Summary:

- This is a technical analysis article. Apple Inc. is reaching for the top of its well-established trading range between $130 and $175.

- Due to this trading range, Apple is not hurting portfolio performance. It is like “closet indexing,” providing an Index-like return or better.

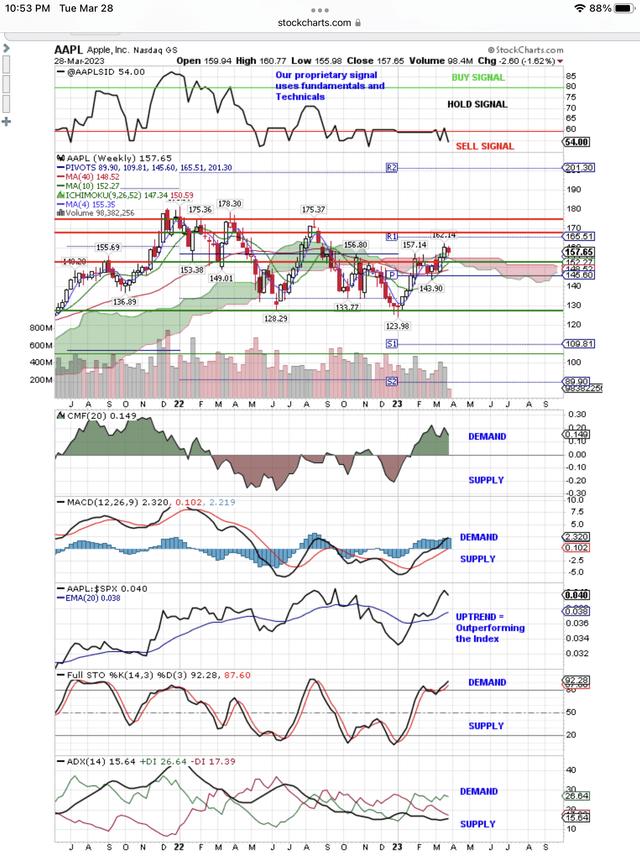

- You can see Apple’s performance vs. the Index on the chart below. As price swings in a trading range, Apple swings in performance relative to the Index.

- As it approaches the top of the trading range, Apple is outperforming the Index.

- We expect this bear market to turn down again to retest the bottom. We think that will take Apple down to retest $130. It may be a buy at $130, but we don’t think it is at $175.

James O’Neil/DigitalVision via Getty Images

In a trading range stock like Apple Inc. (NASDAQ:AAPL), you can see clearly the path up to the top of the trading range, as well as the path back down. Bullish moves in the market take many stocks up to visit their highs, just as bearish moves take many stocks down to revisit their lows.

AAPL seems to be clearly one of these Index-like stocks. Since it behaves like the Index, portfolio managers love it as a place to invest excess cash, especially if they have to be fully invested in a bear market, like mutual funds. APPL has good fundamentals and is considered a safe haven in a bear market that is intent on retesting the bottom. AAPL will go down with the market, but it probably won’t hurt portfolio performance. It is like indexing, but using just one stock.

Everyone knows AAPL has good fundamentals. However, we have to review them because our proprietary SID grade. Using both fundamentals and technicals gives it a weak Hold and borderline Sell signal. We would like to know why our computer is not coming up with a strong Hold and borderline Buy signal. We have to do our due diligence on our proprietary computer rating.

First, we go to Seeking Alpha’s ratings, and then we drill down on the poor ratings that might explain our SID poor rating. As you can see on SA, they rate AAPL favorably for Profitability and Momentum. However, the ratings for Revisions, Valuation and Growth are unfavorable. So far, so good, because this could explain why our computer is giving it a very low Hold rating.

Since our SID System uses both fundamentals and technicals to come up with our poor Hold rating, it is easy to determine whether the fundamentals or technicals are causing the problem. Right now, the technicals are good for AAPL. Demand is taking it to the top of its trading range and it is outperforming the index. Therefore, our weak Hold rating must be due to fundamentals, and SA identifies these as Growth, Valuation and Revisions problems.

Let’s hit SA’s Valuation tab first, because most folks consider AAPL a good value, but not SA. We think that SA is right, and we are going to drill down into the Valuation details by using that tab to identify what we think are important valuation metrics. We go to PEG Non GAAP (Fwd). This covers all the important bases: growth, price, earnings and it is forward looking. SA gives it a D+ rating because it misses the sector median benchmark by 60%.

Now some folks say AAPL is worth that premium because of its ecosystem growth. If so, we need to see an upward revision in growth that is not yet being projected. It is difficult for a company the size of AAPL to be considered growth. It is in the Dow Index of stocks and these are blue chip companies rather than growth.

On Price to Sales, SA gives it a D+ and this misses the sector median benchmark by 147%. Another indication that AAPL is pricey. Further down the list is price to cash flow, and we all know AAPL is a cash machine. SA gives it a “C” rating and it only misses the sector median by 25%.

Let’s move on to revisions. SA gives AAPL a D+ rating. Only 4 analysts show upward revisions for the year while 32 are reporting downward revisions. Earnings due in May also look poorly with only 6 analyst upgrades to 21 downgrades. Of course, AAPL will come close to these downward revisions. With the consensus earnings projected at $5.98 and a forward P/E of 26.45, you can see the rich valuation the market is giving AAPL with the current Dow P/E at only 21.

That leads us to the conclusion that our proprietary grade shown at the top of the chart below is probably close to the mark. Our grade is flickering between a weak Hold and a borderline sell signal. We think it is a sell at $175 and a buy at $130. We think that as the market goes down to retest the bottom, that AAPL will drop to retest $130.

Here is our weekly AAPL chart with our proprietary SID Buy/Hold/Sell signal at the top of the chart:

Apple Testing Top of the Trading Range $130 to $175 (StockCharts.com)

At the top of the chart, you can see our proprietary SID signal has dropped from a weak Hold to a borderline Sell Signal.

Price shows the trading range, and price reaching up to test resistance lines at $170 and $175.

Below price you can see all the signals are showing the Demand that is taking price higher. These signals indicate to us continued upside testing.

Chaikin Money Flow, CMF, shows the improvement from red Supply to green Demand as price is rising. Now it has a bearish double top and money flow is dropping. This is an early sign of possible weakness as AAPL approaches the top of the trading range.

MACD still shows the buying cycle peaking and a continuing buy signal. Also relative strength, the movement of AAPL vs the SPX, is in an uptrend indicating it is outperforming the Index as price continues to move up.

The Full Stochastic and ADX are still showing good Demand and no weakness yet. We expect that as the market continues lower, that these signals will change and AAPL will drop with the market as this bear retests the bottom. Meanwhile, enjoy AAPL’s ride to the top of the trading range.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are u sed by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Use our free, 30 day training program to become a succesful trader or investor. Join us on Zoom to discuss your questions.