Summary:

- Apple Inc. massively underperformed its competitors in personal computer shipments in calendar Q1, according to IDC.

- Should Apple’s performance take a hit due to softening demand, the stock’s valuation premium could become harder to justify.

- Despite valuation fears, I remain an Apple bull for the quality of the company, management team, balance sheet, and growth opportunities.

mbbirdy/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ:AAPL) spent most of the April 10 trading session trailing the S&P 500 (SP500) by a solid two percentage points, or the equivalent of about $50 billion in market cap. Probably to blame was a report delivered by research firm IDC showing that Apple massively underperformed its competitors in personal computer shipments in calendar Q1: a decline of 40% YOY vs. the industry average ex-Apple of 28%.

I don’t think that Apple investors should extrapolate or worry too much about a single data point. However, while probably too early to tell, soft Mac sales in the most recent quarter could pose a risk to Apple’s valuation that, I believe, helps to explain the bearish reaction on Monday.

Putting things in perspective

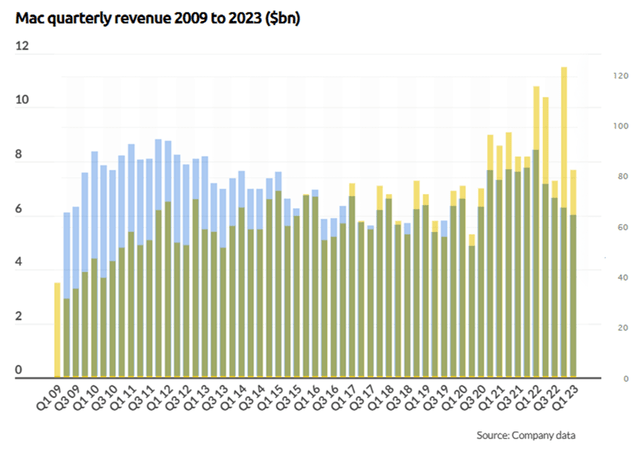

IDC’s report on PC shipments foretells what could be a highly atypical quarter of underperformance in Cupertino in fiscal Q2. Amid a secular decline in PC sales across global vendors that has been taking place since 2011 (despite a brief period of recovery during the COVID-19 crisis), Apple has aggressively grown its Mac business on the back of brand appreciation and technological improvements, most notably via the introduction of Apple’s ARM-based M-series chips in 2020.

The chart below is a superimposition of worldwide PC shipments by quarter since 2009 (blue bars, right axis, in units, provided by Statista) over Mac revenues during the same period (yellow bars, left axis, in dollars, provided by Business of Apps). Apple has defied the odds, namely the secular demand shift from PCs to tablets and smartphones, gaining substantial market share in personal computers over the past decade-plus.

Charts by Statista and Business of Apps

Why Apple bulls might worry

The most obvious way in which the IDC report could be concerning for bulls is that Apple’s days of market share gain in the PC space could be nearing an end.

The thesis is not without its merits, to be clear. Mac sales jumped by 16% per year between fiscal 2019 and 2022, while global PC shipments increased by only 3% per year over the same period. Maybe Apple users have front-loaded their purchases and upgrades, particularly during the stay-at-home days of the pandemic and on the back of the M1 and M2 chip launches. It might be time for demand to cool off for a moment.

But to me, the most concerning second-order consequence of softer Mac sales would be compressed valuations. Not long ago, I talked about how Apple bears could be right in their skepticism over the rich share price.

I explained that I could only justify a share price of $160 in a discounted cash flow (“DCF”) analysis if I assumed a “modified” cost of capital of slightly less than 8% rather than the derived WACC of 10.6%. In plain English: it was clear to me that the market perceived Apple to be a much safer stock (just another way of saying a lower discount rate) than factors like equity risk premium and market beta might otherwise suggest.

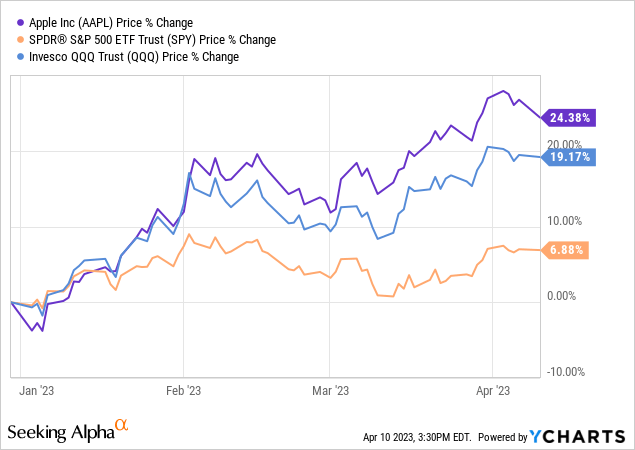

The observation was in line with the consensus narrative that Apple should weather the expected macroeconomic challenges in 2023 much better than many or most other companies in the tech and discretionary spaces. The Cupertino company and its stock have been called an inflation hedge by many and a safe haven by others. The financial results reported in the past several quarters, and the stock’s strong performance so far in 2023 (see below), seem to back up the claims.

But what if Apple is not so immune to softening consumer spending as many seem to believe? As I mentioned in the comments section of my recent article, “AAPL has been very resilient in this choppy market because the company has been very resilient in this choppy economy. Apple is the only big tech company still talking about strong demand.” What if this ceased to be the case?

While much of the evidence seen so far does not seem to fuel these fears, IDC’s recent PC shipments report could raise a yellow flag. If underperformance is witnessed elsewhere in Apple’s product and service portfolio, the stock’s current-year P/E of 27.1x that is quite rich by broad market standards could become harder to justify.

We will certainly learn more on May 4, when Apple reports fiscal Q2.

Why I remain an AAPL bull

Having said the above, I remain an Apple bull. This is the case for several reasons that include: (1) the quality of the management team; (2) the brand loyalty; (3) the robust balance sheet that backs up a generous share buyback program; and (4) the growth opportunities in mixed reality and autonomous vehicles that I bet are still largely not reflected in financial models and, as a result, the share price itself.

To be fair, the concern over possibly bloated valuations in a stock like Apple Inc. is a risk, maybe the biggest of them all in my book. But then again, there isn’t a single investment opportunity in the market that does not come with a laundry list of risks attached to it. I feel more comfortable paying up for quality and holding the position for the long term, weathering the eventual ups and downs in a stock like Apple Inc., than looking for cheaper stocks that are probably cheap for a good reason.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.