Summary:

- Apple beat estimates for Q4 earnings and revenues last week, but not by especially large margins.

- The tech company had record revenues in its iPhone category, but overall top line growth remained only at 6% Y/Y.

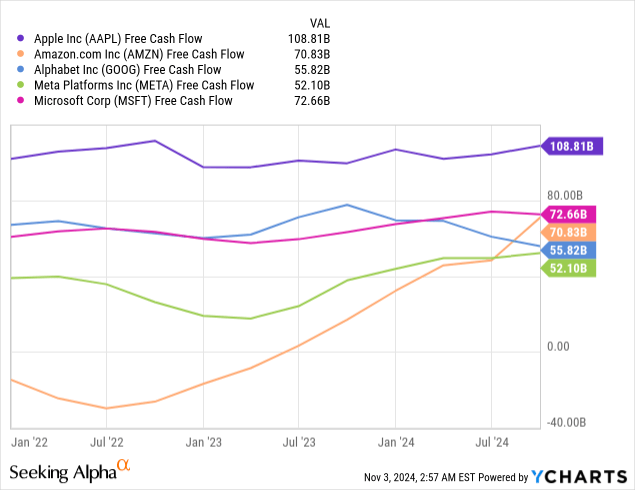

- Apple is the free cash flow-strongest big tech company and buys a lot of shares in the market.

- Apple unfortunately also has the lowest projected long-term EPS growth rate and a relatively high earnings multiplier.

Wongsakorn Napaeng/iStock Editorial via Getty Images

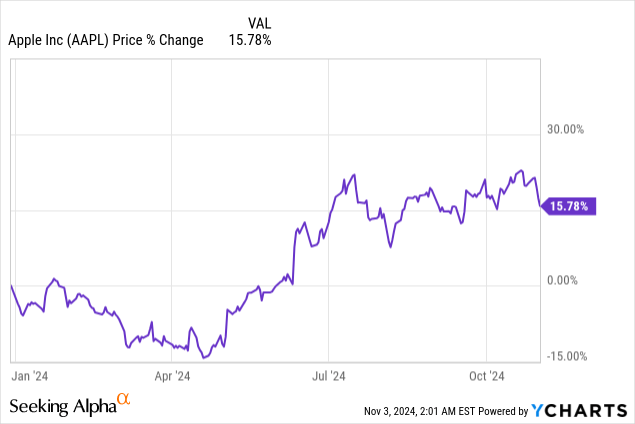

Apple’s (NASDAQ:AAPL) fourth quarter earnings sheet surpassed consensus expectations for the top and the bottom line last week as the company’s Services category marched on to new revenue records. While hardware categories are mostly seeing relatively muted growth, especially the iPhone segment, Services managed to grow at the fastest rate, indicating the growing importance of non-hardware revenue streams for the technology company. Apple also generated a ton of free cash flow, and investors can look forward to strong capital returns in the future. However, Apple has the lowest projected long-term EPS growth rate in the big tech group, and shares are likely about fairly valued here.

Previous rating

In August 2024, I rated shares of Apple a hold because of Warren Buffett’s escalating sales of Apple stock: Buffett Is Teaching The Market A Lesson. Apple’s significant Services momentum, however, is encouraging as the company for the first time reached $25B in quarterly revenue in this segment. In the fourth fiscal quarter, Apple also generated a material amount of free cash flow… which makes Apple one of the free cash flow-strongest tech companies in the world. However, I don’t consider the valuation especially intriguing here and with top line growth only being 6% Y/Y, I maintain my hold rating.

