Summary:

- Warren Buffett shocked markets by selling half his stake in Apple in Q2 2024, perhaps even causing a selloff in the week of August 5th, 2024.

- Buffett’s invested in Apple at c.10 P/E when markets priced it with low expectations and sold at 34 P/E when markets are pricing it with high expectations.

- Buffett’s investment in Apple paid off due to multiple expansion and profit growth.

- Apple’s stock price has historically taken a long time to react to Buffett’s purchases, and the same may be true for his sale.

ozgurdonmaz

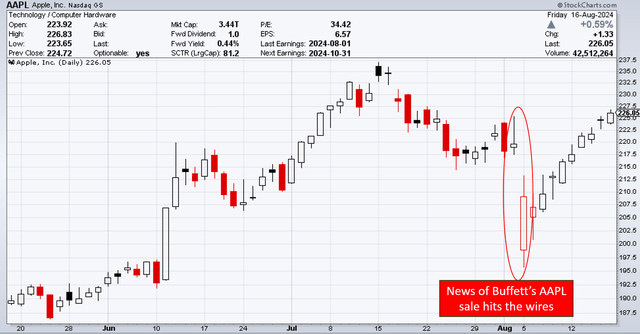

Warren Buffett of Berkshire Hathaway (BRK.A) shocked the markets by disclosing his sale of half his company’s stake in Apple Inc. (NASDAQ:AAPL) during Q2 2024 on August 3, 2024. This may have contributed to a market selloff in the week of August 5. Since then, AAPL stock has recovered. Was the selloff an unwarranted panic, or are investors in denial about the significance of Buffett’s sale?

AAPL performance since Buffett sold (StockCharts)

Part 1: Retracing Buffett’s Purchase of AAPL

To gain hints about the future, let’s look back to the past – when Buffett accumulated his stake in AAPL.

- The time and trajectory of Buffett’s purchases:

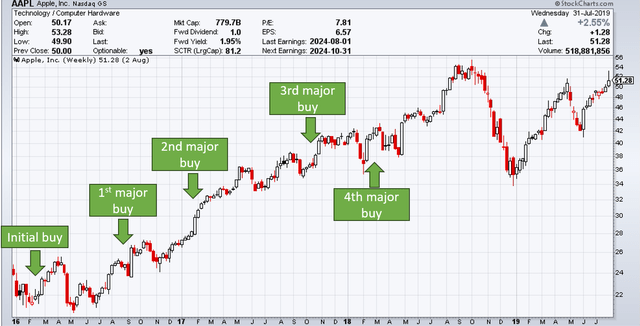

Buffett purchased his stake in AAPL over a two-year period from Q1-2016 (Note that 2016 denotes the calendar year while FY16 indicates Apple Fiscal Year 16 (i.e., the year ended September 2016)) to August 2018, as shown below (source).

Most of the shares were purchased during four quarters: Q4-2016 169m, Q1-2017: 288m, Q4-2017: 125m Q1-2018: 297m. These totaled 879 million shares for these four quarters alone. AAPL’s stock price traded at a range of $26 to $45/share during these four quarters.

Buffett AAPL purchase record (stockcircle.com)

- AAPL’s performance during Buffett’s purchases:

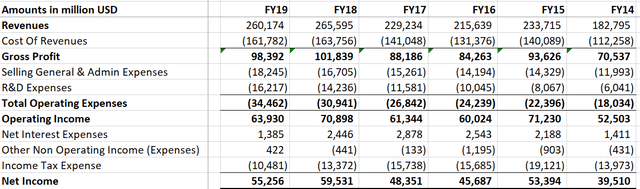

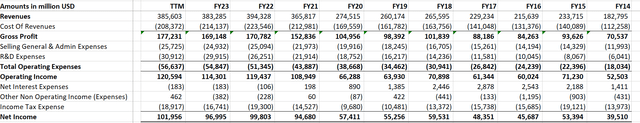

Financially, AAPL’s performance from 2016 to 2018 was a period of stagnation. Sales grew only 11% in FY19 compared to FY15 (CAGR of less than 3%) while operating income was actually lower (net income was higher mainly due to lower income tax expenses).

