Summary:

- AAPL continues to deserve its profitable growth valuations, albeit somewhat pulled forward by the overly optimistic market sentiments, attributed to its increasingly rich operating and Free Cash Flow margins.

- Anyone concerned about the slowing iPhone revenues must be reminded about the record high smartphone global replacement cycle in 2022/China in 2023, with any consequent slowdown a normal event.

- Readers must also note the increasingly sticky AAPL ecosystem, attributed to the growing active installed base and expanding Services gross margins.

- However, here is where things appear to be uncertain, with our conviction surrounding its excellent long-term prospects temporarily negated by the near-term headwinds/premium valuations.

- Interested investors may want to observe the stock’s movement for a little longer before pulling the trigger, with AAPL already underperforming the SPY and QQQ on a YTD and twelve months basis.

by-studio/iStock via Getty Images

We previously covered Apple (NASDAQ:AAPL) in August 2023, discussing the market’s over-reaction to its lower iPhone sales and the decline of its US smartphone sales through FQ3’23.

We had posited that consumers had likely been waiting for the launch of iPhone 15, with the Cupertino giant’s September quarter revenue record for iPhone and Services in FQ4’23 confirming our thesis then.

However, things have taken a seasonal turn afterwards, with the pulled forward iPhone sales in 2022/ 2023 naturally triggering the consequent slow-down in AAPL’s sales by FQ1’24.

For now, we believe that investors may want to focus on its expanding operating and Free Cash Flow margins instead of the decelerating top/ bottom line growth, since the excellent liquidity has directly contributed to its healthier balance sheet and sustained shareholder returns.

While we concur that AAPL may be lofty here, we maintain our Hold rating on the stock, with its growing Services revenue/ profit margins only demonstrating its growing ecosystem and premium global users, no matter the noise in the stock market and the intensifying market competition in the mid-tier segment.

The AAPL Investment Thesis Has Met Its Seasonal Winter

For now, AAPL has reported double beat FQ1’24 earnings call, with revenues of $119.57B (+33.6% QoQ/ +2.1% YoY) and GAAP EPS of $2.18 (+16% QoQ/ +49.3% YoY).

Its most important segment, the iPhone, recorded an impressive $69.7B of sales (+59.1% QoQ/ +5.9% YoY) with the Services revenue also increasing to $23.11B (+3.5% QoQ/ +11.3% YoY).

Combined with AAPL’s robust pricing power with growing gross margins of 45.9% (+0.7 points QoQ/ +2.9 YoY) and somewhat stable operating expenses of $14.48B (+7.6% QoQ/ +1.1% YoY), it is unsurprising that it reported expanding operating margins of 33.8% (+3.7 points QoQ/ +3.1 YoY) in the latest quarter.

The same has been observed in the Cupertino giant’s Free Cash Flow generation of $37.5B (+93% QoQ/ +24.1% YoY) and margins of 31.4% (+9.7 points QoQ/ +5.6 YoY).

These margins are notably improved, compared to the Last Twelve Month [LTM] operating margins of 30.8%/ FCF margins of 27.7%, FY2023 margins of 29.8%/ 26%, and FY2019 margins of 24.6%/ 22.6%, respectively.

We believe that these two numbers may be the two most important metrics that readers must focus for the AAPL stock indeed, since the robust profitability allows the company to consistently improve its balance sheet while returning immense value to its existing shareholders.

For example, readers may want to note its moderating net debts at -$21.98B (-34.8% QoQ from -$33.73B/ -54.4% YoY from -$48.27B) by the latest quarter, though still elevated compared to the net cash of $8.75B reported in FY2019 (+131.8% YoY).

At the same time, AAPL has continued to use its growing liquidity to return value to existing shareholders, with 380M shares/ 2.4% of its float already retired over the LTM, and 2.51B / 16.1% since FY2019.

While minimal, the Cupertino giant also pays out quarterly dividends, similar to that of Nvidia (NVDA), allowing interested investors to regularly accumulate more shares on a quarterly basis.

Therefore, while AAPL’s prospects may have been temporarily called into question, attributed to the elongated smartphone replacement cycle, demand weakness in China, and uncertain Vision Pro demand, we are not overly concerned here.

For reference, its revenues in China has disappointed analysts, with a lower than expected net sales of $20.81B (+37.9% QoQ/ -12.9% YoY) in FQ1’24. This headwind has been partly balanced by the robust sales reported in the EU at $30.39B (+35.3% QoQ/ +9.7% YoY), Japan at $7.76B (+41% QoQ/ +14.9% YoY), and APAC at $10.16B (+60.5% QoQ/ +6.6% YoY).

However, with the latest replacement cycle hitting a new high globally in 2022 and China in 2023 post lockdowns, we believe that it may be premature to expect China to record another breakthrough in sales on a YoY basis, based on the average phone lifespan of 2.75 years.

