Summary:

- We are bearish on Apple Inc. given the near-term uncertainties surrounding the U.S. election, China’s consumption weakness and AI adoption.

- China’s weakness could be underestimated, given the intensifying competition by local brands and precarious Sino-U.S. relations.

- The current consensus outlook on China’s iPhone unit growth appears to be optimistic, given AAPL’s China share loss.

simonkr/E+ via Getty Images

Apple Inc. (NASDAQ:AAPL) reported a mixed set of Q4 FY24 results, in which better-than-expected iPhone revenue and margins were offset by weakness in Service and China that fell short of market expectations and overshadowed the positives from the other regions. Notably, Service revenue missed by ~1%, and China showed no growth on a YoY basis. This result does not bode well for AAPL, given that the beat on the iPhone revenue is insignificant due to the low expectations heading into the print.

Although the sell-side consensus is largely positive on AAPL’s long-term prospects, driven by the recent rollout of Apple AI and the prospect of AI adoption driving longer-term handset and service revenue, we are more cautious on the near-term outlook given the weakness in China. The consensus may still underestimate China’s weakness in the coming quarters, given the combination of weak consumer spending and a highly competitive environment where Chinese brands such as Huawei and Xiaomi are gaining consumer mindshare given their superior value proposition.

With AAPL shares up +22% YTD and trading largely stagnant since July, we believe a pickup in demand for the iPhone 16 model or reaccelerated demand in China may be necessary to move the share price higher.

We would avoid AAPL at this point. This is given the uncertainty in the US election that could result in potential tariff risk, the uncertainty in China’s consumption stimulus that weighs on the overall consumer spending environment, and the ongoing competitive pressure from the Chinese handset makers that could further pressure AAPL’s demand in the country. Finally, AAPL’s current valuation is demanding at 31x FY25E earnings or 1.5x PEG due to the uncertainties heading into next year.

Results summary vs. Bloomberg estimate

- Revenue $94.93 billion, +6.1% y/y, estimate $94.36 billion

- Products revenue $69.96 billion, +4.1% y/y, estimate $69.15 billion

- iPhone revenue $46.22 billion, +5.5% y/y, estimate $45.04 billion

- Mac revenue $7.74 billion, +1.7% y/y, estimate $7.74 billion

- iPad revenue $6.95 billion, +7.9% y/y, estimate $7.07 billion

- Wearables, home, and accessories $9.04 billion, -3% y/y, estimate $9.17 billion

- Service revenue $24.97 billion, +12% y/y, estimate $25.27 billion

- Greater China rev. $15.03 billion, -0.3% y/y, estimate $15.8 billion

- Gross margin $43.88 billion, +8.5% y/y, estimate $43.46 billion.

AAPL’s weak China segment deserves investor attention. We believe the market continues to underestimate the broader weakness. This is driven by a combination of the consumption downgrade trend amid a soft macro backdrop and the hypercompetitive environment of China’s handset market, where local brands are offering a superior value proposition to price-conscious consumers.

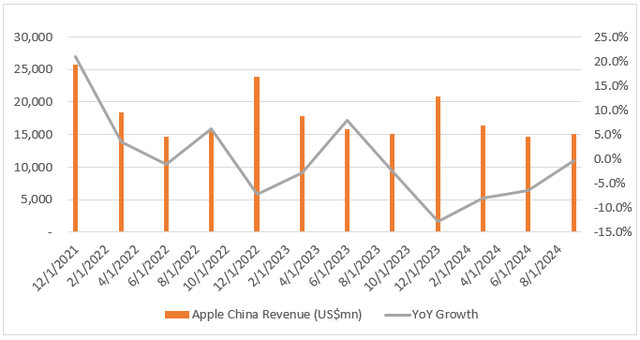

Over the past quarter, AAPL’s China revenue has declined for the fifth consecutive quarter since Q1FY23, with the most recent quarter declining 30bps YoY.