Apple financials (Seeking Alpha)

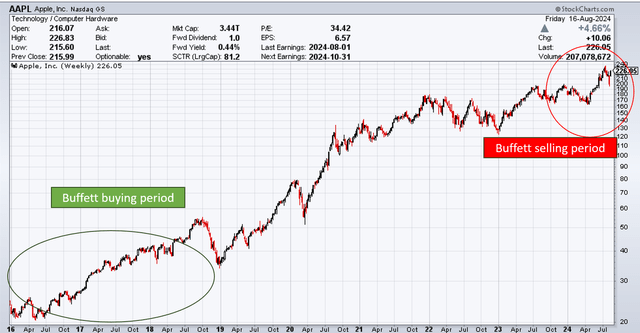

The stock price of AAPL increased somewhat after Buffett’s purchases; however, the market largely seemed to have a mind of its own. As shown below, AAPL’s stock went nowhere for significant periods of time after each Buffett purchase and really started to rise in 2020 (four years after Buffett’s initial purchase and two years after Buffett’s latest large purchase in Q1-2018) during the COVID-19 boom.

AAPL 2016 to 2024 (StockCharts)

If we zoom in a bit more into Buffett’s accumulation period, while AAPL’s stock price increased after Buffett’s initial purchases in 2016, AAPL’s stock price was tepid after the Q4-2017 and Q1-2018 purchases. It even fell sharply to levels below or near Buffett’s 3rd and 4th major buys.

AAPL 2016 to 2018 (StockCharts)

So in short, Buffett’s accumulation of AAPL was spread over a very long period and the stock price and performance were flat for significant periods of time before eventually proving Buffett to be prescient.

- Market sentiment when Buffett accumulated AAPL.

Buffett’s purchases of AAPL were made in an environment where investors were skeptical of AAPL. In early 2016, Buffett’s initial purchase coincided with Carl Icahn’s sale of AAPL. If we select a sample of analyst reports from big-name firms back in 2017 and 2018, the P/E ratios they were giving AAPL were in the teens, for example:

DB’s report on July 10th, 2017 (“FY18 supercycle is more likely just a cycle”) forecast a P/E multiple of 14.x for FY18 and FY19.

Morgan Stanley’s report on April 20th, 2018 (“Cautious into the print, buy any earnings dip”) forecast a P/E multiple of only 11.3 by FY20.

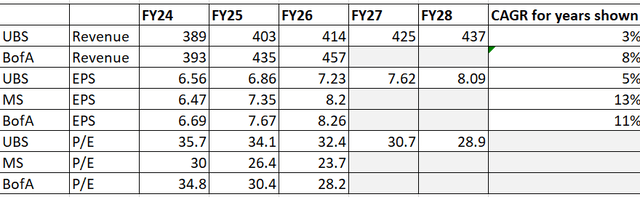

This is an interesting contrast with more recent analyst reports in 2024 that project current multiples as sustainable:

UBS’s recent report on July 16, 2024 (“Expect an in-line June print and Sept guide while FY25 optimism is misplaced”) forecasts AAPL P/E at 28.9 even at FY28, despite projecting <3% annual revenue growth for the next 4 years.

BofA’s recent report on July 11, 2024 (“Strong multi-year iPhone refresh cycle with aging installed base”) forecasts AAPL P/E at 28.2 at FY26.

Morgan Stanley recent report on June 4, 2024 (“Why WWDC 2024 Is A Key Catalyst For Apple, And What Matters Most Next Week”) forecasts AAPL P/E at 23.6 by FY26 (though this is based on forecast growth of 27% in EPS from FY24 to FY26).

By listing and contrasting these analyst reports, my point is less about the accuracy of forecasts (which is an inherently difficult activity) but more about the general sentiment. When AAPL’s P/E was in the low-to-mid teens, analyst reports had forecasts with multiples of teens. Now that AAPL’s current P/E is 34, analyst reports are setting target prices with similar multiples (forecast to slightly decline, mainly due to higher EPS). Even when UBS’s report forecasts less than 3% annual revenue growth for the next 4 years, it still assumes AAPL will maintain a PE of nearly 30.

