Summary:

- Last time, I called Apple Inc.’s earnings miss based on Samsung’s operating data. Today, I see even more reason to expect Apple’s failure for Q1 2023.

- Samsung’s Mobile Experience segment operating profit is guided to fall by ~34.5% YoY. Apple’s revenue is projected to fall by just 5.91% YoY in Q1 2023.

- At the same time, Wall Street analysts give Apple a fairly high premium to its valuation, deviating from historical multiples for years to come.

- CEO Tim Cook has sold part of his shares for the first time since mid-2021.

- Based on this analysis, I anticipate that Apple’s stock could decline by 19.5% this year. I’m downgrading Apple Inc. stock to Sell.

Andreus

Introduction

I previously published my analysis of how Apple Inc. (NASDAQ:AAPL) and its results depend on the results of the company’s largest competitor, Samsung (OTCPK:SSNLF). At that time, on February 1, 2022, I analyzed the Korean company’s report and concluded that Apple will most likely not be able to beat analysts’ forecasts and that Apple CEO Tim Cook will likely disappoint investors with his guidance. As time has shown, that’s precisely what happened. And that EPS miss has become the first one in recent years.

Seeking Alpha data [author’s compilation and note]![Seeking Alpha data [author's compilation and note]](https://static.seekingalpha.com/uploads/2023/4/10/49513514-1681100253920361.png)

It’s been a little over 2 months since then, and all the while I have remained neutral on AAPL. The stock continued to rise – since that publication its total return amounted to 13.4% against the S&P 500 Index (SP500) return of -0.34% as many began to seek a safe haven in mega-cap tech stocks.

At the moment, however, I see no reason to be optimistic – I can’t even remain neutral anymore. In this article, I analyze Samsung’s recent report and other key factors that led me to downgrade my previous Neutral rating to Sell. Let’s dive in for more detail.

Samsung Sends Apple Investors A Warning Message – Again

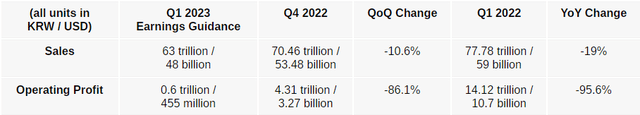

The world’s largest memory chips maker reported on Friday that its operating profit is going to fall more than 95% YoY to 0.5-0.7 trillion won (~$455 million) in Q1 2023, according to Seeking Alpha News. The last time Samsung’s semiconductor business saw such a loss was in Q1 2009, when the world was recovering from the 2008 financial crisis.

Samsung has announced it will cut production of memory chip production due to continued weak demand. As South Korea’s largest family-run conglomerate, Samsung contributes to more than 20% of the nation’s GDP, and its economic struggles are worrisome. This is the second consecutive quarter of significant profit decline for Samsung. In Q4 2022, profits fell by nearly 70% due to the conflict in Ukraine and inflation.

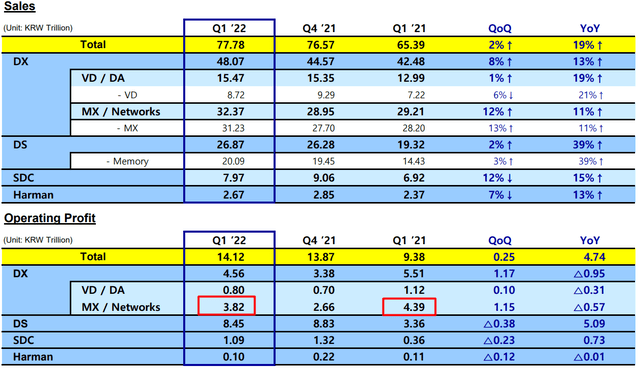

On a positive note, Samsung’s smartphone division may have helped mitigate some of the losses, the full extent of which will be elaborated on during the company’s upcoming quarterly earnings call later this month. Samsung’s Mobile Experience segment – the company’s smartphone division – reportedly earned profits of around KRW 3.3 trillion (~$2.5 billion), according to sammobile.com. However, everything is learned by comparison – if we compare this guidance with Q1 FY2022, it turns out that this positive operating profit is still ~34.55% lower than last year and ~43% lower than in Q1 2021:

Samsung’s Q1 2022 results, author’s notes

Let me remind you that Samsung is Apple’s closest competitor when it comes to smartphone sales, even though this segment accounts for only 34.55% of Samsung’s total revenue [based on Q1 2022 data]. For Apple, the iPhone segment still accounts for about 52% despite all the company’s attempts to diversify into Services in recent years.

