Summary:

- My mid-May timing of a bearish play on Apple Inc. shares was struck at the worst time. Nonetheless, Delta helped me avoid large losses.

- Apple shares have risen on both AI partnership hopes of driving a renewal cycle, and increasing Fed rate cut expectations.

- The terms of Apple’s agreement with Open AI are an eye-opener. I’m willing to recharge my Put Option wager on AAPL shares at a higher Delta at this point.

Henrik Sorensen/DigitalVision via Getty Images

For those less familiar with options, you may not realize the inherent beauty of Delta. It’s almost like an animal that can camouflage itself as danger introduces itself (if you’re Long Delta, that is, not Short). Seeking Alpha has an entire educational article on Delta, which you can read here.

Now, I published a strongly negative article on Apple Inc. (NASDAQ:AAPL) in mid-May, and I’ll provide further support for my continued bearishness below. However, let’s stick to the topic of Delta for a brief moment.

In May, I recommended the November $170 Put Options that were available for a Premium of about $3.35. One options contract reflects exposure to 100 shares, so essentially I paid $335 for downside exposure to 100 shares of Apple. The stock was trading at about $190 at the time, meaning one lot (100 shares) carried a notional value of $19,000.

Had I Shorted 100 shares of Apple at $190, I’d be sitting with a disastrous loss of about $4,500 at this point. Looking at my margin account right now, I can see I’ve lost only about $295 on the Put Option contract I purchased. Obviously, my timing was awful on this trade, but I took the bet I was willing to make, and have lost less than $300 on $19,000 of Apple notional value despite a ~24% move against me. Additionally, my other portfolio positions have risen, so I remain a happy camper.

Now, as my Financial Theory professor instilled in me at the University of Manitoba (great campus!), “there is no free lunch.” This mandates that I have to give up something to benefit from the risk protection that Delta has blessed me with. That offset is the Time Value (unintrinsic value) that I invested in by buying a Put option that, in this case, was about 10% out of the money (OTM).

So I haven’t lost my shirt, and I’m getting ready to reload. Below I’ll summarize my original bearish arguments, address what’s been driving Apple higher, and explain why that isn’t fazing me. I’ll also rework the expiry of my Apple put to correspond with the strategy I presented in my Election Protection article.

Bearish Apple Arguments

What first drew my attention to Apple a few months ago was its fairly pedestrian quarter. While results technically beat the street, China was weak and investor concerns arose about growth. Several Seeking Alpha analysts were quick to emerge with Sell ratings, as well as a Hold rating from Victor Dergunov, who suggested that growth issues were masked by dividends and buybacks. In fact, a $110 billion buyback. I saw that buyback as largely symbolic, more than a sign of strength.

Investors charged into the stock post earnings, but my read was that it was a function of the buyback. My belief is that financial engineering can’t really change the long-term business fundamentals.

Apple has been losing smartphone ground in China and, while that may have been obvious to see, my particular concern was the 6-horse race for smartphone market share supremacy in China. OPPO, vivo, Honor, Apple, Xiaomi, and Huawei were all challenging to be the industry leader for the country. Gone are the days when challengers were willing to play second fiddle to Apple. These other smartphone players are all investing to take the pole position in the country.

I’m also skeptical about whether investors have truly recognized the change in Apple’s capital structure. Debt has exceeded the size of Apple’s famous cash position, and the company has been reporting net interest expense recently (before the $100b buyback)!

I was worried about what Apple’s Q1 2025 guidance might be and, along with expected election jitters, I identified the November 15 options contracts as accommodating both risks. (I now prefer December expiries; see below).

What’s Driven Apple shares 20%+ in the past 2 months?

Apple stock’s recent rise has been primarily for one reason: Artificial Intelligence. Nvidia Corporation (NVDA) reported stellar Q1 results on May 22nd, laying the foundation. A few weeks later, reports emerged about Apple’s AI offerings, along with its partnership with OpenAI to buttress those offerings. Investors at large are now expecting a huge iPhone refresh cycle.

In addition to that, we’ve seen an uptick in the probability that the Federal Reserve cuts rates in September. As of a few days ago, that probability stood at ~90%, and some sources have reported a near-100% cut probability priced into Fed Funds futures in the past day or so. Back in mid-May, the assigned probability was only about 67%.

