Summary:

- Apple has performed well in 2023, with its stock appreciating over 40%.

- Some analysts estimate that AAPL’s new virtual reality headset, Vision Pro, could generate up to $10 billion in revenue in the next five years.

- Apple’s strong management, new product offerings, and shareholder returns suggest the company’s prospects remain bright.

Media Lens King

A Year For The Books

In a market that seems to be emerging from the tech carnage of 2022 (leading many investors and traders to speculate that this shiny new bull market has legs), Apple (NASDAQ:AAPL) investors could be forgiven for looking at other companies and wondering what all the hubbub has been about with rising interest rates foretelling the doom of big tech – after all, the company has fared extremely well compared to its mega-cap brethren.

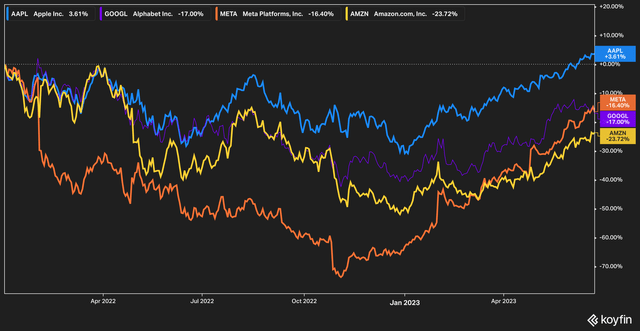

Looking back from the start of 2022 until now may not be pretty, but on a total return basis Apple has definitively out-shined Meta Platforms (META), Google (GOOG) (GOOGL), and Amazon (AMZN), being the only company to eke out a positive return over the timeframe. In 2023 alone, Apple stock has appreciated by over 40%.

The question, of course, is whether or not the good times can continue. Let’s dive in.

Is The Past Prologue?

We first wrote about Apple in January of this year, noting that the stock’s performance in 2022 represented, to us, an interesting opportunity to buy. Since then, the stock has risen by 35%.

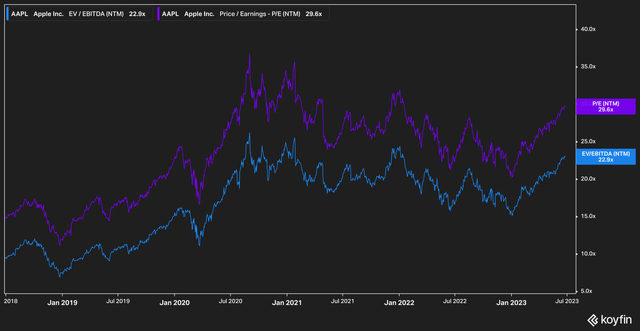

Before diving in, we’ll take stock of the current valuation picture and revenue potential for Apple. As we would expect, forward valuation metrics show us that the relative value of the stock has increased along with the price.

In 2023 Apple’s forward price-to-earnings [PE] has risen from close to 20x to 29.6x today. EV/EBITDA has risen similarly, from around 15x to 22.9x. Interestingly, while these valuations have risen during 2023, the rise has been more or less a return to familiar valuation territory for the stock since it reached peak valuation levels in 2020.

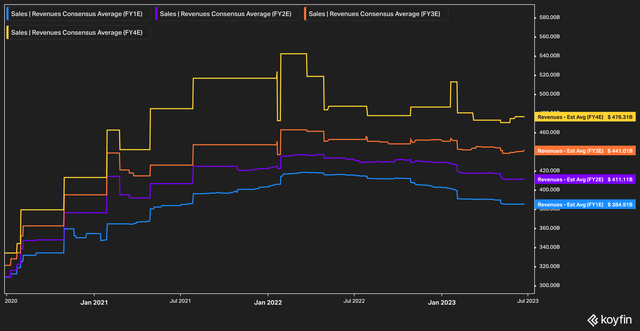

Revenue estimates for the next four years look good, but not great. Earnings expectations for the coming year have moved down off their expected high, while analysts expect that the next few years will be relatively flat (i.e., expectations have not been revised upwards).

Of course, this is Apple we’re talking about, and ‘flat’ to this company means $478 billion in anticipated revenue in four years’ time.

Looking Ahead

Apple’s second quarter results largely held no surprises with top-line revenue down about 3% year over year (although the company did reveal a nice bright spot of growth within India), but whatever earnings were reported were largely overshadowed by the launch announcement for Apple’s long-awaited virtual reality headset, the Vision Pro, which will be available for purchase in early 2024.

Predictably, Apple has priced the headset far above its competitors at $3,400 compared with sub-$1,000 headsets offered by competitors (Facebook’s Meta Quest 3 costs $499). Also predictable, however, are the early reviews that Apple’s headset product is far and away better in quality and experience than its competitors.

Of course, it’s easy to think that the market for Apple’s pricey virtual reality headset will be much smaller than anticipated, or that it will fail to resonate with customers in a meaningful way. After all, most consumers (and investors) have been conditioned in recent years to expect that headsets and virtual-slash-augmented reality devices and services will fail to live up to expectations – remember the Metaverse and Google Glass?

A slightly longer view, however, will remind us that Apple has confounded expectations of failure in the past and successfully broken into (or created) new markets that were previously thought to be inaccessible. The Apple Watch and iPad, after all, were both greeted nervously at the time of their launch.

We believe, however, that the decision is not binary. While it is not likely in our view that the Vision Pro will materially displace Apple’s smartphone business anytime soon, we also think that the headset will have a material impact overall in time as users discover the benefits of integrating the headset with Apple’s robust ecosystem. Worst case, we believe that the introduction of the headset means that Apple will not be left behind in the AR/VR race. In the best case, a recent Barron’s article highlighted the view of Evercore ISI analysts who believe that the headset could generate up to $10 billion in revenue for Apple in the next five years.

Prudent Management

Apple, of course, has more going for it than a new product launch. The company is famously well-run, and the most recent earnings provided some under-the-hood clues for investor that little has changed within the circular walls of Apple’s Cupertino headquarters.

To start, the company continued to repurchase shares. As Apple’s CFO noted in the most recent conference call, “we returned over $23 billion to shareholders, including $3.7 billion in dividends and equivalents and $19.1 billion through open market repurchases of $129 million Apple shares.”

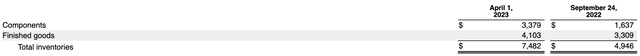

Apple also appears to be strategically re-stocking its inventory, as evidenced by a significant increase in carried component inventory.

Apple Quarterly Inventory (Company Filings)

The company increased its component inventory by nearly $2 billion. A buildup on this scale would generally raise our antennae for most companies as a potential red flag, but Apple management appears to be smartly taking advantage of what is expected to be a short-term decline in component pricing.

To this end, CFO Luca Maestri noted in the conference call that “[t]he environment on the component side is favorable,” and that the company expected this situation to continue into the third quarter.

Statements (and actions) like this should be music to investor’s ears and provide evidence that management continues to be alert and make opportunistic moves whenever they present themselves.

The Bottom Line

While it is true that Apple remains more expensive on a per-share and valuation basis than it was at the start of the year, we think there are ample reasons to believe that the company will continue to perform at a high level. From dynamic new product offerings to massive returns of capital to shareholders and a sharp management team, we believe that the principal risks to Apple come from the outside in the form of deteriorating economic conditions or geopolitical risk in the form of the company’s exposure to China for its supply chain operations.

On the balance, however, we think that the company could still have room to run, and that its prospects remain bright.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.