Summary:

- Apple’s Q1 earnings report shows revenue growth of 2.1% YoY, indicating a recovery after a year of decline.

- The release of the Vision Pro headset and strong iPhone sales contribute to the company’s growth.

- However, Apple still faces challenges, including China-related risks, which may hinder its momentum in the coming months.

Bloomberg/Bloomberg via Getty Images

After a year of revenue declines, it seems that Apple (NASDAQ:AAPL) has finally found its footing. The latest decent earnings report for Q1 along with the successful release of Vision Pro headset indicate that the Cupertino giant is finally on the path to recovery after a year full of disappointments. However, the company still faces several major internal and external challenges, including China-related risks, which might undermine Apple’s momentum in the following months. As such, the company’s shares will likely continue to feel the selling pressure despite the recent appreciation since the downside might not be fully priced at this stage.

Apple Is Finally Growing Again

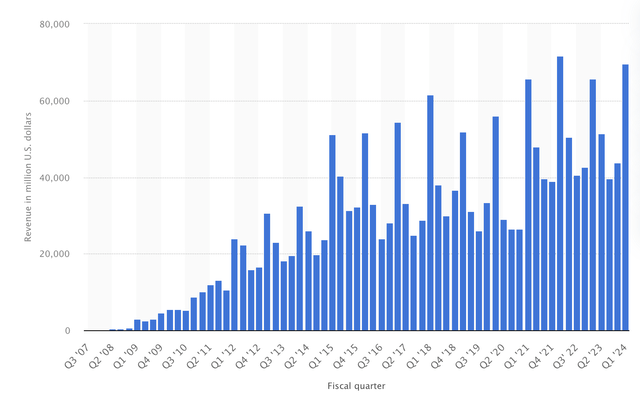

In my latest article on Apple that was published last year, I have been highlighting two major issues that the company has been facing, which are the lack of growth and the rise of China-related risks. If we look at Apple’s performance in FY23, we’ll see that its revenues were declining Y/Y during each consecutive quarter of the last year as a result of the lack of growth catalysts. The good news though is that it seems that the growth issue has finally been fixed and another quarter of revenue declines has been avoided.

Earlier this month, Apple released its Q1 earnings report, which showed that the company’s revenues during the period increased by 2.1% Y/Y to $119.6 billion and were above expectations by $1.34 billion. The company has also reported a solid bottom-line performance, as its GAAP EPS of $2.18 were above the estimates by $0.07.

It would be safe to say that such a performance didn’t come as a surprise, despite the disappointing performance in recent quarters. After all, we shouldn’t forget that Apple released its latest iPhones last September and managed to retain the sales momentum in recent months. That’s one of the main reasons why the revenues generated by the iPhone business increased by 6% Y/Y in Q1 to $69.7 billion. At the same time, the company managed to set a new sales record in several regions, and grew its iPhone user base to a new all-time high, while Q1 became the second-best quarter in terms of iPhone sales in Apple’s history.

Apple’s iPhone Revenue Chart (Statista)

It’s also important to note that even though the company’s overall revenues were on a decline last year, its services business has been exceeding expectations for a while and that was also the case in Q1. The latest earnings report showed that the revenues of Apple’s services business increased by 11.4% Y/Y to $23.12 billion and set a new record for the company. Such a performance was achieved primarily thanks to the rise of the installed base, as Apple now has over 1 billion paid subscriptions across its ecosystem. What’s more is that even if the iPhone sales lose their momentum in the following months, the services business is expected to continue to grow at a double-digit rate in the future and mitigate some of the downsides that might be caused by the weaker performance of other segments.

As for Apple’s other segments, there are reasons to be optimistic about their future as well. In the following months, we’re likely going to see a release of new iPads and MacBooks to boost sales, while the recent launch of Vision Pro headset has the potential to revive growth of the company’s wearable segment that recorded a revenue decline of 11.4% Y/Y to $11.95 billion in Q1. Last year I noted how despite its high price tag of $3500, Vision Pro could become a major catalyst of growth for Apple due to the unique launch strategy that aims to minimize the project’s costs and scale the user base at the same time. It’s safe to say that this strategy has been successful so far since the company could sell as many as 600,000 headsets this year alone, above the previous expectations of 460,000 devices, which could boost the wearables segment revenue by an additional ~$2 billion in FY24.

