Summary:

- Apple’s stock price has likely benefited from the China reopening trade, given its exposure there. However, closer to home, we see technical signs that give cause for concern.

- Recently, Apple restarted its bear market trend by making a series of lower lows, while the Dow went in the opposite direction.

- Apple is continuing to make a series of lower lows, while the Dow Jones is making a series of higher high. One is leading the other.

Chip Somodevilla/Getty Images News

Recently, Apple’s stock price has likely benefited from the China reopening trade given its exposure there. However, closer to home, we see technical signs that give cause for concern.

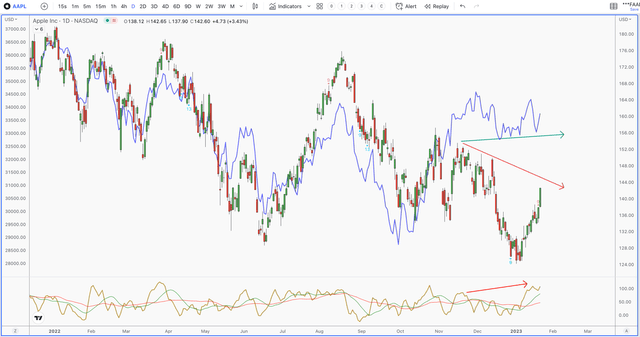

The divergence between Apple Inc. (NASDAQ:AAPL) and the Dow Jones Industrial Average Index (DJI) is alarming. More times than not, when important stocks/markets start moving in opposite directions, it’s a warning sign that one market needs to catch up with the other. The question is – which market is telling the truth?

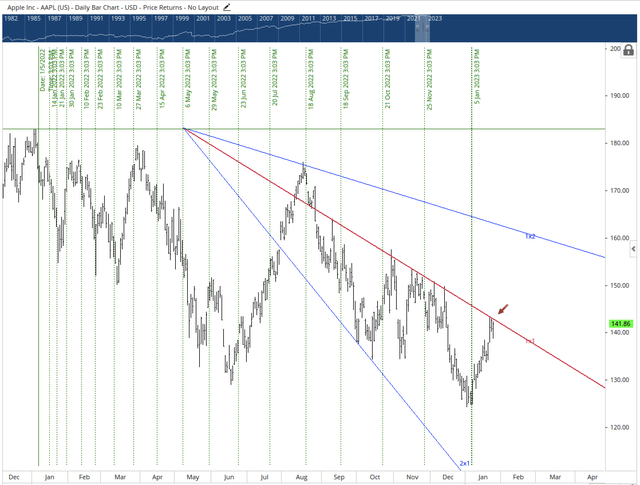

As you can see below, the Dow and Apple have traded in lockstep since the 2022 bear market began. Recently, Apple restarted its bear market trend by making a series of lower lows, while the Dow went in the opposite direction. We are seeing this pattern across many tech names; however, what makes Apple unique is that it’s currently 6% of the weighting in the S&P 500 (SP500). For reference, that’s more than Berkshire Hathaway, Exxon, United Healthcare, Johnson and Johnson, and JPMorgan Chase combined. Additionally, after the recent rally, AAPL is approaching key overhead resistance at the 200-day moving average.

What’s behind this divergence? I believe it’s Apple’s exposure to the overleveraged U.S. consumer. As of 2021, the average iPhone costs $873, up from $809 the year prior. Now, not everyone pays the full amount upfront, but the point is that the iPhone is an expensive consumer discretionary item. Since 2019, consumers are also using their smartphones for a longer period, with an average of a four-year replacement cycle compared to three years.

In the most recent October Q422 quarter for the 2022 fiscal year, Apple missed consensus on iPhone sales, which accounts for 47% of sales. The company did not provide any Q1 guidance for the 2023 fiscal year. For the stock to break through, it will likely require a significant positive earnings catalyst and/or outlook when it reports in February.

Since that October report, there is further data indicating that the condition of the U.S. consumer has only weakened and the headwinds have gotten stronger. This is important because the market is signaling a recession in 2023/2024. If the recession is consumer-focused, and deeper than anticipated, then the market will need to price in low consumer spending.

Consumer Is Weaker Than Market Has Priced In

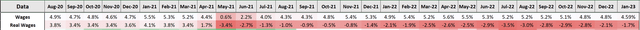

Though wages have consistently been up for some time, they have been unable keep up with inflation. As a result, real wages have been negative for 21 months in a row.

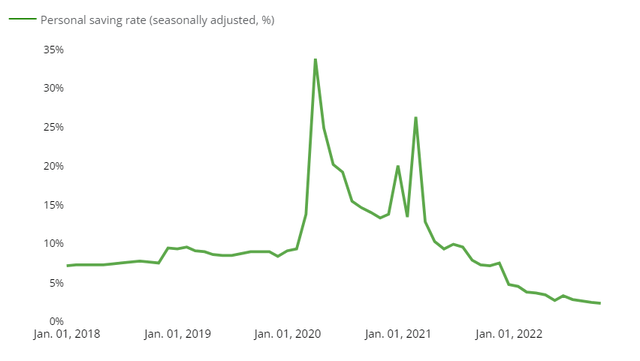

As a result, the Personal Savings Rate is at a 5-year low of 2.3% and near the record low set in 2005.

