Summary:

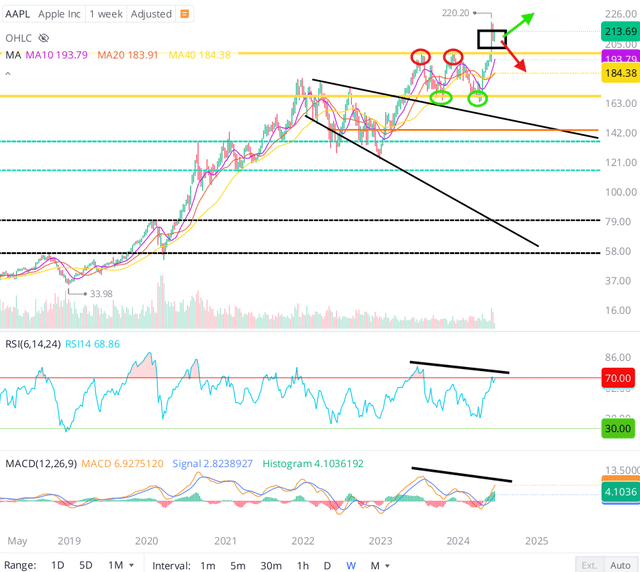

- The introduction of Apple Intelligence has triggered a sharp rally in AAPL stock, which has broken out to new all-time highs in recent weeks.

- While Wall Street analysts are raising price targets – chasing Apple stock higher – based on AI potential, but consensus estimates for revenue and EPS are largely unchanged!

- With a trading multiple expansion at the heart of Apple’s rally, I think the long-term risk/reward for AAPL stock is deteriorating.

- Warren Buffett is selling aggressively, and our valuation model predicts a downside of -45% for AAPL stock. Hence, I continue to view AAPL as a tactical “Sell”. Read on to learn more.

ozgurdonmaz

Introduction

On the back of announcing the addition of Apple Intelligence to its ecosystem at the 2024 WWDC event on 10th June, Cupertino tech giant Apple, Inc. (NASDAQ:AAPL) has seen its stock break out to new all-time highs:

Given its role as a pivotal gatekeeper of the digital world, investors seem to be giving Apple credit for joining the red-hot Generative AI trend. However, is the breakout in AAPL stock real, or are we looking at a bull trap?

Apple: Artificial Intelligence, Multiple Expansion, and Mixed Consensus Estimates

In my previous report on Apple, I wrote the following:

Apple is an incredible consumer products and services company that will continue to make billions of dollars in free cash flow every year; however, in the absence of growth, justifying a premium valuation such as the one commanded by AAPL stock is becoming increasingly difficult for investors. And in my view, this is why AAPL stock has massively underperformed its big tech peers so far this year.

Now, a high-moat business like Apple can certainly command an above-market multiple through a temporary growth slump; however, Apple’s future growth trajectory is a blur at this point due to the lack of a clear needle-mover. With Sam Altman (OpenAI’s CEO), Jony Ive (legendary iPhone designer), and Tang Tan (former Chief of Design at Apple) reportedly working on a new consumer AI device, for the first time in a very long time, there are questions around Apple’s dominance getting gazumped by the AI revolution. As you may know, Apple recently canceled its autonomous EV project to focus its efforts on GenAI, and now Apple is apparently in talks with Google to license Gemini AI for the next iPhone! Given Google’s botched AI product launches over the past year, Apple’s decision to partner with them reeks of desperation.

Under CEO Tim Cook’s leadership, Apple’s business and stock have gone from strength to strength, with incremental improvements across products and services, but Apple’s innovative DNA seems to have been lost with the loss of Steve Jobs. While Apple can still play a vital role in the fourth industrial revolution [AI], the Cupertino giant needs to get the house in order quickly and start delivering disruptive innovation again. The Vision Pro is a good start, but we still need to see a lot more data to trust the face computer as the next needle-moving product or platform for Apple!

By striking a deal with OpenAI [owned 49% by Microsoft (MSFT)] to bring chatGPT to Apple’s ecosystem (Siri in particular), Apple is simply catching up with its big tech peers like Microsoft and Alphabet (GOOG) (GOOGL). While privacy-focused Apple Intelligence is proof that Tim Cook and Co. are trying to get their house in order, none of the GenAI features announced at WWDC were truly groundbreaking. Apple’s promise of privacy is great, but I remain skeptical about an AI-driven supercycle for Apple until data shows otherwise.

Since WWDC, multiple Wall Street analysts have raised their price targets for Apple stock, citing its AI potential. However, as I see it, Apple relying on third-party LLM models to power Apple Intelligence exposes a lack of innovation at the iPhone maker.

