Summary:

- Apple faces significant challenges in China, with mounting competition from Huawei and strict AI regulations impacting market share and sales.

- Despite Apple’s efforts, sales in Greater China fell by 6.5% in Q2 2024, with Huawei gaining ground, especially in the foldable smartphone segment.

- AI features in the iPhone 16 are delayed in China, limiting its appeal compared to Huawei’s advanced AI capabilities and innovative product lineup.

- Apple’s struggles in China could lead to negative earnings revisions and market share losses in other Asian markets, impacting long-term growth potential.

nayuki

Apple, Inc. (NASDAQ:AAPL), since the launch of the first iPhone in 2007, has grown beyond what many investors thought possible. Apple’s market capitalization of close to $3.4 trillion is truly astronomical. The company has emerged as one of the biggest wealth distributors in the world, spending nearly $100 billion on stock repurchases in the past 12 months alone. Although I divested AAPL some time ago to allocate the proceeds to other fast-growing names (as a growth investor, I had to make that decision), I do not doubt that Apple will continue to be a good stock to own in the long run. However, a closer look at China, Apple’s biggest international market behind Europe, suggests the company has its work cut out to remain relevant in this all-important market.

The mounting competition from local tech giant Huawei in China has put Apple in a disadvantageous position, along with Beijing’s tightening AI regulations. Almost a year ago, I downgraded Apple based on valuation concerns, and the stock has gained 26% since then, trailing the S&P 500 by approximately 500 basis points. I am maintaining my bearish view of AAPL given the challenges the company is facing in China.

Apple Is Losing Ground In China

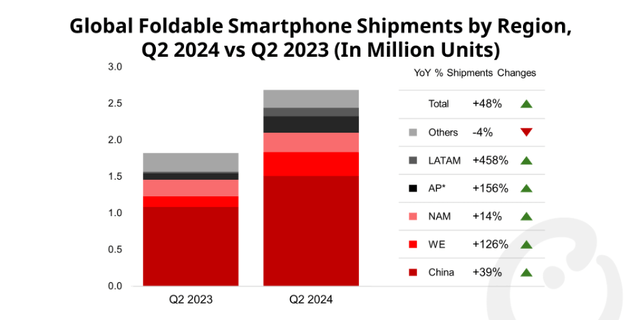

In recent years, Apple has faced challenges in retaining its market dominance in China’s smartphone industry. In the second quarter of 2024, Apple’s ranking slipped to 6th, while Huawei emerged as the 2nd largest player, following the success of its new smartphone lineup.

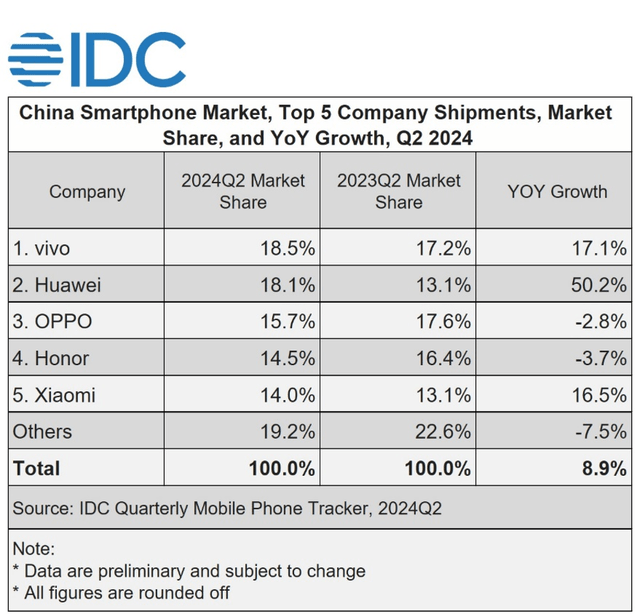

Apple’s quarterly results for the three months ended on June 30 showed a 6.5% decline in sales in the Greater China market, reaching $14.7 billion. For the nine months ended in June, Apple’s sales in Greater China fell by 9.7% YoY. The geopolitical tensions between the U.S. and China have played a part in this, with the Chinese government encouraging consumers to buy local technologies instead of Western brands. Chinese officials are requested not to use foreign phones for work as well. Apple is trying to grab back a fair share of the market in China. However, there are challenges in addressing the Chinese government’s strict regulations on generative AI, delaying the iPhone 16 series’ full potential in China.

Exhibit 1: Apple’s quarterly revenue from the Greater China region

FinChat

Since the launch of Mate 60 Pro in August last year, Huawei has been steadily gaining market share in China. Despite export control measures limiting Chinese tech firms from producing advanced chips, Huawei’s willingness to bear these costs has paid off. Huawei’s share of the Chinese smartphone market in Q2 2024 was 18.1%, representing a year-over-year growth of 50.2%. In the second quarter, Apple saw a 3% decline in unit shipments. Apple’s market share in China reached 13.6% in Q2, slightly below Xiaomi, which has entered a purple patch with Chinese consumers embracing its latest smartphones.