Strong fourth quarter earnings, Services momentum and free cash flow

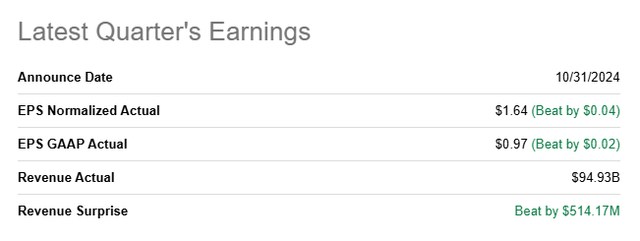

Apple beat consensus estimates for both the top and bottom line in the fourth fiscal quarter: the tech company reported adjusted earnings of $1.64 per-share which surpassed the average prediction by $0.04 per-share. Revenue beat the average prediction by a $514M, chiefly due to strength in Services.

Seeking Alpha

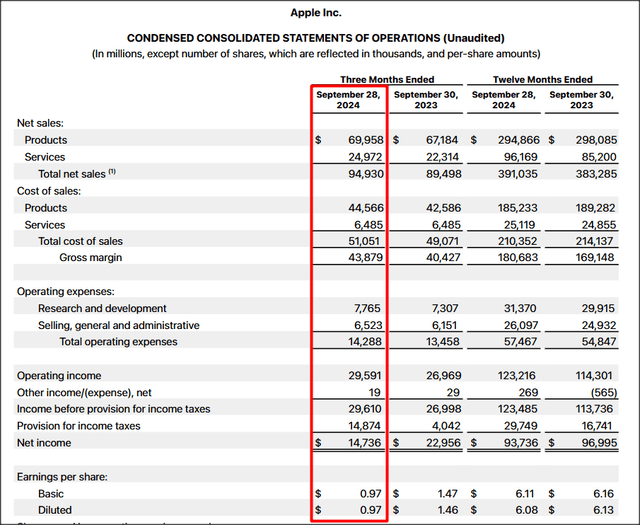

Apple generated $94.9B in revenue in the fourth quarter, showing 6% year-over-year growth. Sales in the iPhone category reached a new record at $46.22B and also increased 6% year-over-year. Apple earned $29.6B in operating income in Q4’24, showing 10% Y/Y growth. Its earnings, however, were impacted by a $10.2B income tax charge related to an unfavorable ruling by Europe’s highest court. The European Union’s Court of Justice ruled against Apple in September in a tax dispute and ordered the technology company to pay $14.1B in back taxes to Ireland. As a result, Apple’s net income dropped 36% Y/Y to $14.7B.

Apple

The main take-away from Apple’s fourth fiscal quarter earnings release was that the Services category continued to out-perform all hardware categories. Services generated $25.0 in quarterly revenues which calculates to a 26% revenue share and a growth rate of 12% Y/Y, by far the highest in Apple’s operating portfolio. In the year-earlier period, Services accounted for a 25% revenue share. The second-fastest revenue category was iPads with revenue growth of 8% Y/Y. The wearables category was the only hardware category which suffered a top line decline (-3% Y/Y) in the fourth fiscal quarter.

Services includes essentially all of Apple’s non-hardware revenue streams including Apple’s insurance program, the Apple One subscription service, iCloud, Apple TV+, Apple Music, Apple Pay, Apple Card and others. In my opinion, Services continues to be the most attractive segment for Apple with the most upside potential. I expect Apple to be able to grow Services to a ~30% revenue share by the end of last year.

In terms of free cash flow, Apple remains the most profitable big tech stock: in the last year, Apple generated $108.8B in free cash flow. The fastest growth in free cash flow in the last three years, however, comes from Amazon (AMZN), especially because of its Cloud business.

Further, a lot of this free cash flow is returned to Apple’s shareholders which makes the stock chiefly a capital return play. In fiscal year 2024, which ended on September 28, 2024, Apple repurchased $94.9B worth of its own shares compared to $77.6B in the previous year (+22% Y/Y).