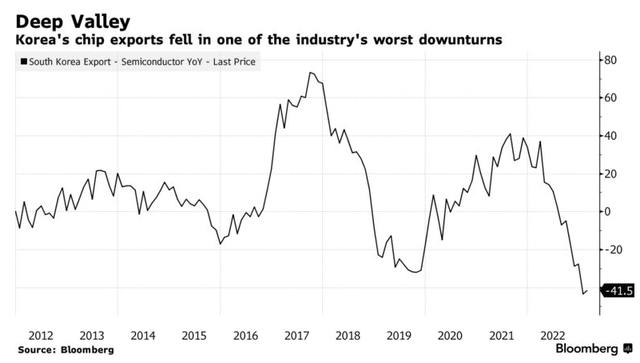

In my opinion, there are 2 bad news pieces for Apple in the whole story with Samsung’s Q1 2023 guidance. First, the Korean company’s and its competitors’ attempts to cut chip production may point to the realization of a scenario I have long written about in my articles on Apple and other tech stocks – if their products are not a pressing need for consumers, the elasticity of demand to changes in the real incomes of the population will be quite high; as a result, smartphone sales will come under severe pressure – there is nothing to change them for if they still work. Especially if there is not much change in functionality. Yes, certain segments of the population are willing to cut corners on other costs just to get a new device – but we are talking about the majority here, not the minority. And the trend in chip production around the world suggests that manufacturers are preparing in advance for the consequences of this very high elasticity:

Second, Samsung’s Mobile Experience segment itself shows a sharp decline in operating profit – a bad sign for Apple’s main source of revenue.

Apple Stock Valuation: The Earnings Dip Is Not Priced In

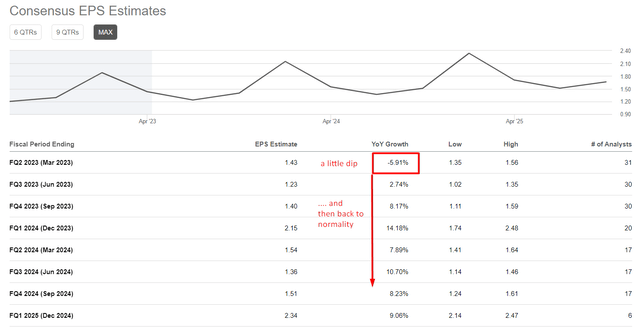

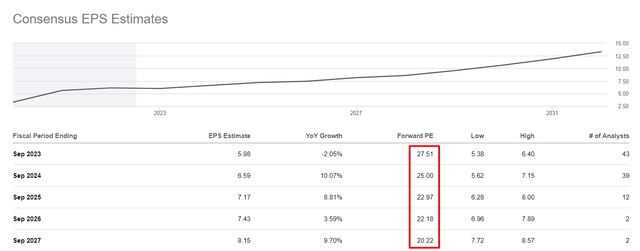

While Samsung’s Mobile Experience operating profit is expected to decline by up to 34.5% in Q1 2023, Apple stock is pricing in a slight deviation from its long-term EPS growth [-5.91% YoY], which looks like normal seasonality.

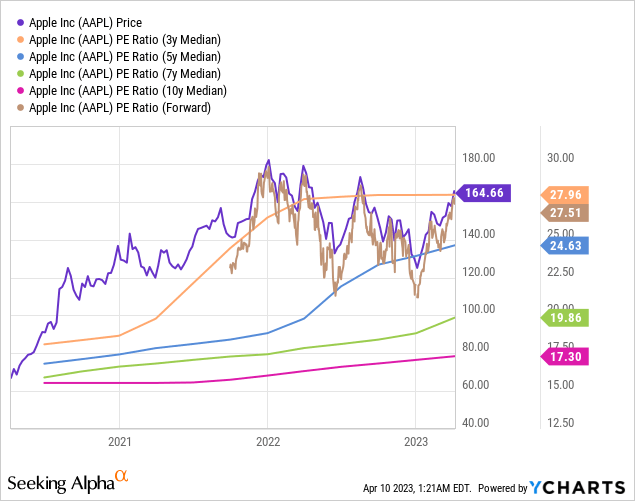

At the same time, Wall Street analysts give Apple a fairly high premium to its valuation, deviating from historical valuation multiples. Below I give an example from a recent report by Bank of America analysts who first estimate the P/E multiple for FY2024 at 26 times and then explain that this is in line with the historical range of 9-34x with the median at 14x – in my opinion, the reader should have a sense of contradiction just from the very description of these assumptions.

