Summary:

- Latest iPhone 16 sales data from in China showed robust growth in this key market.

- When combined with the record installed base and subscription revenue growth, this foreshadows a strong Q4.

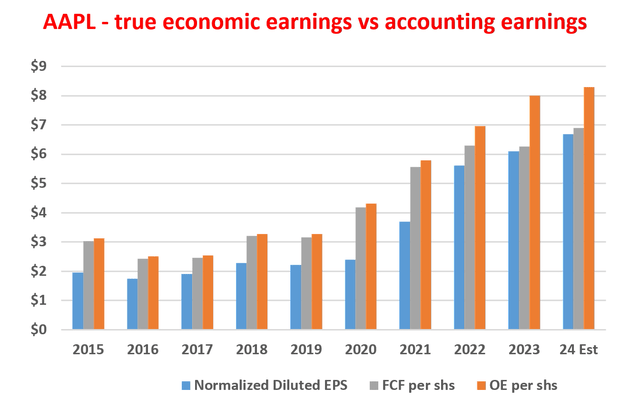

- For the longer term, AAPL’s true economic earnings are much higher than its accounting EPS, thanks to its capital-light model (by about 24% based on my analysis).

- Thus, its valuation is considerably cheaper than the current accounting P/E of ~35x.

marchmeena29

AAPL stock: Latest iPhone sales data and Q4 earnings

My last work on Apple (NASDAQ:AAPL) was published more than a month ago, shortly after the release of its new iPhone 16. Naturally, this is the article’s focus. In particular, the article focused on the software ecosystem and services surrounding the new iPhone, as reflected in its title “Apple iPhone 16 Release: Don’t Forget Software And Services.” In particular, I urged investors to look beyond its hardware updates and focus more on software and subscription growth and argued for a buy rating based on the following considerations:

Apple’s service revenue, now its second-largest income stream, has grown impressively, with a 6.56x increase since 2013, and continues to expand. Go forward, I expect its AI and subscription-based services to not only drive EPS growth but also expand margins.

Since that writing, there has been updated sales data for the iPhone 16. Also, the company is scheduled to release its 2024 FY Q4 earnings report (“ER”) in about a week (on Oct. 31, 2024). In the meantime, it has indeed delivered terrific returns for investors, and its price climbed by more than 38% in the past six months alone (see the next chart below). As a result, the stock is not cheap at all, trading at about 34.7x of its FWD earnings.

Seeking Alpha

These developments have motivated this examination of the stock, which also serves as an earnings preview for its Q4 earnings report. In the remainder of this article, I will focus on two updates from this re-examination. First, I see the latest iPhone sales data as an immediate catalyst for its Q4 ER to drive the stock price even higher.

Second, I will also explain why the current EPS estimates (which are based on accounting earnings) substantially underestimate its true economic earnings (by about 24% according to my analysis) due to the company’s capital model. Thus, AAPL’s valuation is not as high as the 34.7x P/E mentioned above.

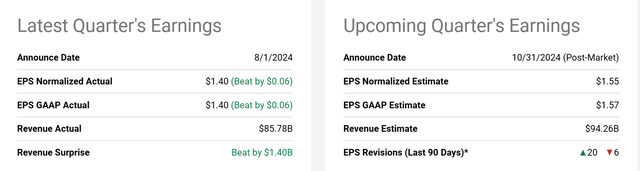

AAPL stock: Q4 preview and latest iPhone sales data

Apple’s released Q3 earnings on Aug. 1, 2024. Its profits exceeded analysts’ expectations on both the top and bottom lines. To wit, the company reported normalized earnings per share (“EPS”) of $1.40, which was $0.06 higher than the consensus estimate. Additionally, Apple’s revenue totaled $85.78 billion, surpassing the projected figure by $1.40 billion. Looking ahead to the upcoming Q4, analysts are anticipating continued growth for Apple. The consensus estimate for normalized EPS stands at $1.55, suggesting a potential increase of 10.7% compared to the previous quarter. Revenue is expected to reach $94.26 billion, also representing a growth of around 10% QoQ.

Seeking Alpha

I’m optimistic that AAPL’s actual numbers can beat consensus estimates again in Q4 for several reasons. First, I expect the continued growth of its subscriber base and subscription revenues (this is the focus of my last article, so I won’t further elaborate here anymore). Second, the latest iPhone 16 sales data are also very encouraging according to data provided by Counterpoint. Quote (the emphases were added by me):

BEIJING, Oct 18 (Reuters) – Apple’s new iPhones got off to a strong start in China, with their sales rising 20% in their first three weeks since their launch compared with its 2023 model, according to data from research firm Counterpoint. “We’re seeing strong iPhone 16 series unit sales in China,” Counterpoint said, adding the iPhone 16 Pro and Pro Max models were doing particularly well, with their combined sales rising 44% compared with their equivalent 2023 versions.

China is the biggest smartphone market in the world and a key market for Apple. Such a large sales ramp-up in China serves as a foreshadowing for another strong Q4.

AAPL stock: Accounting vs. economic earnings

As aforementioned, AAPL’s valuation can feel off-putting on an accounting basis. However, the accounting EPS underestimates its true earnings power due to its capital-light business structure. Moreover, whatever it does spend on capex, most of it is for growth capex, not maintenance capex. As detailed in Greenwald’s book entitled Value Investing:

The growth part should be considered part of the owners’ earnings because it can be returned to the owners if the owners decide not to grow the business anymore – a key insight that investors like Buffett have recognized. The maintenance capex and growth capex in this work is estimated in these steps. First, calculate the ratio of PPE (properties, plants, and equipment) to sales for each of the five prior years and find the average. We use this to indicate the dollars of PPE it takes to support each dollar of sales. We then multiply this ratio by the growth (or decrease) in sales dollars the company has achieved in the current year. The result of that calculation is growth capex. We then subtract it from total capex to arrive at maintenance capex.

