Summary:

- We admit to making a mistake in rating Apple as “hold” and now believe it should be rated as a “strong buy.”

- Apple has the potential for growth in its monetizable installed base, particularly in markets like China and India.

- We discuss the impact of interest rates and recession risks on Apple’s valuation and consider whether Apple is still a better investment than Treasury bonds.

Getty Images

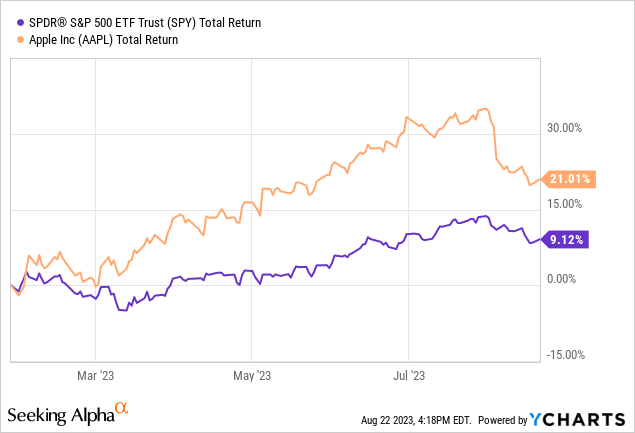

Although we hate to admit it, even as savvy analysts, we still tend to make some mistakes when evaluating companies. One of these mistakes could be Apple (NASDAQ:AAPL), which we rated “hold” in early January this year after it significantly outperformed the index, rising 21.45% while the S&P 500 gained only 7.97%.

Funnily enough, this realization came quite unexpectedly when I was on vacation in France a few weeks ago after my iPhone 13 Pro’s screen shattered when it hit a concrete street in Paris. In those following days that I had to use a cheap replacement phone, I admittedly had a lot of time to reflect on just how “indispensable” Apple’s products really are, as Warren Buffett would put it. Despite the recent slowdown in revenue growth and higher interest rates, we are changing our stance from “Hold” to “Strong Buy,”. We believe investors should use the recent decline in the stock price as a buying opportunity.

You have a product that’s that personal, that valuable. They talked about the iPhone 10 costing $1,000, and that’s a lot of money. But I have a plane that costs me a lot, maybe a million dollars a year or something, but if I use the iPhone like all of my friends do, I would rather give up the plane. The iPhone is enormously underpriced. (Warren Buffett)

A Justified Valuation

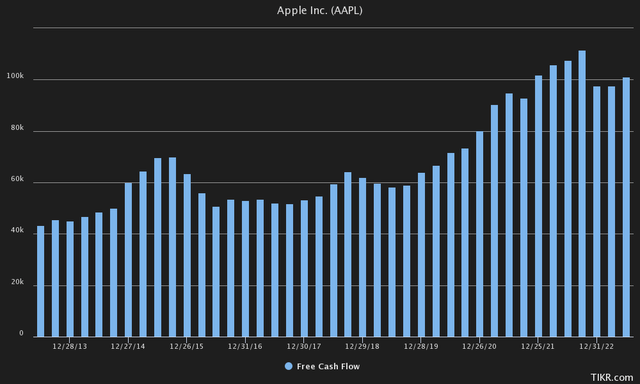

First, one of the main reasons we were skeptical about Apple at current levels had to do primarily with the amount of growth we were predicting for the next few years. More specifically, if you look at free cash flow and revenue on a trailing 12-month basis, you can see that it has basically stayed flat or even declined a little bit over the past few quarters.

We expected it to stay that way for the next few years, or at least we thought it would stay well below the growth of the last 10 years, when growth was close to 10%. What we should have especially taken into account were device upgrade cycles, which have slowed down after a huge increase in 2021.

It has become very clear that instead of looking at this boom-bust cycle starting in 2020, we would have been better off looking 5 years ahead and considering earlier how much their monetizable installed base is growing and less about the recent upgrade cycle. The installed base has grown by 100-150 million users since 2019 and crossed the 2 billion user mark this year. Since last year, Apple has also reportedly added more than 200 million active users. Even talking about the upcoming upgrade cycle with the iPhone 15, according to Dan Ives of Wedbush, there are about 250 million iPhones that have not had an upgrade in the past 4 years, which could lead to a very lively upgrade cycle coming up.

