Summary:

- February this year, I issued a conservative article on Apple arguing that the multiple is just too high relative to the growth dynamics.

- Since then Apple has delivered similar returns to the market, which were primarily driven by the massive share buyback program and AI potential.

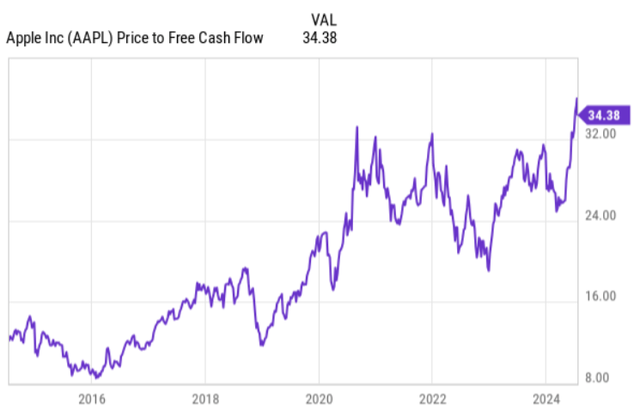

- During this time the P/FCF multiple has expanded from already rich level of 29x to 34x now.

- In the meantime, the sales dynamics have continued to be weak and the bets on Vision Pro seem to not be paying off.

- In this article I explain why, in my opinion, the current multiple is disconnected from the underlying fundamentals.

ozgurdonmaz

My previous article on Apple Inc. (NASDAQ:NASDAQ:AAPL) was issued in early February this year, when I made the case to avoid going long the stock. The reason was simple – too high multiple relative to the underlying growth. Back then the P/FCF multiple stood at ~29x, while the China sales were deteriorating and the only source of next growth wave was Vision Pro, which, in my opinion, inherently lacks traction in mass markets. Meanwhile, I also emphasized the danger of shorting Apple given two aspects (1) AAPL’s presence in the Magnificent 7 bag and all of the major equity indexes out there, where the passive flows do not care that much of multiples and (2) the Company’s cash balance in conjunction with strong free cash generation profile.

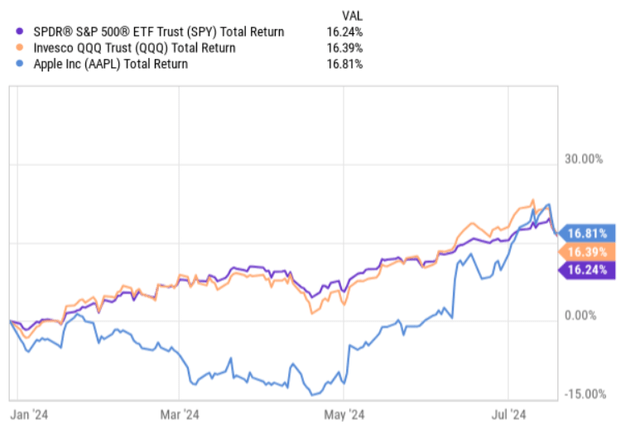

On a YTD basis, Apple has managed to deliver similar returns to those of the market as measured by the S&P 500 and Nasdaq-100. In fact, all of the positive returns from Apple have been registered since early May, when the Management announced a historical $110 billion share buyback program.

From the valuation multiple perspective (in terms of P/FCF) APPLE has become an even more expensive stock with the metric increasing to 10-year high – at P/FCF of ~ 34x.

This level of P/FCF could be easily deemed as very high and per definition requiring robust growth trajectory to compensate the investors for going long so aggressively priced asset. Plus, we have to consider that theoretically the fact that Apple trades at its 10-year high (from the valuation perspective) – and even above the period, when iPhone sales to China were booming and the interest rates were extremely accommodative – the current growth prospects have to be really strong to justify all of this.

Let’s now review the key data points that have emerged after the publication of my previous article on AAPL to determine whether it is a buy now.

