Summary:

- Apple has been one of the best-performing companies in the past decade, and should continue this performance in the long run.

- The tech giant still has many growth opportunities in segments such as fintech, health, India, and advertising.

- While fundamentals remain strong, the elevated valuation and macro headwinds may be a concern in the near term.

- I rate the company as a hold.

Scott Olson

Investment Thesis

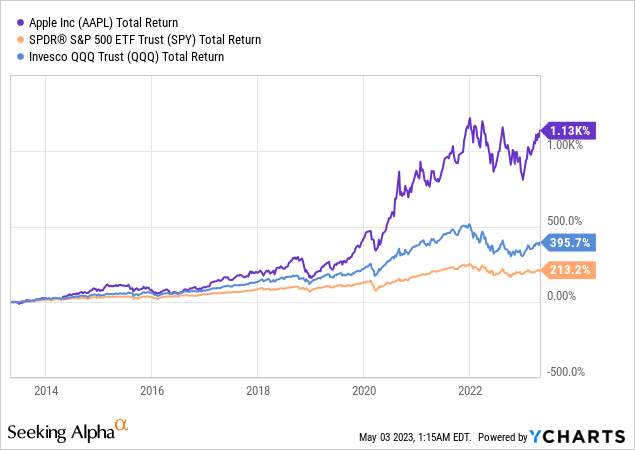

Apple (NASDAQ:AAPL) has been one of the best-performing companies in the past decade with shares up over 900%, significantly outpacing the broader indexes such as the S&P 500 (SPY) and the NASDAQ (QQQ). The company is going to report its latest earnings tomorrow, May 4th, and growth is expected to moderate, as inflationary pressure and the weakening economy continue to impact demand.

While growth is poised to slow in the near term, the company’s long-term outlook remains very strong. It is seeing massive growth opportunities in Fintech, Health, India, etc as it continues to diversify its revenue streams. Valuation, however, is a potential concern that could weigh on the share price in the near term, as the current multiples remain pretty elevated. Therefore I believe the company is a hold at the moment and investors should wait for pullbacks to get in.

Growth Catalysts

In order to diversify from the relatively cyclical and saturated product market (mainly iPhone, Mac, and iPad), Apple has been expanding its ecosystem into other markets and regions, and the growth opportunities are massive. Fintech and Health are two of the most prominent targeted segments as the company continues to make its aggressive push into the market.

Fintech is a huge and fast-growing market, as the adoption rate of e-commerce and contactless payments continues to increase. According to Vantage Market Research, its global market size is forecasted to grow from $133.8 billion in 2022 to $556.6 billion in 2030, representing a strong CAGR (compounded annual growth rate) of 19.5%.

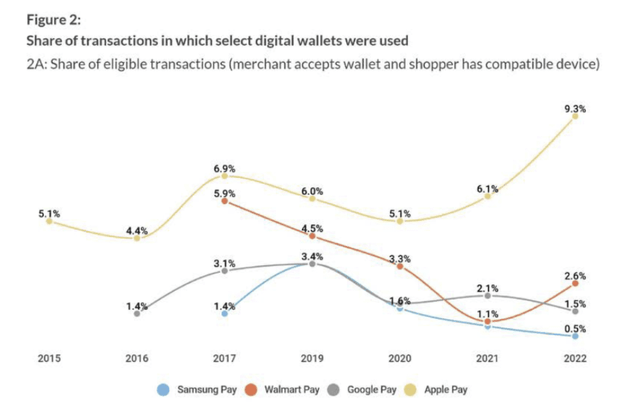

While Apple Pay is relatively new compared to competitors such as Google Pay (GOOG) (GOOGL) and Amazon Pay (AMZN), it has been growing much faster thanks to the massive existing customer base. As shown in the chart below, Apple Pay’s market share in digital wallets has almost doubled from 5.1% in 2015 to 9.3% in 2022, while peers’ market share has generally been trending down. Thanks to the rising penetration rate, the estimated in-store transaction value of Apple Pay has also grown from $91.7 billion in 2021 to $199.4 billion in 2022.

Despite the recent progress, the company’s penetration rate of in-store transactions is only around 5.8%, as it continues to trail other competitors such as Visa (V), American Express (AXP), and Venmo (PYPL). In order to capture more market share, the company continued to expand its offerings and recently launched Apple Pay Later, its own BNPL (buy now pay later) solution. This should help attract more younger users and fight off competition from other BNPL companies such as Affirm (AFRM) and Klarna.