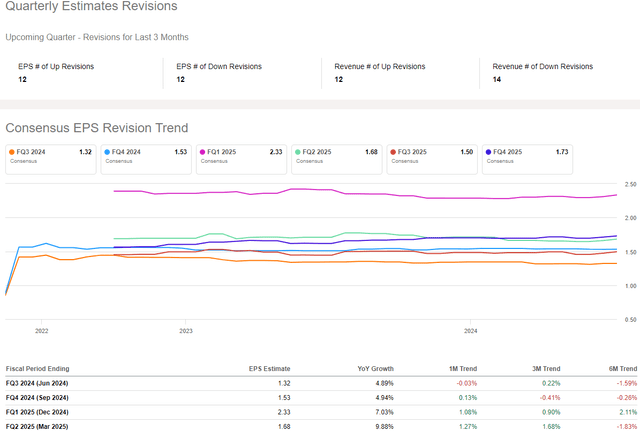

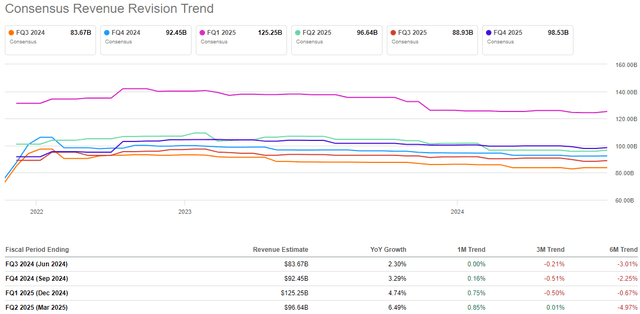

More importantly, consensus analyst estimates for Apple’s near-term revenue and earnings [EPS] still indicate low-single-digit y/y growth in upcoming quarters, and revision trends remain mixed!

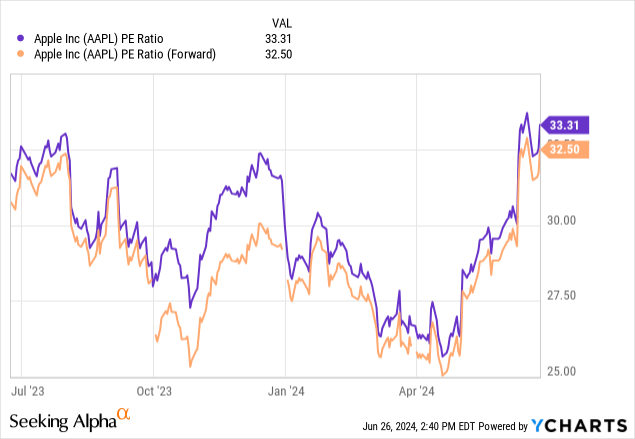

As a result, the entirety of Apple’s latest run up from the $160s to the $210s is directly attributable to an expansion in trading multiples, with AAPL’s forward-PE ratio going from ~25-26x to ~32-33x over the last few weeks.

Given Apple’s lack of growth, AAPL’s long-term risk/reward has deteriorated significantly in light of its latest run-up, as you can observe through TQI’s Valuation Model below.

Apple’s Fair Value And Expected Return

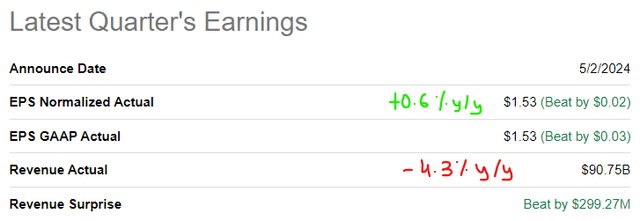

Last quarter, Apple outperformed top and bottom line estimates; however, revenues of $90.75B represented a decline of -4.3% y/y, and EPS of $1.53 grew by a measly +0.65% y/y [primarily due to stock buybacks].

While Apple’s leadership has guided for a swift return to positive y/y growth in Q2 2024, consumer spending is faltering amid a highly uncertain macroeconomic backdrop, which is bad news for Apple due to its heavy reliance on hardware sales.

