Summary:

- Apple’s stock has declined by ~10% after reporting negative sales growth for the third consecutive quarter.

- The company’s hardware business is struggling for growth, but its Services business is sparing some blushes with healthy growth.

- Apple’s stock is overvalued and has a downside risk of around 30-35% based on DCF valuation.

Lauren DeCicca/Getty Images News

Introduction

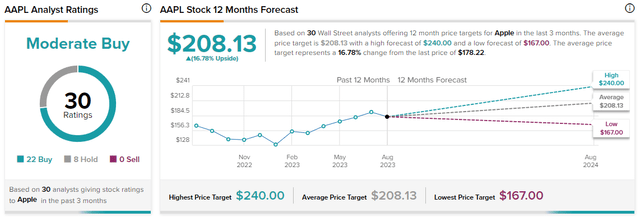

Despite reporting negative sales growth for the third consecutive quarter, Apple (NASDAQ:AAPL) continues trading at a lofty premium to the market [S&P-500], with Wall Street analysts looking for a healthy double-digit upside in the Cupertino giant’s stock over the next twelve months. Interestingly, AAPL stock has 22 “Buy”, 8 “Hold”, and 0 “Sell” ratings on Wall Street.

TipRanks

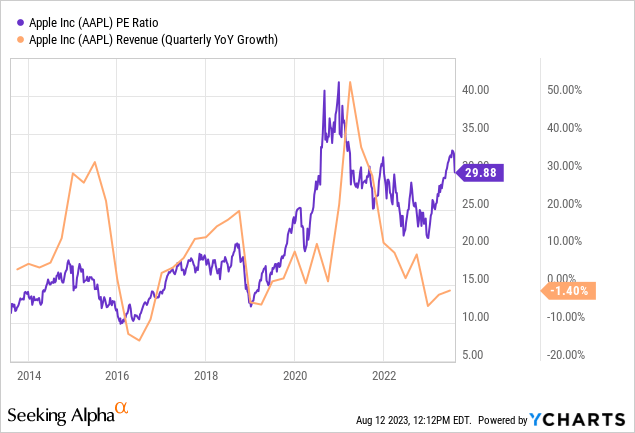

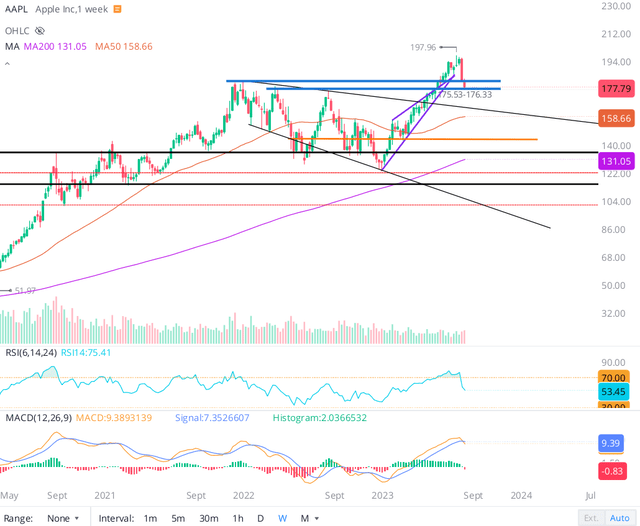

On the back of a stunning year-to-date melt up, Apple’s P/E multiple has expanded from ~21x to ~30x, and at this point, investors are finding it really hard to defend the stock. In light of its Q2 2023 report, Apple’s stock has declined by ~10% in quick order. With RSI and MACD indicators rolling over, Apple looks set for a deeper pullback in the upcoming weeks and months.

Apple stock chart 8/13/2023 (WeBull Desktop)

In this note, we shall analyze Apple’s FQ3 2023 report, and re-consider our bearish stance on AAPL stock [shared in Apple Stock Is A Tactical Sell Near Its All-Time Highs] using our Quantamental Analysis process.