Part 2: How Buffett’s investment in AAPL paid off

Buffett’s investment in AAPL paid off from (i) multiple expansion and (ii) profit growth.

AAPL financials 2014 to LTM24 (Seeking Alpha)

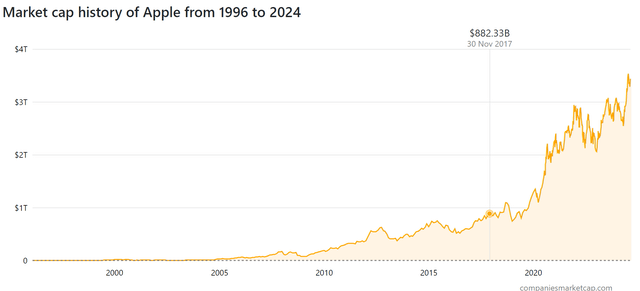

In 2016-2018, AAPL earned $45 -$59bn a year and which corresponded to a P/E of around 10 once AAPL’s $200+ billion net cash position at the time is considered. AAPL’s market cap at the time is shown below for reference: (i.e., AAPL’s market cap in Q4-2017 was $882 billion minus $280 billion in cash, divided by $59 billion in earnings for a P/E of around 10).

Market cap AAPL from 1996 to 2024 (CompaniesMarketCap)

By 2024, Apple earned $100B net profit a year and had a P/E of 34. Buffett’s investment grew by sixfold as AAPL’s net profit doubled while its P/E tripled.

What Buffett appears to have done was buy AAPL when the market priced in low expectations (and correctly assessed that the market had underpriced AAPL’s ability to generate and grow profits) and sell when the market was pricing in high expectations for AAPL (and perhaps assessed that the market had overpriced AAPL).

Part 3: Future Implications

So what does this mean for the future?

Buffett sold nearly half his stake in AAPL in Q2-2024, after trimming his position in AAPL in Q1-2024 for ostensible tax reasons. He praised Apple in May 2024 as “even a better business” than American Express (AXP) or Coca-Cola (KO).

But Buffett abruptly about-faced in Q2-2024 – some factors must have strongly motivated him to do so. We probably won’t know what, given Buffett tends to praise companies he likes rather than comment negatively on things he doesn’t like.

However, we can try to take a guess. If Buffett bought (and kept buying Apple) over a two-year period in 2016-2018 when markets were pricing in low expectations, then given his modus operandi, his sale is possibly because he sees AAPL as overpriced. While the trade war with China was perhaps a good time to buy AAPL during the gloom, perhaps the AI “boom” is a good time to sell into optimism.

If we look at AAPL forecasts made by major investment banks, even the optimistic ones are seeing only 10% CAGR for revenue, but somehow they are still expecting P/E multiples of nearly 30.

Sample of analyst estimates on AAPL (Seeking Alpha)

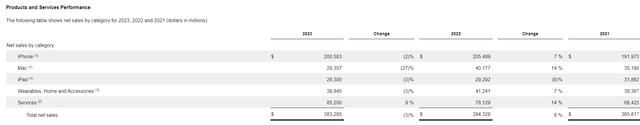

Where revenue growth is going to come from is a big question. There’s been much discussion of AAPL’s lack of major product innovation in the past few years (with upgrades being more incremental in nature). As per the snapshot below from AAPL’s 10-K, its main products as well as their proportion of sales have remained relatively stagnant from FY21 to FY23.

AAPL by product sales breakdown (AAPL 10-K)

I believe this is because the iPhone serves unique needs that few other products do: the iPhone is a one-of-a-kind product, a must-have because of the connectivity and labor-saving efficiencies it offers. Even if one does not use it for social media, entertainment, or other non-essential uses, and notwithstanding any data privacy concerns, there are enough daily application scenarios that make it invaluable. These include replying to work emails on the road, hailing an Uber when on a business trip in an unfamiliar city, last-minute travel itineraries change due to weather, ordering random grocery items, etc. There are so many uses for it, the $1,000+ per-unit price is well worth it, even if just for emergencies unless a person is totally living off the grid and entirely forgoes any modern amenities.