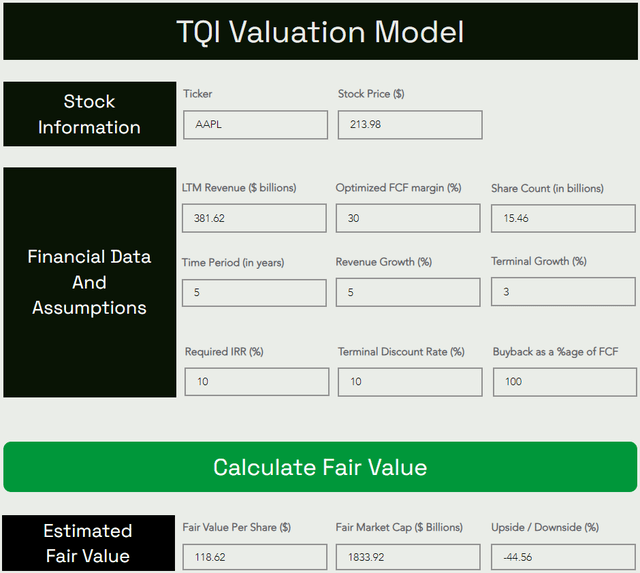

Despite Mr. Market’s excitement around Apple Intelligence, I am sticking with our conservative assumptions for future revenue growth and optimized FCF margins for today’s valuation exercise.

Here’s my updated valuation model for Apple:

TQI Valuation Model (Free to use at TQIG.org) TQI Valuation Model (Free to use at TQIG.org)

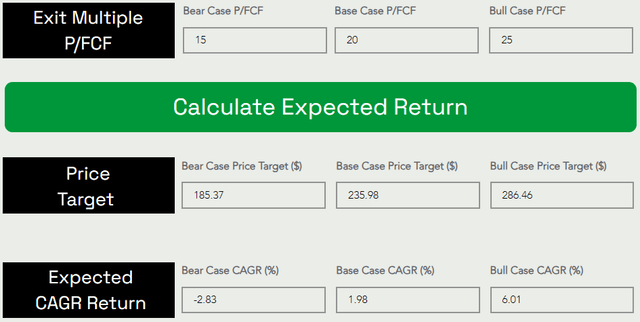

In light of recent developments, TQI’s fair value estimate for AAPL stock stands at ~$119 per share, i.e., a downside of -45%. Assuming a base case exit multiple of 20x P/FCF, I see Apple rising to $236 per share by 2029 at a CAGR rate of ~2%. Since Apple’s expected CAGR return is lower than our investment hurdle rate, long-term S&P 500 (SP500) annual return of 8-10%, and risk-free treasury yields of 4%+, I continue to view Apple stock as a tactical “Sell” at current levels.

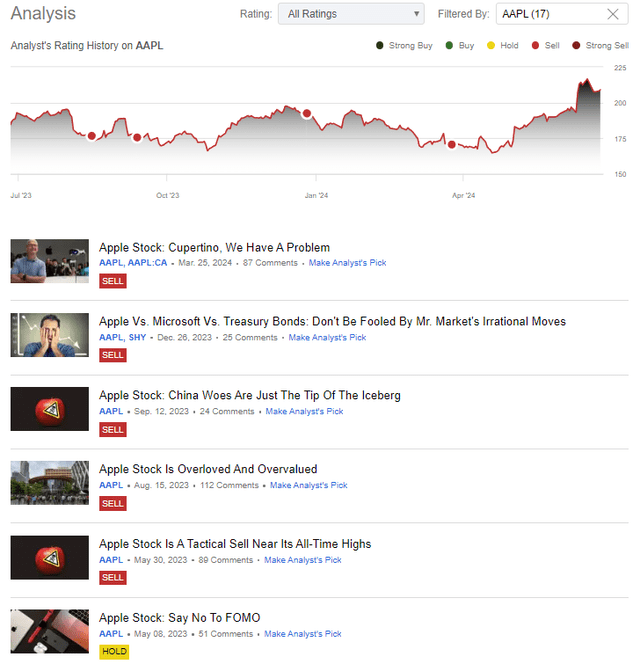

Over the past year, I have published several tactical “Sell” ratings on AAPL stock, citing its lack of fundamental growth, rich valuation, and poor long-term risk/reward:

Author’s Coverage on Apple (SeekingAlpha)

With AAPL stock sitting close to all-time highs in the $210s [+20% higher than my initial “Sell” call at $175 per share], I have clearly been wrong thus far. However, it is interesting to note that Warren Buffett’s Berkshire Hathaway (BRK.B) has trimmed its stake in Apple by 14% [or 126.2M shares] over the past couple of quarters.

As of today, Apple’s hardware and software ecosystem is unbeatable; however, the DOJ’s lawsuit against Apple is a wildcard that threatens this sustained competitive advantage. Hopefully, the antitrust overhang will accelerate Apple’s journey to its fair value – creating a worthwhile buying opportunity for long-term investors. Given Apple’s lousy growth numbers, I still think we will get an opportunity to buy Apple at or below fair value within the next 12-24 months.

Currently, I have no position in Apple stock. Warren Buffett is selling, and I think you should too!

Key Takeaway: I continue to rate Apple’s stock a tactical “Sell” in the $210s.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.