Summary:

- I believe Apple’s first quarter results will reflect a slowing demand environment for the iPhone.

- Services remain a bright spot for Apple, with double-digit growth expected in 2024.

- The impact of Vision Pro on overall sales will not be substantial enough to offset potential weaknesses in iPhone sales in China.

ozgurdonmaz

Thesis

Apple Inc. (NASDAQ:AAPL) has received several downgrades since I last covered the stock earlier in December as analysts worry about the weaker sales of the iPhone 15, particularly in China. Although the concerns relating to the demand environment in China remain a concern for the company, I believe the current pessimism may be overblown. In my view, Apple can sustain a low- to mid-single digits, driven largely by a services business that thrives on an installed base of more than 2 billion active devices, even as product sales remain depressed. I believe India can be a market where Apple can benefit by increasing its market share along with other emerging markets. I re-iterate my hold rating on the stock.

Q1 Earnings Preview: iPhone Sales to Remain Under Pressure

I believe Apple’s first-quarter result will reflect a slowing demand environment for the iPhone, and there will be a decline in iPhone sales in the greater China region due to tough competition from Huawei and reduced consumer spending. In my view, an important point to look out for is what Apple’s management has to say about recent changes in the App Store, as these changes might impact the company’s services unit growth in 2024. There might be some improvement in gross margins in the quarter, driven by higher adoption of the more expensive iPhone Pro Max models. I believe buybacks in the first quarter will be in the range of $20-$22 billion, similar to the fourth quarter, but Apple has room for expansion in buybacks due to its large cash position.

Services Might Provide Some Optimism

As I stated in my previous article, services remain a bright spot for Apple, and I believe growth can remain in the low double-digits even as pressure persists for the iPhone and, more recently, watches. Over the past four quarters, services sales have grown at an average of 13.5% in constant currency. Assuming there are no regulatory actions that impact the licensing fee Google pays to remain the default search engine on Apple devices, I believe the services segment will likely achieve double-digit growth again in 2024.

Shareholder Returns To Remain Strong

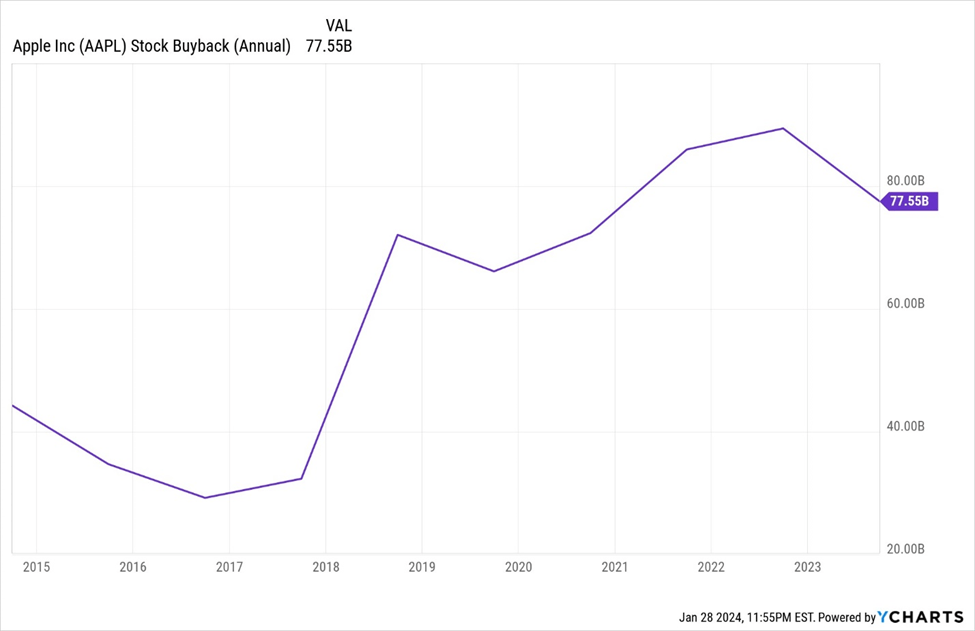

I believe Apple is well-positioned to set a new record for returning cash to its shareholders in 2024, utilizing a combination of new debt and its existing cash reserves. As of September 30, there was $74.1 billion of availability under Apple’s authorized share-repurchase program. Over the years, Apple has returned over $812 billion to shareholders since 2012, averaging around $24 billion per quarter over the past year. In the next 12-24 months, quarterly returns could potentially increase to around $28 billion or more following the $90 billion expansion of the buyback authorization in May 2023. While a new buyback authorization, which is expected to exceed the current $90 billion plan, may not be announced until May, historical patterns indicate that such announcements typically coincide with the release of fiscal 2Q earnings.

