Summary:

- Apple Inc. stock is scheduled to report its FY Q3 earnings post-market on August 1.

- Many Apple bears are overly sensitive to the iPhone shipment data and miss other key variables.

- I expect updates from Q3 earnings to serve another lesson to such overreaction.

- In particular, I anticipate seeing the iPhone’s strong pricing power and the continued growth in service revenues.

- These should offset volume fluctuations in the past quarter, if any.

spxChrome

AAPL stock: FY Q3 earnings report on August 1

I last covered Apple Inc. (NASDAQ:AAPL) about a month ago (on June 14, 2024, to be exact). The article was titled Apple: How It Shorts Fiat Money And Why It Benefits Me. The article argued for its attractive long-term return prospects, with a particular focus on its capital allocation flexibility. More specifically,

Apple Inc. is a strong buy both in the near term and also long term. In the near term, I see the AI upgrades announced in its WWDC24 conference to be a dominating force in the next 1~2 years. In the longer term, Apple’s unique strength allows it to short fiat money at a large scale via share repurchases and cheap borrowing. This creates double (or even triple) compounding benefits for Apple shareholders.

In this article, I want to switch the perspective to the near term given its upcoming earnings report (ER). To wit, AAPL is scheduled to hold a conference call to discuss fiscal Q3 earnings results on Thursday, August 1, 2024. In the remainder of this article, I will detail the catalysts I expect to see in this upcoming ER, especially those surrounding its flagship iPhones. In a nutshell, I expect the ER to serve another blow to bears who have been betting against the company.

AAPL stock: what the bears missed

Many AAPL investors (in particular, the bears) have become overly sensitive to the iPhone shipment data, in my view. As a recent example, earlier this year, the market was very concerned about the softened demand and competition in the smartphone market in China. The concern has led to a stock price correction for AAPL to as low as $165 as illustrated by the chart below.

However, such an overreaction missed a few key considerations. First, quarterly fluctuations largely represent noises in my view, especially for cyclical markets such as smartphones. Indeed, as the latest IDC data shows, global smartphone shipments have reversed the trend in recent quarters and rose 6.5% in Q2 2024. More importantly (the quote was slightly edited by me and the emphases were added by me also):

Global smartphone shipments increased 6.5% in the second quarter, driven by Apple and Samsung… According to IDC, smartphone shipments rose to 285.4 million units in the second quarter, marking the fourth consecutive quarter of shipment growth. As Apple and Samsung both continue to push the top of the market and benefit the most from the ongoing premiumization trend, many leading Chinese OEMs are increasing shipments in the low end in an attempt to capture volume share amidst weak demand.

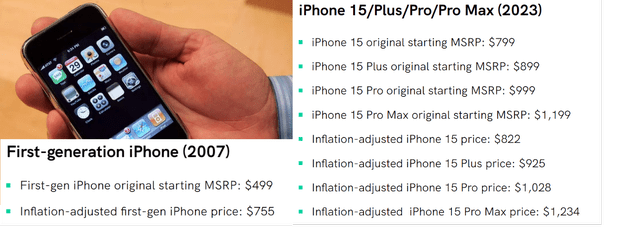

The comments below lead me to the second key factor bears often miss on iPhone-related issues: its premium pricing and remarkable pricing power. As a result, even IF the growth in volume slows, I do not expect sales in dollar amounts to slow, and historical data seem to support this perspective. AAPL’s iPhones have been able to increase their prices substantially (even after adjusting for inflation) over the years, and customers are happy to pay for them. As seen in the next chart below, the 1st generation iPhone (still remember how it looks?) was priced at $755 on an inflation-adjusted basis (or $499 “only” when not adjusted for inflation). Fast-forward to 2023, the iPhone 15 series is priced in a range of $822 to $1,234 on an inflation-adjusted basis.

Equally fundamentally, AAPL has now evolved a highly sticky ecosystem based on its iPhones, as detailed next.

AAPL stock: service revenues in focus

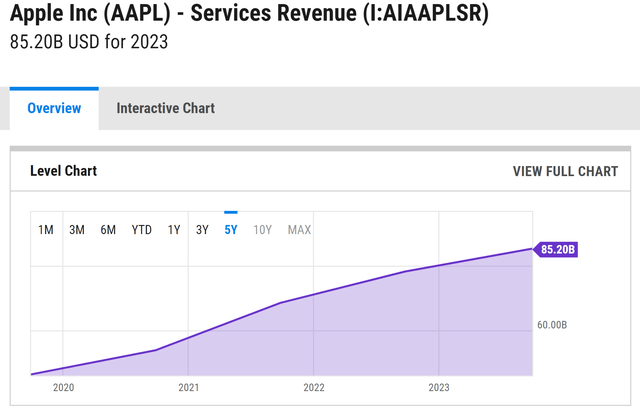

As a reflection of the potency of the ecosystem surrounding its iPhones, Apple’s services revenue has grown significantly over the past few years. They reached an all-time high in the more recent quarter at $85.2 billion, as illustrated by the chart below.

