Summary:

- I’m sharing with you 3 things that I found strange about the new Apple product – Vision Pro glasses.

- I argue with a recent report from Goldman Sachs and cast doubt on the viability of Vision Pro and the too-bullish expectations associated with it.

- Based on common sense valuation, the upside potential for AAPL is limited to a low single-digit annualized growth rate over the next few years, in my view.

- So I reiterate my earlier Sell rating.

Ekaterina Rekina/iStock via Getty Images

You’ve probably read many articles – both positive and not-so-positive – about what follows from Apple Inc.’s (NASDAQ:AAPL) recently unveiled, highly anticipated next-generation spatial Vision Pro glasses, which are going to retail for $3,499. Apple CEO Tim Cook expressed his excitement over the long-awaited introduction of augmented reality [AR] technology, stating that it has the potential to unlock unprecedented experiences by merging digital content with the real world. This device, unlike competitors such as the Meta Platforms Inc.’s (META) Meta Quest, does not require dual joystick accessories but instead utilizes hand tracking, allowing users to control the interface through mid-air gestures, according to Seeking Alpha News. The introduction of Apple Vision Pro marks the most significant new product line for Apple since the launch of the Apple Watch in 2014, signifying the company’s venture into spatial computing and hinting at a wave of exciting developments in the future, people say.

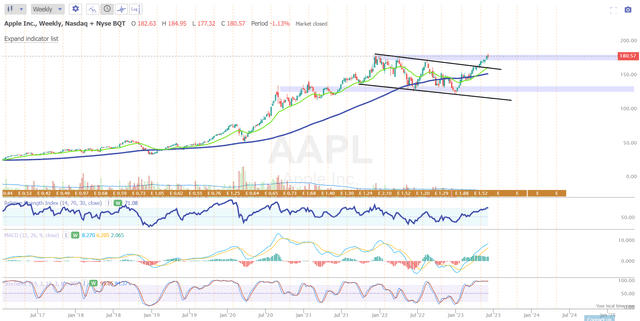

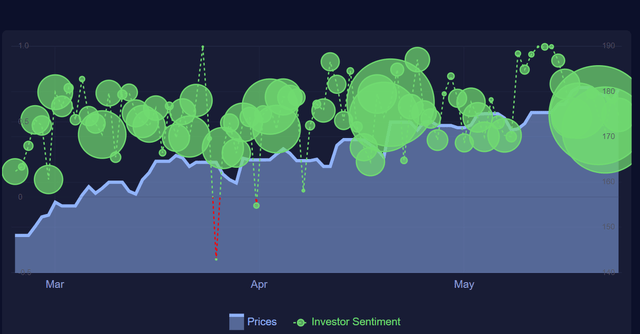

Thanks in part to this announcement, Apple’s stock shot to its all-time high while unsuccessfully attempting to break through strong technical resistance at around $180 per share.

TrendSpider Software, AAPL stock [weekly], author’s notes

It’s not the first time I’ve written about the stock, but lately, my bearish thesis hasn’t come true – in many ways, the most likely explanation is the emergence of a new bubble in the market, which I described in more detail in my other article.

Since no analyst can ever tell you when a new bubble will start and when exactly it’ll end, I suggest looking at the actual and relatively predictable data that is important to Apple and trying to evaluate it all in a reasonable and unbiased way. This is going to be a bit long, but let’s just try.

Apple Tries To Put Glasses On You

Let’s see what’s strange about the new Apple product.

First, the price, of course. Don’t skim as I know you heard it already in other articles, so I’ll try to point at this characteristic from a bit different angle. The first iPhone was introduced for $599 back in 2007 and then the median income of an American household was $50,233. This means that the iPhone accounted for ~1.2% of annual income, which is quite a lot, in my opinion [I’m talking about the annual pre-tax income here].

If we consider only those for whom the iPhone cost less than 1% of their annual income, there were 35 million such people. Thankfully, mobile operators helped, and by the end of the year, you could buy an iPhone for $399 with a 2-year contract. This expanded the market to 70 million Americans at the time.

The price of Vision Pro now amounts to 5% of the median income [$70,784]. And only for 7 million people, the new gadget won’t take more than 1% of their annual income. There is no assistance from mobile operators to rely on. So the initial market for the Apple Vision Pro is significantly smaller compared to the 1st iPhone. If one out of every ten people becomes an early adopter, it would result in only 700 thousand sales or $2.4 billion in revenue. But Apple is already giving positive projections of a planned 900,000 units sold in the first year since launch [~$3.15B in sales]. The management’s projection – if true – would account for 10.8% of iPad sales for FY2022 or approximately ~0.82% of Apple’s total revenue [TTM], to put things into perspective. Consequently, the Vision Pro may be categorized as a smaller ecosystem product, similar to Apple Pay.

