Summary:

- Apple Inc. is expected to report another negative quarter with FQ4’23 sales down nearly 1%.

- Analysts actually predict that Apple’s growth potential is limited, with delays in new product releases and a lack of focus on AI contributing to that reality.

- The stock still trades at 26x FY24 EPS targets while the company doesn’t have the growth supporting this valuation.

mphillips007/iStock via Getty Images

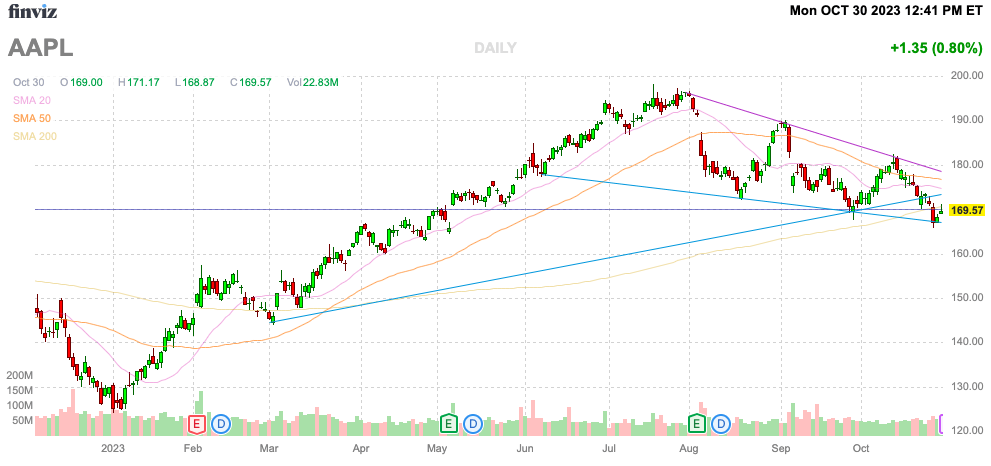

Apple Inc. (NASDAQ:AAPL) reports key FQ4’23 results after the close on November 2. The company guided to a fourth consecutive quarter of lower sales for the September quarter, yet the stock recently traded at all-time highs. My investment thesis remains ultra Bearish on the stock, with the disconnect between the forecasted weak financial results and the stock market.

Source: Finviz

Another Negative Quarter

Most investors following Apple don’t appear to understand the company isn’t growing at a 10% to 15% annual clip. Consensus estimates for FQ4’23 are as follows:

- EPS of $1.39, up 7.9% YoY.

- Revenue of $89.31 billion, down 0.8% YoY.

The market doesn’t appear to appreciate that Apple reported the following negative quarterly results:

- FQ3’23: -1.4% YoY

- FQ2’23: -2.5% YoY

- FQ1’23: -5.5% YoY.

Apple has actually missed analysts revenue targets in 3 of the last 5 quarters. On the FQ3’23 earnings call, CFO Luca Maestri guided to quarterly results similar to the June quarter:

We expect our September quarter year-over-year revenue performance to be similar to the June quarter, assuming that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter.

The tech giant reported FQ3’23 results slumped 1.4%. The consensus analyst estimates are for Apple to actually beat the technical guidance of management by $420 million with a 1.4% sales dip in the September quarter amounting to revenues of only $88.89 billion.

Investors really need to grasp the recent history of weak quarterly revenues for Apple. Prior to Covid revenue pull forwards mostly in FY21, the company reported 8 quarters where revenues were not higher than 2% YoY growth in the 6 of those quarters.

The tech giant is about to go through another period where revenues are set to be no higher than 2% growth in 5 out of the last 6 quarters. Even worse, the company faces a tough computer market, impacting both Mac and iPad sales, due to the market pull forwards from the work-from-home crowd during Covid lockdowns.

Apple is set to launch new Macs tonight in an odd event only 3 days prior to fiscal year-end results. The “Scary Fast” event is likely focused on new Macs with the faster M3 chip, but the event is only virtual, so the company isn’t likely to announced any monumental product updates.