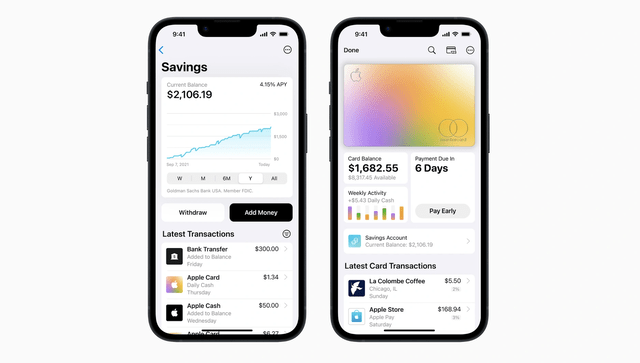

Besides, the company also partnered with Goldman Sachs (GS) last month to launch a 4.15% high-yield savings account. I believe this will onboard a lot of new users considering how low the yields from other major banks are. This should also substantially boost the money circulating in the Apple ecosystem as the account is highly complementary to the Apple Card and Apple Pay.

Health and Wellness is another major segment Apple has been focusing on, especially since the launch of the Apple Watch, which almost doubles as a monitoring device. The health and wellness market is also massive as people are now being increasingly aware of their own health and well-being. According to McKinsey, its market size is estimated to be $1.4 trillion with a CAGR of 5% to 10%. While Apple is not currently involved in all subcategories, this gives you an idea of how many opportunities are out there.

Apple Watch remains the key in this market and the company is expected to bring more monitoring capabilities to the device. Last year, it is disclosed that the company may bring blood-pressure monitoring technology to the Apple Watch as soon as next year. Earlier this year, the company also made significant progress in bringing glucose monitoring technology to the watch, which could take on CGM (continuous glucose monitor) device makers such as DexCom (DXCM) and Abbott Laboratories (ABT). This presents a massive opportunity as 37.3 million Americans currently have diabetes, and 20% of people do not know they have it, according to the CDC.

Amidst the rise of AI, Apple is also developing an AI-powered health coaching subscription service, which delivers personalized health programs through AI. I believe these ongoing expansions in offerings should continue to increase the company’s presence in the health industry and become a meaningful growth driver down the road as the technology matures.

Expansion In India

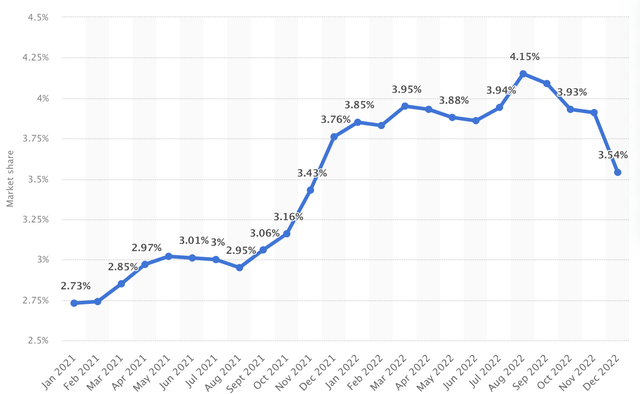

India also presents ample room for growth, as Apple currently has very little presence in the large and fast-growing country. According to Statista, the company currently has a market share of just 3.5%, vastly below competitors such as Samsung (OTCPK:SSNLF), Xiaomi, and Vivo. While its market share has improved after the launch of its online store in 2020, the penetration rate remains absurdly low. In order to speed up the expansion, the company finally opened its first two physical stores in Mumbai and Delhi last month and is expected to open more in the coming quarters. Winning a meaningful market share in the country should drive growth as India is currently the second largest smartphone market only behind China.

Advertising and AR/VR

Advertising and the upcoming mixed-reality headset are also two segments with great potential. While Apple is not known for its search advertising business, the company is now trying to grow the segment by monetizing the app store. The move is smart as the company has first part data advantage while competitors such as Meta (META) and Snapchat (SNAP) are struggling with ad targeting after Apple’s privacy update. I believe the company will leverage this advantage and slowly expand advertising into other in-house apps as well. According to CNBC, Apple’s search advertising is already generating roughly $5 billion in 2022 (or 1.2% of total revenue) and I expect the strong momentum to continue moving forward.

The mixed-reality headset is a high-risk high-reward bet in my opinion. The company is aiming to enter the AR/VR (augmented/virtual reality) market with the product and compete with Meta’s Oculus Quest. According to Markets and Markets, the market is estimated to grow from $37 billion in 2022 to $114.5 billion in 2027, representing a strong CAGR of 25.3%. Unlike the other segments mentioned above, AR/VR is relatively less competitive due to its higher entry barrier. The public reception of the technology remains very mixed but it could turn out to be a strong growth driver if the user experience came out to be much better than expected.

Investors Takeaway

I am not worried about Apple’s fundamentals and prospects, as the company still has many expansion opportunities to drive growth. However, the company’s lofty valuation may be an issue. It is trading at a PE ratio of 28.7x, which represents a premium of 15.3% compared to its 5-year historical average of 24.9x. Revenue and EPS are also expected to be flat or down for the year as macro headwind hits. The elevated valuation alongside the moderating growth this year will likely limit its upside potential in the near term. I believe investors should be patient and there is no need to rush in as the macro backdrop is expected to be weak this year. Growth should see a meaningful rebound next year as comps gets easier and demand returns. Therefore I rate the company as a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.