Summary:

- Apple reported better than expected FQ2’23 results, and beat top line and EPS predictions by good margins.

- Weakness in PC shipments represents a headwind for Apple’s product revenue growth.

- $90B stock buyback comes at a time when shares are expensive again.

Nikada/iStock Unreleased via Getty Images

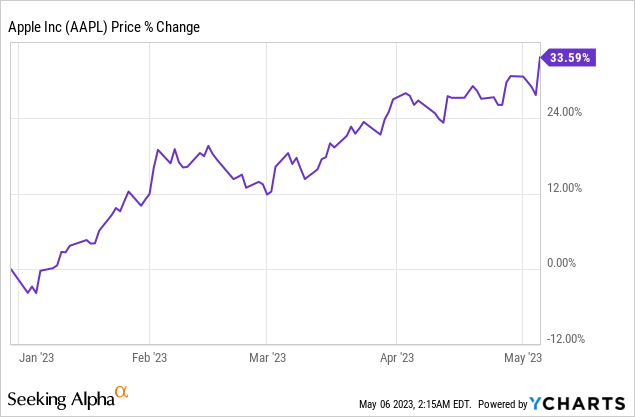

Apple (NASDAQ:AAPL) reported better than expected results for its second fiscal quarter on May 4, but the firm nonetheless saw a drop in its top line as moderating demand for consumer electronics and high inflation weighed on Apple’s performance. Although the top line effect was not as severe as feared and Apple beat top line expectations by $2.0B, I believe headwinds for the consumer electronics market are growing. Apple also announced a new $90B stock buyback… which unfortunately comes at a time when Apple’s valuation have seen a sharp revaluation to the upside. With headwinds growing and shares of Apple being expensive with a P/E ratio of 26X, I believe the risk profile is skewed to the downside!

Apple beat on the top and bottom line

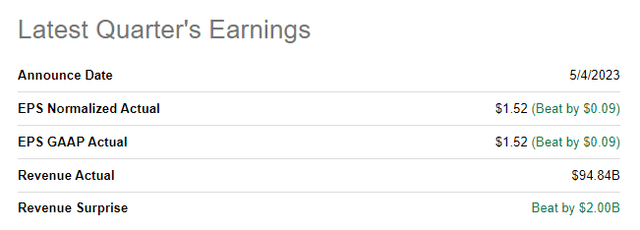

Apple reported strong results, with both earnings and revenues coming in above estimates for the second fiscal quarter. Apple reported EPS of $1.52 per-share, beating the average estimate by $0.09 per-share. Apple’s FQ2’23 revenues were $94.9B which beat estimates by $2.0B.

Headwinds to device shipments post a challenge to Apple’s top line growth

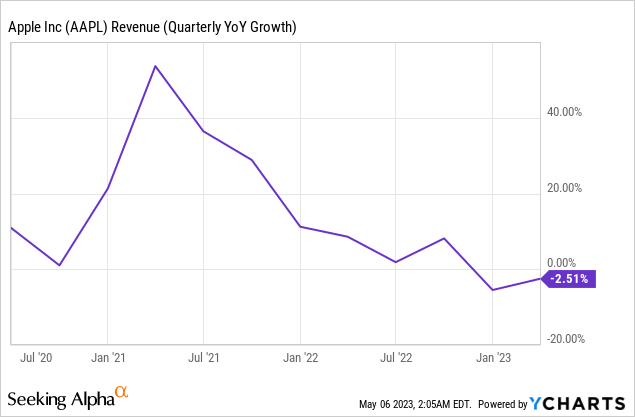

Apple largely sells its products to consumers, therefore exposing the company to cyclical changes in consumer spending. Apple has seen a slowdown in post- pandemic growth as consumers upgraded their IT equipment during the pandemic to prepare themselves for remote studying and working… which has resulted in a serious post-pandemic normalization of the company’s top line growth rates. In FQ2’23, Apple’s top line growth was (2.5)%, indicating that it is much harder now for Apple to generate product sales than at the beginning of the pandemic.

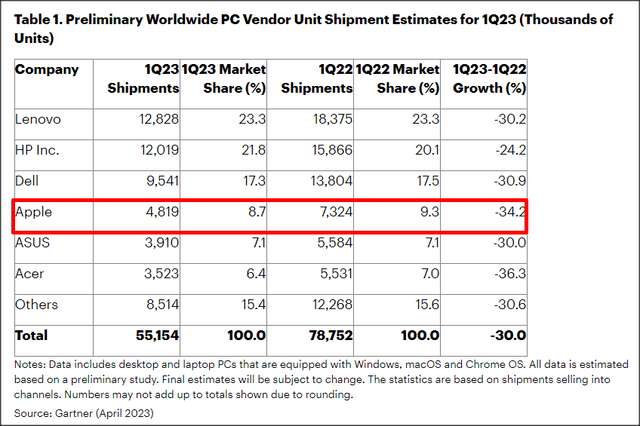

The correction in the PC market – which has been reflected in a steep decline in global PC shipments – is continuing as well: Gartner expected that global PC shipments saw double digit declines for most vendors, including Apple. Most vendors have seen steep declines in volume shipments in the PC market, including Acer, Asus, Lenovo and Dell. High inventories are also to blame for slowing revenue growth and since shipments decelerated sharply in the first quarter, Apple’s hardware business will likely remain under pressure in the next few quarters as well.