Brief Review Of Apple’s FQ3 2023 Report

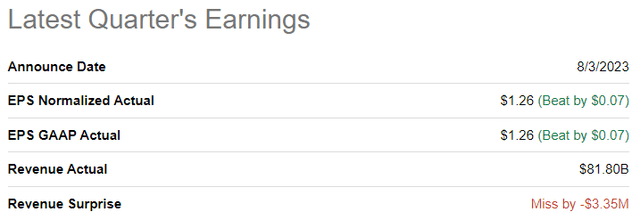

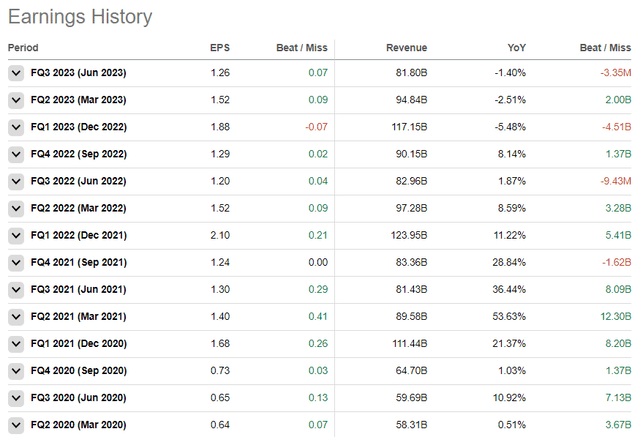

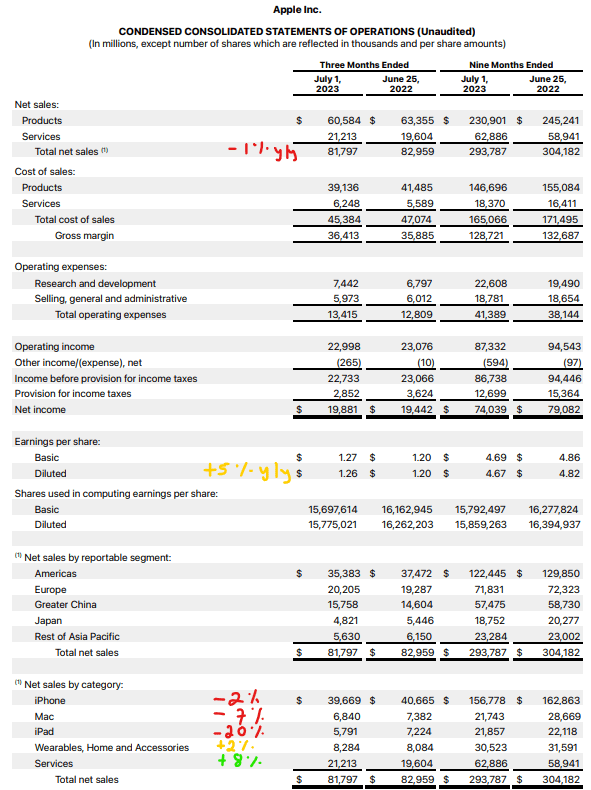

For FQ3 2023, Apple recorded revenues and normalized EPS of $81.8B (-1% y/y) and $1.26 (+5% y/y), respectively. While Apple’s earnings were better than expected, revenues fell slightly short of consensus expectations due to a -2% y/y decline in iPhone sales amidst a slump in global smartphone market.

SeekingAlpha

SeekingAlpha

Higher interest rates continue to affect demand for consumer electronics, and this dynamic is pressuring Apple’s hardware businesses as you can see in the numbers below. Fortunately, Apple’s Services business re-accelerated back up to +8% y/y in FQ3 2023. As per its earnings release, Apple’s installed base of active devices reached a new all-time high in every geographic market, with paid subscriptions rising beyond 1 billion for the first time in Apple’s history.

Apple FQ3 2023 Earnings Release

Despite ongoing macroeconomic pressures having an adverse impact on Mac and iPad segments, Apple’s Wearables segment returned to positive growth (+2% y/y) in FQ3 2023, with continued strength in Apple Watch sales. While Apple’s hardware business is clearly struggling for growth, its installed user base and ecosystem are still in expansion mode. With the technology giant pushing deeper into digital media and financial services, I believe Apple’s Services business can continue to deliver healthy growth for years to come.

While Apple is looking at under-penetrated emerging markets like India and Brazil for hardware sales growth, I still don’t see a pathway for Apple to deliver double-digit top-line growth via geographic expansion. In my view, Apple must launch a needle-moving product in the near future to re-invigorate the growth story. During the FQ3 2023 earnings call, Apple’s CEO, Tim Cook expressed excitement about Apple Vision Pro (to be launched in 2024); however, I am reserving my judgment on this product until I see evidence of broad adoption. An Apple Car [EV] has been talked about for a while, but there are no concrete developments on this front in the public domain.

