Summary:

- Apple Inc. shares are trading near all-time highs, with bulls banking on a major AI-driven upgrade cycle.

- I question the consensus excitement and find it extremely optimistic, as some AI features are already being delayed while competitors like Google are running ahead.

- Shares are pricing AI success as a certainty, and ignore a growing list of problems and risks.

- Challenges include the inability to grow the total addressable market and generate new revenue streams, pressures from regulators and developers, market share losses in China, potential breakage of the Google search relationship, and more.

raditya

Apple Inc. (NASDAQ:AAPL, NEOE:AAPL:CA) shares are trading close to all-time highs, as bulls, primarily relying on an AI-driven upgrade cycle, are currently fending off an ever-growing list of issues.

To name a few, a historically high valuation, little to no hardware growth, mounting pressures from regulators and app developers, market share losses in China, and uncertainty regarding a $20 billion Google (GOOGL) (GOOG) agreement.

What’s even more baffling, is that many Apple Intelligence features, which are the basis of the bull thesis, are being delayed, and seem to be lagging Android.

So, what is going on here? Let’s find out.

Introduction — From Bull To Bear

I started covering Apple on Seeking Alpha in April 2023 with a ‘Buy’ rating. At the time, Apple was trading at a mid-twenties P/E, and while it was already going through a growth deceleration phase, I claimed it was stronger than ever.

The company was coming out of the pandemic boom, and it made sense that its product sales would struggle to sustain growth after such a significant pull-forward in demand. I argued that this short-term headwind is overshadowing a highly profitable services division that is rapidly growing, strengthening the Apple ecosystem.

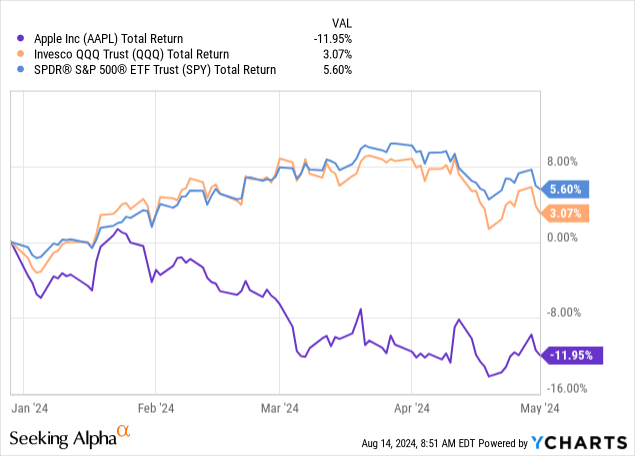

I projected that Apple will have a great 2024 year, as the pandemic pull-forward pressures ease, and services continue to improve. However, in the early months of 2024, it became clear that wasn’t going to happen.

Apple was a major laggard to start the year, as the market perception was that the company completely missed on AI. In addition, the company was still seeing product revenues decline, Vision Pro became a bust, it had lost significant market share in China, and regulatory pressures became even more material.

All of the above became irrelevant, in the days leading to Apple WWDC, and even more so in the days following the event. All of a sudden, the sentiment completely shifted. Wall Street analysts upgraded their price targets in unison, citing an upcoming historical upgrade cycle driven by Apple Intelligence.

After being a long-time bull and investor in Apple, I wish I could remain in that camp, but I can’t ignore the abundance of warning signs I’m seeing.

So, as Apple shares are still hovering near all-time highs, this is a key time to dive into the factors that might make investors want to reconsider their position.

Assessing The Probability Of An Apple Intelligence Historical Upgrade Cycle

Before I dive into the mountain of problems, I think we should start by trying to answer a simple, key question. What is Apple Intelligence, and what is the probability it will fuel a highly anticipated upgrade cycle?

We all saw the demos, so there’s no need for me to repeat them here. However, I think it’s important to take a step back and put on our consumer hats. I doubt that, outside the investment world, there’s that much excitement about Apple Intelligence. I’ll take a step further, I think many Apple customers don’t even know about it. It might be a personal view or anecdotal, but occasionally those pieces of information are critical.