Seeking Alpha, author’s notes

Our PO of $168 is based on ~26x our E2024 EPS of $6.30. Our target multiple compares to the long-term historical range of 9-34x (median 14x). We believe a multiple at the higher end of the historical range is justified given a large cash balance and opportunity to diversify into new end markets, increasing mix and diversity of services.

Source: BofA’s report as of April 5, 2023 [proprietary source]

How can a year-end target multiple of ~26x be compared to the median of 14x?

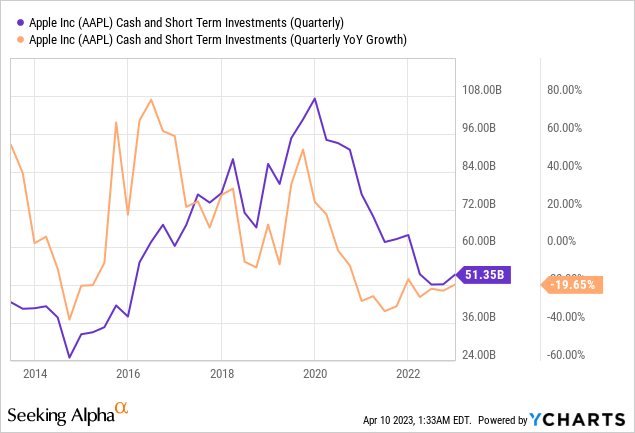

I understand that there should be a premium for Apple being the largest tech company in the world with a huge moat and therefore part of the assets of most passive funds. But if we are going to put a premium based also on the large cash balance as BofA says, would not it be fair to also take into account the rate at which those cash piles have been depleted in recent years?

I agree that Apple deserves a premium for being able to continue diversifying into Services – however, the current state of affairs in that segment is not the best, either, according to the same BofA report:

BofA’s report as of April 5, 2023 [proprietary source]![BofA's report as of April 5, 2023 [proprietary source]](https://static.seekingalpha.com/uploads/2023/4/10/49513514-16811050421324925.png)

The current situation reminds me of Q1 2022. Back then, a year ago, AAPL’s implied P/E multiple rose to 28.22x while the stock price was around $174/share. The TTM EPS reached $6.15, which was a record high. After that, the multiple dropped to 22.5 by mid-2022, TTM EPS dropped just 10 cents [to $6.05], and the share price dropped to ~$136 [-22%]. I think today the risk of such a scenario repeating itself has risen sharply again – Q1 2023 results are unlikely to please investors, as is Tim Cook’s presumably cautious guidance again.

Macrotrends.net [author’s notes]![Macrotrends.net [author's notes]](https://static.seekingalpha.com/uploads/2023/4/10/49513514-16811055355702796.png)

By the way, a few words about Tim Cook – as an indirect confirmation of the high probability of my conclusions are his recent sales. On April 3, the CEO sold over $9 million worth of company stock at prices ranging from $165.41 to $165.845 per share. The last time Mr. Cook sold was in mid-2021. This coincided with another indirect confirmation of my conclusions about the impending multiple contraction due to weaker-than-expected operating results – the weekly chart of AAPL stock shows strong resistance from which a correction of at least ~16% looks quite likely:

TrendSpider Software, author’s notes

Your Takeaway

Of course, I’m sure that Apple Inc. is very well positioned for the long term. The company’s loyal customer base is known to readily adopt new products and stay within the Apple ecosystem, which contributes to consistent revenue. Apple’s innovative product pipeline, which includes iconic products such as the iPhone, iPad, and Apple Watch, often fuels investor optimism about the company’s potential for breakthrough technologies. Diversifying revenue not only through hardware but also through services such as Apple Music, iCloud, Apple TV + and Apple Arcade helps minimize risk and generate multiple revenue streams. In addition, Apple’s solid balance sheet and still-substantial cash reserves allow it to invest in R&D, M&A, and share buybacks, which has a positive impact on the stock price.

My revised Sell rating is based solely on tactical positioning, highlighting that the market has not yet adjusted to this information, or is choosing not to, despite common sense. Samsung’s guidance, which proved to be worse than initially anticipated, serves as a reminder that Apple is not impervious to slowing demand and that the company may not always meet high expectations. The path to long-term success inevitably includes setbacks and crises, and it appears we are currently witnessing one of them.

I project Apple Inc.’s P/E ratio to be around 23x by the end of FY2023, with a full-year EPS of $5.76 – a negative miss of 3.64% compared to the consensus [like in Q4 2022]. Based on this analysis, I anticipate that Apple Inc. stock could decline by 19.5% this year.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!