Sources: US Department of Commerce, US Bureau of Labor Statistics, Wall Street Journal (all sourced through Haver Analytics); Deloitte economic analysis.

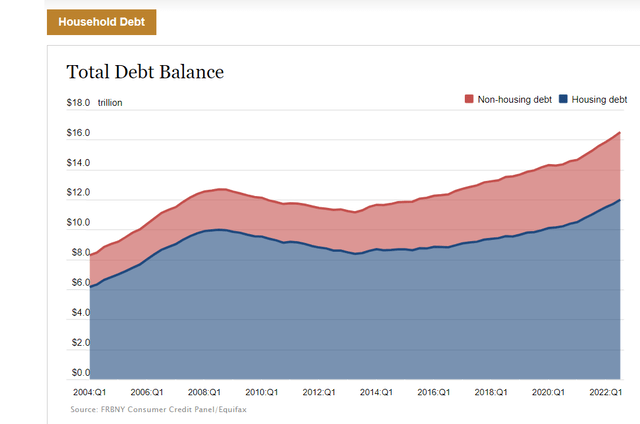

Meanwhile, U.S. consumer household debt continues to rise. According to the latest Q322 NY Fed Quarterly Report on Household Debt and Credit, household debt rose to $16.51 Trillion on Higher Mortgage and Credit Card Balances. Mortgages are the largest component of household debt. Balances climbed by $282 billion and stood at $11.67 trillion at the end of Q3.

FRBNY Consumer Credit Panel/Equifax

Within non-housing debt – credit cards, auto loans, retail credit cards, home equity lines of credit all have been increasing.

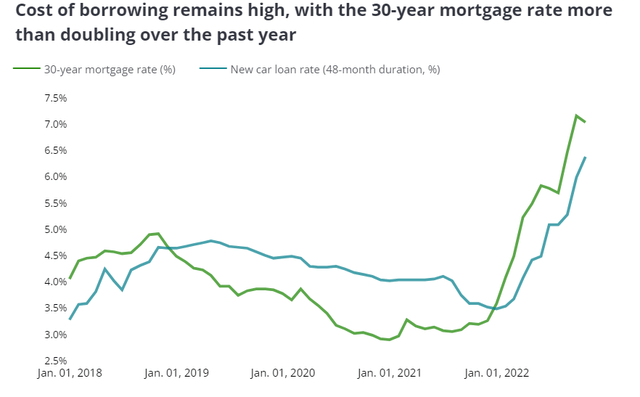

US Department of Commerce, US Bureau of Labor Statistics, Wall Street Journal (all sourced through Haver Analytics); Deloitte economic analysis.

The costs of borrowing continues to rise. Housing, Cars and Food costs take up 2/3 of the U.S. consumer budget. Meanwhile, in 2022, transportation is up 14%, food is up 11% and shelter is up 7% adding further pressure.

These key data points indicate that the US consumer is overleveraged and will continue to face significant headwinds. Given Apple’s exposure to the U.S. consumer, this is likely the driver behind the recent divergence between Apple and DJIA. Is Apple the canary providing a warning for the broader market?

Apple Earnings On Deck: What To Expect

Apple is scheduled to release Q1 numbers for the fiscal 2023 year on 2/2/23. The majority of recent analyst revisions have been downward. Consensus for the quarter currently stands at $1.96 compared to $2.10 the prior year. The market will be looking for an update on the supply issues related to the Foxconn factory and its impact on iPhone shipments, further guidance on FY 2023, and the general demand outlook.

We have written on Apple in the past here: Apple Is Tech’s Best Value Stock.

Conclusion

Apple Inc. is continuing to make a series of lower lows, while the Dow Jones is making a series of higher high. One is leading the other, and I believe we will find out which one very soon. Regarding Apple’s high market cap in the S&P 500, it will act as an anchor around the market unless we can see a breakout soon. I will not be bullish on an intermediate bounce until Apple can reclaim the below trendline.

Considering the deteriorating state of the consumer, and Apple’s reliance on consumer spending, any additional bounce into 2023 should be sold.

Next Thursday, on February 2nd at 4:30 pm Eastern, I will be holding a webinar for premium Tech Insider Network members to discuss how I plan to navigate the broad market, as well as various tech positions we are targeting to own this year.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Check out my premium service “Tech Insider Research”

Our weekly reports are 10–20-page deep dives on individual stocks. In the past years, our free analysis predicted Roku’s meteoric rise, Zoom’s IPO success, Nvidia’s sustained growth, Bitcoin’s rise, and more. My paid service has done much more.

In 2021, we predicted many 100%+ gains across cloud software, semiconductors, and bitcoin.

Give your tech portfolio an edge.