According to Mark Gurman of Bloomberg, many of the Apple Intelligence features won’t even come with the initial iPhone 16. He is probably the best insider at Apple, and he himself is saying that Apple Intelligence, at its current form, is far from being a game changer.

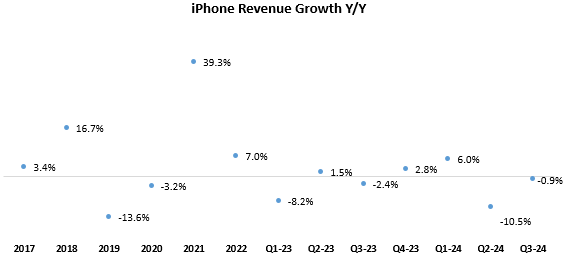

Created by the author based on data from Apple financial reports.

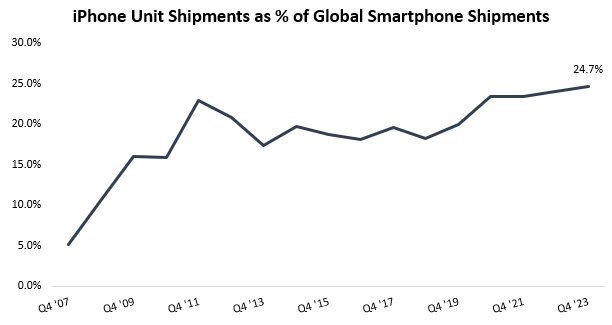

Historically, every few years, there’s a big iPhone cycle. The last one was in 2021, driven by the strength of the iPhone 13 and supported by the market environment during Covid-19. Even without Apple Intelligence, the iPhone was due for an acceleration. However, as I wrote in previous articles, it appears that the gaps between cycles are becoming longer and longer, as there’s really little change from one version of the iPhone to the next.

I argue that the investment world’s enthusiasm regarding Apple Intelligence is somewhat detached from the consumer, and I don’t expect a meaningful bump in sales from the iPhone 16.

Keep in mind that iPhone sales are either flat or down for seven consecutive quarters, so the comps alone should support an uptick in growth, but not something “historical.”

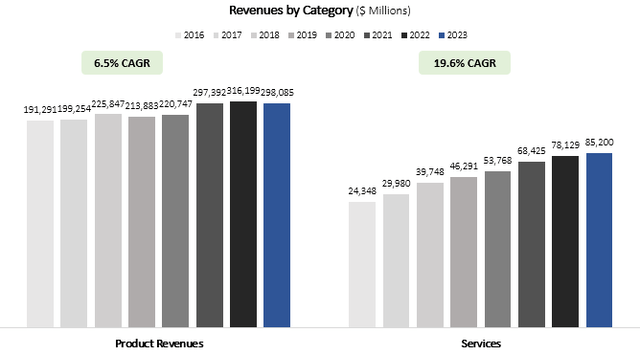

Where Is Services Growth Coming From, And Why It’s At Risk

Apple Services revenue primarily consists of (from large to small) — App Store fees and ads, traffic acquisition revenue (Google), and first-party services like Apple Music and Apple Pay. Let’s tackle these.

Created by the author based on data from Apple financial reports.

App Store

Apple’s App Store revenue has been under scrutiny for a long time, with the company taking a 30% cut from developers, or what developers like to call the Apple Tax. While many other app stores around the world are taking a similar cut, including Google Play and Sony’s (SONY) PlayStation, it appears that Apple is taking it to the extreme.

For instance, Apple wants to take a cut from creators being paid through Patreon, and it goes a long way to prevent providers like Spotify (SPOT) from directing users to cheaper ways to subscribe to their services.

The EU is leading the way when it comes to trying to change Apple’s ways. Recent developments include forcing the company to enable 3rd party app stores, allow links, and more, but Apple is still trying to get its cut by charging other types of fees. To me, expecting Apple’s 30% cut to continue seems too optimistic.

