Summary:

- Apple Inc. reported fiscal Q3 results relatively in line with expectations, with a slight decline in revenue but an increase in diluted EPS.

- The company’s services revenue and active device base reached all-time highs, showing operational consistency and stability.

- Apple should be viewed and valued as a consumer staple, with modest expectations for future revenue growth and a focus on efficiency gains and increasing services revenue.

- We believe Apple stock has a role to play in a diversified portfolio and that the valuation of Apple remains reasonable.

Nikada/iStock Unreleased via Getty Images

Thesis

Apple Inc. (NASDAQ:AAPL) recently reported results for their fiscal third quarter. While there were some noteworthy accomplishments in the quarter, the results were largely in line with expectations. The value of investing in Apple is their SWAN characteristics, and investors who expect high levels of growth will likely be disappointed. Apple stock has the characteristics and valuation of a consumer staple, and as the saying goes, you get what you pay for.

Fiscal Q3 Highlights

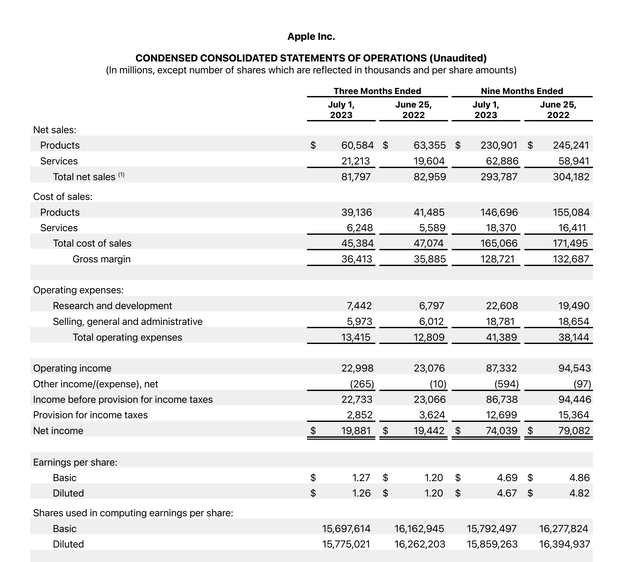

For their fiscal third quarter, Apple reported revenue of $81.8 billion, which was down 1% year-over-year. They also reported diluted EPS of $1.26, which was up 5% year-over-year. The stock is currently down after hours, likely because some investors were disappointed by these numbers and the lack of meaningful revenue growth.

Income Statement (Apple’s Fiscal Q3 Earnings Release)

Taking a step back, the quarter really wasn’t that bad. Apple’s services revenue reached another all-time high, and the company has over 1 billion paid subscriptions. Their installed base of active devices also reached another all-time high. Their revenue hung in there, and EPS grew despite what is a challenging macro environment for many companies.

Investors who are disappointed by this quarter may want to reevaluate why they hold Apple. If an investor holds Apple with the expectation that their past growth will continue in the future, it’s likely they will be disappointed. Apple has a specific role to play within a diversified portfolio, and that role is different than it has been at times in the past.

The Case for Investing in Apple

As mentioned in our previous article on Apple, the investment case for Apple is based around operational consistency and stability. The company serves as a sleep well at night, or SWAN, investment that an investor can use to add stability to their portfolio. At a mammoth valuation near $3 trillion, it’s unlikely that Apple will be able to grow revenues at the rate they have in the past. Apple will likely focus their efforts on efficiency gains and increasing their percentage of services revenue going forward, which could have the effect of improving margins and increasing EPS without needing to meaningfully increase revenues.

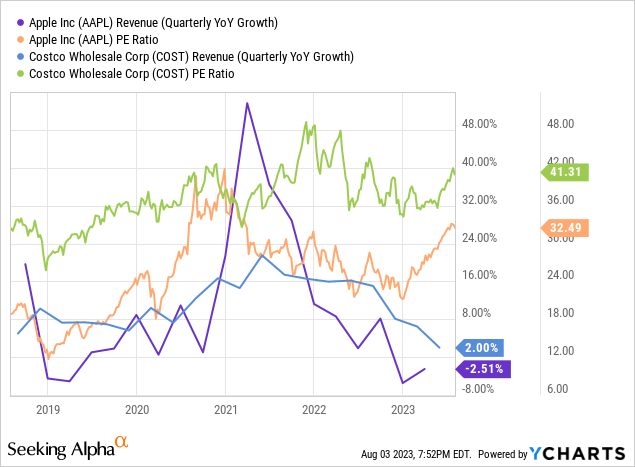

We would liken an investment in Apple to one in Costco (COST) or another similar consumer-facing company with a high level of brand recognition and customer satisfaction. These companies aren’t going away anytime soon and can have a role to play in a portfolio even if their annual revenue growth rates remain sub 10%. These types of companies can continue to increase profitability over time as they find new ways to operate more efficiently due to their scale and find new products/services to introduce that benefit from their high amount of consumer appeal.