Why I am sitting on the fence: Apple’s valuation + low EPS growth rate

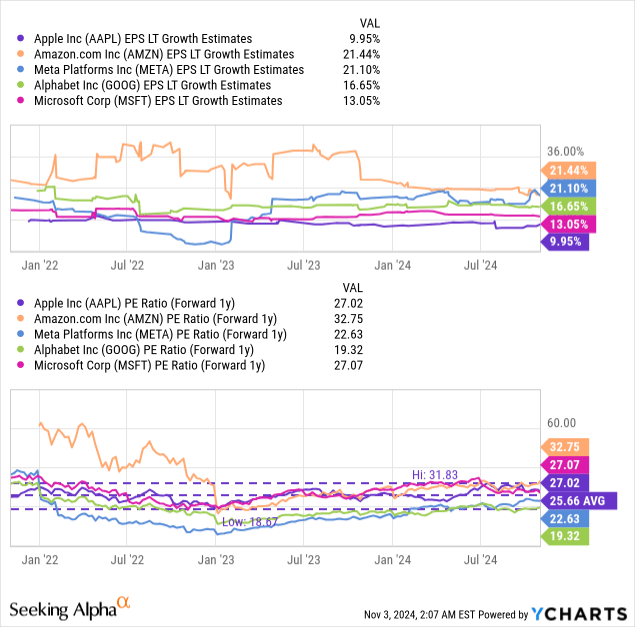

Apple is currently valued at a price-to-earnings ratio, based off of FY 2025 earnings, of 27.0X which places the company in the middle of the big tech group in terms of valuation and which is about 5% above the long-term average of 25.7X. Shares of the tech company suffered a setback at about the time Warren Buffett’s stock sales were reported in August, but have recovered moderately since. Still, from a valuation perspective, I don’t believe Apple’s shares are actually that attractive for investors.

This is because Apple’s revenue growth has moderated quite a bit in recent years. In Q4’24, Apple grew its top line only 6% Y/Y mainly because the company has not released any major blockbuster products in recent years. For comparison, Google (GOOG) reported 15% top line growth in the September quarter, due in large part to strong momentum in Cloud, while Amazon managed to grow its top line 11% in the September quarter. In the long term, analysts expect all of Apple’s big four rivals in the big tech group — Google, Amazon, Microsoft and Meta Platforms — to out-perform, by a large margin, Apple’s annual EPS growth: Apple is expected to grow its EPS only at 10% annually compared to an average 18% for the other four big tech companies.

Apple is operating in a very mature market for smart phones, laptops and computers, while other tech companies, especially Google and Amazon, are seeing strong growth in their Cloud operations. Therefore, Google represents the best value for me in the big five tech group, followed by Meta Platforms: Meta’s Valuation Makes No Sense. Amazon has considerable long-term revaluation potential in its Cloud business as well, which is where its operating income is surging, resulting in me putting a $325 price target on Amazon’s shares recently.

In my last work on Apple, I calculated a fair value of $215 for shares of Apple, based off of a fair value P/E ratio of 30.0X (based off of historical valuation ratios). This fair value has not changed for me after Apple’s Q4 and since Apple’s shares are currently trading at $222, I consider the tech company to be about fairly valued. However, if Apple were to see either an acceleration in revenue growth in its hardware or Service categories or were to debut a new flagship product, then I would certainly be willing to review my fair value target and stock rating.

Risks with Apple

The biggest risk for Apple, as I see it, relates to the company’s heavy reliance on hardware revenues. From a diversification perspective, Apple’s dependence on device sales — PCs, laptops, tablets and iPhones — is potentially problematic, especially during a down-turn in the device market. What would change my mind about Apple is if the company were to see deteriorating free cash flow or moderating growth in the important Services category.

Closing thoughts

Apple submitted a solid earnings sheet for the fourth fiscal quarter on October 31, 2024 and the consumer electronics company managed to beat both the top and bottom line consensus estimates, but not by especially large margins. Apple also provided further proof that the future of its business model, as far as top line growth and revenue diversification are concerned, are linked to the Services segment, which posted yet another record in terms of revenue in Q4’24. In my opinion, Services could represent ~30% of Apple’s total revenues at the end of next year, and I expect this percentage to successively grow going forward as well. However, I am on the fence with regard to Apple’s valuation which, given its relatively low EPS growth, represents an unattractive risk profile at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.