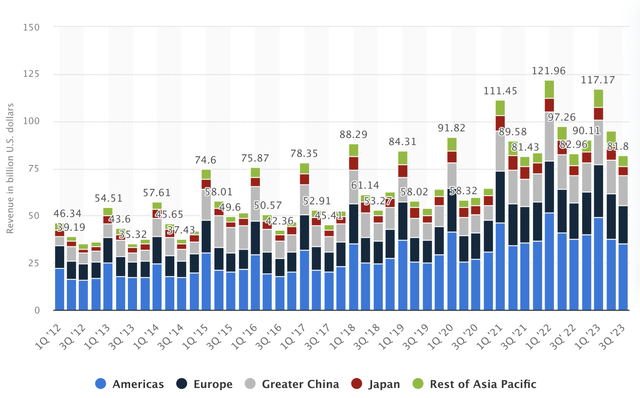

In our previous assessment, we also completely discounted the future potential of markets such as China and India, which are expected to experience strong growth, leading us to believe there is still quite a bit of growth ahead for Apple over the next 5 years. China grew from $2.8 billion in 2010 to $58.7 billion in 2016, or from 4% of total sales to 25% of total sales. Currently, on a TTM basis, Apple generated $72.95 billion in revenue from the China region, or just over 19% of total revenue.

India is beginning to resemble China in many ways. Sales in the region are beginning to rise in serious numbers, and Apple opened its first store in the country earlier this year. The demographics of the population are also very similar to China, with India’s per capita income also growing rapidly from its low levels similar to China in the early 2000s. According to Gene Munster of Deepwater Asset Management, India could add 3% to income growth in the next 6-7 years alone if it becomes as large as China.

If we add to this the revenue growth that Apple should be able to generate from new products such as the Vision Pro, continued revenue growth from their services’ category, and their ability to pass on costs to consumers with newer iPhone models, it is very clear why Apple absolutely has the potential to grow by more than 5% over the next 5 years.

Interest Rates

Second, we were, and to some extent still are, very skeptical about the current interest rate environment. Warren Buffett also likes to compare investments to current interest rates when evaluating investment opportunities. We do this by looking at the yield and comparing it to both short-term and long-term Treasuries.

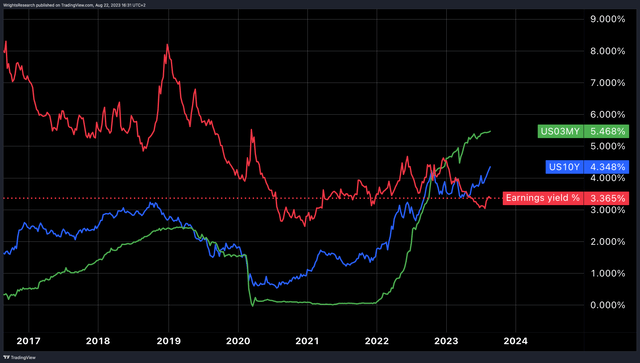

Tradingview, Wright’s Research

As you can see above, the earnings yield we are getting on Apple stock has fallen, while the yield investors are getting on Treasury bonds is rising sharply. The 10-year is currently trading nearly 100 basis points above the earnings yield, meaning that investors are mostly paying for and counting on future growth to generate returns.

However, if there is enough growth, which we can safely predict, Apple may still be undervalued relative to treasuries. If investors are looking for a 10% return and the earnings yield is currently at 3.36%, then the stock becomes worthwhile if Apple is able to grow its earnings by an average of about 6.64%. If we go back to our growth parameters and Apple is able to get 3% earnings growth from India and another 3% from price increases, growth in services and their new Vision Pro/new products, then Apple still seems like a sound investment compared to government bonds.

From another perspective, if we estimate Apple’s weighted average cost of capital (WACC) at 9%, and they grow their free cash flow at 6% (terminal rate) for the foreseeable future, it means we can calculate intrinsic value because the life of the company is finite. If we take Apple’s $100.99BN in FCF over the past 12 months and divide it by 3%, we arrive at a market cap of 3.37T, or $215.61 per share.