Using the above Greenwald method, the next figure below compares AAPL’s owners’ earnings (“OE”) in recent years vs. its accounting EPS and free cash flow (“FCF”). As clearly shown, AAPL’s owner’s earnings have been consistently more than both its accounting EPS and FCF by a noticeable margin. For FY 2024 in particular, my analysis points to an OE that is about 24% above its accounting EPS.

Based on this projection, AAPL’s valuation multiple is about 28x, vs. the 34.7x FWD P/E quoted above using the consensus EPS estimate. Next, I will contextualize the implications of such a P/E for AAPL’s return potential.

Author

AAPL stock: True P/E and projected return

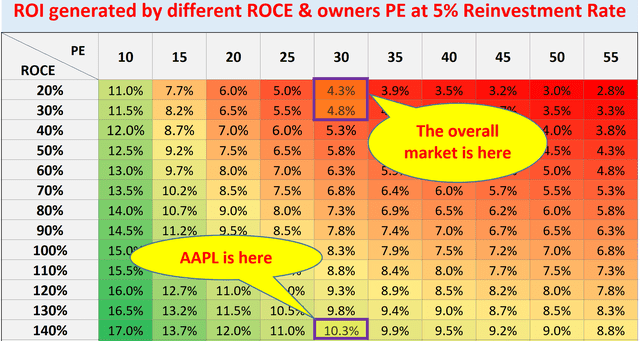

Piggyback on the concept of OE detailed above, the following chart shows my return projection for the stock under its current condition in comparison to the overall market. The model used in this projection has been detailed in our earlier article. Thus, I will only quote the end results here.

As a business owner, the return on investment (“ROI”) in the long run is a function of two variables: The P/E multiple paid to acquire the business and the growth rate of the business. The first variable determines the owner’s earning yield (“OEY”), the horizontal dimension in the following chart. The second variable, the long-term growth rate, is in turn determined by the product of the ROCE (return on capital employed) and the reinvestment rate (“RR”), the vertical axis of this chart.

Author

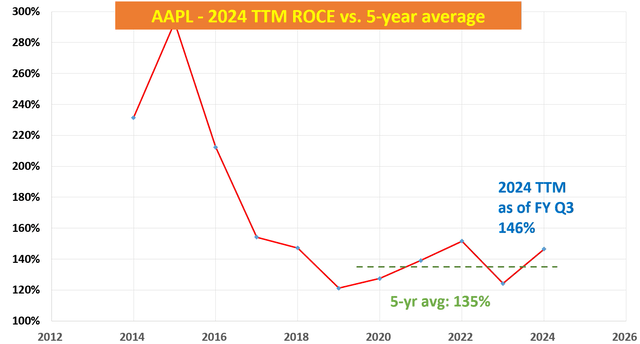

Under current conditions, AAPL is trading at 28x of its FWD OE, as analyzed above. This multiple translates into an OEY of ~3.6%. My estimate for its current ROCE is about 146% based on its TTM financials as of 2024 Q3 (a good reflection of its capital-light mode as aforementioned). A 5% reinvestment rate (which is the average level for mega-caps and also for the overall S&P 500) thus could lead to more than 7% organic growth (140% ROCE * 5% RR = 7% organic growth rate). As a result, I anticipate the total ROI from AAPL to surpass 10%, consisting of more than 3.6% of OEY and more than 7% of growth, far better than my anticipated return from the S&P 500.

Author

Other risks and final thoughts

In terms of negatives, I will pay special attention to management’s update on the integration of AI features into its products. The market has good reasons to be concerned about Apple’s progress on this front. As an example, findings from this Yahoo report suggest that “Apple is at least two and half years behind the generative AI technology compared to the current market leaders.” Another issue that I would tune in on during the earnings is the potential updates on its Indian Tata plant. For readers new to this development, Tata Group’s Apple iPhone component plant suffered extensive damage from a fire earlier this month and production was suspended. India is also a key market and assembling site for Apple. The shortfall in the Tata plant could generate ripple effects on AAPL’s vast and intricate global logistic network.

In terms of other positives, Apple’s installed base of active devices is at a record level in all geographic regions. I expect this base to keep growing in both Q4 and beyond thanks to loyal Apple fans and also its ongoing platform updates. These updates, such as Apple Intelligence (which incorporates OpenAI’s ChatGPT across its operating systems), have indeed made the Apple ecosystem much more user-friendly and powerful based on my own experiences thus far.

All told, my view is the positives far outweigh the negatives under current conditions, and thus AAPL remains a compelling Buy both in the near and longer term. In the near term, recent iPhone 16 sales data and subscription data suggest good odds for AAPL to beat consensus estimates again in the upcoming FY Q4 earnings report. In the longer term, dissecting its capex into growth and maintenance capex suggests that its accounting EPS significantly underestimates its true economic earnings and thus its OE-based P/E is around 28x only (vs. about 35x based on accounting EPS). When combined with its superb ROCE, this translates into a very favorable return/risk curve in my mind compared to the overall market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.