For the next quarter, Apple’s management guided revenue growth “similar to FQ3 results”, i.e., -1% y/y. With interest rates climbing up in recent weeks, the consumer is looking tapped out. Since a majority of Apple’s devices are sold through some sort of exchange or financing program, I would expect a slower upgrade cycle over the coming quarters. Inflation is coming down; however, the Fed is still in tightening mode, and given the lagged effects of monetary policy, I think the macroeconomic environment (and consumer spending) is likely to worsen in the near future. Apple’s business performance is still in decline, and it is unlikely to recover dramatically any time soon.

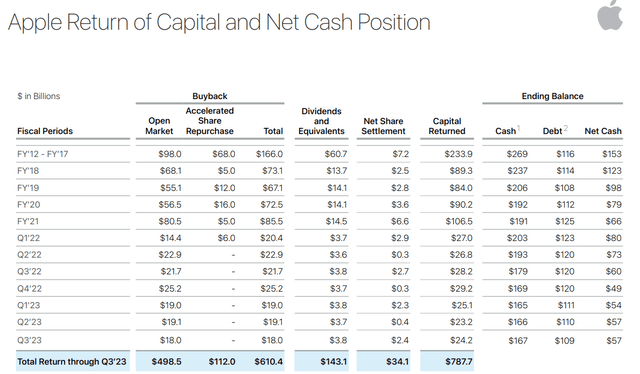

That said, Apple is still a cash cow and an infinite buyback pump. In FQ3 2023, Apple generated $24.3B in free cash flow and returned nearly all of it to AAPL shareholders via stock buybacks [$18B] and dividends [$3.8B].

Apple Investor Relations

Given Apple’s cash-rich balance sheet and robust free cash flow generation, I expect Apple to remain an infinite buyback pump for several years to come. However, Apple is finding growth hard to come by in a tough macroeconomic environment. At ~30x P/E and a negative revenue growth rate, AAPL stock is ridiculously expensive. And we can visualize Apple’s valuation issue through our Valuation Model.

Apple’s Fair Value And Expected Returns

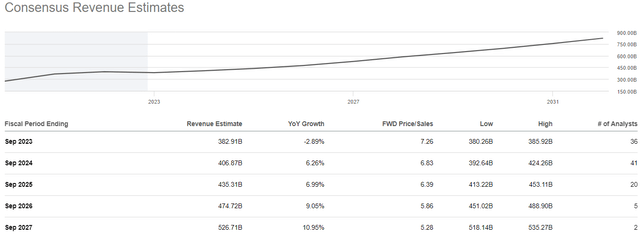

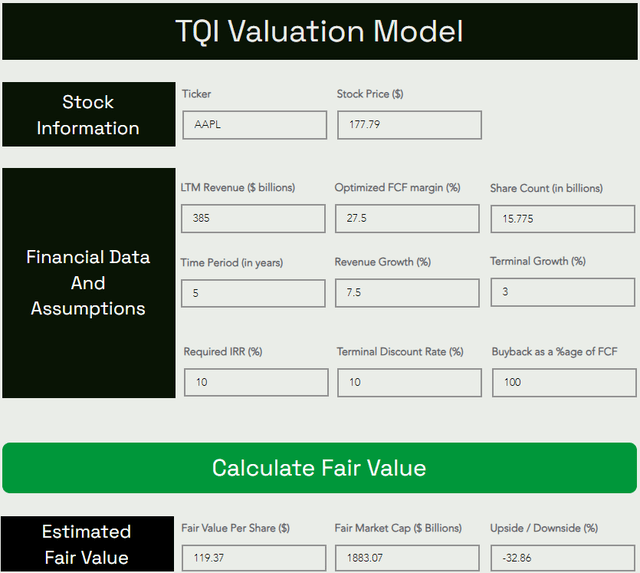

According to our Valuation Model, Apple’s fair value is ~$119.37 per share (or $1.88T). While some of you may disagree with this assessment, I feel the model assumptions are quite generous. For the modeling period, we have assumed an FCF margin expansion for Apple to 27.5% and a 7.5% CAGR revenue growth rate (higher than consensus analyst estimates).

Apple revenue estimates (SeekingAlpha)

Here’s my latest valuation for AAPL:

TQI Valuation Model (TQIG.org)

In the event of a hard landing in the economy, I could see Apple re-tracing to its fair value (and it could easily overshoot to the downside). Hence, I see a downside risk of around ~30-35% in AAPL stock based on DCF valuation.