As a result, it may be more prudent to expect a temporal seasonal dip in its top/ bottom line growth, with things likely to lift by the end of 2024 or early 2025. That will just be in time for AAPL’s supposed release of the iPhone 16, consistent with most of its new launches in Fall.

With the headwinds being cyclical instead of structural, readers need not worry about the Cupertino giant’s prospects, especially due to its consistently growing installed base at over 2.2B active devices (+10% YoY).

Combined with an expanding Services gross margin of 72.8% (+1.9 points QoQ/ +2 YoY), attributed to the robust advertising, cloud services, payment services, and video demand, it is apparent that AAPL’s bottom lines may continue to outperform expectations moving forward.

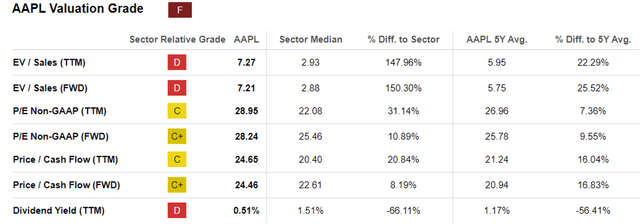

AAPL Valuations

For now, AAPL’s FWD P/E valuation of 28.24x suggests a certain premium compared to its 1Y mean of 27.73x, 3Y pre-pandemic mean of 15.59x, and the sector median of 25.46x.

Then again, based on the Magnificent Seven stocks’ mean P/E valuations of 37.32x with AAPL interestingly positioned below the median point, it appears that the stock may have just been carried away by the upward momentum observed in the market thus far.

For reference, Alphabet (GOOG) trades at FWD P/E valuations of 21.18x, Meta (META) at 24.12x, AAPL at 28.24x, Microsoft (MSFT) at 35.18x, Amazon (AMZN) at 40.17x, Nvidia (NVDA) at 53.82x, and Tesla (TSLA) at 58.57x, in ascending order.

With the International Monetary Fund concurring on the increased likelihood of a soft landing and the labor market still robust, it appears that the Fed may very well pivot as soon as H1’24, as more analysts price in a 0.25 basis point reduction in interest rates by the May 01, 2024 FOMC meeting.

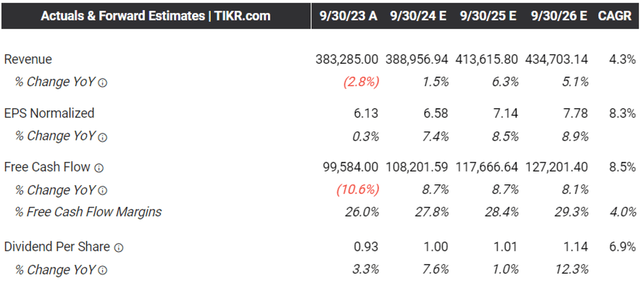

The Consensus Forward Estimates

For now, we believe that AAPL’s premium valuations are somewhat unwarranted, since the consensus estimates minimal top/ bottom line growth at CAGRs of +4.3%/ +8.3% through FY2026.

These numbers are notably moderated compared to the previous estimates of +10.8%/ +10.3% and the historical growth of +8.6%/ +16.7% between FY2016 and FY2023, respectively.

The only silver lining to the AAPL investment thesis is the projected expansion in its FCF margins to 29.3% by FY2026, allowing the management to sustain its balance sheet improvement and shareholder returns over the next few years.

So, Is AAPL Stock A Buy, Sell, or Hold?

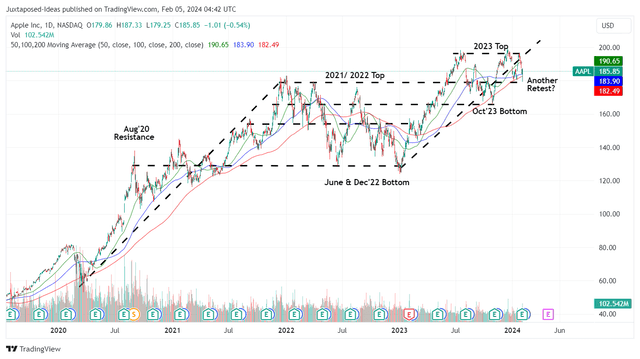

AAPL 4Y Stock Price

With AAPL likely to face further near-term uncertainties, we can understand why it has continued to trade sideways over the past few quarters, with the stock recently failing to break out of its previous 2023 top, while appearing to retesting the support levels of $180s.

Here is where things appear to be uncertain, with our conviction surrounding its excellent long-term prospects temporarily negated by the near-term headwinds.

With the market sentiments currently nearing extreme greed and things seemingly lofty here, it may be more prudent to reiterate our previous Hold rating on AAPL indeed, as it remains to be seen if bullish support may materialize here with a moderate pullback to the $165s possible.

Interested investors may want to observe the stock’s movement for a little longer before pulling the trigger, with it already underperforming the SPY and QQQ on a YTD and twelve months basis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, TSLA, NVDA, META, MSFT, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.