The new M2 and M3 chips are supposed to be a huge positive for performance of the Macs, but Apple sales is slumping in this category due to the Covid pull forward. Mac sales for all purposes peaked in FQ1’22 and have slumped during FY23 with sales down substantially this year.

Morgan Stanley has long been one of the most positive investment firms on Apple, but analyst Erik Woodring predicts the company guides the key holiday quarter below consensus due in part to iPhone 15 Pro/Pro Max supply constraints. The analyst made the following comment:

We are more cautious on the December quarter (FQ1’24) given iPhone supply shortages and uneven consumer spending, and believe Apple will guide to a revenue range that is both below normal seasonality and Consensus expectations.

The firm still has a $210 price target on the stock for 12 months from now, but this disconnect is where our view cautions investors. Morgan Stanley isn’t bullish on the growth prospects for a company that has regularly struggled to grow in the last 5 years outside of the major Covid pull forwards, yet the analyst predicts 24% upside for an already very expensive stock.

Note, the December consensus estimates are for revenues to grow only 5% on top of a quarter that slumped 5% last year. The guidance for FQ1’24 revenue of $123.0 billion doesn’t even top the $124.0 billion level of FQ1’22.

More Product Delays Reduce Growth Potential

While existing products are struggling, the latest news suggests Apple isn’t making any huge progress with new products. The AR/VR device product lineup appears to be deteriorating despite initial excitement over the Vision Pro device, and the Apple Car has all but disappeared from market visibility.

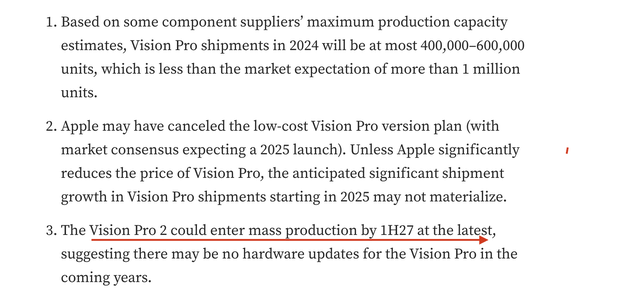

According to influential Apple analyst Ming-Chi Kuo, Apple will only ship ~500,000 Vision Pro units during 2024. At a price of $3,500, the tech giant would only generate $1.75 billion in revenues amounting to only half a percentage point with FY24 sales targets topping $404 billion.

The really bad news from Ming-Chi Kuo is that Apple has pushed back any plan for a cheaper Vision Pro device until 1H’27. Without a strong roadmap for higher volumes, one has to wonder how much developers focus on the MR device.

Apple famously drove iPhone loyalty due to constantly refreshing and advancing the product line on an annual basis. The leading App Store and constant support for new smartphones caused consumers to become tied to the ecosystem limiting users from straying to other smartphone brands that at times appears to have had better features.

The AR/VR device doesn’t appear headed down this path yet with years in between the initial device release and a second device, which won’t even be a refresh of the original product. Based on history and some of the struggles Meta Platforms (META) is facing with their AR/VR devices, Apple investors shouldn’t expect FY25 or FY26 revenues to expand in this category limiting any revenues from new products and leaving the business focus entirely on products with a long history.

Analysts are forecasting FY24 and FY25 revenues will grow at ~5% clips. Investors have to question whether total stock returns will be all that positive with the stock trading at nearly 26x EPS targets and targets for 5% growth, possibly aggressive here.

Remember, the Morgan Stanley price target of $210 suggests Apple would trade at 32x FY24 EPS targets of $6.55. The logic for the stock reaching such a target doesn’t exist based on the forecasted growth rates.

Takeaway

The key investor takeaway is that Apple isn’t likely to report a great quarter after the close on Thursday. The stock is priced similar to other tech giants like Microsoft (MSFT), which is growing sales at nearly 13% rates and aggressively positioned for AI growth, while Apple misses out on AI and is struggling with their focus on AR/VR devices.

Apple Inc. investors should continue to exit the tech giant, which has no growth but is trading like a fast-growing tech stock. Apple has been a safety trade the last year, but the company continues to report spooky results.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.