Second, we haven’t seen anyone live (on stage) with Vision Pro glasses on their eyes. Send me a non-promotional video if you could find it. Going back to the example of the first iPhone, which was unveiled 6 months before it went on sale, the Vision Pro is promised to go on sale early next year. But at least then we saw the product in use – Steve Jobs showcased its features, including making a phone call, browsing the internet, and sending emails. In my opinion, there is a non-zero chance that Vision Pro may repeat the situation that happened with AirPower, the charging station Apple unveiled in September 2017 and promised to go on sale in 2018. After 18 months of silence, Apple announced that AirPower won’t hit store shelves.

Third, the possible use case confuses me. I don’t know about you, but if I were to spend $3.5 thousand on such glasses, I’d be primarily interested in more convenient content viewing and entertainment, not in routinely completing tasks like answering corporate email, scrolling through the newsfeed, chats, and the like. You know, to come home after a hard day at the office [the product’s main target audience, in my opinion] and watch a movie or dive into the metaverse [sometime soon this should become commonplace, right?] And if so, then I have a problem, because even if the product actually sees the light of day, it’ll only last 2 hours with a power bank in my pocket, if I want to move freely. If I’d want more, I’ll have to tie myself to a wall.

From all this, I conclude that by announcing what I think is obviously a half-finished product, the company has simply decided to prop up its high market capitalization with new growth expectations. However, as we can see, the actual incremental revenue stream won’t be big even if a) the product actually sees the light and b) Tim Cook’s positive projections come true [900,000 units sold in the first year]. And it’s far from certain that the production of these glasses won’t become an income drag for Apple, which could reduce the profit margin and EPS.

Apple’s Unjustified Valuation And Wall Street Expectations

A few days before the Vision Pro was unveiled to the public, analysts at Goldman Sachs updated their bullish thesis on Apple stock [May 22, 2023 – proprietary source] with a “Buy” rating and a 12-month price target of $209 per share [+15.7% upside]. Let’s take a look at the calculations that led them to these conclusions.

While the AR/VR industry has seen disappointments, analysts believe Apple has unique advantages that could lead to success in this space, such as its large user base, established developer ecosystem, existing content investments, direct sales model, and ecosystem benefits. They provided a hypothetical financial model suggesting that the AR/VR headset and related services could generate $11 to $20 billion [$15.5 billion in the middle] in annual revenue from FY2024 to FY2028 and contribute to net income growth.

The main advantage of Apple’s AR / VR offering is its integration with the rest of the company’s ecosystem, the analysts say:

GS [May 22, 2023 – proprietary source]![GS [May 22, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/9/49513514-16863005140271788.png)

As a counter-argument to those who consider the price of Apple’s glasses to be unreasonably high, Goldman Sachs cites the example of the above-average price of handsets, which is many times higher than the average price of a smartphone on the market.

GS [May 22, 2023 – proprietary source]![GS [May 22, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/9/49513514-16863006879852521.png)

Also, the company’s extensive retail network, with over 520 locations worldwide and plans for more, provides an advantage for introducing the device to the public. In contrast to competitors who struggled to showcase their headsets, Apple’s well-established retail stores, known for their comfortable and educational environment, can facilitate the mainstream adoption of mixed reality.

This is all great, of course, but what are the assumptions behind the $15 billion in additional revenue over the next few years? Let’s go from the top line:

GS [May 22, 2023 – proprietary source]![GS [May 22, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/9/49513514-16863008751121962.png)

First, I think we can forget about the “1 million devices sold in FY2023” right away – Apple won’t have time to bring the product to the market even if its own plans are fulfilled in my opinion. Second, the earlier statement about selling 1 million devices has been greatly reduced – by as much as 6 times, according to some rumors:

Accordingly, don’t even think about 5.5 million units sold in FY2024 – the plan now, as I wrote, is to sell 900,000 units.

The selling price in the 1st year of sales is expected to be $3.5 thousand, which is 16.7% below the projected price from GS. The price elasticity of demand will prevent the Goldman analysts’ projections from becoming reality if you ask me. I’m also confused by the forecast that Apple’s AR /VR solutions will have a 55% share of the overall market by FY2030 – as if Meta and other peers are doing nothing.

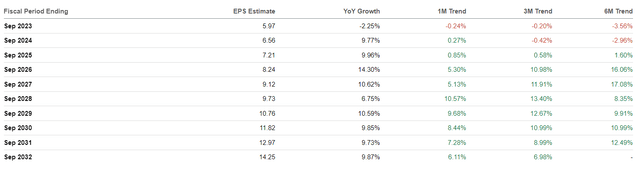

Surprisingly, with these positive forecasts and assuming this new segment’s EBIT grows at a CAGR of 57% [2024-2030], the incremental impact on net income will be ~1%. That sounds insane. And it doesn’t prevent analysts from continuing to raise their forecasts for the company’s EPS figures in the coming years and ignoring the existing risks:

