Summary:

- Apple Inc.’s fiscal first quarter results for the December-ending quarter came in ahead of revenue estimates thanks to the iPhone.

- Despite lowered expectations, commentary for the current quarter seemed a little soft, as management cited numerous headwinds.

- Shares remain a good long-term hold, but investors looking to buy might want to wait for a better valuation and improved technicals.

Nikada/iStock Unreleased via Getty Images

After the bell on Thursday, we received fiscal first quarter results from technology giant Apple Inc. (NASDAQ:AAPL) for its all-important December-ending quarter. Revenue expectations have been coming down over time, and a lack of new product launches for the holiday season combined with one less week in the fiscal period has led to muted growth hopes.

As I discussed in an article back in October, Apple analysts had been trimming their hopes for fiscal Q1 for some time. In April 2022, the Street was looking for more than $141 billion in December 2023 quarter revenues. With some product timelines being pushed back a bit, along with some economic weakness in China and other key markets, that number has come down to a little over $118 billion recently. There has also been some concern that the return of Huawei as a major smartphone player in China could limit sales of the new iPhone 15 line.

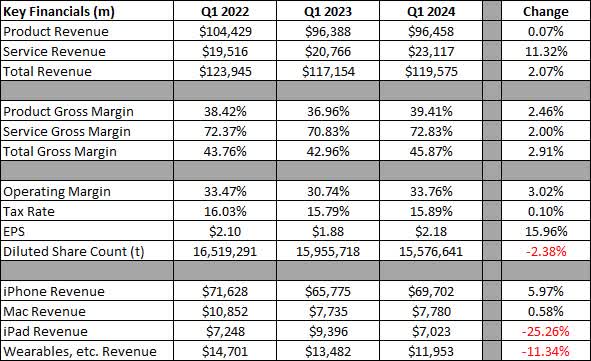

Overall, expectations called for just 1% year-over-year growth, but last year’s period did have an extra week due to the way the calendar fell. Key results compared to the past two fiscal Q1 periods can be seen in the graphic below. The change column represents the year-over-year change from Q1 2023 to Q1 2024, while changes in margins and tax rates are the actual percentage difference between the two periods.

Apple Q1 Results (Company Earnings Releases)

It was definitely nice to see a 6% growth in iPhone revenue, although, in recent years, the company has launched some higher-priced devices, so unit growth was probably a bit more muted. Overall, China sales were down more than $2 billion year-over-year, which did miss estimates a bit, but Apple was able to beat the Street for its overall total by about $1.4 billion thanks to the iPhone. The weakness in iPads was expected due to refreshes not being expected until March 2024, and the Wearables segment was hurt a bit by some bans on certain Apple Watches.

The one thing you can’t argue with in terms of Apple is its profitability. Apple reported a net profit of $34 billion, although that number was still down a touch from two years earlier. Gross margins continued their recent rise, although part of that is the Services segment taking a larger slice of the pie. The company’s operating expenses rose a little less than revenues did in percentage terms, which helped offset a slight headwind from other income items and a small increase in the quarterly tax rate. Earnings per share hit a new record, despite net income not nearly being as such, with a bit of help from the buyback.

Looking forward to the current quarter, management was fairly upbeat. It reminded investors that due to challenges in the December 2022 period, it saw a bit of extra sales and iPhone replenishment in the March 2023 quarter, which helped revenues by about $5 billion in sales. Thus, management called for similar growth rates for the iPhone and Services as compared to the December period, despite those rates in the December period being impacted by the extra week. Foreign exchange is also expected to be a little bit of a headwind. I don’t think Apple has a major iPhone sales problem that the Street was worried about, but things aren’t exactly firing on all cylinders either, which is why Apple shares dipped in the after-hours session once this guidance was given.

One worry as we move forward through calendar 2024 is regarding the Services segment. Not only did revenues in the latest period come in a little light, but Apple had to announce a number of changes to the App Store in the European Union to comply with the new Digital Markets Act. As a result, the company will receive reduced commissions, which not only will impact revenue growth but also margins for the segment. The Services segment is projected to be Apple’s best future segment for revenue growth and has the highest gross margins, so this could be a major deal if we see similar laws go into effect in other countries or regions.

One of the main reasons why I’ve been mostly neutral recently regarding Apple has been its valuation. Over the past year, the stock is up about 24%, but earnings estimates for this fiscal year and the next have only risen by about 2%. As a result, Apple shares went into Thursday’s report at more than 28 times earnings, an expensive number for a stock that is barely growing. As a comparison, you could pay another 4 points or so for Microsoft Corporation (MSFT), which is growing revenues and earnings by the mid to high teens at the moment. However, I’m hesitant to bet against Apple shares because I think the overall market will rise as we get closer to Fed rate cuts. A rising tide should lift most boats, and I think Apple could still do okay even if the results aren’t as great as previously thought.

I also can’t bet against Apple over the long term, however, just because of the strength of the company’s ecosystem. The installed base of active devices has now surpassed 2.2 billion, up about 200 million from a year earlier. The company generated more than $37.5 billion in free cash flow in the period, which allowed the greatest capital return plan in history to continue at a brisk pace. Apple has brought its share count down quite significantly over the past decade, and it will likely continue to do so as it moves towards its longer-term goal of being cash-neutral. To date, the current capital return plan has given back almost $840 billion to shareholders, and the company finished the latest period with a net cash position of $65 billion.

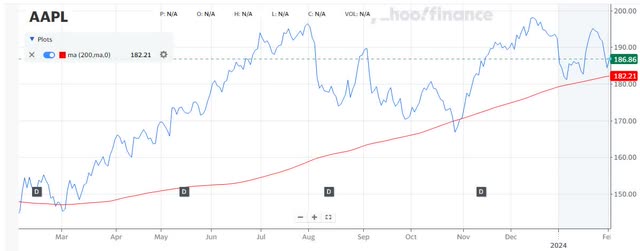

What could get me to upgrade Apple shares to a buy? First, I would really like to see the valuation come in a bit. In the past, I’ve talked about buying when the stock trades in the low to mid-20s on a forward P/E basis, and I think that’s a good starting point. Additionally, shares have been very close to their 200-day moving average lately, the red line seen in the chart below. The stock hasn’t spent a lot of time below that key technical level lately, so if it stays below this line after earnings, I’d like to see the stock settle for a little bit until the technicals improve a little.

AAPL Last 12 Months (Yahoo! Finance)

In the end, Apple Inc. announced a decent set of fiscal Q1 results, but the company overall just isn’t growing that fast right now. Last year’s extra sales week limited revenue percentage increases for the Services and iPhone, while product launch timing cut down the iPad’s figures. The company is a very profitable one with a very strong ecosystem and continues to generate lots of cash flow, which is why I remain a believer in the long term. However, this premium valuation and lack of growth currently keeps me from recommending the name as a buy in the short term, and the initial reaction from the Street was a near 4% decline in Apple shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.