Summary:

- I reiterate a ‘Sell’ rating for Apple stock with a fair value of $192 per share due to concerns about growth in China.

- Huawei’s launch of the Mate XT Ultimate trifold smartphone could significantly impact Apple’s market share and iPad sales in China.

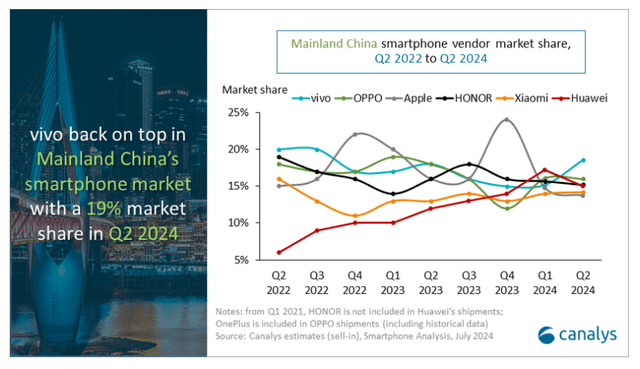

- Apple’s revenue from Greater China declined by 3%, and local brands like Huawei, Xiaomi, and Vivo are gaining market share in the high-end segment.

- Despite strong growth in Apple’s service business, I remain pessimistic about their near-term growth in China, projecting only mid-single-digit revenue growth.

Tim Robberts/DigitalVision via Getty Images

I assigned a ‘Sell’ rating on Apple (NASDAQ:AAPL) in my previous article published in July 2024, highlighting my concerns about their growth in China. Recently, Huawei launched their first-ever trifold smartphone, aiming to take market share from Apple in the high-end smartphone market. I anticipate Apple continuing losing growth momentum in China in the near future. I reiterate a ‘Sell’ rating with a fair value of $192 per share.

Huawei’s Launch of Trifold Smartphone

In September 2024, Huawei announced their latest Mate XT Ultimate Design, a trifold smartphone that can be converted into a 10.2-inch tablet. Huawei strategically launched their trifold smartphone right after Apple released its iPhone 16 in China. In my opinion, Huawei’s trifold Mate XT is highly disruptive in the high-end smartphone market and Apple is likely to lose growth momentum in China as a result.

I think the trifold smartphone could potentially have a significant impact on Apple’s growth in China for the following reasons:

- So far, Apple has not announced any product roadmap for their folding phone. Instead, Apple continues to launch new iPhone models with minor hardware modifications. I think iPhone has not made any significant progress in leading technology advancement. In November 2016, Apple was granted a patent for a retro-style flip phone with an OLED screen display, as reported by the media. However, after that, Apple has not made any progress on their foldable phones.

- Additionally, the trifold smartphone could potentially replace iPad products, particularly iPad mini model. The trifold smartphone allows users to read digital contents, watch movies and play games, similar to the experience on a tablet device. Huawei’s trifold smartphone could potentially attract some customers who were initially considering purchasing iPad. Personally, I’d prefer carrying one trifold phone, instead of both a traditional smartphone and a tablet.

As discussed in my previous article, I expressed concerns about Apple’s business growth in China. As depicted in the chart below, Apple’s market share fell out of the top 5 in Q2 2024, with the local brands gaining tremendous market shares in recent years. In Q3 FY24, Apple’s revenue from Greater China declined by 3% on a constant FX basis, indicating their growth challenges posed by the rise of local brands in the high-end smartphone market.

Recent Result and Growth Outlook

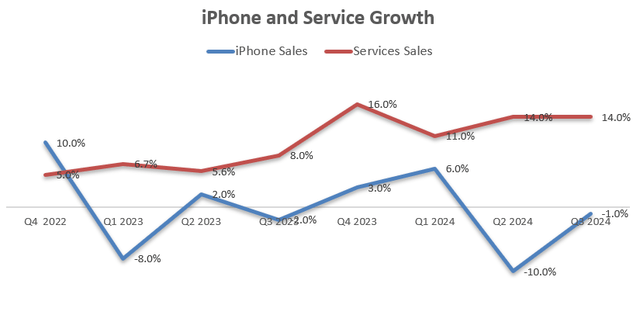

Apple released its Q3 FY24 result on August 1st, reporting 4.9% growth in revenue with 1% decline in iPhone revenue and 14% increase in services.