It’s also important to consider that the “Apple Tax” reduces the incentive for new app development, and the fact that Apple is developing first-party apps or features that are similar to successful third-party apps probably doesn’t help either.

Traffic Acquisition

In case you haven’t heard, Apple’s annual ~$20 billion check from Google is at risk. Whether Apple develops its own search engine, goes to an alternative like Bing (MSFT), or finds a way to keep the Google partnership relatively unchanged, this is still a very crucial source of revenues and profits that’s at higher risk.

First-Party Services

Google’s payments to Apple reflect the value of owning the distribution and the platform. This value is captured by Apple both through taking a cut from third-parties’ success, and through first-party services.

Generally speaking, Apple’s first-party services have nothing special about them. Arguably, there are better alternatives to Apple Music, cheaper storage options than iCloud, and the Apple Pay underlying technology is great, but not unique to Apple.

The primary reason these services succeed is because of their integration with Apple’s devices, as evidenced by the fact that they are rarely used by Android users.

Although this is a smaller portion of revenues, and also comes with lower margins, as regulators increase the pressure on Apple to open up, there’s a risk that these services won’t do as well.

Based on recent results from Universal Music (OTCPK:UMGNF), we know that Apple Music is lagging Spotify, and from Nielsen data, we know that Apple TV+ isn’t a big success.

AI Has The Potential To Disrupt Apple’s Smartphone Leadership

I had an iPhone for as long as I can remember, and I also have AirPods, Apple Watch, and an iPad. After watching the Made By Google two days ago, I have to say, it was the first time I considered switching.

There were so many features, on live demo, that I could envision myself using and actually getting value from, that I thought to myself, why shouldn’t I try a different option? It doesn’t hurt that it’s also cheaper and in any category where Google has a competing app, I prefer it over Apple.

Created by the author using data from Statista.

Things like Gmail, Google Maps, Google Photos, YouTube, Chrome. I use all of those on my iPhone, and I have to believe they’ll work at least somewhat better on a Pixel.

Google is the only company that can integrate the entire stack, from the chip, to the OS, to the AI model, and the applications. If there was ever a time when Google could gain a meaningful technological advantage over Apple, it’s now.

This isn’t a Google hardware bull case, as they are far from having the necessary infrastructure for retail distribution to reach a much bigger scale. However, it is a risk to Apple’s dominance, especially considering most of the technological benefits will come to fruition with Android by itself.

China Problem Didn’t Go Anywhere

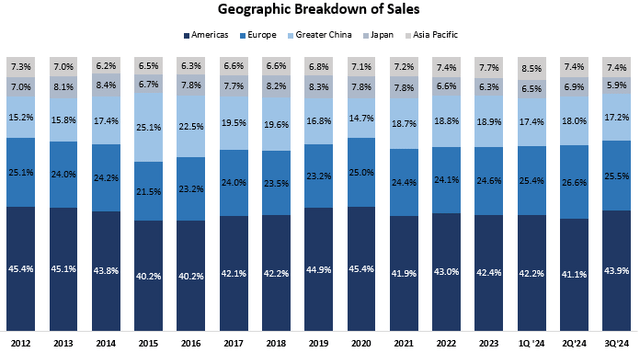

Last quarter, revenue in China declined by 6.5% to $14.7 billion, the lowest level since Q3 ’22. Apple has been bleeding share to local companies like Huawei, which are offering a much cheaper product.

This has led Apple to take aggressive actions regarding pricing, giving discounts of as much as 20% per device. Not something you see from Apple frequently.

Apple’s management insists that things in China are fine, and they find a way to paint a brighter picture than what the simple numbers show.

However, with tensions between the U.S. and China on the rise, and with intense competition coming from domestic players, I don’t see how Apple’s future in China gets much better.

Created and calculated by the author based on data from Apple financial reports.