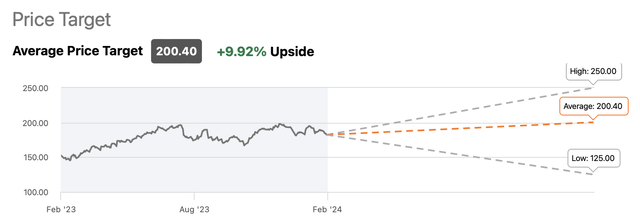

Another positive thing about Apple is that it appears that its stock currently trades at a discount and represents ~10% upside according to the street consensus. With a forward P/E of ~28x, the shares are also trading close to the S&P 500 average P/E of ~27x. This might suggest that if the market continues to grow on positive macro data, then Apple’s shares could further appreciate and even outperform the rest of the pack given the amount of growth catalysts that the company has.

What’s more, is that the continuation of the buyback program could ensure a further appreciation of the share price in the following months. In Q1 alone, Apple repurchased 112 million of its shares at a total price of $20.5 billion, and a similar thing could happen in the following quarters as well. Add to all of this the fact that there’s an indication that Apple is likely to return to growth and once again increase its revenues Y/Y this year and beyond, it makes sense to believe that the bullish thesis is not fully dead at this stage.

Apple’s Consensus Price Target (Seeking Alpha)

Is The Momentum Going To Be Short-Lived?

The biggest issue with Apple is that even though its shares have an upside at the current price and could further appreciate in the near term on positive macro data, the company faces several major challenges that could undermine its growth potential in the long run. Let’s not forget that while the street expects Apple to grow Y/Y in FY24 in part thanks to the decent results in the previous quarter, the company’s guidance was not as solid as the street expected. This is due to the fact that Apple is highly reliant on China both from the supply and demand side, which has become one of the company’s biggest weaknesses in recent years.

On the one hand, Apple is struggling to compete with local Chinese competitors, which have been aggressively increasing their market share on the mainland in recent years. In Q1, Apple’s revenues in the Greater China region decreased to $20.8 billion, down from $23.9 billion a year ago and below the street expectations of $23.5 billion. On top of that, Chinese brands like Xiaomi and Huawei are about to release their newest smartphones in China in the foreseeable future, which could make it even harder for Apple to generate aggressive returns there in the future. While the Cupertino giant recently decided to offer additional discounts to Chinese consumers, it’s questionable whether such a tactic would work given the rising competition that offers smartphones at more affordable prices and the potential deflation in China that could undermine the company’s sales efforts on the mainland. The street already made dozens of revenue downside revisions in recent months and expects the company’s sales to decrease Y/Y in Q2 as China’s consumer sentiment remains muted.

On the other hand, Apple continues to be greatly exposed to geopolitical risks due to the majority of its supply chain remaining in China. There’s an indication that close to 80% of the company’s manufacturing partners have a footprint in China, while Apple itself recently deepened its cooperation with Chinese firms. Given the rise of tensions in the Taiwan Strait, the worsening of Sino-American relations, and the potential implementation of new trade restrictions, it becomes obvious that having great exposure to China is no longer considered an advantage as was the case even a decade ago.

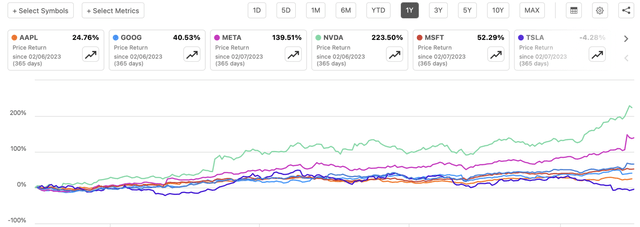

As a result of all of this, Apple’s stock could be ‘dead money’ in the foreseeable future as the company is in a worse position in comparison to its Big Tech peers that are not that exposed to China, especially from the supply side. If we compare the performance of Apple’s stock to its Magnificent 7 peers, we’ll see that the company has greatly underperformed against most of them except for Tesla (TSLA), which also has great exposure to China. Considering this, it’s safe to assume that Apple could continue to underperform against the other big names that don’t directly face the same ‘China problem.’

Apple’s Price Return Comparison Against Its Peers (Seeking Alpha)

The Bottom Line

Apple is in a tough spot currently. On the one hand, it’s great to see that its business is finally growing again after a disappointing performance in FY23. On the other hand, there’s a risk that its momentum is going to be short-lived due to the various internal and external challenges, including China-related risks, that the company faces. As such, I’m sticking with my HOLD rating for now considering that while Apple’s stock has some additional room for growth thanks to the latest developments, its upside appears to be limited at the current price since most of the downside is likely not fully priced in at this stage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.