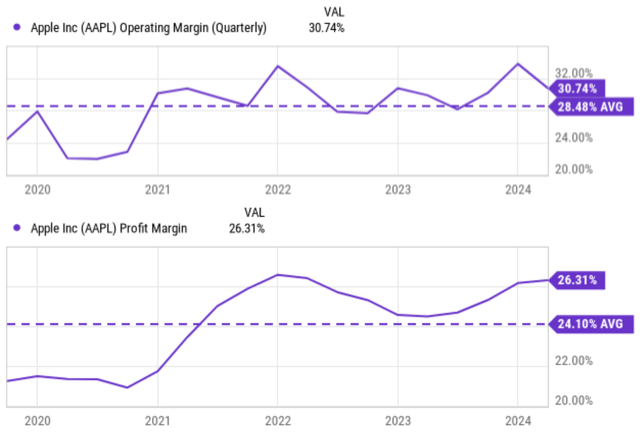

Looking ahead, I anticipate the company to keep reporting robust growth in services in the Q3 ER. My optimism is rooted in several reasons. First and foremost, service revenues are stickier and more likely to recur than hardware sales. Second, service revenues also enjoy higher margins than hardware sales (which are already terrific due to iPhones’ pricing power, as argued above). Its financials do point to an upward trend in profitability in tandem with the expansion of service revenues.

To wit, the chart below shows AAPL’s operating margin (top panel) and profit margin (bottom panel) recently. As shown, both margins have trended upward over the past few years, and both currently hover well above the 5-year averages. The operating margin currently is about 30.7% and the profit margin is about 26.3%, in contrast to their five-year average of 28.4% and 24.1%, respectively. Finally, AAPL’s service revenue is well-supported by a mind-boggling installed base of over two billion. Such an installed base can also help to support revenues from other related product lineups such as iTunes, Apple Music, iCloud, Apple TV+, and accessories.

In particular, I also look forward to more updated information on the development of Apple Intelligence and its integration with the iPhones in the upcoming ER. I am optimistic that this integration of AI will catalyze a strong wave of iPhone replacements/upgrades among its user bases. I expect the integration to continue the hallmark of AAPL products: powerful, intuitive, and well-meshed into the experiences of other AAPL devices.

AAPL stock: Other risks and final thoughts

In terms of downside risks, both AAPL and its tech peers face a common set of headwinds, such as the overall global economy, potential disruptions in the supply chain, etc. However, given Apple’s unique model, it also has some company-specific risks. The top one in my view is its relatively large exposure to China. It relies on China extensively, both for its manufacturing needs and also as a key end market. The exposure entails considerable geopolitical risks, given the ongoing tension between the U.S. and China.

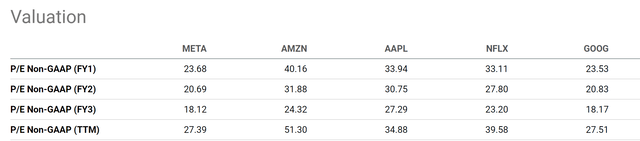

The ongoing presidential election in the U.S. further compounds such geopolitical risks, especially considering the potential candidates’ vastly different platforms on trade and tariffs (among other things). Another specific risk involves AAPL’s valuation multiples. Due to the large price rallies in the past quarter, AAPL now trades at an elevated valuation, not only in absolute terms but even by the FAANG standard. More specifically, the chart below compares AAPL P/E to the rest of FAANG stocks. As seen, in FY1 non-GAAP terms, Apple has the second highest P/E ratio of 33.9x only after Amazon.com, Inc. (AMZN). Alphabet Inc. (GOOG), (GOOGL) and Meta Platforms, Inc. (META) are trading around 23x of their FY1 earnings only.

However, I won’t recommend betting against a wonderful business only based on a relatively high valuation. Despite the P/E premium, my analyses still point to robust return potential both in the long term (the focus of my previous article) and in the near term. In particular, in the near term, I anticipate several catalysts from the upcoming FY Q3 earnings report serving another blow to the bears. These catalysts include the strong pricing power (which should offset volume fluctuations – if any) and the continued growth in service revenues (hardware sales have become only part of the equation by now).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.