Summary:

- Warren Buffett’s investment in Apple stock aligns with his investing rules, such as a competitive moat and good management team.

- Apple stock does not meet Benjamin Graham’s value investing criteria, such as a low debt level and reasonable dividend yield.

- Although Apple is a great company, it may not be a suitable investment for value investors at its current price.

Scott Olson

More than a month ago Berkshire Hathaway (BRK.A) (BRK.B) had an annual general meeting with its stockholders. During the meeting, Warren Buffett, the company’s CEO, confirmed once again his bullish attitude towards Apple (NASDAQ:AAPL) stock, one of the biggest jewels of the corporation’s portfolio. Many authors here at Seeking Alpha agreed with the Oracle of Omaha. Since then, many bullish materials have been written. In my view, AAPL stock is a good investment for Warren Buffett. But it would have not been a very sound bet for Buffett’s mentor Benjamin Graham and his value investing approach, in my view. Personally speaking, I would not buy AAPL stock right now at the current valuation.

Warren Buffett – Rules of Investing

I am sure many of you know that Apple stock still takes the most share of Berkshire Hathaway’s portfolio. It is one of the most successful investments for Mr. Buffett that has been steadily rising in value.

Warren Buffett had a teacher called Benjamin Graham that taught him his own investing method. Yet, Buffett’s investing method differs from that of Graham. Let me first tell you about the rules of investing the Oracle of Omaha follows and why AAPL is his favorite investment.

Here are Buffett’s investing rules:

- Some people say that Warren Buffett is a value investor. One of his rules involves buying stocks at low multipliers. Because value investing involves finding companies that are undervalued and underestimated by the market… I perfectly understand and respect this rule which allows market participants to avoid glamorous and overpopular stocks that are far too expensive. But Buffett is not always a value investor. On the surface, it seems like Berkshire Hathaway is holding a growth stock in Apple. However, AAPL was purchased back in 2016 when it was much cheaper than it is now. Unfortunately, we do not know the exact date when Berkshire Hathaway first opened a position in Apple. All we know for sure is that sometime during the first quarter of 2016, the company purchased just over 9.8 million shares.

