Summary:

- Apple’s stock is downgraded to a “Sell” rating due to a crisis of new ideas and expected revenue growth pressure in the near term.

- Red flags also include declining product sales and geopolitical risks related to the U.S. relationships with China.

- According to my valuation analysis, the stock is substantially overvalued with double-digit downside potential.

Justin Sullivan/Getty Images News

Investment thesis

My latest neutral thesis about Apple’s (NASDAQ:AAPL) stock worked well since the stock declined more than 6% since the article went live, compared to -1% for the broader stock market. Today, I would like to downgrade my rating for AAPL again. Yes, the company is still the largest in the world, and it is the absolute free cash flow [FCF] machine. But the latest iPhone event revealed a massive crisis of new ideas at Apple. I also expect the company’s revenue growth to experience pressure over multiple quarters amid the current harsh environment, and warning signs from Beijing do not add optimism either. My valuation analysis suggests that the stock is overvalued as well. All in all, I assign the stock a “Sell” rating.

Recent developments

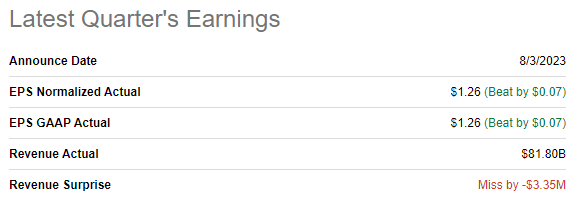

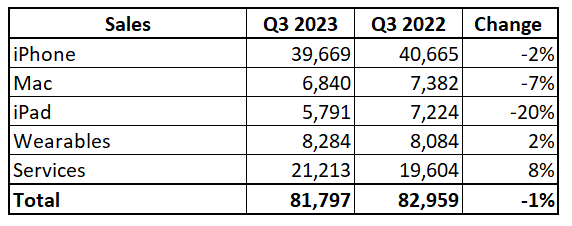

A lot has happened since I wrote my previous article about Apple. The company reported its latest quarterly earnings on August 3, missing consensus revenue estimates but topping the EPS expectations. Revenue declined for the third quarter in a row with a 1.4% YoY decline.

Seeking Alpha

A lot has already been written about the latest earnings, so I will highlight critical metrics dynamics to underline some red flags. Product sales were down YoY by 4%, which is substantial given the company’s scale. Inside product categories, iPad sales dropped YoY by a massive 20%. While the iPad contributed less than 10% to the total product quarterly sales, Apple earns its service revenues from all devices it sells. That said, a substantial decrease in iPad sales will negatively affect the service sales to iPad users. The same is true with Mac sales, which declined YoY by a notable 7%. Weakness in product sales was mostly offset in full by services, but it is essential to understand that service revenue growth was driven by the fee increases. While Apple’s ability to exercise strong pricing power is impressive, it is not infinite, and exercising it frequently will highly likely undermine Apple’s brand loyalty.

Compiled by the author

Apart from softening product sales last quarter, I see other red flags for Apple investors. The bearish trend in the global smartphone market will likely continue by the end of this year as the International Data Corporation [IDC] forecast this year to demonstrate the lowest volume of smartphone shipments in a decade. It is crucial to mention that IDC’s recent revision of a 4.7% drop in global shipments is downward of the original forecast of a 3.2% decline. Personal computer shipments are expected to return to growth in 2024, but shipment volume will still be lower than the pre-pandemic level. The reasons for the demand softness are on the surface: sticky inflation and high-interest rates, which weigh on the intensity of economic activity. In his recent press conference, Jerome Powell left the door open for one more hike this year, and his rhetoric was hawkish. A tight monetary policy will continue to weigh on the labor market, which also does not add optimism regarding consumer spending on discretionary electronics like smartphones.

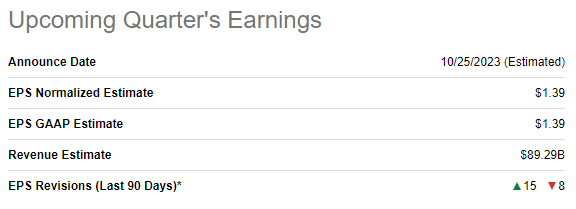

The upcoming quarter’s earnings release is scheduled for October 25. Quarterly revenue is expected by consensus at $89.3 billion, which indicates a solid 1% YoY decline. Despite the expected revenue decline, the bottom line is expected to show resilience with a slight EPS expansion.

Seeking Alpha

While governmental officials denied rumors regarding iPhone bans in China, complicated relationships between the world’s two largest economies are another red flag for investors. Apple has massive exposure to the Chinese market and crucial production facilities there. That said, the company faces significant geopolitical risks amid the current state geopolitical situation. It is also important to remember the good British proverb: “Where there’s smoke, there’s fire”. This means that an iPhone ban in China for key officials might eventually turn out to be true, given the political and industrial espionage concerns.