Looking at interest rates and Apple’s growth, we would only start to worry about whether treasuries become a viable alternative when the difference between the 10-year yield on treasuries and the earnings yield moves toward 200 bp. Right now, if Apple were perfectly priced, the market is only factoring in a 1% growth rate, compared to the 2% growth rate we would take as a given, and 6% as the potential upside scenario.

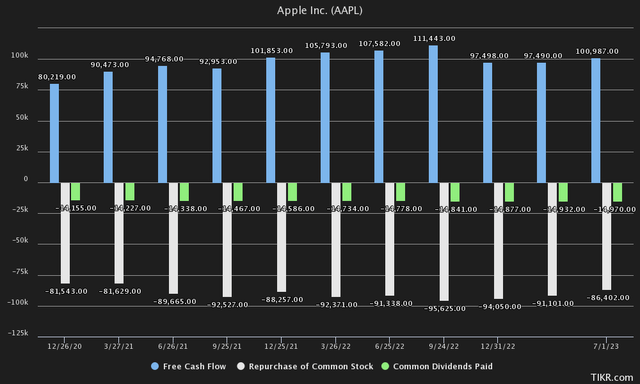

Apple also still remains a great capital allocator. According to Buffett, companies should only buy back shares if they believe their shares are undervalued. Internally, Apple must also believe that their shares are undervalued, as otherwise they would just be buying Treasuries with their free cash flow, leaving the cash on the balance sheet. Currently, almost all free cash flow is used to pay dividends and buy back stock. Even if Treasuries became a viable alternative, Apple would still generate income from interest if they decide to keep the money on their balance sheet.

The third reason we were skeptical about apple was recession risks and geopolitical/macroeconomic risks in China when it comes to manufacturing. The yield curve and spreads between the 2-10-year rate and the 3-month to 10-year rate are still strongly inverted, meaning a recession is still likely in the cards for the United States.

Because Apple is the largest traded company and has more than 2 billion users, they are most likely to feel macroeconomic headwinds if they occur. And even though Apple is already diversifying its supply chains to India and abroad, we would remain very cautious about China given the latest macroeconomic data.

The Bottom Line

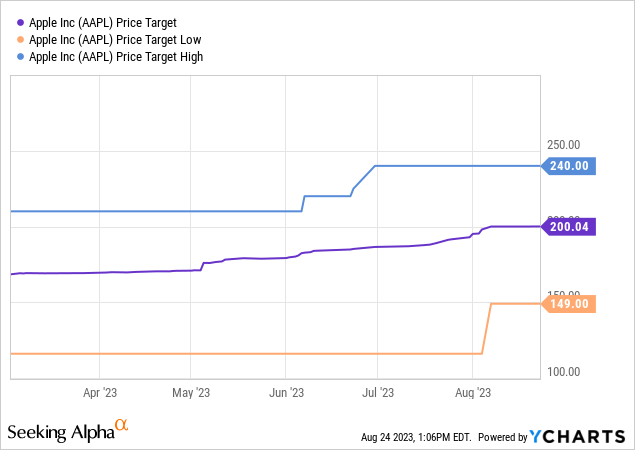

Taking all of the above into account, we change our rating from “Hold” to “Strong Buy,” with a potential upside of $215 per share. While we believe Apple could be a bit more of a pain in the short term, given economic indicators and weak growth for FY2023, we believe Apple is still a better investment than Treasury bonds.

So this “Strong Buy” rating only works well for investors with an investment horizon of at least 5+ years, as most of the growth described is likely to be realized only in the next few years, with the majority weighted to the back half of this period. We fully concur with Buffett, who, according to the latest available data, has not sold any Apple stock since 2020 and Apple still holds the largest position of any publicly traded company in Berkshire’s portfolio.

I made a mistake a couple of years ago, and I sold some shares when I had certain reasons why gains were useful to take that year from a tax standpoint. But having heard me say that, it was a dumb decision.

As for the broken iPhone 13 Pro, I had to wait a few days for an appointment at the Apple Genius Bar in Brussels and had to have the screen repaired at an Apple Premium Partner at a cost of nearly 400 EUR ($432). Perhaps iPhones are still priced too low, considering that the total operating cost of this iPhone, including replacing the screen, was over 1,500 EUR ($1,6K), which I still believe to be worth every penny.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.