillion, or roughly half its current price.

Thesis Risk

The largest risk to our thesis is whether Apple could create a new product line that could boost revenues and profits. The company’s recent Watch and AirPod businesses have done incredibly well. It’s been rumored to be working on a headset and car. We see these businesses as having less value, but if they succeed, they could help drive significant value.

Conclusion

Apple Inc. is one of the largest corporations in the world and it remains enormously profitable by its portfolio of assets. The company spends all of its cash flow on shareholder returns, but its valuation has made it so that its shareholder returns are quite low (~4% annualized). The company no longer has a massive cash position to justify that.

Apple, Inc.’s business is expected to decline, at least this year. The company has some potential products that could reverse that, but we don’t see them succeeding at scale. As a result, we expect Apple Inc. returns to drop down, making it a pure long-term investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.