Summary:

- Apple is set to make its most significant new product launch in eight years at the upcoming WWDC in June.

- Apple’s mixed reality device is expected to take center stage at CEO Tim Cook’s keynote. However, initial expectations are low, and Apple is considered early based on its previous roadmaps.

- However, Apple’s massive installed base could deliver the crucial differentiating factor to help pave the way for developers to create “killer apps” for its MR device.

- Investors thinking Apple’s MR launch could flop might have failed to consider Apple’s unrivaled consumer ecosystem moat.

- However, its “F” graded valuation suggests that it’s too expensive to add at the current levels, as optimism over a successful launch has likely been baked in.

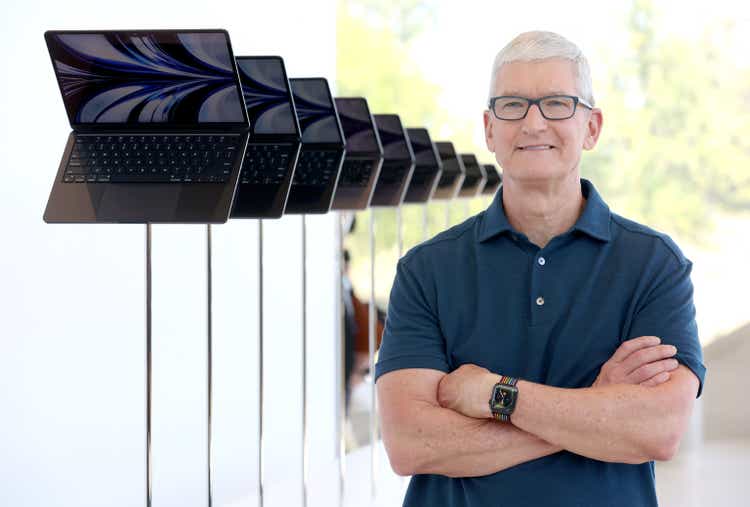

Justin Sullivan

Apple Inc. (NASDAQ:AAPL) has confirmed the line-up of its Worldwide Developers Conference, or WWDC, slated to start on June 5. All eyes will be on CEO Tim Cook’s keynote on the first day as the Cupertino company looks set to launch its highly-anticipated mixed reality or MR device.

DIGITIMES highlighted in a recent commentary how Apple has gone about its pre-WWDC releases differently from its past behavior. DIGITIMES noted that “Apple has been revealing upcoming software updates” before the event.

The updates include a “notable revelation” to Apple’s iPadOS, announcing the “launch of Final Cut Pro and Logic Pro,” which is considered a “departure” from Apple’s habit of keeping such critical releases under wraps before WWDC.

Therefore, it has been speculated that Apple is likely “clearing the way” to prepare developers to focus on what could be Apple’s most significant product release in “eight years.“

I think enough hype and anticipation have been built into Apple’s MR device release since the start of 2023. Notably, Bloomberg’s Mark Gurman has gotten his hands (incidentally) on Meta Platforms’ (META) “upcoming [XR] model, the Quest 3.”

Gurman’s review of the Quest 3 (expected to cost more than Quest 2’s $400) was positive, suggesting that Meta remains well-poised to be the market share leader in the lower-end segment. Moreover, Gurman highlighted that “Meta may even benefit from Apple helping popularize XR,” bolstering CEO Mark Zuckerberg & his Reality Labs team to push ahead before Apple’s mass market launch subsequently.

Notwithstanding, I think Gurman correctly identified that the critical battle for supremacy between Meta and Apple will likely come down to who can deliver the “killer apps.”

Meta possesses a “several-year advantage over Apple in top-flight games built for VR.” However, Apple could mitigate that advantage by “offering access to hundreds of thousands of iPad apps” and providing easy conversion into xrOS.

I think it’s essential for investors to note that Apple has always targeted the premium segment for its iPhone and allowed Android to corner the less profitable budget segment. Therefore, I don’t expect Apple’s hardware strategy for its MR device to be significantly different to protect Apple’s highly-prized profitability margins.

Therefore, while Meta could have a lead in the lower-end segment for now, Apple’s market leadership in the consumer ecosystem could still see it making more profits against Meta.