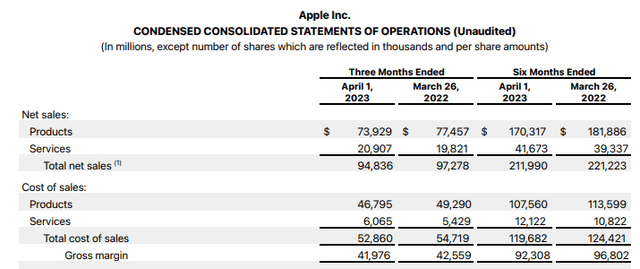

Apple’s product revenues in FQ2’23 declined 4.6% year over year to $73.9B due to weakness chiefly in consumer spending which has been reflected in a drop in global device shipments. Apple’s Services revenues, however, grew 5.5% year over year to $20.9B and reached an all-time record. Services revenues now account for 22% of total revenues, showing an increase of 2 PP year over year. Apple’s Services includes revenues from the sale of ads, AppleCare, digital content, Cloud, digital payments and other services and it is a fast-growing business for Apple with which the company can offset moderating growth in its mature product portfolio.

Why I believe Apple’s $90B stock buyback is misguided

Overall, I would rate Apple’s operating performance as solid, given how difficult the consumer markets are right now.

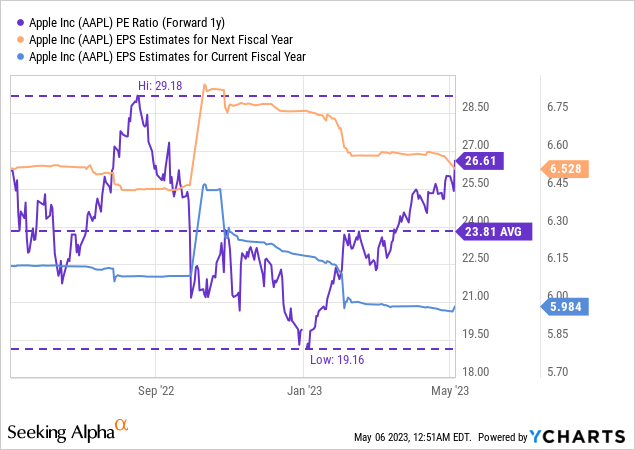

Apple also announced another $90B stock buyback authorization which indicates that the consumer technology company could repurchase, at its current valuation, approximately 3.3% of outstanding shares. The $90B stock buyback is obviously a big deal for investors, but I believe it is misguided. Apple’s shares have seen a strong upwards revaluation since the beginning of the year, resulting in a P/E valuation that is now above Apple’s 1-year average.

Instead, it might be better to invest more heavily into product innovation since Apple hasn’t had a new blockbuster product in years. Apple could also return more cash to shareholders as dividends which are more steady and predictable.

Oftentimes, companies buy back their shares at exactly the wrong time which is when they are expensive from a P/E point of view. Apple’s shares are currently valued at a P/E ratio of 26.6X… which is approximately 12% above Apple’s 1-year average P/E ratio. The best time for massive buybacks is when the stock is making new lows and the price-to-earnings multiple has contracted. At 26.6X forward earnings, there is a good chance that Apple is overpaying for its shares.

What is also a bit of a concern is that Apple’s EPS estimates have been falling, reflecting growing concerns over the level of device shipments in a market that is seeing growing consumer spending challenges. Apple is currently expected to see a 2% EPS decline in FY 2023 while FY 2024 EPS is expected to rebound 9%… and this may be an overly optimistic assumption if the market sees a recession this year. Currently, Apple’s EPS up/down estimate revision ratio is 3/13 and the revenue up/down estimate revision ratio is 3/14… meaning analysts expect continual top line and profit challenges for Apple. In other words, analysts don’t expect Apple’s competitive position to improve very much in the near term.

Risks with Apple

The biggest risk that I see with Apple right now is that consumer technology markets continue to erode and suffer from headwinds resulting from inflation as well as economic uncertainty. Revenues from the sale of consumer electronics products accounted for 78% of Apple’s FQ2’23 revenue mix. There is also a risk of overpaying for Apple’s earnings potential through stock buybacks, especially in a market that may not have seen the bottom yet regarding device shipments.

Final thoughts

Apple presented better than expected results for its second fiscal quarter, and the revenue decline was not as big as anticipated… which was definitely good news for shareholders. It is also good news that the Services revenue share continued to grow which helps Apple be less reliant on hardware revenues in the long term. However, hardware consumer electronics still make up the overwhelming majority of Apple’s revenue base and the company will be exposed to the weakness in PC shipments for quite some time.

The $90B stock buyback that Apple announced may not be as good a deal as investors think it is, which is because Apple’s shares, after a strong upwards revaluation in 2023, are now quite expensive on an earnings basis. With a P/E ratio of 26.6X (on a forward basis) and continual headwinds in device shipments, I believe the risk profile remains skewed to the downside!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.