Seeking Alpha, AAPL’s EPS Revisions

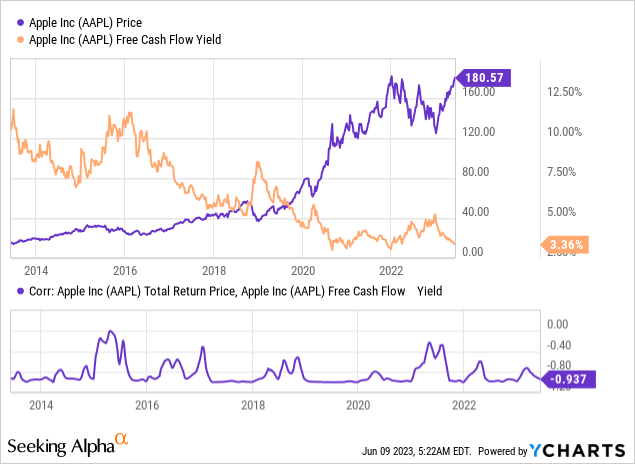

I bet you’ve heard many times that Apple stock is overvalued. I understand very well that no matter how high the P/E ratio is raised, Apple’s valuation doesn’t depend so much on fundamental factors as on the impact of buybacks and overall sentiment. But as long as the FCF yield is as low as it is now [3.36%], the initiative to use free cash flow to continue equally aggressive share buybacks is fading. If we look at the historical perspective, a FCF yield as low as today was the ideal tactical move to cash out until it improves:

Note: just look at the FCF yield’s peaks and bottoms and match them with the total return price

I’m increasingly reading the opinion that AAPL valuation shouldn’t matter in the long run because the company can easily outgrow it as time goes on. That’s a half-truth, of course – valuation is always important. But the company continues to grow its sales and profits, which can’t be ignored. But since most of you are long-term investors, it’s important to look not just 5 years into the future, but 10 years, and this is where Apple stock will most likely have problems in terms of total return. The S&P 500 Index (SPX) (SPY) (SP500), which includes Apple stock at 7.4%, has a strong correlation with its P/E ratio – the higher the latter, the lower the total return of SPY over the next decade:

Bank of America [June 8, 2023 – proprietary source]![Bank of America [June 8, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/9/49513514-16863032341537013.png)

If you believe that the current 7.4% share of the index of the 500 largest companies in corporate America is a stable value [which in itself is arguably historical nonsense], then Apple stock shouldn’t grow significantly even under this condition, since the lion’s share of the growth thesis is already priced in for the next few years.

Seeking Alpha, AAPL’s EPS Estimates [author’s notes]![Seeking Alpha, AAPL's EPS Estimates [author's notes]](https://static.seekingalpha.com/uploads/2023/6/9/49513514-1686303393204841.png)

The upside – if there’s any left – looks absolutely minimum right now, in my view.

The Bottom Line

Of course, I could be wrong again, as I’ve been several times in the past, and Apple stock may indeed continue to surf its new all-time highs every year from today. I can’t predict exactly when what I think is an emerging bubble of hope will burst.

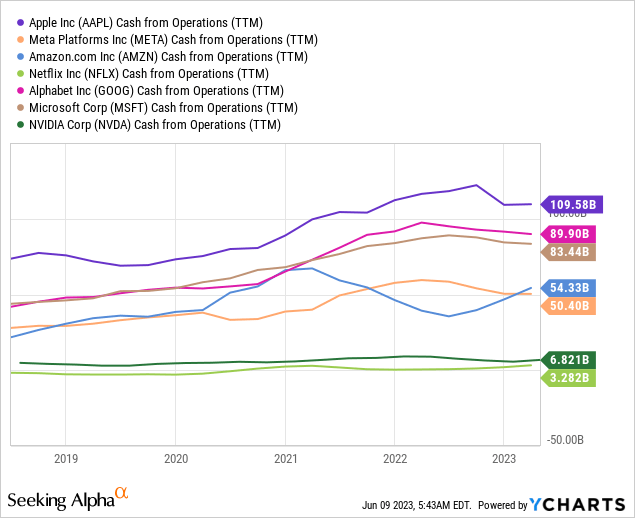

Also, one has to realize that buybacks will continue to play an important role in supporting the stock because no matter how low the FCF yield drops, the absolute magnitude of cash flow generated from operations looks absolutely unprecedented even compared to other FANGMAN companies.

Who knows – maybe my fears about slowing demand for highly elastic goods really that I have are overblown and Apple stock deserves all the positive sentiment we’re seeing now?

Macroaxis.com, AAPL’s sentiment analysis

However, these upside risks don’t change my overall assessment of the stock: At best, the upside potential is limited to a low single-digit annualized growth rate over the next few years. Apple is too expensive, and I believe the hype around AR/VR has only poured unnecessary and superfluous kerosene on this burning flame. I may be wrong, but Apple stock isn’t worth the risks at the current price level – so my Sell rating remains unchanged this time.

Thank you for reading! Please, let me know what you think in the comment section below!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

![wccftech.com [author's notes]](https://static.seekingalpha.com/uploads/2023/6/9/49513514-16863012570880787.png)