Company report, Astrada Advisors

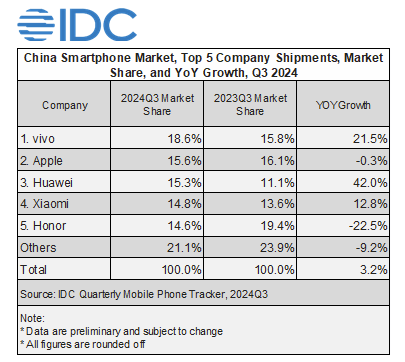

This trend is consistent with data from IDCs. These show that AAPL continues to see a market share decline in China despite low single-digit YoY growth in the overall market as demand shifts to local brands such as Vivo, Huawei, and Xiaomi.

IDC

This change in demand dynamics positions AAPL in an awkward position against the high-end and the mass market brands. Within the premium segment, the iPhone 16 Pro starting price of RMB 7,999 and the RMB 16 Pro starting price of RMB 9,999 are much higher than those of Huawei Mate 60 Pro and Pro+, priced at RMB 5,699 and RMB 8,999, respectively. The 15%-40% premium over the other premium Chinese handsets may not be justified when consumers are price sensitive. In addition, Huawei’s recent launch of the Pura 70 flagship phone earlier this year has gained solid traction, with 6.5m units sold thanks to its advanced camera and AI upgrade.

On the mass market side, Vivo and Xiaomi have been targeting budget-conscious consumers. Notably, Xiaomi is increasingly looking to expand into the high-end segment with its Ultra-series, leveraging its partnership with Leica and the recent rollout of the Xiaomi 15.

We note that Xiaomi 15 features a 3nm Qualcomm Snapdragon 8 Elite SoC with one of the best-in-class CPU/GPU performance that is capable of delivering a 45%/44% increase in performance vs. the previous generation. On the display side, Mi 15 has a 1.5K M9 LTPO OLED display made by TLC and has adopted an ultrasonic fingerprint sensor vs. the prior optical sensor. However, the key selling point lies in the Leica camera with three Summilux 50MP lenses (a main Light Fusion 900 sensor lens, a 50MP ultra-wide sensor, and a 50MP telephoto lens). The starting price for Mi 15 is RMB 4,499, while the Pro version is priced at RMB 5,299. Relative to the iPhone, Xiaomi’s Mi15 offers one of the best cost-to-performance ratios, and this may better resonate with consumers amid China’s current macro backdrop.

Finally, with the ongoing restrictions on Apple devices within government and state-owned agencies, along with related institutions (e.g., higher education), we expect Chinese handset makers to continue to be the key beneficiaries of this trend. Cook has met with China’s Ministry of Industry and Information Technology several times to express AAPL’s desire to continue to invest in China. AAPL is unfortunately caught in the midst of the Sino-U.S. trade war. Chinese regulators are likely to continue to target globally recognized US brands within China as a countermeasure should the US trade pressure intensify in the new administration.

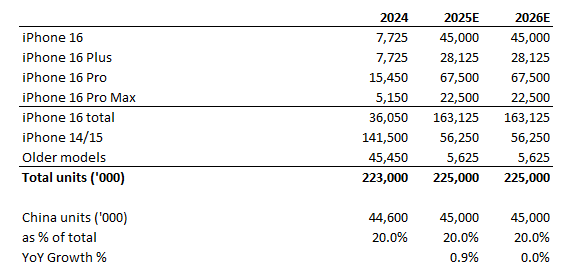

The current consensus estimates 220m—230m iPhone unit sales for FY25 and FY26, with the iPhone 16 series accounting for 70% of the total estimate.

According to IDC, we can calculate that China accounts for roughly 20% of Apple’s iPhone unit sales. Current consensus assumes a 350% increase in iPhone 16 sales for FY25, of which China’s shipment is expected to increase by 1%, assuming China’s contribution holds. Even so, a 1% increase in unit sales for iPhone seems to be optimistic, given AAPL’s declining share in China.

Company report, Astrada Advisors

In conclusion, AAPL has had a great run this year, but investors should be more cautious about the 2025E outlook, given the uncertainties surrounding the U.S. election and China’s consumption stimulus. We would avoid this stock until there is further evidence of 1) strong adoption of AI driving handset volume, 2) minimal tariff risk post-U.S. election, and 3) sustainable consumption recovery trend in China.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.