Thesis review

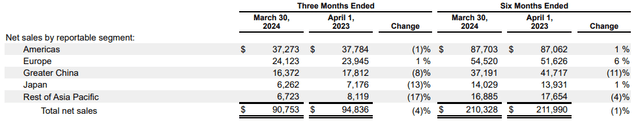

In my previous article I emphasized a slowdown in one of the key markets for Apple – China. Plus, the sales growth rate across other geographies was rather minimal and only barely offset the decline in China sales. So, the previous quarterly earnings report revealed a sales growth of just 2% relative to the comparable quarter year earlier.

Now, if we look at the most recent 10-Q filing (March 30, 2024), we will actually notice a drop in sales of circa 4% compared to April 1, 2023 results. The key driver of this negative dynamic was primarily the decline in iPhone sales (drop of almost 9%). Out of all product categories, iPhone is the most critical one not only from the sales perspective, but also from its inherent characteristics to serve as a material avenue for generating cross-sales on other AAPL’s products.

In the context of AAPL’s sales generation dynamics, it is also worth underscoring the fact that it is not only China region, which is struggling, but really the entire Asian continent that theoretically embodies the greatest growth prospects (especially compared to mature markets such as Europe and the U.S.).

AAPL Quarterly Report, May 3, 2024

Currently, one of the key hopes for AAPL is India, which exhibits strong sales growth patterns and has the potential to gradually become a very critical market for the Company. For example, the India revenue climbed by about 33% (to circa $8 billion) in the 12 months through March from $6 billion a year earlier.

Yet, if we take a step back and look at the absolute figures as well as the subpar momentum in current sales, what we could expect from India is to primarily offset the declining volumes elsewhere and / or contribute a couple of percentage points to the overall top-line number.

Speaking of the sales potential, we have to theoretically pay some attention to Vision Pro, which was expected to act as a major catalyst for AAPL’s increases sales generation. While we do not have concrete sales data for this specific product, it is clear that the incremental sales stemming from Vision Pro launch have been negligible. In fact, Vision Pro has not yet registered sales of 100,000 units in a quarter since its launch in the U.S. and instead it now faces a 75% decline in domestic sales in the current quarter. There have been some attempts from AAPL to strengthen this offering by launching it in additional markets and upgrading to visionOS 2, but I still find it difficult to believe that it will gain the necessary traction in the market to move the needle in AAPL’s total sales number.

Apart from the bets on Vision Pro, the Company has shifted its focus on AI (e.g., AI-focused chips) to exploit the opportunity set there. Currently, it is hard to predict how successful this area will turn out for AAPL, but I would certainly not accept a thesis that right because of this AI potential, AAPL deserves to trade at so high premium. The key issue, in my view, will be for AAPL to monetize the AI investments and convince the customer base to pay even higher price for some of its products due to a more expensive AI powered chips. Here we have to keep in mind the competition from other players and the customer motivation to pay higher for price for premium AI solutions. Now, I am not arguing that there will not be any uptick in AAPL’s top-line as a result of AI investments, but I am just questioning whether it will be high enough to justify the aggressive multiple.

Finally, we have to also factor in the major announcement of $110 billion share buyback program, which on the surface seems like a significant element driving the shareholder value up. However, there are two aspects that, in my opinion, render this activity not that important for the investment decision making:

- The $110 billion share buyback package is considerable from the absolute figure perspective, but in the context of AAPL’s market cap of ~ $3.4 trillion it does not play that huge of a role (i.e., it explains about 3% of the current market cap).

- From this move AAPL will drastically reduce its liquidity reserves, which means two things: (1) reduced income from financial investments and (2) reduced war chest that was considered one of the main sources of how AAPL would accommodate its future growth (e.g., by venturing into a massive acquisition).

The bottom line

All in all, AAPL is a sound business with a significant cash generation profile that enables the Management to announce significant buybacks, while keeping the growth agenda alive and financial profile strong.

The issue, however, is that the multiple is just too high and seems to keep rising despite the stagnating growth and ambiguous growth potential. Given the P/FCF multiple of ~ 34x, we should be talking about a sustained double digit growth, which is clearly not the case now. While there are some pockets of opportunities out there (e.g., India, Vision Pro, and AI offering), none of them are strong enough or embody the right prospects to both offset the subdued demand in Asia and fuel the double digit sales growth engine for AAPL.

As a result of this, I am still maintaining my conservative stance on Apple.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.