The recent Apple Wonderlust event also did not add optimism to me. At this event, the company unveiled the iPhone 15 family and a new Watch series and processors. Once again, new products were built on past proficiency rather than introducing new jaw-dropping features. While the iPhone’s fan base is vast, and so is Apple’s brand loyalty, the company’s approach of subtle improvements to its flagship products might not last infinitely. The technological landscape is evolving, and Chinese smartphone manufacturers seem to soon become strong competitors for Apple, especially given the latest unveiling of Huawei’s 5G smartphone. Let me remind readers that the iPhone ended Nokia’s era sixteen years ago because the latter failed to innovate and recognize secular shifts before the Finnish giant was disrupted. With every new iPhone series looking pretty much the same as the previous one, it seems that Apple now faces substantial technological disruption risks.

Valuation update

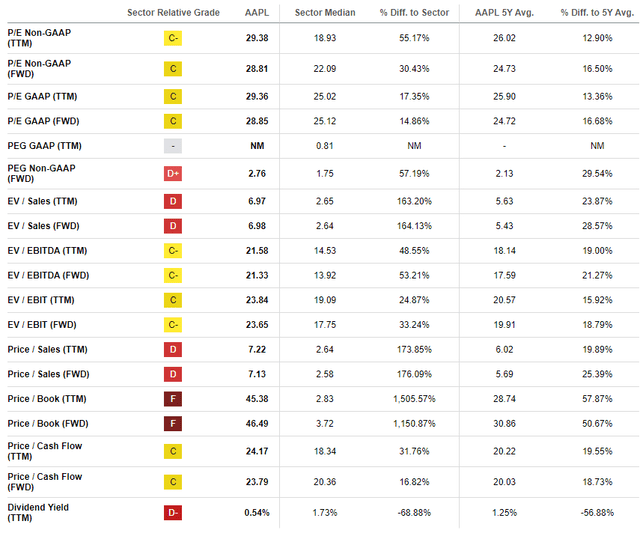

The stock rallied almost 41% year-to-date, significantly outperforming the broader stock market. Seeking Alpha Quant assigns APPL the lowest possible “F” grade because its multiples are substantially higher than the sector median. I am okay with the premium in comparison to the sector’s multiples since Apple is a cash machine with an unmatched ecosystem. But the comparison to Apple’s historical average valuation multiples is a much more warning sign. The current multiples are double digits higher than the five year’s averages across the board, which indicates overvaluation to me.

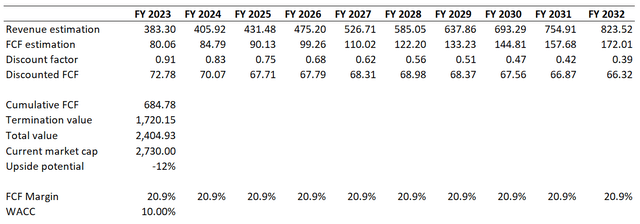

I have to proceed with the discounted cash flow [DCF] approach to ensure that my conclusions from the analysis of the valuation ratios were correct. I use a 10% WACC for discounting. Consensus revenue estimates forecast a 9% CAGR for the next decade, which I consider fair enough to use in my calculations. I use a 20.9% TTM FCF ex-SBC margin for the whole decade. I do not expect a notable expansion of this metric due to the challenges described in the previous section of my article.

According to my DCF simulation, the business’s fair value is approximately $2.4 trillion, which is 12% below the current market cap. That said, the stock is overvalued with double-digit downside potential. Unattractive valuation is another big red flag to me.

Risks to my bearish thesis

Apple is the world’s largest company with a vast ecosystem, which allows the company to introduce new revenue streams with no customer acquisition costs. That said, for Apple bears, there is always a big risk that the company might introduce a new appealing feature that will unlock new solid revenue streams with almost no incremental costs. This will lead to the improvement of the consensus revenue growth estimates and will make my DCF calculations irrelevant. On the other hand, the effect of any new feature will unlikely be significant compared to the company’s above $2 trillion valuation.

As a growth stock, AAPL’s fair share price highly depends on the discount rate. The higher the Federal Funds rates are, the higher the discount rate, which weighs on the present value of future cash flows. But it works the other way around as well. Any slight hints regarding the potential pivot in the Fed’s monetary policy can be a huge positive catalyst for the stock market, especially for growth stocks. But I consider this risk low given the rising crude oil price and the U.S. unemployment rate still close to historical minimums.

Bottom line

To conclude, AAPL is a “Sell”. The current valuation does not reflect the fundamental challenges the company is facing. I admit that some of the challenges are related to the cyclicality of the broader economy. Therefore, red flags related to the softening demand for smartphones and PCs are temporary. However, the lack of innovation is a huge secular problem for Apple, and the company can repeat Nokia’s failure if it does not start addressing the evolving technological landscape.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.