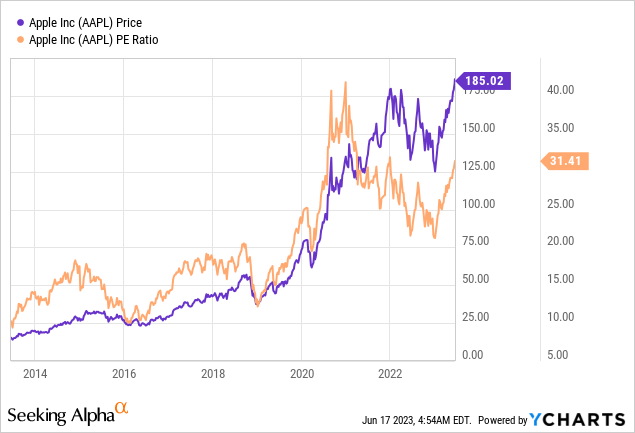

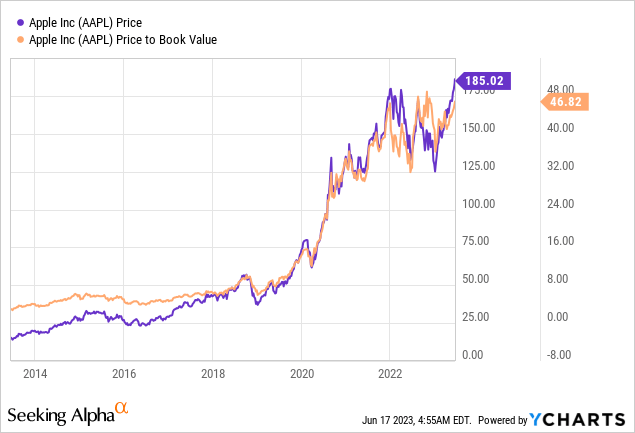

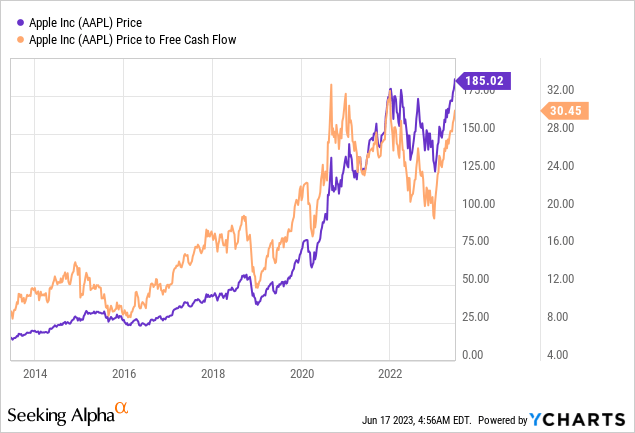

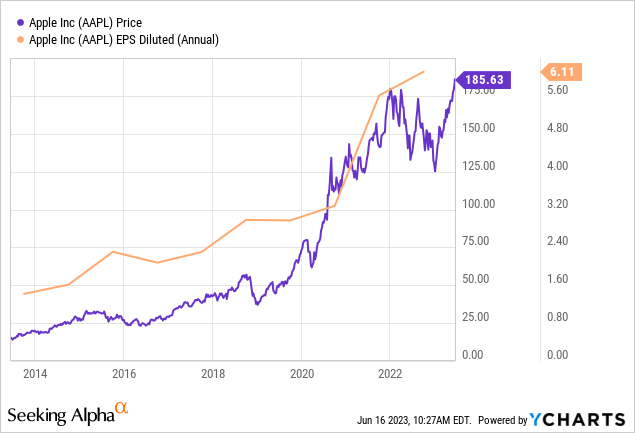

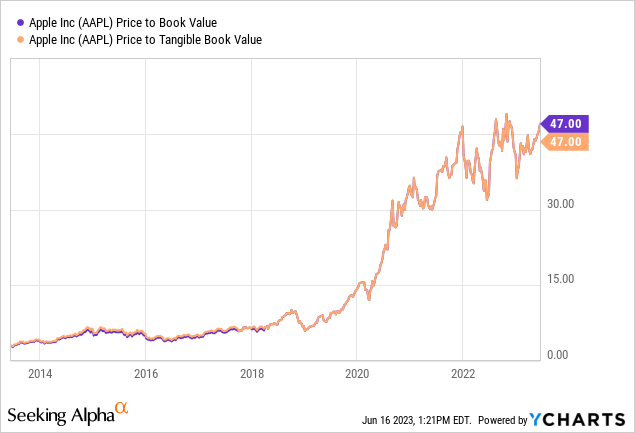

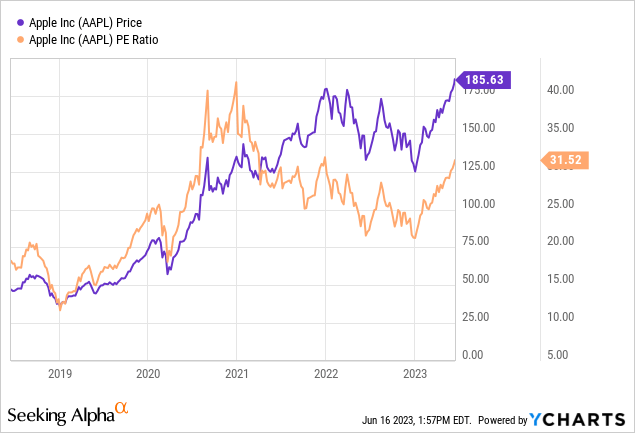

I have prepared the diagrams below to illustrate Apple’s historical valuation ratios. The stock was initially purchased in 1Q 2016 by Berkshire at a price-to-earnings (P/E) ratio of slightly more than 10x, a price-to-book (P/B) ratio of around 6x, and a price-to-free cash flow (P/FCF) ratio of no more than 10x. As of the time of writing the indicators are 31x, 47x, and 30x respectively.