As discussed previously, their Greater China business declined by 3% on a constant currency basis. During the earnings call, the management did not fully address the market concerns about local competitions. Instead, they just expressed general confidence in the long-term growth in China. As analyzed in my previous coverages, services remain an important growth driver for Apple. The service business posted another 14% revenue growth, which is quite remarkable.

For the near-term growth, I am considering the following factors:

- Greater China accounts for around 19% of total revenue. I am quite pessimistic about Apple’s growth in China, given the rise of local brands such as Huawei, Xiaomi, and Vivo. These brands, which initially focused on low- and mid-range smartphones, are now expanding into the high-end market. Huawei’s trifold smartphone is an excellent example of local innovation and technology advancement in the high-end smartphone market. As such, I only assume Apple will deliver a mid-single-digit revenue growth in China in the near future.

- Apple possesses strong advantages in their service business, thanks to the massive installed base of smartphones, iPads and computers. Apple has been expanding their service offering in recent years. I anticipate the segment will grow by 15% in the near future.

- For the rest of the business, I assume Apple will deliver above-market growth, growing by 7% annually.

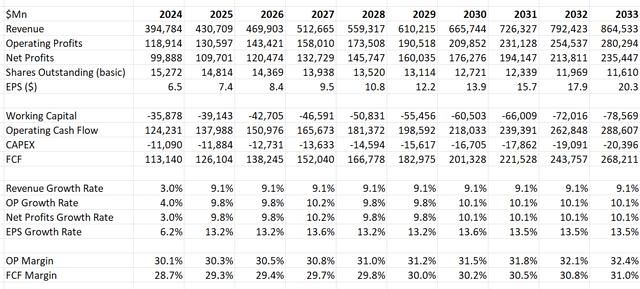

Putting together, I calculate Apple will grow its revenue by 9.1% organically.

Valuation Update

As discussed above, I forecast Apple’s revenue will grow by 9.1% organically, reflecting their strong growth potential in services and a mid-single-digit growth in China due to local competitions. The organic revenue growth rate is 10bps higher than my previous model, due to the higher revenue mix towards services. Services accounted for 28.2% of total Apple’s revenue in Q3 FY24, a significant increase from 25.9% in Q3 FY23. As the Services business grows faster than the company as a whole, a higher revenue mix towards services could accelerate its organic revenue growth.

I model 20bps annual margin expansion driven by 10bps from higher revenue mix towards services, and 10bps from new product offerings. The fast-growth of Apple’s services business is crucial for Apple’s margin expansion, as Apple’s product gross margin is around 35.3%, much lower than Services gross margin of 74%. With these assumptions, the DCF can be summarized as follows:

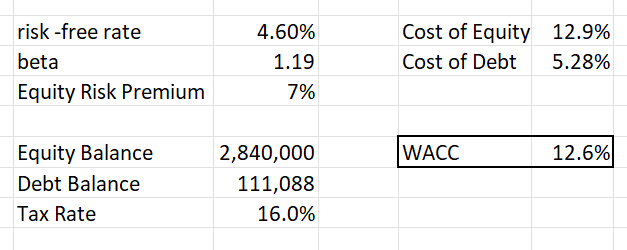

Apple had a weighted average interest rate of 5.28% in FY23. The WACC is calculated to be 12.6% as follows:

Apple DCF-WACC

Discounting all the FCF, the fair value of Apple’s stock price is calculated to be $192 per share. The fair value was $180 per share in my previous DCF model, and the fair value change is primarily due to the change in revenue growth rate.

Upside Risks

As I assign a ‘Sell’ rating, I am considering the following upside risks. I think the biggest potential upside for Apple is their Service business, which represented more than 28% of total revenue during the recent quarter. Apple could potentially expand their subscriber base through additional offerings in advertising, cloud, apps and payment services. It would be extremely difficult for competitors to match Apple’s reach, considering Apple’s massive installed device base. For instance, Apple TV+ has gained growth momentum in recent years. During the earnings call, the management indicated that more Apple services will be available later this year, including payment with rewards via Apple Pay and a redesigned Apple Fitness+ experience etc. A strong growth in Services could support a higher stock multiple, as these services are more recurring in nature.

End Note

I think Apple has been losing their edge in technology innovation, particularly in the smartphone market. The rise of Chinese brands and Huawei’s launch of a trifold smartphone could further impact Apple’s growth in China. I reiterate a ‘Sell’ rating with a fair value of $192 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.