But I would tend to view AAPL’s other products as “better to have” (even though I own multiple iPads, Macs, etc.). They’re nice to have, but you can get by in your daily life without ever using an iPad or Mac (whereas a smartphone saves time every day on tasks that otherwise need to be done in front of a computer). No other AAPL product is anywhere near the iPhone, nor does it appear AAPL is close to developing one. Rolling out an autonomous electric car could have had a meaningful impact on AAPL revenues, but AAPL gave up on that. Recently, there’s been news about AAPL developing tabletop robots that are actually just a robotic arm plus an iPad. However, I believe that just goes to show how far AAPL is from any significant new product breakthrough, touting another “widget” rather than a must-have like the iPhone.

Even the AI story around AAPL is mainly the next generation of iPhones carrying Gen-AI features, with some analysts touting additional replacement demand as a plus. But this is really a short term-ism argument, even if Gen-AI features allow AAPL to persuade users to replace iPhones and pull forward some demand, this is essentially a drop in the bucket compared to AAPL’s $3.4 trillion market cap. For example, assuming the current $200bn a year sales in iPhones reflects a 5-year replacement cycle as estimated by Morgan Stanley’s above-quoted research report (other sources estimate maybe 3 years). If this 5-year replacement cycle temporarily becomes 4 years because of buzz around Gen-AI, then revenues will increase to $250bn/year. However, if the replacement cycle falls back to 5 years if no further significant updates, then it’s really just a pull forward of revenues rather than anything permanent.

More significantly, once the pace of new features slows down, people might replace their iPhones even less frequently. In 1970, Americans on average replaced passenger cars every 5.6 years. By 2023 this had increased to 14 years. Imagine if iPhones (or whatever other smartphone eventually ends up dominating the market) were replaced every 10 or 15 years on average. AAPL might not be able to sustain current levels of revenue and profitability.

In fact, if smartphones reach a high level of maturity and only need to be replaced once every say 10 years or more, then it might make sense for a competitor to sell the phone at cost (or even give it away for free). This would lock in future expenditures on the phone, a scenario that would destroy the profitability of smartphone makers. This is similar to how GE stopped producing small appliances in 1984 and sold its appliance division (the same division that invented the toaster, etc.) in 2016.

Part 4: Risks to bearish thesis

If we study Buffett’s initial purchase of AAPL and the stock price’s tepid changes for long periods after the purchases, then Buffett’s recent sale does not necessarily mean AAPL’s stock price will go down anytime soon. AAPL’s stock price could stay at current levels or even head higher for years. This is even if AAPL continues to roll out products with new features or even new products at a rate that convinces customers to maintain or upgrade at a faster rate. AAPL’s revenues/profits stagnated for years from FY15 to FY19 before seeing rapid growth in the COVID-19 pandemic boom, so this FY21 to FY23 lull could just be “consolidation” before another break higher.

Conclusion:

Buffett bought AAPL when the markets priced in low multiples and expectations, and sold AAPL when the markets priced in high multiples and expectations. History does not indicate how soon AAPL’s stock price will reflect Buffett’s judgment on its value (perhaps it could happen in a meltdown, as seen recently in the week of August 5; or perhaps it could happen slowly over the years).

Buffett’s prescience could take years to play out, which is why his AAPL investment took years to become superbly profitable. This may also be why AAPL’s stock price recovered soon after the initial dip on August 5th. Investors looked around and saw AAPL’s fundamentals seemed intact and there was no reason to panic. But Buffett buys before the market fully sees the value and I suspect, again, he is selling before the market fully appreciates the downside.

I believe for the small investor, it is probably worthwhile to follow in Buffett’s footsteps and take some chips off the table. At least do not be in denial about the significance of Buffett’s move and hope AI etc. save the day.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.