Summary:

- Apple Inc. beats nicely on top and bottom lines for fiscal Q2 2023.

- Company raises dividend and increases authorized buyback.

- Apple Inc. shares need to hold the 50-day moving average to keep sentiment bullish.

Nikada/iStock Unreleased via Getty Images

After the bell on Thursday, we received fiscal second-quarter results from technology giant Apple Inc. (NASDAQ:AAPL) for its March-ending period. The company has been one of the best performers in the market so far this year, up more than 32% as a number of large-cap tech names have recovered from some of last year’s pain. It turns out that the quarter wasn’t as bad as the Street was expecting, sending Apple shares higher initially after the report.

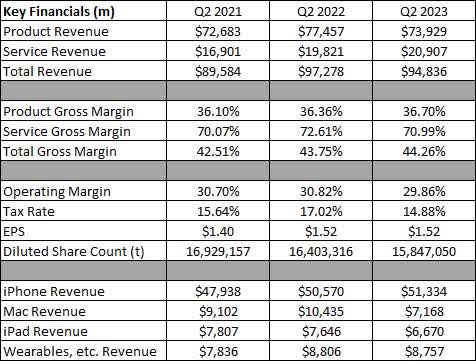

Over the past couple of months, Street estimates have come down as analysts have worried about a slowdown in consumer spending. Going into this report, the average estimate called for $92.84 billion in Q2 revenues, down more than 4.5% over the prior year period. When Apple reported its previous quarter a few months back, the street was expecting over $97 billion for the March period, which would have been a decline of just 0.25%. In the table below, you can see how Apple fared against the past two Q2 periods, with dollar values in millions except per share amounts.

Q2 Earnings Summary (Company Earnings Report)

In total, this Apple Inc. quarterly revenue print was solid. It’s nice to see the iPhone report an increase, even if only 1.5% with some smartphone sales shifted into this period due to supply chain constraints from China’s covid shutdowns late last year. Basically, the Mac and iPad sunk the entire quarter against the year-ago period, while Wearables hung in there and Services grew by more than a billion dollars. Apple beat the street by $2 billion on the top line, although that was based on reduced expectations, as I mentioned above.

The margin results were pretty good as well. Product margins likely rose with a mix shift towards the iPhone, with the smartphone going to almost 69.5% of product revenues in this period, up more than four percentage points year over year. While services margins did come down, that segment becoming larger as a percentage of the whole business helps the margin profile. Of course, a lot of services spending can be on the operating side at times, so these high margins don’t always tell the entire story.

Apple’s operating margin did come down about a percentage point. This was mostly driven by a loss of a few billion dollars in revenue combined with a more than 8.5% increase in operating expenses. Other income items were a small headwind, but that lower tax rate added about four cents to the EPS print, along with the continued help from the buyback. Overall, Apple beat the street by 9 cents, its largest beat since the Q2 report a year ago.

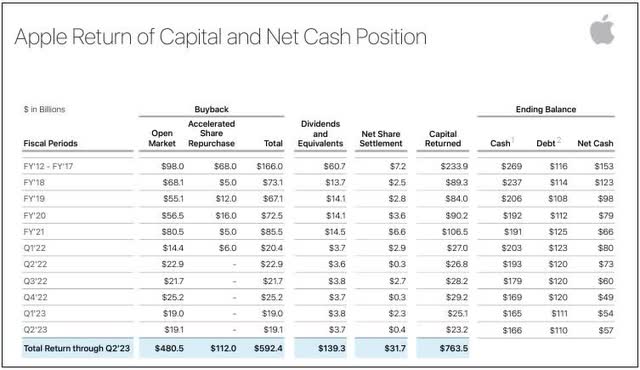

The other major news investors were looking for was in terms of the tremendous capital return plan, which Apple updates us on in this report each year. As I figured would happen, the dividend was raised by a penny per share, another token amount. The annual payout will now be $0.96, which yields well below 1%, but this name is all about the buyback. Some income investors remain disappointed that the dividend yield is low. However, you can’t argue with this total capital return plan that in the next few years could hit $1 trillion returned since it started a little more than a decade ago.

Apple announced a $90 billion increase to its share repurchase plan, as management continues to work towards a cash-neutral position on the balance sheet. In recent years, the buyback has been running at about a $20 billion per quarter pace. While the cash position is coming down over time, this is still a company producing tremendous cash flow, so even once Apple gets to around the cash neutral area, it still will have plenty of financial flexibility to continue buying back shares and reducing the outstanding share count. The graphic below shows the history of the capital return program, with an important note being that the net cash balance did rise sequentially despite more than $23 billion being returned to shareholders in the period.

Q2 2023 Capital Returns Update (Apple Investor Relations)

As for Apple shares, they went into the earnings report above $165, which put them only about three percent away from the average price target on the street. I mentioned previously that I thought the stock was overextended a bit, as it was way above the 50-day moving average. That’s proven mostly correct, with the stock a bit sideways lately as the gap to that key technical level has narrowed quite a bit. To keep sentiment on the positive side, the stock needs to hold the 50-day (at $159 but currently rising) and prevent that line from rolling over in the near term.

In the end, Apple Inc. delivered another solid set of results. Revenues did decline over the year-ago period, but not as much as expected, and iPhone sales did grow a little. Gross margins saw a nice increase, helping to drive a large bottom-line beat, with some help from a dip in the tax rate. With results like this, Apple Inc. remains a great long-term hold, although I keep cautioning investors that we could see some choppy times in the coming quarters if the U.S. does find its way into recession territory and consumer spending slows.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.