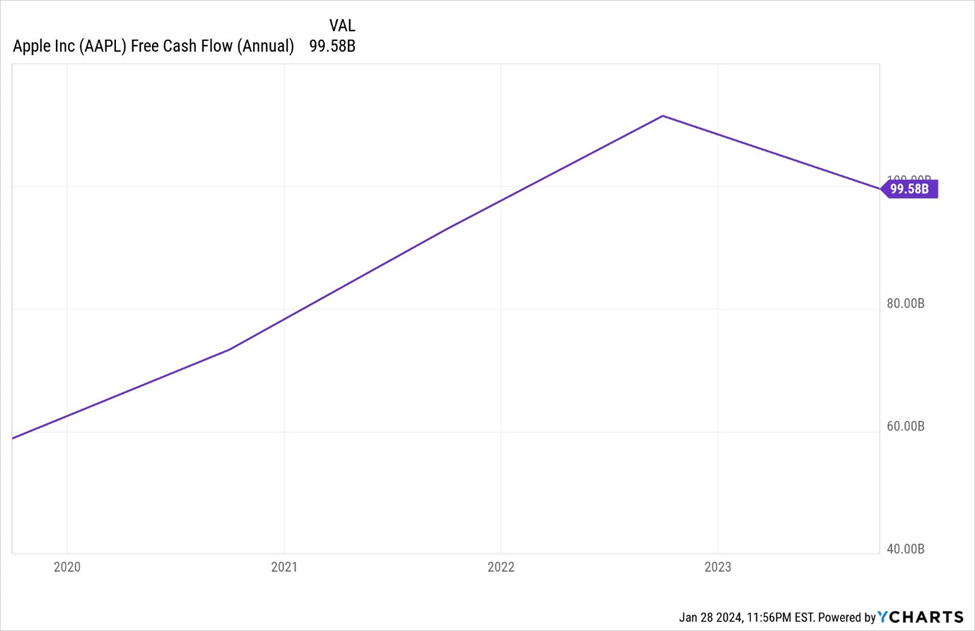

Ycharts

Apple’s annual free cash flow, expected to exceed $100 billion in fiscal 2024 (as per consensus estimates), could further extend the timeline for achieving cash-neutral status unless the company adopts a more shareholder-friendly capital allocation policy or one focused on mergers and acquisitions to expedite the process. Even as Apple continues to set historic highs in share repurchases and dividends, the company’s credit ratings remain exceptionally strong, underpinned by its robust business ecosystem and industry-leading cash reserves. In its last fiscal quarter, Apple returned $24.6 billion to shareholders through stock buybacks and dividends, and I expect this trend to continue increasing in the short-to-medium term.

Ycharts

Introduction of Vision Pro Mixed-Reality Headset

I believe Apple’s introduction of the $3,499 Apple Vision Pro mixed-reality headset on February 2 will certainly create a buzz, but the impact on overall sales will not be substantial enough to offset potential weaknesses in iPhone sales in China. The company expects to sale 400,000 headset units in the first year, generating approximately $1.4 billion in revenue, which would represent less than 1% of Apple’s total company revenue. Even in a best-case scenario, where unit shipments reach 750,000, resulting in sales of about $2.6 billion, it would still represent just around 0.7% of Apple’s projected sales for 2024. While the media will likely generate significant hype around the product launch, I believe it might take two to three more iterations of the device to gain traction among developers and reduce the price to make it accessible to a larger portion of Apple’s approximately 140 million iPhone users in the US.

Valuation

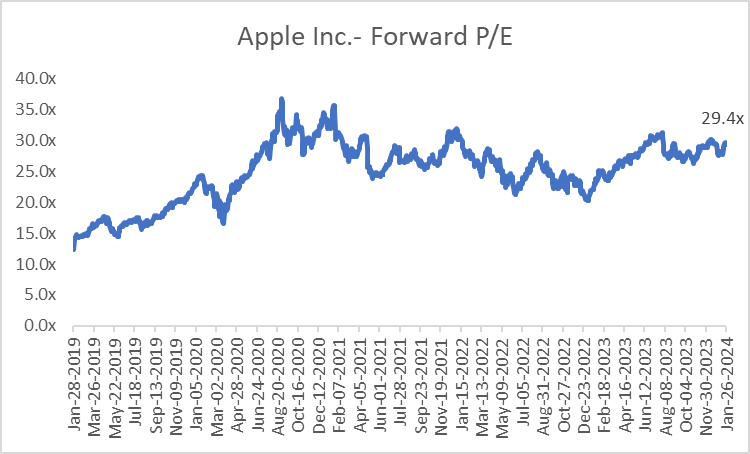

AAPL shares traded at in the mid- to high-teens range prior to the pandemic, following which the shares re-rated to a range in the low-20s to low-30s, with the averages for the year holding more tightly between 25-28x. Apple’s strong product suite and strong cashflows with higher services growth led to Apple’s valuation multiple increasing over 50% in 2023 and doubling over the past five years. However, given the slowdown in growth and increasing competition in China, I believe the multiple does not have any room to expand further from current levels. I see limited meaningful innovation and continued demand/regulatory weakness, which should pressure the multiple going into 2024, given little scope for upward estimate revisions. Hence, I remain cautious and re-iterate my hold rating on the stock.

Capital IQ

Conclusion

Although I believe the recent pessimism around the Apple stock may be overhyped, the company faces some significant headwinds that will materially impact the company’s growth in the near-term. The stock is trading at an elevated multiple, and I do not see much room for expansion from here, given lack of catalysts for the stock currently. Hence, I stay cautious and re-iterate my hold rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.