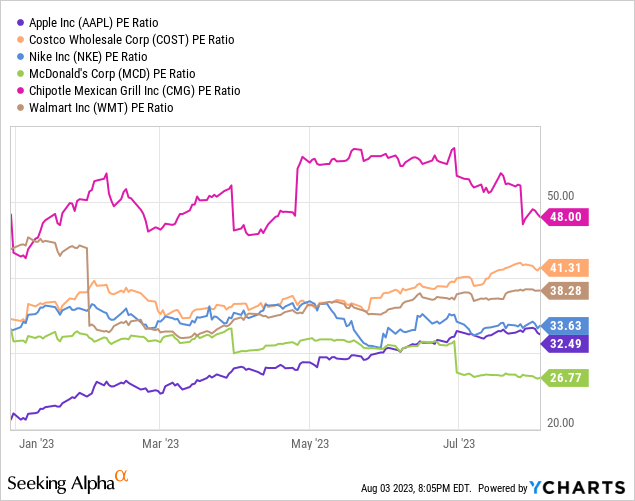

While this is entirely anecdotal, I hear far more investors complaining about how Apple is “overvalued” than investors complaining about the valuation of Costco. We would argue that Apple is trading at a lower valuation than Costco and many other consumer staples companies, despite arguably having more profitability and growth levers to pull.

Apple has the growth and valuation characteristics of a consumer staple, and investors will get what they pay for. Investors should have modest expectations for Apple’s future revenue growth and view the company as playing a certain role within a diversified portfolio rather than expecting Apple to be the primary growth driver of the portfolio going forward. Despite it being viewed by many as a “tech stock,” Apple will likely be unable to achieve results “tech investors” have begun to expect.

Price Action

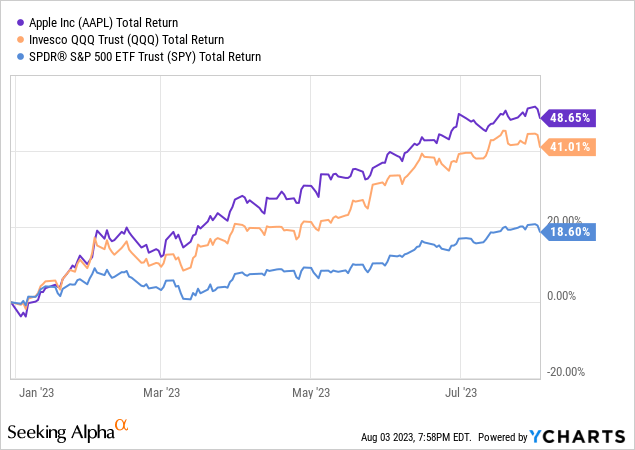

Apple has been a big outperformer in 2023, but investors probably shouldn’t expect this level of outperformance to continue going forward. Further price appreciation will likely be the result of earnings growth rather than multiple expansion.

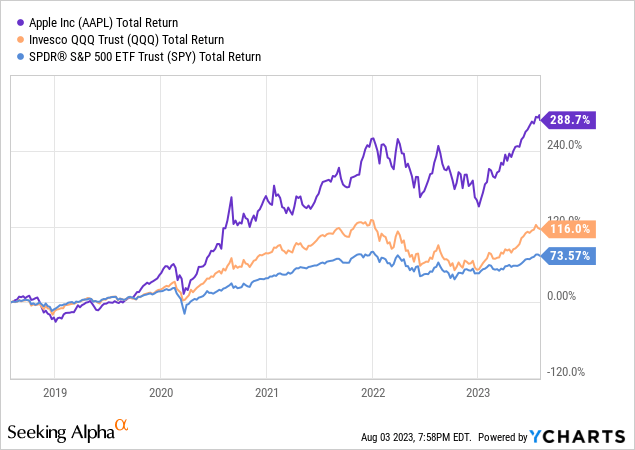

Apple has massively outperformed the market over a five year timeframe as well, but investors likely won’t see such massive levels of outperformance over the next five years.

Valuation

Much of Apple’s price appreciation in 2023 has been off of P/E expansion. While a P/E over 32 might seem expensive relative to other big tech peers or the overall market, we believe Apple should be compared with other consumer-facing companies with recognizable brands and high levels of customer satisfaction. When looking at Apple’s valuation through this lens, the company doesn’t look nearly as expensive and, in fact, appears to be fairly valued.

Our opinion on what Apple’s peer group should be is consistent with our view that Apple will act as a consumer staple company going forward and begin to look less like a “tech stock” over time. That isn’t to say that Apple won’t create new products or innovate, it’s just to say that Apple is approaching a later stage in their corporate lifecycle and investors should adjust their expectations accordingly.

While for many investors Apple is in the “never sell” camp, we would certainly look to sell if the company was trading at a P/E of 40 or more without a meaningful improvement in the outlook for earnings growth.

Risks

We continue to view the biggest risks to Apple as the potential negative implications of increasing geopolitical tensions as well as the possibility that the company falls out of favor with consumers.

Geopolitical tensions could disrupt Apple’s supply chain and/or impact their ability to sell into some of their end markets.

If the company were to fail to innovate they could fall out of favor with consumers and see their once dominant mind share decline.

We view the overall risk/reward and valuation as being reasonable at these levels as long as an investor has realistic expectations for Apple’s growth going forward.

Key Takeaway

Despite a lukewarm investor reaction to Apple’s fiscal Q3, we believe the company did all right given the difficult macro environment. Our opinion remains that Apple should be viewed and valued as a consumer staple. Apple continues to serve a specific purpose in a diversified portfolio. As long as investors have realistic expectations for Apple’s growth going forward, the company remains at a reasonable valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to AAPL and COST. UFD Capital, LLC manages a hedge fund and does not provide investment advice to anyone else. This is not investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.