But Buffett has not reduced his stake in AAPL. In fact, he has grown the stake. But if you are thinking about buying Apple’s stock, remember that it is not cheap now. It might keep rising in value for a while. But I would not personally touch it right now. My sentiment remains intact since my last article on Apple.

Another investing rule:

- Invest during market turmoil. This is a good rule to follow as well, in my opinion. It is quite a risk to invest heavily just when everyone else is too optimistic because it means you are likely to overpay for the assets you buy. The year 2016 was complicated for stocks. It is not appropriate to compare it to the shocks of 2020 or 2008-2009, for example, but we know say Buffett did not first buy AAPL during the bull market. Berkshire Hathaway keeps raising its stake at AAPL even during fair days.

- Buying assets for the long term is another rule Warren Buffett considered to be important. Most of Berkshire Hathaway’s holdings have been owned for many years. As the Oracle of Omaha once famously said, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” This is a good approach, in my view, because you avoid acting like a speculator with a short-term investment horizon. But sometimes market situations change. So, you really need to have faith in the asset you buy. As I have mentioned above, Buffett has been holding AAPL since 2016 and has not appeared inclined to sell it. It is indeed a profitable company with a strong market position, so it may be reasonable to believe Apple’s still have a bright future.

- Invest in companies with a competitive moat. A competitive moat means a competitive advantage the business has over its competitors.

Buffett said it was the most important criterion of successful companies. He compared this advantage to a “moat” surrounding an “economic castle.” The more unique the competitive advantage is, the more likely the company will do well over decades. There is no doubt Apple has a competitive advantage over its peers in the production of electronics. In my view, Apple’s most important strength is its strong brand image. Its products are perceived as premium quality goods and consumers are often willing to overpay for these. I am sure many of you have seen crowds of people waiting outside of Apple shops waiting for a new model to get delivered to the shops. No doubt, it is also an important reason to invest in Apple’s stock.

- Invest in companies with a good management team. I am sure no one doubts Tim Cook’s competence. Since he took his place as Apple’s CEO in 2011, he diversified the company’s business. Apart from traditional electronics, Apple has also launched its payment system, a streaming platform, cloud, and advertising services. In fact, as reported in the release of the full-year results, Apple’s services were its second largest revenue source. The point I am making is that the company is growing and expanding into different product categories. It is possible to destroy a company with a great competitive advantage if it does not have a good management team.

- Invest in companies you know. That is obvious for Warren Buffett. He is known for reading all of the published documentation for each of Berkshire Hathaway’s holdings. This means all of the annual reports, financial statements, earnings releases, presentations, industrial analyses, and many more. He regularly reads hundreds of pages of information to assist his investment decisions. So, he obviously knows Apple’s business very well.

But the entire criteria I have mentioned above is not enough to convince me to buy AAPL stock right now.

Ben Graham’s investment criteria and AAPL stock

Now I will try to show you why AAPL stock is not a great investment at the moment according to Benjamin Graham’s investment criteria.

- First of all, Ben Graham liked to invest in large and sound companies that have been existing for many years. That’s important for me as a conservative investor. Obviously, Apple, the most valuable corporation in the world, fulfills this criterion.

- Then, Ben Graham liked the company to have a current ratio of more than 2. According to Apple’s latest financial results, its total current assets are $112,913 million, whilst its total current liabilities are $120,075 million. Since the current ratio is current assets/current liabilities, Apple’s current ratio is about 0.94x. This is substantially below Graham’s requirement. I would not personally demand a ratio of more than 2x. But it’s important to have a ratio above 1x, at the very least.