All reasons to cheer, certainly, and Apple Inc. has regained the crown of the world’s most valuable company, ahead of Microsoft (MSFT) and Nvidia. But is it really deserved?

Flies In The Ointment

Here are my concerns about all the excitement:

- While both Apple and Open AI appear to have been mum on the financial details of their collaboration, speculation is that Open AI will benefit only from Apple’s distribution of ChatGPT, rather than any financial consideration. This is a flag for me. Apple is probably the most capable smartphone maker in the world to levy a high price for ChatGPT usage, but it might be paying nothing. If that’s the case, and Open AI is truly pursuing distribution above all else, then they can strike similar deals with other smartphone manufacturers and distribute their solutions wherever and whenever. While indeed AI integration may result in a very healthy refresh cycle, markets look ahead, and competition fears still loom here for a company that seems to be leaning on the innovations of external firms.

- As mentioned above, an initial September interest rate cut is all but priced in. Probabilities can’t climb higher than 100%, and so I expect less room for rallying on this already priced-in news.

- Apple is the consumer company of all consumer companies, and an absolute decline in monthly CPI raised serious questions about the health of the consumer. Add onto that a weakening employment picture, and suddenly things look a lot less rosy for a company so highly dependent on new device sales.

- Valuation cannot be forgotten.

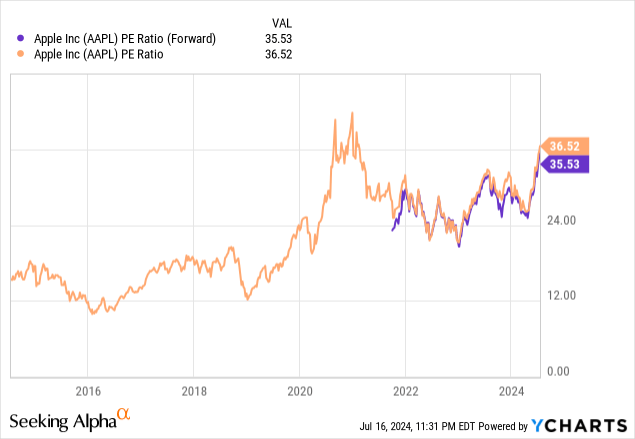

Apple shares are now trading higher than 35x P/E both on a TTM and Forward Basis. This is extremely rich for the largest company in the world. Let’s not forget the theory that mature companies will trend towards the level of GDP growth as time passes.

Rejigging The Put Trade

Things have not turned out as we (okay, as I) expected, and what I deemed largely as a superficial run-up in shares of Apple on financial engineering hoopla (the Q1 buyback) has transformed into a bull stampede.

I believe my original bearish arguments still have merit, and I’ve collected a few more reasons to be pessimistic on shares amid the run-up. The Open AI/Apple (supposed) partnership terms tops that list. The AI solutions providers appear ready to do anything to distribute their wares, and I doubt that gives Apple any leg up.

When I originally wrote in mid-May, I targeted a low-delta Put Option play, 10% out of the money. That certainly helped protect the position from dollar losses. Implied vol has risen slightly, but regardless, I’m willing to place a higher-Delta bet now. With AAPL shares trading at ~$235 right now, I’m interested in the December $225 Puts for a price of $8.50. As I expressed in my article on broad market portfolio protection, I’m hoping that a December expiry retains much of its value even after the election, and in the case of Apple also its critical Q1 2025 guidance.

Before then, Apple is due to report its Q3 2024 earnings on August 1, just a few weeks from now. Individual investors should assess whether they’d like to review another financial report from Apple before considering any new position. It’s possible that Apple will reveal more detail about the incorporation of AI into their products.

Risks

The main risk is that markets can remain in bull mode indefinitely, although again it’s really difficult to see that, given Fed Fund futures are pricing in 100% (or nearly 100%) rate cut expectations. The earnings season which just got into swing could also deliver surprisingly robust results.

Investors inexperienced in options should carefully assess whether options strategies/positions are right for them. Options, by nature, are leveraged instruments that are subject to greater volatility. Holding options that expire out of the money will have zero value.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I hold OTM Put Options in shares of Apple. I'm also Short a small number of shares.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.