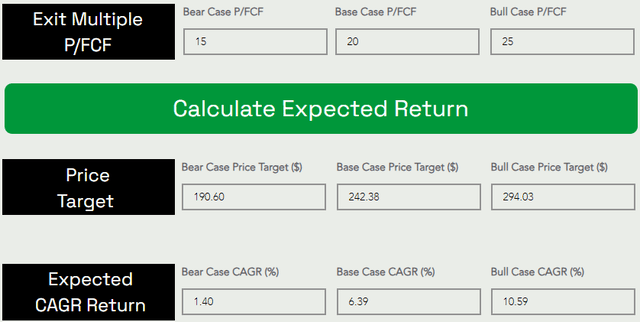

Now, predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x [P/FCF].

Applying this figure as an exit multiple, I see Apple stock rising to $242.38 per share by 2027-28 at a CAGR of ~6.4%. Since Apple’s expected return falls short of my investment hurdle rate of 15%, AAPL stock is not a buy at current levels under our methodology.

TQI Valuation Model (TQIG.org)

In recent days, I have heard multiple arguments for buying the dip in Apple stock as it’s a safe haven; however, I remain convinced that short-duration treasuries (treasury bills and notes) yielding ~5-5.5% offer significantly better risk/reward than Apple’s stock.

Concluding Thoughts

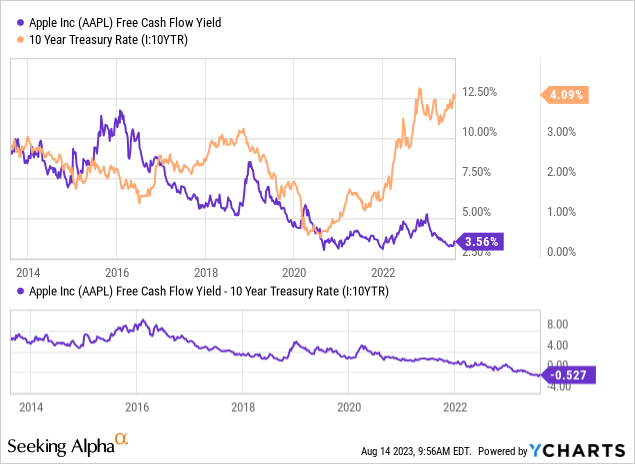

With the recent move in long-duration yields, the 10-yr US treasury yield now sits close to October-2022 highs of ~4.25%. And since my last update on AAPL, Apple’s equity risk premium [the spread between Apple’s free cash flow yield and 10-yr US treasury yield] has gotten even more negative. Under immutable laws of money, equity risk premium must be positive, and this is why, I think Apple’s current valuation is unsustainable.

As we have noted previously, Apple’s revenue is currently in decline (even in the absence of a recession). Hence, the stock trading at historically high trading multiples (not seen outside of a zero-interest rate world) is simply unsustainable. With Apple’s equity risk premium sliding deeper into negative territory over the last few months, the violation of the immutable laws of money is getting to an absurd level.

Furthermore, the full effects of the Fed’s aggressive monetary policy tightening haven’t been realized yet (nor are the effects of bank credit tightening being instigated by the regional banking crisis). Hence, the macro environment for Apple remains uncertain, and its financial performance could get even worse in upcoming quarters. Given the sheer lack of an equity risk premium, I think Apple stock is likely to get de-rated at some point. At this moment in time, the market narrative is being dominated by AI talk (and hype to some level); however, financial realities (macro and valuations) still do matter, and a day of reckoning is coming for AAPL stock as it remains overloved and overvalued.

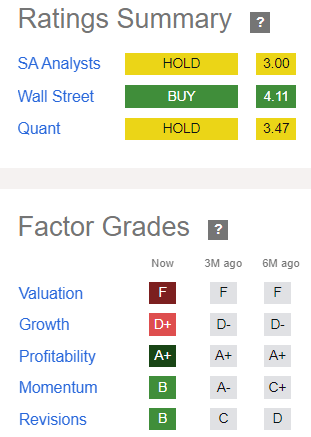

Earlier in this note, we reviewed Apple’s technical setup, which is pointing toward a deeper pullback in AAPL stock. According to SA’s Quant rating system, Apple is losing momentum [grade deterioration from “A-” to “B”] and the stock remains richly valued [Valuation grade – “F”].

Apple’s Quant rating (SeekingAlpha)

With fundamental, technical, quantitative, and valuation data looking unsupportive, I am sticking with my “near-term” bearish view on AAPL stock. A negative equity risk premium violates the immutable laws of money, and that’s where AAPL stock is right now. In my view, the risk/reward for long-term investors is quite unfavorable at current levels.

Key Takeaway: I continue to rate Apple’s stock as a tactical “Sell” in the $175-180 range.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.