- His other criterion was a low debt level. The total debt should be less than two times the net current asset value (NCAV). NCAV is calculated by subtracting a company’s total liabilities from its current assets. As I have mentioned above, Apple’s current assets are just $112,913 million, whilst its total liabilities are $270,002 million. So, we get a negative value and this criterion is not fulfilled. Graham also said the company’s total debt should be less than its book value. Again, this criterion is not fulfilled because Apple’s total debt is $109,615 million, whilst its book value is just $62,158 million. Well, that’s a concern. But Apple is not headed for bankruptcy. At the same time, it is rather a disadvantage for such a renowned and large company to have such debt ratios.

- Then, the company should have stable earnings growth.

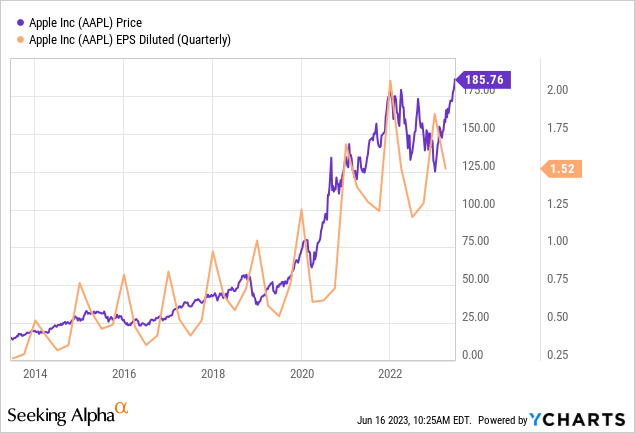

Below is the quarterly EPS history.

It seems that quarterly EPS has not been growing in the recent couple of quarters. However, it is a volatile indicator. So, turning to the annual EPS history below, we can say the earnings have been growing well. But only in the last 2 years has the growth rate been very high. Normally, such an EPS growth does not last for a long time.

But overall, the earnings have been rising, not falling. I would say, the earnings are good and encouraging for me as well.

- After that, according to Graham, a company should consistently pay dividends and have a reasonable dividend yield. It should be at least two-thirds of the AAA bond yield. As of the time of writing, Moody’s seasoned AAA corporate bond yield is at 4.67%. Apple’s dividend yield is currently lingering at around the 0.50% mark. Again, this criterion is not fulfilled. I can personally accept such a low dividend yield, provided the company’s stock has a huge growth potential.

- Graham also insisted that investors should not overpay for the assets they buy. So, in order to make sure the stock is fairly valued or even undervalued, Benjamin Graham advised checking for a stock’s price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and also the price-to-tangible book value (P/TB) per share. Ideally, the stock price should be below two-thirds of its tangible book value per share and also below two-thirds of its Net Current Asset Value (NCAV). The P/E ratio should be less than 40% of the highest P/E ratio the stock had over the past 5 years. Apple fulfills none of Graham’s valuation criteria.

To start with, Apple’s P/B ratio is near all-time highs. Obviously, the company’s stock price is far above its book value of $3.95. As I have mentioned above, Apple’s NCAV is a negative figure and cannot be compared to its tangible book value. Now let us look at Apple’s P/E ratio.

Apple’s P/E ratio is not at its all-time high. It is currently lingering near the 31.50x mark. This is about 33% below its 5-year high of 42x. But still, this is not 40% below the 5-year high.

The valuation concern is the biggest one, in my view. So, even if I accept AAPL stock’s other imperfections, I will not buy it now because it is far too expensive.

My take

As I mentioned at the beginning of my article, AAPL is not a great fit for Benjamin Graham. However, it is a suitable investment for Warren Buffett, given Apple’s competent management and its economic moat. Then, don’t forget that Mr. Buffett first invested in AAPL when it was really cheap. It is not cheap at the moment. So, if you are a value investor, think twice about buying it right now. No question, it is a great company that is highly likely to just keep growing. But I would not personally buy this great corporation’s stock right now due to what I see as an overvaluation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.