At around 18% of revenues, China is a significant geography that could end up being a big drag on results. I wouldn’t be surprised if we start hearing stuff like “Excluding China, growth was…”.

It remains to be seen if investors would be willing to play along.

No New Meaningful Revenue Streams

For such a long time, I was on the other side of this argument. I kept saying that Apple is a big innovator and that its core product suite, combined with the diversified services segment, will be enough to generate growth.

However, it’s tough to not hold Apple’s recent failures against them.

So far this year, it was reported that Apple killed the car project, and the Vision Pro failed to meet expectations. Apple TV+ is also not doing so well.

So really, we haven’t seen something new and successful from Apple for a long time, and I’m not sure what’s in the pipeline either, aside from Apple Intelligence, which we already discussed.

What investors need to remember is that even if Apple Intelligence delivers on the consensus historical upgrade cycle, it’s still one upgrade cycle, and not necessarily a long-term TAM increase.

Valuation Disregards The Problems, Already Prices In Success

In short, I’m quite suspicious about an AI-fueled upgrade cycle, especially as it seems like so many analysts are already taking it for granted. Combine that with the long list of increasing risks I’m seeing, it’s hard for me to be bullish on the near-to-mid-term Apple story.

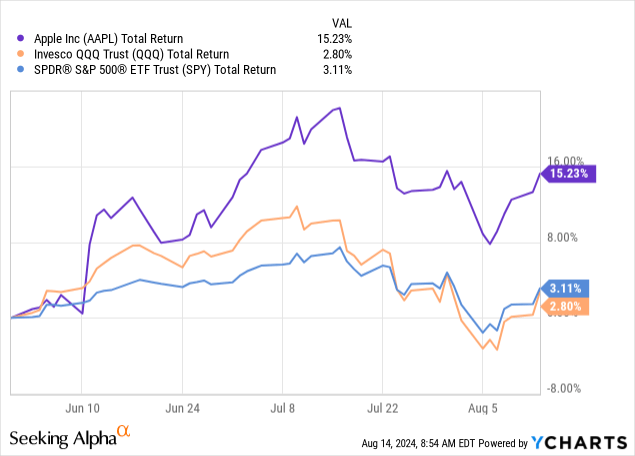

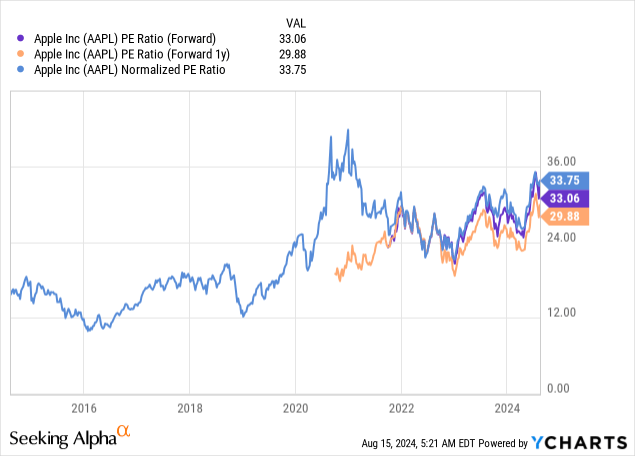

That is enhanced by the recent surge in stock price, and current valuation:

After jumping by 33% from the April lows, Apple shares are trading at 33.0 times forward earnings, and 29.9 times next year’s earnings. As you can see, this is the highest valuation Apple ever traded at, aside from the COVID-19 years.

Keep in mind, these multiples are based on estimates from a consensus of analysts who seem very optimistic about an upcoming upgrade cycle.

Conclusion

I don’t see how you can justify paying a record multiple for a company that’s undeniably not at its peak, with a growing list of risks, and very high expectations that won’t be easily met.

In my previous article about Apple, I said that buying it at around $170-$180 means you’re getting the AI potential for free. Today, the opposite is true. You’re paying handsomely for the AI potential, and then some.

I think the downside risk from here far exceeds the upside, and therefore, downgrade Apple to a Sell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.