Meta has the world’s largest social network, with nearly 3B monthly active users. However, that hasn’t translated into runaway leadership in its XR business. Notwithstanding, Meta managed to accumulate about “20 million sales” for its Quest devices as of late March.

In contrast, Apple has revised its projections downward from 3M to 900K “due to factors such as cost considerations.” In addition, Apple doesn’t expect to make money initially, with the MR devices “sold roughly at cost.”

Deepwater Asset Management’s (formerly Loup Ventures) Gene Munster expects Apple’s MR device to account for 10% of its total revenue by 2030. He highlighted that Apple seems to be “entering the headset market earlier than it usually does when entering a new product category.” As such, he indicated that investors would need to account for higher execution risks compared to its other key product launches. Notably, he sees “two potential outcomes for Apple’s headset: it’s a flop or it’s a hit.”

I assessed that Apple likely sees the importance and urgency of defining the potential “post-iPhone era.” The rapid diffusion of the power of generative AI could help players like Microsoft (MSFT) make a comeback in defining a “platform shift” that could be detrimental to Apple’s gatekeeper ambitions.

I believe Meta likely sees significant potential in the interplay between AI and the Metaverse. Meta’s President of Global Affairs, Nick Clegg, highlighted in a recent event that “both generative AI and the metaverse can coexist and complement each other.” He added that “generative AI is essential for enhancing the metaverse experience and streamlining processes such as building virtual worlds.”

Therefore, I believe Apple is likely seeing a potential for generative AI to challenge its walled garden dominance as competitors build up their AI capabilities to define what could be the next computing platform.

However, Stratechery’s Ben Thompson reminded investors that Apple remains well-poised to benefit from the open-source generative AI community. Given Apple’s 2B device base (or 1B+ installed base), Apple is a behemoth in the consumer tech ecosystem. Therefore, he highlighted that the proliferation of open-source models could help Apple if its devices could perform generative AI at the edge.

Possible? You bet. Qualcomm (QCOM) CEO Cristiano Amon discussed in a recent interview that the leading Android chipset maker has a generative AI strategy at the edge, which it sees as the continued shift toward edge computing to benefit makers like Qualcomm. As such, the company has developed “hardware architecture that can support high-performance AI computations on various edge devices, such as phones, PCs, and cars.”

Who dares to bet against Tim Cook & his team that Apple doesn’t have such a strategy? But, most importantly, which company is the best-placed to navigate a shift toward MR or generative AI at the edge than Apple?

I believe Apple bears should not understate the significant moat of Apple’s consumer ecosystem. Moreover, Nvidia (NVDA) CEO Jensen Huang’s recent commencement speech at a graduation ceremony suggests why Apple’s massive installed base proffers it such a critical lead against Microsoft, Amazon (AMZN), or Meta Platforms.

Nvidia investors should know that Nvidia’s data center GPU moat stretches beyond its hardware capability. It has built up such a defensible moat with its CUDA ecosystem. However, Nvidia needed to solve a “chicken or egg problem” at the start.

Why? Because CUDA has no large installed base of consumers to start with. Nvidia couldn’t attract enough developers to build for CUDA without having a large installed base. Likewise, it couldn’t grow a large installed base of customers buying applications without having enough developers to build applications.

Hence, how did Jensen Huang solve this quandary? Here’s what Huang articulated:

So to solve the chicken or egg problem, we used GeForce GPU, our gaming GPU, which already had a large market of gaming, to build the installed base. – DIGITIMES

There you have it. Morningstar also corroborated the substantial moat of Apple’s iOS ecosystem:

Switching costs from iOS are as strong as ever thanks to more auxiliary products and services that make switching away from iOS more difficult over time, while a non-Apple iOS experience does not exist – Morningstar

Despite that, AAPL’s “F” valuation grade and less constructive price action suggest investors should remain patient about a pullback before adding. However, the lack of decisive sell signals indicates that AAPL could continue grinding higher and potentially re-testing its all-time highs.

However, I see the risk/reward as fairly balanced at the current levels, with no optimal entry points. Hence, I parsed that investors have likely baked in a strong slate at Apple’s upcoming WWDC as it looks to launch a new potentially category-defining product.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN, MSFT, QCOM, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!