Exhibit 2: Smartphone shipments in China and market share

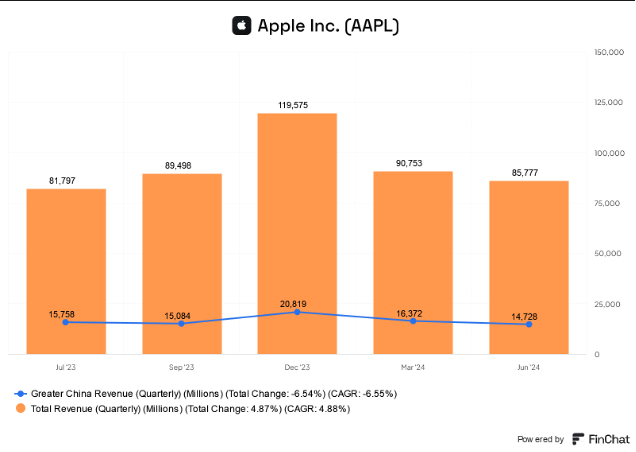

Huawei’s superior position with its foldable smartphone segment constitutes one of the most notable threats that Apple faces in China. Huawei announced that it will launch the Mate XT, a three-way foldable phone, on September 20, 2024, competing directly with the iPhone 16. This new model already boasts over 3.6 million pre-orders, depicting the high interest in China for innovative smartphones. Currently, Huawei has a commanding 27.5% share of the global foldable smartphone market and a much greater 42% share in the Chinese market. These figures indicate Huawei’s technological advancements and the strong interest in its foldable phones among global consumers, especially in Asian markets, where Android is continuing to dominate.

The global foldable smartphone market is expanding, with shipments increasing to more than 2.5 million units in Q2 2024, reflecting a 48% year-over-year increase. Nevertheless, it remains a niche market, accounting for only 1.3% of the broader smartphone market. The growing trend that has been experienced in the sales of Huawei foldable phones in China is, however, limited by other factors such as high prices and technical issues, including durability of the screens and hinge issues.

Exhibit 3: Foldable smartphone shipments by region

With approximately 17% of Apple’s revenue generated in China, the company needs to address the growing demand for innovative features in China to ensure that it will not lose market share to local competitors. For now, it seems like Apple is relying on promotional campaigns and AI to buck the trend, but a closer evaluation of Apple’s AI strategy suggests the company is already lagging behind market leader Huawei.

Can AI Features Turn The Tide For Apple In China?

The iPhone 16 is Apple’s response to the challenges discussed above. Tim Cook, CEO of Apple, recently said the company is entering a new era as artificial intelligence tools are touted as one of the key attractions for making consumers upgrade their devices.

Nevertheless, Apple faces challenges in implementing these AI capabilities in China. Although the iPhone 16 will be shipped to Chinese consumers on September 20, AI features will not be launched then. The policies of the Chinese government greatly restrict the proliferation of generative AI technologies. All AI models before launching to the public must be authorized and vetted. Apple Intelligence is not expected to be available in the Chinese language at least until the beginning of 2025, implying that Chinese consumers will not experience the full capabilities of the iPhone 16 for some time. Without these features, the iPhone 16 is likely to find it tough to grab market share from the likes of Huawei.

Following the reveal of the iPhone 16, Weibo (a platform similar to X) was flooded by trends focused on the release, with AI being the main focus. Most users were unhappy that the version available in China would not have the new features, and remarked that there was no point in buying an iPhone lacking AI capabilities. Some even made comparisons with the upcoming Huawei models in China, highlighting the technological superiority of Huawei’s latest product line. Moreover, Apple has neither named a local AI partner in China nor stated how it intends to follow the local regulations.

To make matters worse, there is doubt whether Apple Intelligence would ever be approved in devices sold in Mainland China, given that the 188 LLMs currently available for public use in China have all been developed by domestic tech companies. Apple Intelligence, if approved, will be the first foreign AI player to enter the Chinese market.

Even if Apple Intelligence features are approved in China, that does not guarantee immediate market share gains. In fact, Huawei currently offers seemingly superior AI features compared to what’s in store for the iPhone 16. While the major AI features launched with the iPhone 16 include advanced image editing, real-time text summarization, and advanced personalized assistance, Huawei, with its upcoming HarmonyOS Next operating system, is offering far superior system-level capabilities – not just application-level features. Some examples include image generation, smart assistant services for visually impaired users, advanced content creation tools, and even advanced voice repairing tools.

Counterpoint Research senior analyst Ivan Lam believes Apple Intelligence does not offer a clear advantage over existing AI features launched by Chinese smartphone manufacturers.

Apple Intelligence has not shown a clear advantage over the AI functions offered by other Chinese brands either, so the impact of AI will be limited for iPhone.

An exclusive report published by the South China Morning Post earlier today revealed that e-commerce platforms are offering the latest iPhone 16 devices at a discount to the official price, which is an alarming sign as it indicates lower-than-expected demand for these devices. For instance, the iPhone 16 Plus (512 GB) is available for 8,999 yuan on Pinduoduo, a steep discount from the official launch price of 9,999 yuan.

Financial Implications Of Apple’s China Struggles

As established earlier, China is one of the most important markets for Apple, generating close to 20% of annual revenue. In the long run, failure to win market share in the Chinese smartphone market will prove to be a massive damage to the ecosystem growth of Apple, limiting the topline growth potential of the company. In the short term, Huawei’s dominance in China will negatively impact the unit shipment growth expected by analysts in 2025, which may lead to negative earnings revisions. Apple’s failure to win Chinese market share despite offering substantial discounts also highlights the structural, systemic issues faced by the company. Such challenges may soon lead to market share losses in other neighboring Asian markets as well, given the similarities in consumer preferences in the East Asia region.

Takeaway

Apple, although a wonderful business, is facing significant challenges in China, one of its key global markets. The launch of the iPhone 16 is unlikely to reverse Apple’s market share losses in the foreseeable future, and the company does not seem to have a clear pathway to thwart the threat from domestic smartphone manufacturers, especially Huawei. Although I still expect modest revenue growth from Apple in the next few years, I do not feel comfortable investing in Apple today at a time when the company is showing some cracks in one of its most important markets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.